ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Tuesday, October 24, 2023

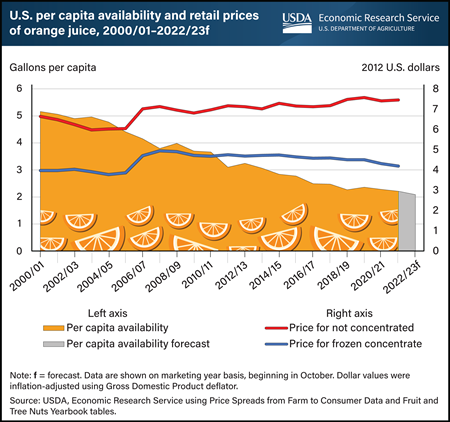

Orange juice, once a staple beverage in many U.S. households, has experienced a steady decline in consumption over the last two decades. While waning consumer demand has played a role, decreased domestic orange production has also negatively impacted per capita availability, a proxy measure for consumption. Orange juice imports from Brazil and Mexico have tempered some of this decline, however, availability of orange juice has fallen from about 5 gallons a person in the 2000/01 marketing year to a forecast of 2 gallons per person in 2022/23. Most oranges grown for the processing/juice market in the United States are harvested in Florida. In recent years, Florida’s citrus crop has suffered from disease and extreme weather events, resulting in smaller orange harvests. Reduced supply has contributed to generally higher orange juice prices. However, adjusted for inflation, prices for frozen concentrated orange juice and not from concentrate (the two main categories) increased at comparatively modest rates between 2000/01 and 2021/22. The price of frozen concentrated orange juice rose by 5 percent over 20 years, while orange juice not from concentrate rose by 12 percent over the same period. The modest increase in the real price highlights the impact of declining demand, somewhat muting the price effect associated with lower supply. This chart is based on the USDA, Economic Research Service (ERS) Fruit and Tree Nuts Outlook Report, released September 2023, and data from the ERS Fruit and Tree Nuts Yearbook and Price Spreads from Farm to Consumer.

Monday, October 23, 2023

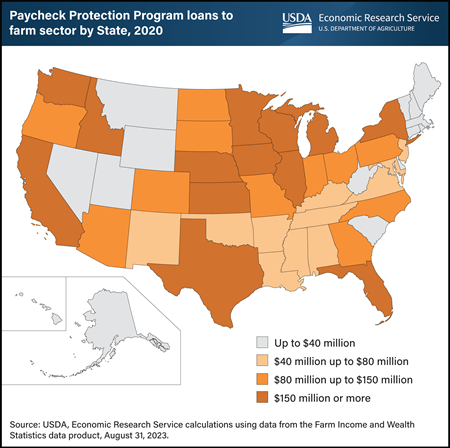

Researchers at the USDA, Economic Research Service estimate that the Paycheck Protection Program (PPP) provided $5.8 billion to the farm sector in 2020. The PPP was a non-USDA assistance program for small businesses adversely affected by the pandemic. Total Federal Government payments to the farm sector in 2020 were $45.6 billion, meaning that PPP payments were 13 percent of total payments. The Small Business Administration (SBA) administered the PPP, providing forgivable loans to eligible small businesses and certain other entities to allow them to cover some of their payroll costs. Businesses had to meet specific eligibility requirements, such as having positive payroll and/or making profits. The PPP loans were forgiven in full if the loan was used on eligible expenses, including at least 60 percent on payroll expenses. Agricultural producers in California were the largest recipients of PPP loans at $1.1 billion, followed by Washington at $285 million. California leads the Nation in the value of agricultural production and has the highest hired labor expense among States. Other top recipients of PPP loans included Texas ($281.5 million), Iowa ($252.6 million), Illinois ($251.8 million), and Florida ($247 million). The latest publicly available data from the SBA show almost all the PPP loans (98 percent) made to the farm sector in 2020 have been forgiven. This map updates information in COVID-19 Working Paper: Distribution and Examination of Coronavirus Food Assistance Program Payments and Forgivable Paycheck Protection Program Loans at the State Level in 2020, published August 2023.

