Suggested citation for linking to this discussion:

U.S. Department of Agriculture, Economic Research Service. (2025, February 6). Farm sector income & finances: Farm sector income forecast.

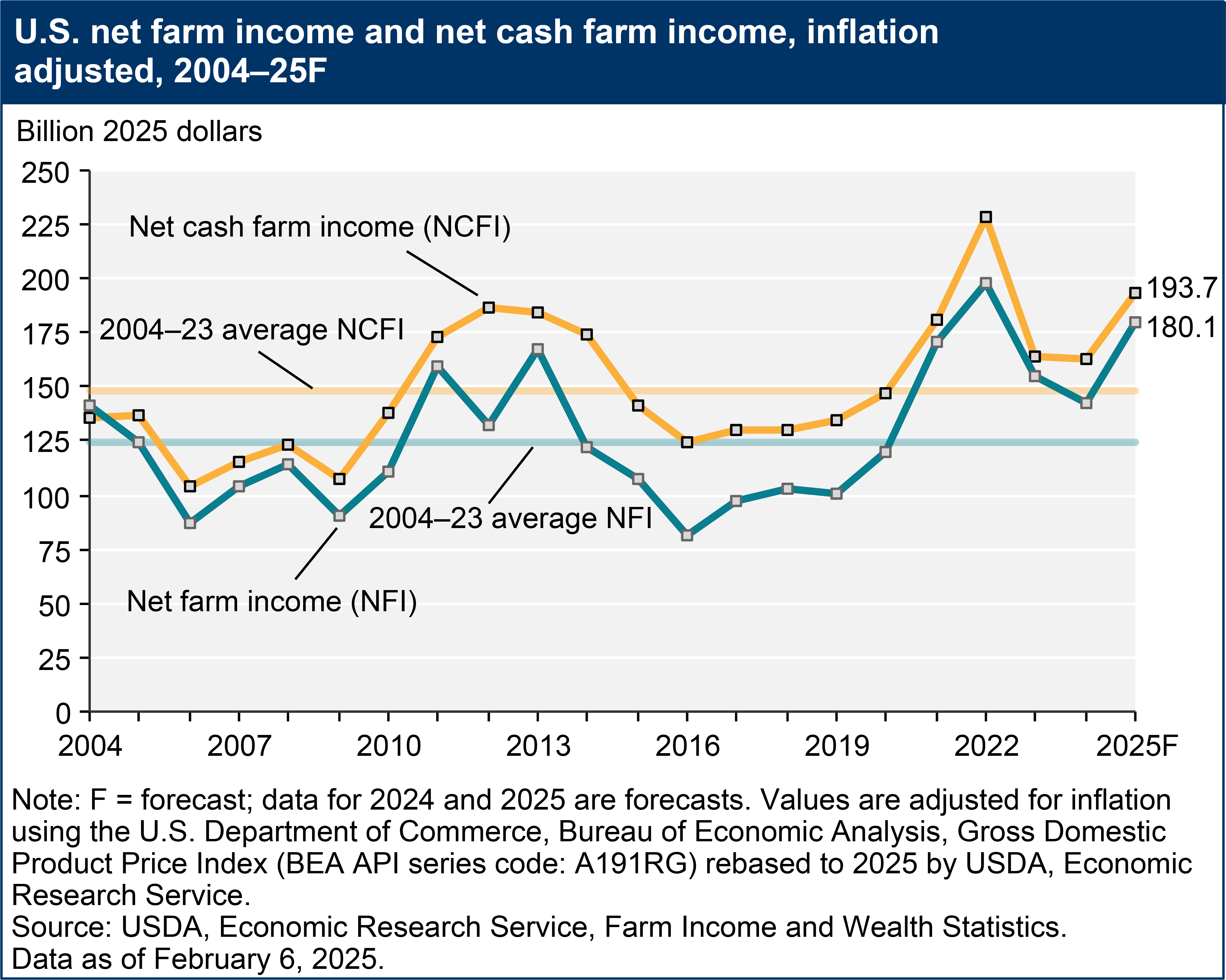

Net farm income, a broad measure of profits, is forecast to increase in 2025 after declining in 2023 and 2024 from a record high in 2022. Forecast at $180.1 billion for 2025, net farm income would be $41.0 billion (29.5 percent) higher than in 2024. Net cash farm income is forecast at $193.7 billion for 2025, an increase of $34.5 billion (21.7 percent) relative to 2024 (not adjusted for inflation).

In inflation-adjusted 2025 dollars, net farm income is forecast to increase by $37.7 billion (26.4 percent) from 2024 to 2025, and net cash farm income is forecast to increase by $30.6 billion (18.8 percent) compared with the previous year. If realized, both measures in 2025 would remain above their 2004–23 averages (in inflation-adjusted dollars) yet below their record high in 2022.

See all forecast and estimate data on farm income and wealth statistics or see a summary of the forecasts in the table U.S. farm sector financial indicators, 2018–2025F.

Download chart image | Chart data

Note: In the text below, year-to-year changes in the major aggregate components of farm income are generally discussed in nominal dollars, although cases are noted where the direction of change is reversed using inflation-adjusted dollars.