Thursday, October 19, 2023

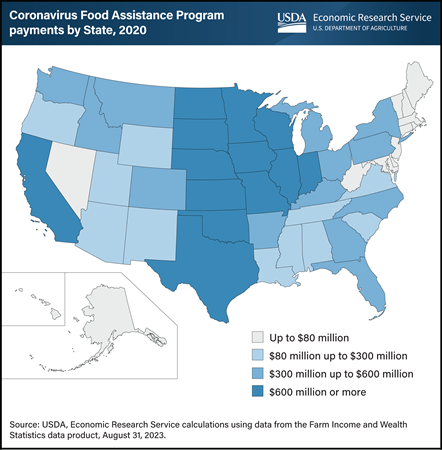

In 2020, two rounds of Coronavirus Food Assistance Program (CFAP) payments provided $23.5 billion to U.S. farmers and ranchers who faced sales losses, lower prices, or increased production and marketing costs associated with the Coronavirus (COVID-19) pandemic. The CFAP was USDA’s primary pandemic assistance program. According to the USDA, Economic Research Service data product Farm Income and Wealth Statistics, producers in nine States received more than a billion dollars each in estimated CFAP payments in 2020. Those States were: Iowa ($2.1 billion), California ($1.8 billion), Nebraska ($1.6 billion), Minnesota ($1.4 billion), Texas ($1.3 billion), Illinois ($1.3 billion), Kansas ($1.1 billion), Wisconsin ($1.0 billion), and South Dakota ($1.0 billion). In calendar year 2020, direct Federal payments to U.S. farmers and ranchers totaled $45.6 billion. Therefore, the payments made from CFAP were more than half of all direct government payments made that year. CFAP continued to make payments to U.S. producers and ranchers in 2021. This chart updates information that appeared in the USDA, Economic Research Service report COVID-19 Working Paper: Distribution and Examination of Coronavirus Food Assistance Program Payments and Forgivable Paycheck Protection Program Loans at the State Level in 2020, published August 2023.

Wednesday, October 18, 2023

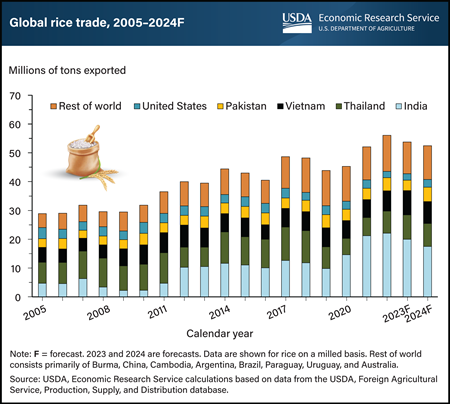

Global rice trade is projected to decline in 2023 and 2024 after India, the world’s largest rice exporter, implemented additional export restrictions on rice in July and August 2023. India accounted for more than 40 percent of global exports in 2022, supplying more rice than each of the next four largest suppliers—Thailand, Vietnam, Pakistan, and the United States. In summer 2023, India placed a ban on export sales of regular-milled white rice while imposing tariffs and additional restrictions on other types of exported rice. Global prices for rice then rose by 12 to 14 percent by the end of July. Prices continued to surge in August, reaching their highest since 2008, dropping slightly by mid-September as panic buying slowed. The impact is felt by many of the world’s food-insecure countries, especially in Sub-Saharan Africa, India’s largest export market. This region is expected to import less rice in 2023 and 2024 even as Thailand, Vietnam, and Pakistan pick up additional sales, despite tight supplies in Thailand and Vietnam. This chart is drawn from the October 2023 Rice Outlook, published by USDA, Economic Research Service. Also see the August 2023 and September 2023 Rice Outlook.

Tuesday, October 17, 2023

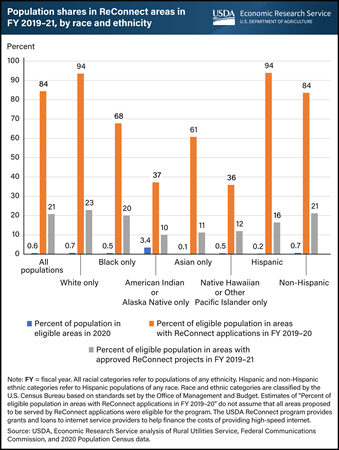

The ReConnect program is one of several USDA efforts to help improve broadband access in rural areas. Nearly 16 percent of households in nonmetro areas lacked access to broadband (high-speed internet) in December 2022, compared with about 3 percent of households in metro areas, according to data from the Federal Communications Commission. Researchers with the USDA’s Economic Research Service (ERS) examined the racial and ethnic characteristics of the people in areas eligible for ReConnect grant and loan projects to understand how well the program has served different rural groups. Based on data from the first two rounds of ReConnect funding, initiated in fiscal years 2019 through 2021, researchers found that 3.4 percent of the overall American Indian/Alaska Native (AIAN) population in 2020 lived in areas eligible for ReConnect, which is targeted to rural areas with no broadband access. That marked a higher share of the population being eligible than for any other race or ethnicity, with the next closest being 0.7 percent of the White population. However, project applications came from organizations, such as internet service providers or telephone cooperatives, that served areas with lower shares of eligible AIAN people. For instance, even if every proposal in areas with an AIAN population had been funded, only 37 percent of the eligible AIAN population would have been reached, the second-lowest proportion across racial and ethnic groups. Approved projects served 10 percent of the eligible AIAN population, the lowest proportion of any racial or ethnic group. Overall, approved first and second round ReConnect projects are extending broadband service to 21 percent of the eligible population. This chart is drawn from the ERS report Three USDA Rural Broadband Programs: Areas and Populations Served, published in October 2023.

Monday, October 16, 2023

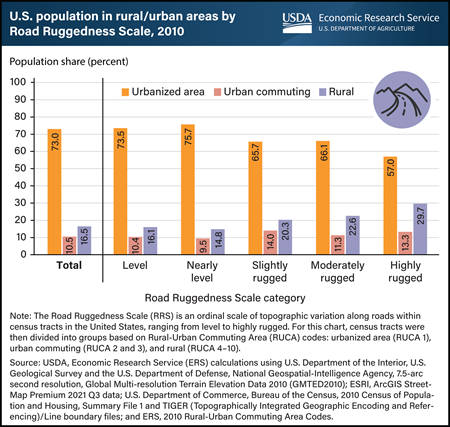

Researchers with USDA, Economic Research Service (ERS) developed the Road Ruggedness Scale—a five-category measure of topographic variability along roads—and used it to study the interplay of population, rurality, and ruggedness in the United States. They found that in 2010, as land became more rugged (had greater changes in elevation), generally more of the population lived in rural census tracts (the small geographic areas used to collect population data). For example, in level census tracts, the rural portion of residents was 16.1 percent, while the rural portion living in highly rugged census tracts was nearly double that amount (29.7 percent). The reverse was true for urbanized area census tracts, with the share of residents decreasing from 73.5 percent in level locations to 57.0 percent in highly rugged ones. However, even in the top ruggedness categories, most people lived in urbanized area census tracts, indicating that ruggedness and rurality are not synonymous. The relationship between ruggedness and rurality also varies by region. The rural population share in highly rugged census tracts of the Intermountain West (57.7 percent) and Appalachian Mountains (45.7 percent) was much higher than the national share of 29.7 percent, while the share in the Pacific Coast was much lower (18.6 percent). This chart appears in the ERS report Characterizing Rugged Terrain in the United States published on August 1, 2023.

Thursday, October 12, 2023

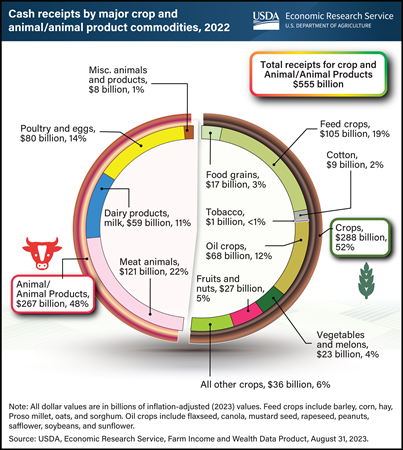

U.S. farm operations reported record cash receipts of $555 billion from the sales of all commodities in 2022. This beat the previous high from 2014 by 3.1 percent after adjusting both amounts for inflation and was 28 percent above the 20-year average level. The 2022 record cash receipts primarily resulted from the strength of 2022 commodity prices, although production levels in 2022 were also strong. Cash receipts from crops amounted to $288 billion, while receipts from all animals and animal products totaled $267 billion. A comparison of 2022 levels by commodity group to their respective inflation-adjusted 20-year average levels (2002–2021) indicates widespread high performance relative to historical averages. Operations selling meat animals (cattle, calves, and hogs) reported $121 billion in cash receipts in 2022, 18 percent higher than its 20-year average. Farm operations with feed crops (primarily corn) reported $105 billion in cash sales, 53 percent above its 20-year average. Poultry and egg receipts were $80 billion (primarily made up of broilers and chicken eggs), 67 percent above the average. Oilseed crop receipts were $68 billion (primarily soybeans), 54-percent above its 20-year average. Find additional information and analysis on the USDA, Economic Research Service topic page Highlights from the Farm Income Forecast, reflecting data released on August 31, 2023.