Summary Findings

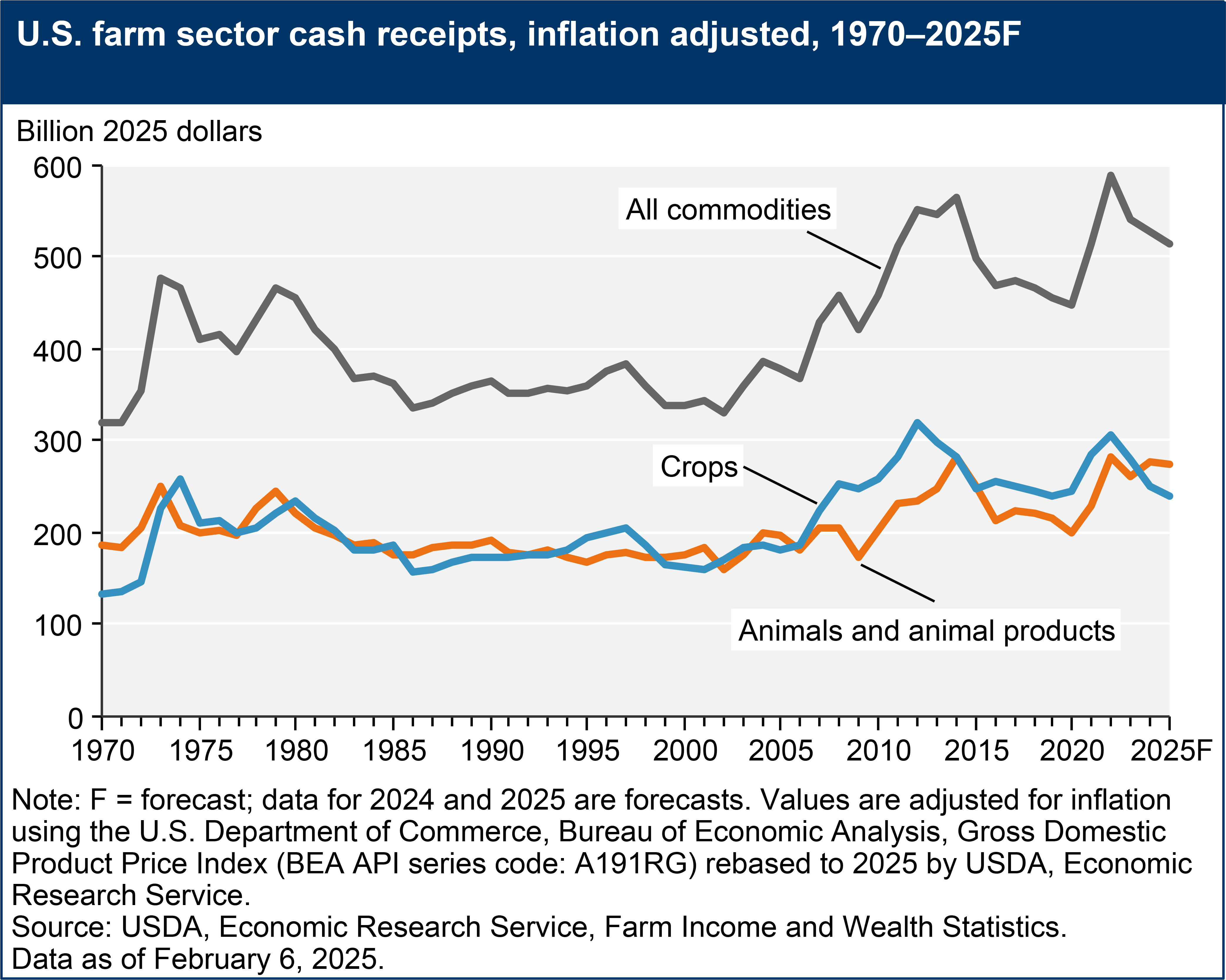

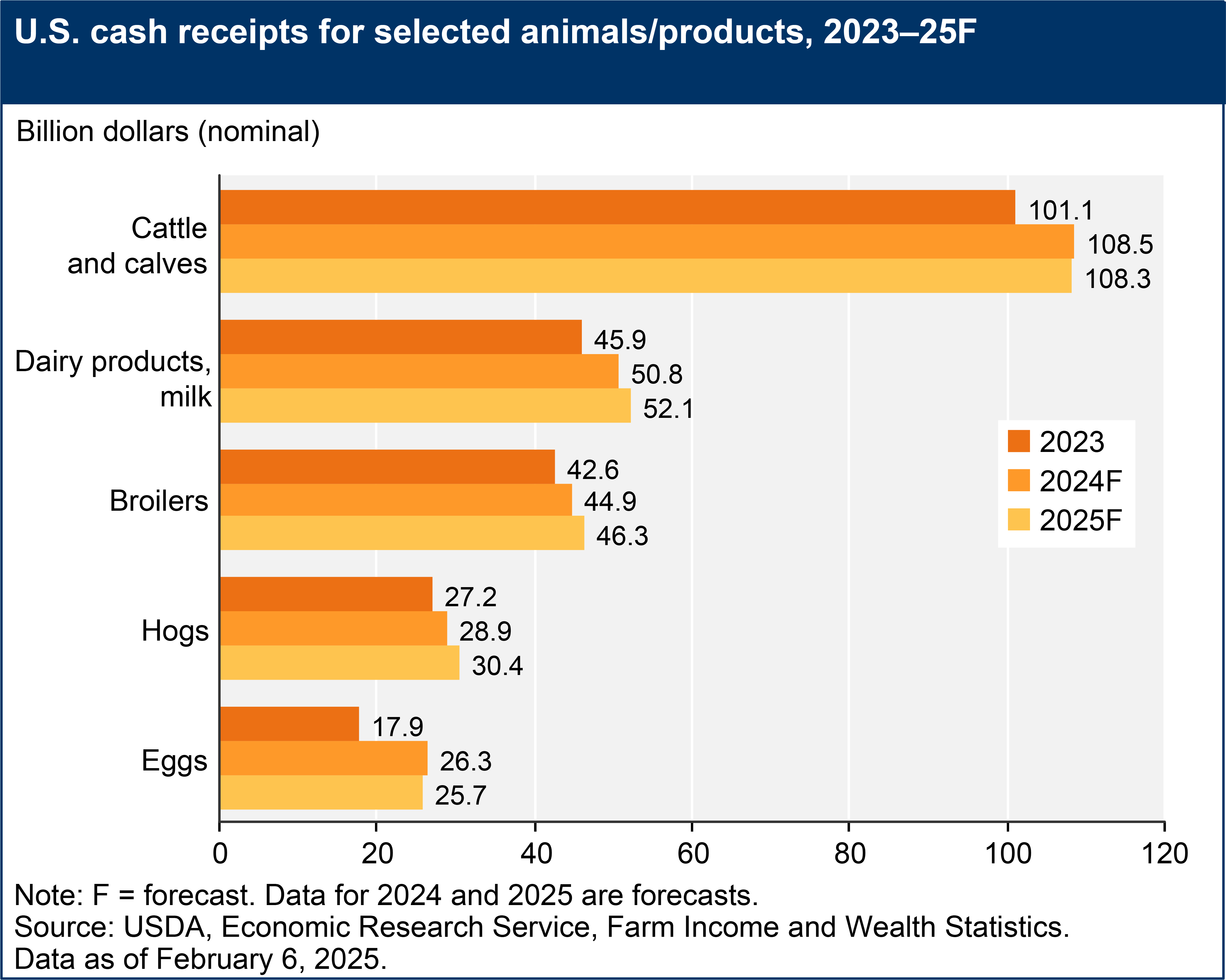

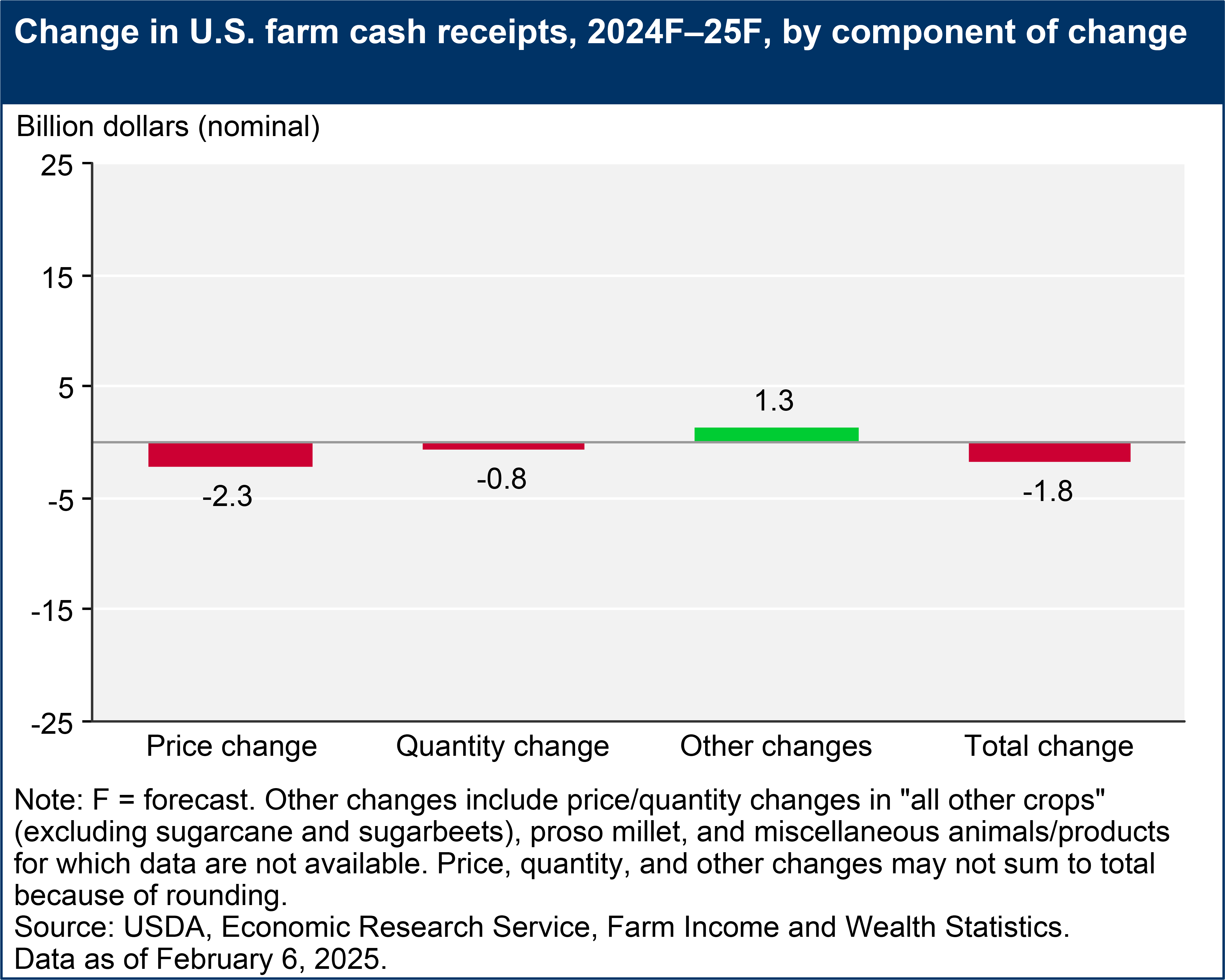

- Overall, farm cash receipts are forecast to decrease by $1.8 billion (0.3 percent) from 2024 to $515.0 billion in 2025 in nominal dollars. Total crop receipts are forecast to decrease by $5.6 billion (2.3 percent) from 2024 levels to $239.6 billion following lower receipts for soybeans and corn. Conversely, total animal/animal product receipts are projected to increase by $3.8 billion (1.4 percent) to $275.4 billion in 2025. Receipts for hogs, milk, and broilers are forecast to rise relative to 2024.