Wednesday, October 11, 2023

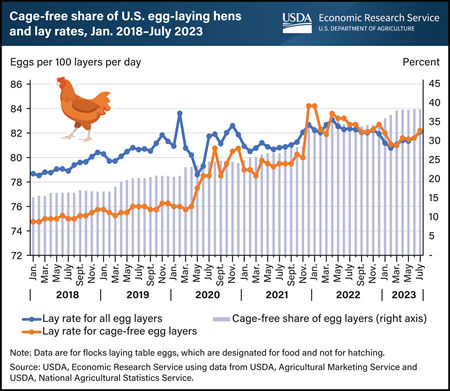

Cage-free hens, which unlike caged hens are free to roam during the laying cycle, comprise a growing percentage of the U.S. egg-laying flock. The cage-free flock has grown as States have passed and enacted legislation banning confinement of hens and as multiple retailers and food service providers have pledged to only source eggs from cage-free operations. Additional State bans are planned to take effect between 2023 and 2026. According to the USDA, Monthly Cage-Free Shell Egg report, the cage-free egg-laying flock (including certified organic hens) increased by more than 10.5 million hens in the first 6 months of 2023. As a result, cage-free hens increased as a proportion of the total U.S. laying flock, expanding from 36 percent in January to 38 percent in June. A closer look at USDA’s data reveals that the nonorganic cage-free flock accounted for most of this increase, while the organic egg-laying flock accounted for a smaller share of growth. The same report estimates cage-free hens’ productivity. Starting in late 2021, cage-free lay rates have been moving mostly above or at similar levels to the lay rates in the overall table egg-laying flock, a departure from the previous trend. This chart is drawn from the USDA, Economic Research Service’s Livestock, Dairy and Poultry Outlook, August 2023.

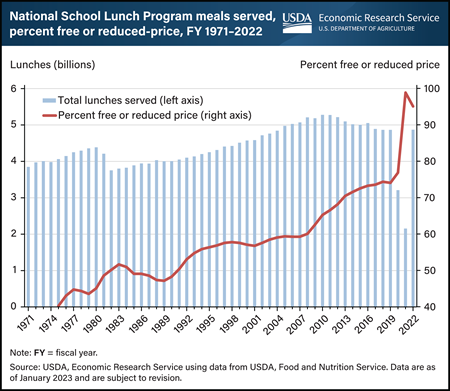

Tuesday, October 10, 2023

The USDA’s National School Lunch Program (NSLP) served 4.9 billion lunches in fiscal year 2022, and about 228.9 billion lunches since 1971. Any student in a participating school can get an NSLP lunch. Typically, students may be eligible for either a free, reduced-price, or full-price lunch depending on their household’s income. Compared with previous years, a higher share of the lunches were served for free or at a reduced price in fiscal years 2020 through 2022. This was in large part because of USDA waivers during the Coronavirus (COVID-19) pandemic allowing for meals to be provided free of charge to all students. These waivers expired in June 2022. The onset of the pandemic in March 2020 interrupted the operations of many schools, disrupting the provision of lunches through the NSLP. In response, USDA allowed schools to serve free meals through the Summer Food Service Program or the NSLP’s Seamless Summer Option, while the temporary Pandemic Electronic Benefit Transfer program reimbursed eligible families for the value of school meals missed because of these disruptions. This chart appears on the USDA, Economic Research Service’s National School Lunch Program page within the Child Nutrition Programs topic page.

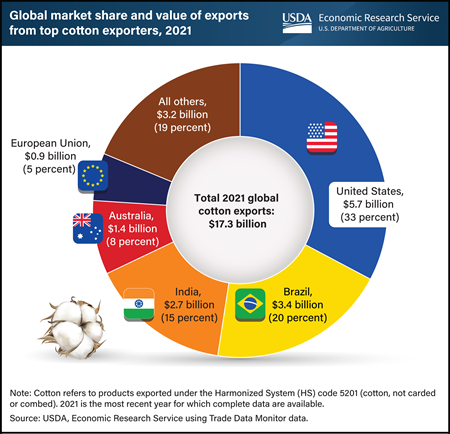

Thursday, October 5, 2023

The United States is the global leader in cotton exports by value, holding a 33-percent share ($5.7 billion) of the global export market in 2021. U.S. cotton exports expanded to $8.9 billion in 2022 and, while U.S. cotton exports in 2023 are expected to be lower than 2022 levels, USDA’s 10-year projections for U.S. exports indicate growth in the long term. In 2021, the most recent year for which complete global data are available, U.S. exports of cotton totaled nearly 3 million metric tons, 47 percent more volume than the next highest exporter, Brazil. Other major competitors in the global cotton market include Australia, India, and the European Union, with 2021 market shares (in terms of value) ranging from 5 to 15 percent each, as well as several exporters from Africa, including Benin, Burkina Faso, and Côte d’Ivoire. In addition to maintaining the largest share of the aggregate global market, the United States is a key supplier to several top importer markets. For example, in 2021, U.S. cotton accounted, by value, for 39 percent of cotton imports to China, the top cotton importer in the world. Other top destinations for U.S. cotton exports include Vietnam, Turkey, Pakistan, and Mexico. These countries combined with China, accounted for more than 70 percent of U.S. cotton exports in 2021. This chart is drawn from the USDA, Economic Research Service report, U.S. Export Competitiveness in Select Crop Markets, March 2023.

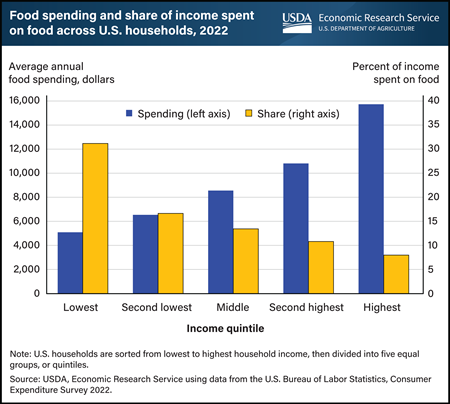

Wednesday, October 4, 2023

Households spend more money on food as their incomes rise, but the amount spent represents a smaller share of their overall budgets. When U.S. households were divided into five equal groups, or quintiles, by household income, households in the lowest income quintile had an average after-tax income of $16,337 and spent an average of $5,090 on food (about $98 a week) in 2022. Households in the highest income quintile, with an average after-tax income of $196,794, spent an average of $15,713 on food (about $302 a week) in 2022. As households gain more disposable income, they often shift to more expensive food options, including dining out. Food spending as a share of income rose across all income quintiles in 2022 as food prices increased faster than the overall inflation rate. Food prices increased 9.9 percent in 2022, the largest annual increase since 1979, and food-at-home (grocery) prices increased 11.4 percent. However, despite these large price increases, households’ share of income spent on food in 2022 was lower than in 2019 for the lowest three income quintiles and nearly the same for the highest two income quintiles. In 2022, food spending represented 31.2 percent of the lowest quintile’s income, 13.4 percent of income for the middle quintile, and 8.0 percent of income for the highest quintile. This chart appears in the Food Prices and Spending section of the USDA, Economic Research Service’s Ag and Food Statistics: Charting the Essentials data product.

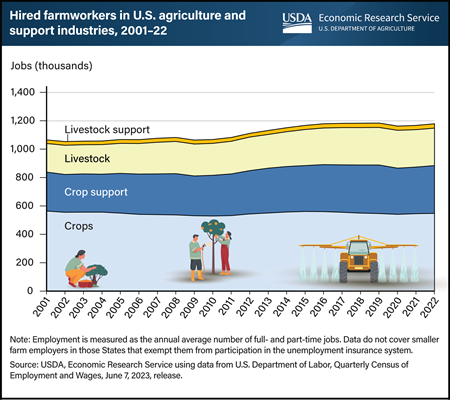

Tuesday, October 3, 2023

Data from the U.S. Bureau of Labor Statistics’ Quarterly Census of Employment and Wages (QCEW) show wage and salaried employment in agriculture stabilized in the 2000s and has been on a gradual upward trend since 2010. U.S. agriculture employment rose from 1.11 million jobs in 2012 to 1.18 million jobs in 2022, a gain of 6 percent. Employment growth was fastest in crop support services (27,500 jobs added, a 12-percent increase) and the livestock sector (31,400 jobs added, a 10-percent increase). Crop support services firms provide specialized services to farmers, including labor contracting and custom harvesting. By comparison, employment of direct hires in the crop sector, which has the largest number of hired farm workers, grew 1 percent. Data from QCEW are based on unemployment insurance records, not on surveys of farms or households. As a result, they do not cover smaller farm employers in States that exempt such employers from participation in the unemployment insurance system. However, survey data sources such as the U.S. Department of Commerce, Census Bureau’s American Community Survey and Current Population Survey also show rising farm employment since the turn of the 21st century. This chart appears in the USDA, Economic Research Service topic page Farm Labor, updated in August 2023.