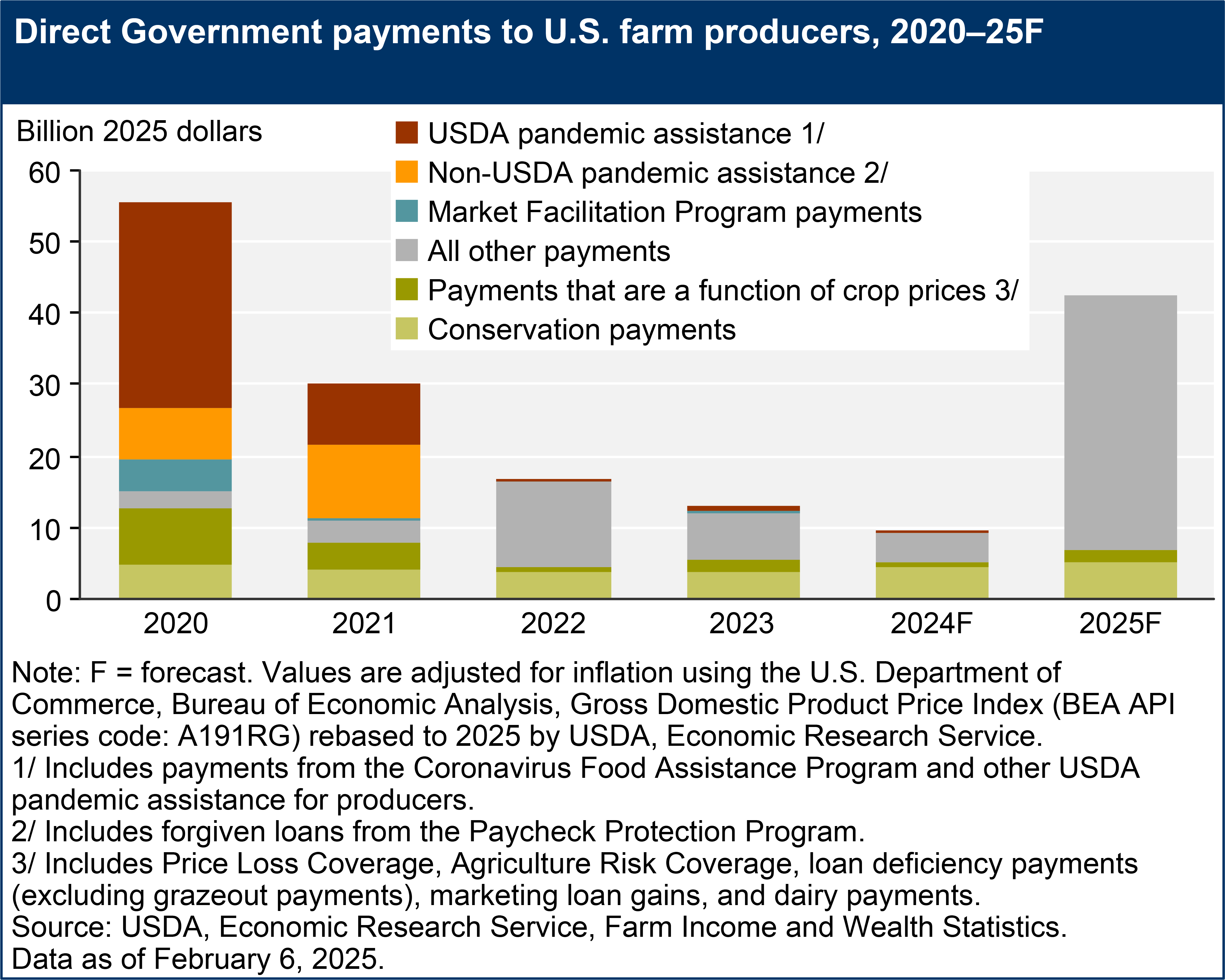

- Direct Government farm payments are forecast at $42.4 billion for 2025, a $33.1-billion increase from 2024. Direct Government farm payments include Federal farm program payments paid directly to farmers and ranchers but exclude U.S. Department of Agriculture (USDA) loans and insurance indemnity payments made by the Federal Crop Insurance Corporation (FCIC). The forecast increase is largely because of supplemental and ad hoc disaster assistance to farmers and ranchers from the American Relief Act of 2025.