Monday, October 2, 2023

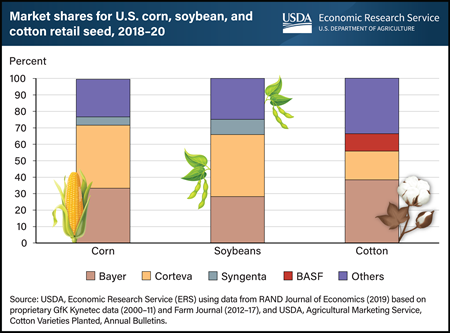

Two companies—Corteva and Bayer—provided more than half the U.S. retail seed sales of corn, soybeans, and cotton in 2018–20, the most recent period for which estimates are available. In recent decades, the U.S. crop seed industry has become more concentrated, with fewer and larger firms dominating seed supply. Today, four firms (Bayer, Corteva, ChemChina’s Syngenta Group, and BASF) control the majority of crop seed and agricultural chemical sales. In 2015, six firms led global markets for seeds and agricultural chemicals. The concentration can be traced to the expansion of intellectual property rights to private companies for seed improvements in the 1970s and 1980s, creating an incentive to research and develop new biotechnology seed traits and seed varieties. As biotechnology advanced, companies created genetically modified (GM) varieties of seed, such as herbicide-tolerant or insect-resistant corn, soybeans, and cotton. Mergers occurred between companies that produced and sold pesticides (primarily herbicides, insecticides, and fungicides), seed treatments (seed coatings to protect against insects or fungi), crop seeds, and seed traits. As a result, the U.S. crop seed sector has become highly integrated with agricultural chemicals and more concentrated. This chart is drawn from data in the USDA, ERS publication Concentration and Competition in U.S. Agribusiness, published in June 2023, and the Amber Waves article Expanded Intellectual Property Protections for Crop Seeds Increase Innovation and Market Power for Companies, published in August 2023.

Thursday, September 28, 2023

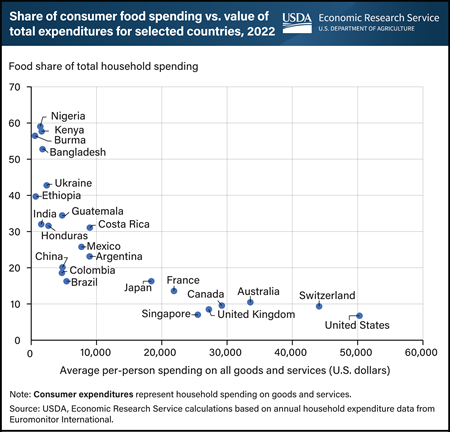

Consumers in low-income countries spend a greater proportion of their budgets on food than those in higher income countries. As incomes rise with economic development and urbanization, the share of income spent on food tends to fall while discretionary spending on household goods, education, medical services, and recreation tends to increase. In low-income African and South Asian countries, spending on food accounted for more than 40 percent of total consumer expenditures in 2022. In Nigeria, Kenya, Burma, and Bangladesh, more than 50 percent of consumer spending went toward food. In the Latin American countries of Costa Rica, Honduras, and Guatemala, spending on food accounted for more than 30 percent of total consumer spending. This contrasts with higher income economies in Latin America, including Argentina, Colombia, and Mexico, where an average of about 22.5 percent of budgets was spent on food. In emerging markets such as Brazil, India, and China, where incomes are rising, the share of discretionary income spent on nonfood categories has increased. In higher income economies, including the United States, Switzerland, Australia, and Canada, disposable incomes remain larger and the food share of consumer expenditures is smaller than those in countries where urban communities are still expanding. This chart is drawn from the USDA, Economic Research Service topic page International Consumer and Food Industry Trends.

Wednesday, September 27, 2023

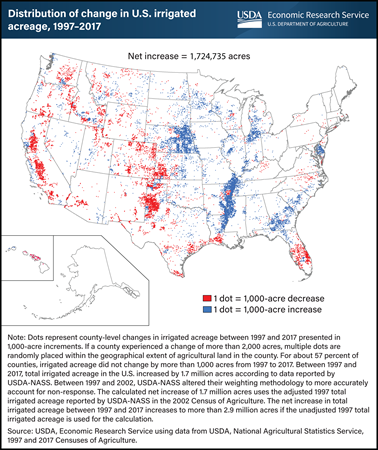

U.S. irrigated agriculture has seen regional changes in the past two decades, influenced by a variety of factors. From 1997 to 2017, total U.S. irrigated agricultural acreage increased by 1.7 million acres. Irrigated acreage grew primarily in the eastern United States, where agriculture production is historically rain-fed, and declined in the West, where a generally arid climate necessitates irrigation for most crops. In the East, increased frequency and severity of drought have driven farmers to move from rain-fed to irrigated production. In the West, farmers have begun to take irrigated land out of production as surface water supplies dry up, and they face increasing competition for water from growing urban centers. This chart was drawn from the USDA, Economic Research Service report Trends in U.S. Irrigated Agriculture: Increasing Resilience Under Water Supply Scarcity, published in December 2021.

Tuesday, September 26, 2023

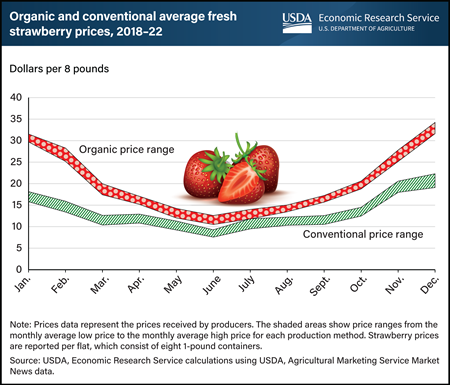

Fresh strawberry prices tend to exhibit strong seasonal trends in part because of their relatively short shelf life. Even being refrigerated immediately after harvest, fresh-picked strawberries last about 1 to 2 weeks, reducing the ability to store the crop and maintain a consistent supply. In the United States, grower prices for fresh organic strawberries move in tandem with conventional strawberry prices throughout the year while also typically running 40 to 50 percent higher than conventional prices—this difference is known as a “price premium.” In late fall and throughout winter, supply wanes even though demand remains robust. During this period, grower (or farm-gate) price premiums for organic strawberries rise above typical levels. From 2018–22, the highest average price premium was in January, when organic strawberry prices were 74 to 88 percent higher than conventional strawberries. Price premiums in July averaged 18 to 24 percent. Organic strawberry production has increased faster than conventional production. Since 2008, domestic organic strawberry acreage has tripled in California, which provides about 75 percent of U.S. organic strawberry production. This chart updates one that appeared in the USDA, Economic Research Service report The Changing Landscape of U.S. Strawberry and Blueberry Markets: Production, Trade, and Challenges from 2000 to 2020, published in September 2023.

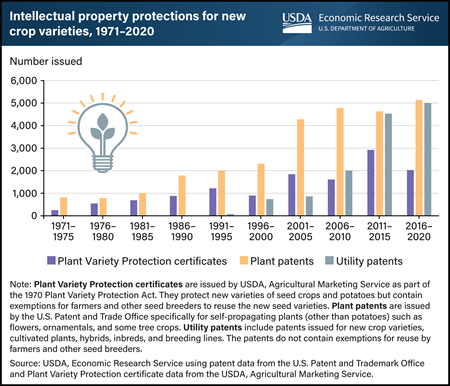

Monday, September 25, 2023

Before 1970, most crop breeding was done in the public sector. Seed companies lacked incentives to invest in crop breeding because they had no legal mechanism to restrict unlicensed use of improved seed, except for hybrid seed, which could be protected through trade secrets. The 1970 Plant Variety Protection Act aimed to encourage seed companies to improve crop varieties beyond hybrid seed. That aim was cemented after several court rulings ensured the private sector could benefit from its research into new seed varieties and genetically modified traits. In the following years, the number of intellectual property rights, such as Plant Variety Protection certificates, plant patents, and utility patents, began to rise. Genetically modified varieties of corn, soybeans, and cotton were introduced in the United States in 1996 and became the dominant seed choice among farmers within a few years. From 2016 to 2020, a total of 5,137 plant patents, 5,010 utility patents, and 2,028 Plant Variety Protection certificates were issued for new crop varieties, more than double the rate of a decade earlier. This chart appears in the USDA, Economic Research Service publication Concentration and Competition in U.S. Agribusiness and the Amber Waves article Expanded Intellectual Property Protections for Crop Seeds Increase Innovation and Market Power for Companies.