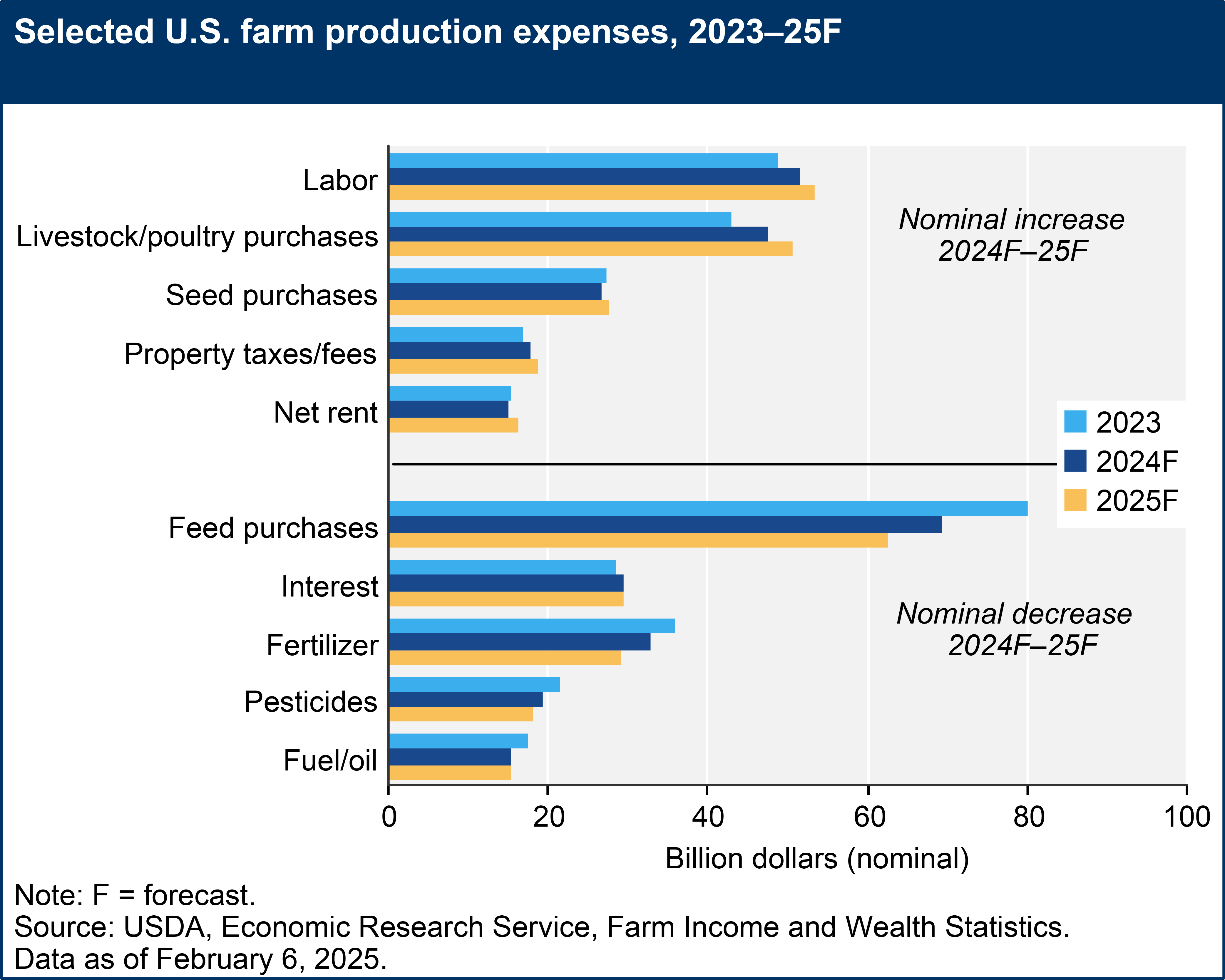

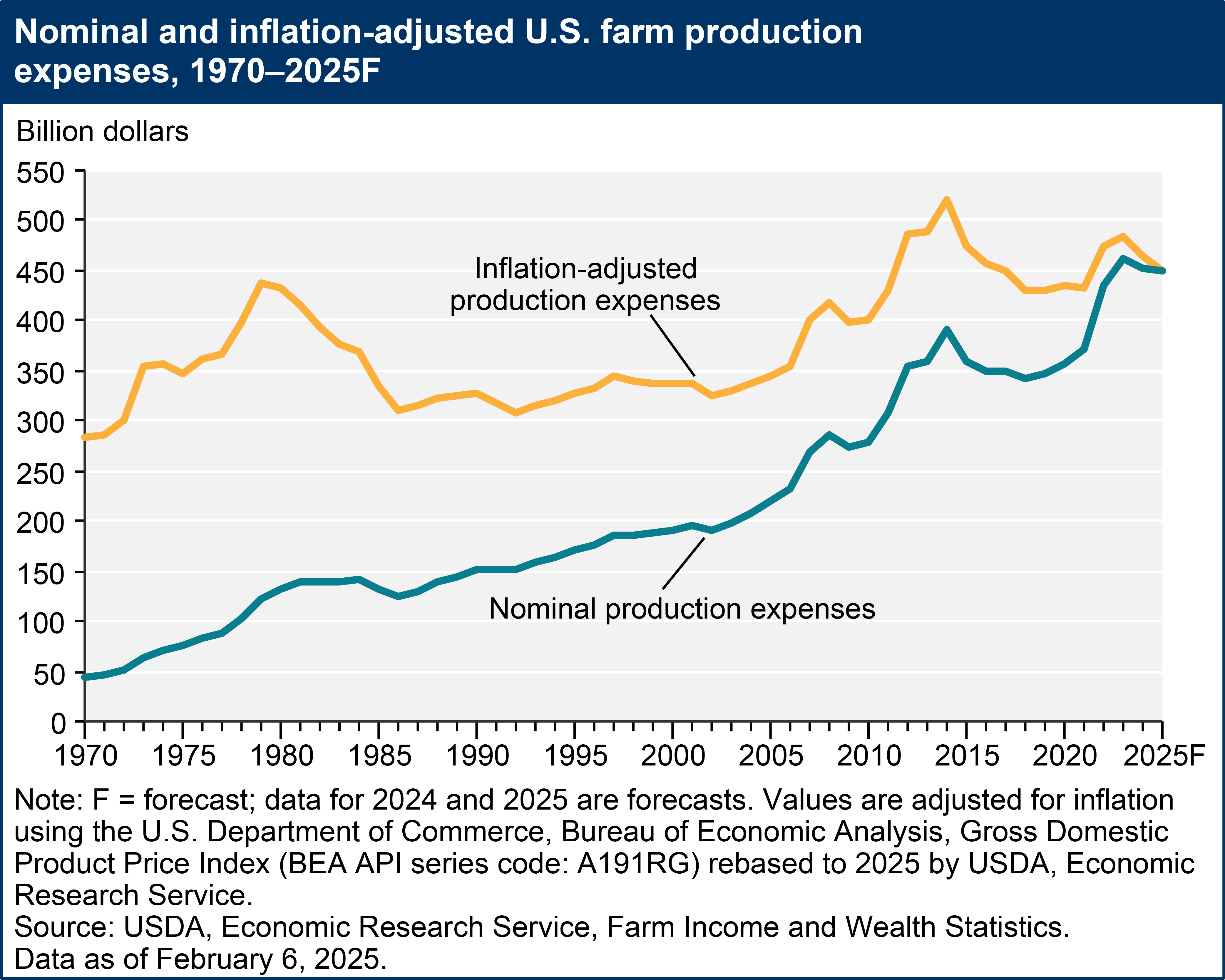

- Total production expenses, including those associated with operator dwellings, are forecast to decrease by $2.5 billion (0.6 percent) from 2024 to $450.4 billion in 2025. Spending on feed is expected to see the largest decline in 2025 while livestock/poultry purchases are expected to see the largest increase relative to 2024.

- Farm sector equity is expected to increase by 4.3 percent ($156.8 billion) from 2024 to $3.83 trillion in 2025 in nominal terms. Farm sector assets are forecast to increase 4.2 percent ($176.6 billion) to $4.40 trillion in 2025 following an expected increase in the value of farm real estate assets. Farm sector debt is forecast to increase 3.7 percent ($19.8 billion) to $561.8 billion in 2025. Debt-to-asset levels for the sector are forecast to improve slightly from 12.8 percent in 2024 to 12.8 percent in 2025. Working capital is forecast to increase 3.9 percent in 2025 relative to 2024.

Total Cash Receipts Forecast To Fall in 2025

Total inflation-adjusted cash receipts are forecast to fall $14.2 billion (2.7 percent) from 2024 to $515.0 billion in 2025. Crop cash receipts are projected to decline $11.5 billion (4.6 percent) during the year, and animal/animal product cash receipts are expected to fall by $2.8 billion (1.0 percent).

Download chart image | Chart data

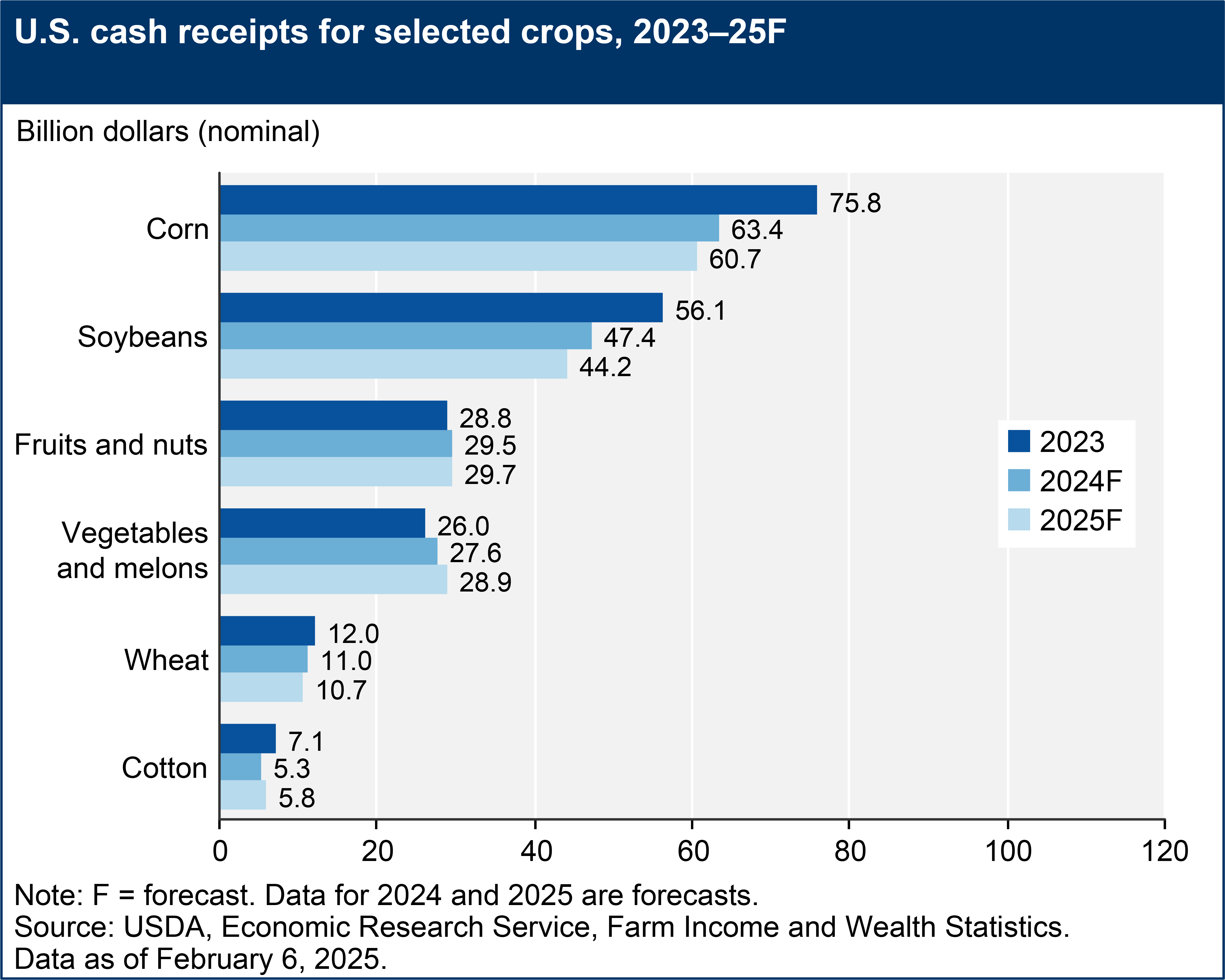

Crop Receipts Projected To Fall in 2025

Crop cash receipts are forecast at $239.6 billion in 2025, a decrease of $5.6 billion (2.3 percent) from 2024 in nominal terms. Combined receipts for corn and soybeans are forecast to fall $5.8 billion, while vegetable and melon receipts and cotton receipts are expected to increase.

Corn receipts are expected to fall by $2.7 billion (4.3 percent) in 2025, due to forecasted declines in both prices and quantities sold. Falling prices in 2025 should outweigh slight growth in quantities sold for soybean receipts, which are forecast to decrease by $3.1 billion (6.6 percent). Conversely, growth in quantities sold should outweigh falling prices for cotton receipts, which are projected to increase by $0.5 billion (10.2 percent). Forecasted lower prices and quantities sold should result in a decrease in wheat receipts of $0.4 billion (3.5 percent). Receipts for hay are projected to fall by $0.8 billion (9.4 percent), mostly due to lower prices.