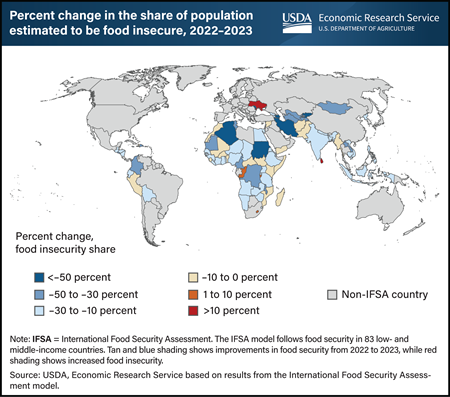

Thursday, September 21, 2023

USDA’s International Food Security Assessment (IFSA) model estimates how food prices and incomes affect food demand and access in 83 low- and middle-income countries. Food security is then evaluated by estimating the share of a country’s population that is unable to access sufficient calories to sustain a healthy and active lifestyle. In IFSA countries in 2023, almost 229 million fewer people are estimated to be food insecure compared with 2022, a 16.8-percent decrease. That improvement stems from average annual income growth of 3.7 percent for countries included in the IFSA. In 2023, the average per capita Gross Domestic Product—a proxy for income—for the IFSA countries was $2,415, higher than the $2,253 average for 2020–22. In addition, the drop in the price of vegetable oils contributes to food security improvements in 2023. Vegetable oil is a common component of many foods and, according to the Food and Agricultural Organization of the United Nations, makes up about 10 percent of calories consumed in a day in low-income countries. The year-to-year reduction in food insecurity indicates recovery from factors that continue to affect the global economy, including the Coronavirus (COVID-19) pandemic, high inflation rates for food and farm production inputs, and the ongoing Russian military invasion of Ukraine. This chart appears in the USDA, Economic Research Service report International Food Security Assessment, 2023-33, published in August 2023.

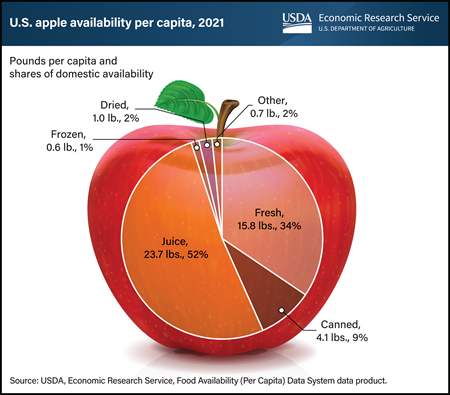

Wednesday, September 20, 2023

Apples are a fall staple, showing up in lunch boxes, pies, cobblers, crisps, and cider. In 2021, 45.9 pounds of apples per person were available for domestic consumption, according to USDA, Economic Research Service’s (ERS) Food Availability data product. Fifty-two percent of the available apples for U.S. domestic use (23.7 pounds per person) was in the form of juice or cider, or about 2 gallons per person. Fresh apples accounted for 34 percent (15.8 pounds per person). Canned, frozen, dried, and other forms made up the remaining 14 percent of apple availability in 2021. Over the last 10 years, per-person apple availability reached a high of 49.2 pounds per person in 2016. Much of the decrease since 2016 was because of declining availability of fresh apples. In 2016, fresh apple availability was 19.3 pounds per person. This chart uses data from ERS’ Food Availability (Per Capita) Data System (FADS), updated in April 2023.

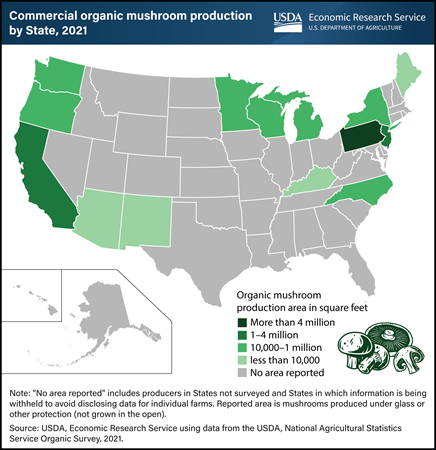

Tuesday, September 19, 2023

Pennsylvania led the United States in organic mushroom production with about 9.6 million square feet devoted to organic mushrooms in 2021. That amounts to about 61 percent of total U.S. square footage, a significant increase from 39 percent in 2019. California followed Pennsylvania, producing about 3.3 million square feet in 2021. Pennsylvania also leads the United States in conventional mushroom production. Mushrooms generally are produced in a controlled environment, so natural soil and temperature conditions are likely not factors in Pennsylvania’s dominance in this industry. Instead, Pennsylvania farmers have been significant producers of mushrooms since the 1880s and have the specialized knowledge and ventilated housing needed for extensive mushroom production, as well as organic straw and manure for use as composted substrate (the surface material on which mushrooms are grown). Farmers grow Agaricus, which includes the common white button mushroom, portabello, and crimini varieties, as well as specialty mushrooms such as shiitake, oyster, and other exotic mushrooms. The Mushroom Council, an organization of U.S. fresh mushroom producers, reports that at the retail level in 2022, organic crimini mushrooms made up 43 percent of the volume of organic sales, white 42 percent, portabello 9 percent, shiitake 3 percent, and other specialty mushroom varieties 3 percent. This chart appears in the USDA, Economic Research Service special article U.S. Organic Mushroom Industry Overview in the Vegetables and Pulses Outlook: December 2022, published in December 2022.