Vegetable and melon cash receipts are projected to increase $1.3 billion (4.6 percent) in 2025. This figure includes growth of $0.1 billion in potato receipts. Cash receipts for fruits and nuts in 2025, are forecast to increase $0.1 billion (0.4 percent) in nominal terms during the year but are projected to decline in inflation-adjusted terms. Falling prices and quantities sold are expected to drive rice receipts $0.3 billion (8.5 percent) lower, while barley receipts are forecast to decline $0.2 billion (17.1 percent). Receipts for both sugarcane and sugar beets are forecast to fall in 2025, by $0.4 billion (23.3 percent) and $0.5 billion (20.0 percent), respectively.

See data on value of crop production (in the value added table) and crop cash receipts.

Download chart image | Chart data

Animal/Animal Product Receipts Forecast To Remain Stable in 2025

Total animal/animal product cash receipts are forecast at $275.4 billion in 2025, an increase of $3.8 billion (1.4 percent) in nominal terms from 2024 but a decline when adjusted for inflation. Although growth in receipts is forecast for most major animal/animal products in nominal terms, receipts for cattle and chicken eggs are projected to decline.

Milk receipts are expected to increase $1.4 billion (2.7 percent) nominally in 2025 due to higher prices and quantities sold. Cash receipts from cattle and calves are expected to fall $0.2 billion (0.2 percent), as lower quantities sold should outpace growth in prices. Hog receipts are forecast to rise by $1.5 billion (5.3 percent), as prices and quantities sold are both expected to grow.

Broiler receipts are expected to increase $1.4 billion (3.0 percent) in 2025, due to higher prices and quantities sold. Forecasted growth in prices should drive receipts for turkeys $0.2 billion (4.9 percent) higher during the year. However, cash receipts for chicken eggs are expected to decrease $0.6 billion (2.2 percent) in 2025, resulting from a forecasted decline in prices.

See data on value of animal/product production (in the value added table) and animal/product cash receipts.

Download chart image | Chart data

Lower Prices and Quantities Sold Forecast to Contribute to Cash Receipts Decline in 2025

To better understand the factors underlying the forecast change in annual receipts from 2024 to 2025, the change was decomposed into two separate effects: (1) a price effect projecting the change in cash receipts associated with holding the quantity sold constant at 2024 levels and allowing prices to change to forecast 2025 levels; and (2) a quantity effect holding prices constant from 2024 and quantities changing to forecast 2025 levels. In 2025, both falling prices and falling quantities sold are expected to result in lower forecast total cash receipts. Overall, cash receipts are forecast to decrease $1.8 billion in 2025, with an estimated negative price effect of $2.3 billion, and a projected negative quantity effect of $0.8 billion. In addition, a net increase of $1.3 billion in cash receipts is from commodity forecasts that have price and quantity effects that cannot be separately determined. Price effects on cash receipts are forecast to be negative for crop commodities but are projected to be positive for animals/animal products. Quantity effects are forecast to be negative overall for both crops and animals/animal products.

Download chart image | Chart data

Direct Government Farm Payments Forecast To Increase in 2025

Direct Government farm program payments are those made by the Federal Government to farmers and ranchers with no intermediaries. Most direct payments to farmers and ranchers are administered by the USDA using the Farm Bill but can also come from supplemental programs authorized by the U.S. Congress. Government payments discussed here do not include Federal Crop Insurance Corporation (FCIC) indemnity payments (listed as a separate component of farm income) and USDA loans (listed as a liability in the farm sector’s balance sheet). Direct Government farm program payments are forecast at $42.4 billion for 2025, a $33.1-billion increase above the $9.3-billion total forecast for 2024. This overall increase reflects higher anticipated payments from supplemental and ad hoc disaster assistance, mainly from the funding authorized in Disaster Relief Supplemental Appropriations Act, 2025 contained in the American Relief Act, 2025.

- Supplemental and ad hoc disaster assistance payments in 2025 are forecast at $35.7 billion, and consist primarily of payments from the Disaster Relief Supplemental Appropriations Act of 2025. The act included the Economic Assistance for Producers and other payments related to losses due to natural disasters in 2023 and 2024. Except for 2024, supplemental and ad hoc disaster assistance has represented the largest category of direct Government payments since 2020.

- Conservation payments from the financial assistance programs of USDA's Farm Service Agency and Natural Resources Conservation Service (NRCS) are expected to be $5.1 billion in 2025, an increase of $662.6 million (15.1 percent) from the 2024 level. The increase in conservation payments is due to an increase in payments from NRCS programs, including payments from the Inflation Reduction Act funds allocated for USDA’s conservation programs.

- Farm bill commodity payments under the Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) programs combined are forecast to more than triple in 2025, increasing $1.1 billion relative to 2024. ARC payments are forecast at $865.3 million in 2025, and PLC payments are forecast at $729.1 million. The ARC program provides income support payments when actual crop revenue declines below a specified level. The PLC program provides income support payments when the effective price of a covered commodity falls below its effective reference price.

- The Dairy Margin Coverage Program (DMC) is forecast to make $68.0 million in payments in 2025, which is $8.9 million lower than in 2024 due to higher projected milk prices in 2025.

See data table on Government payments.

Download chart image | Chart data

Production Expenses Forecast To Decline in 2025

Farm sector production expenses, including expenses associated with operator dwellings, are forecast at $450.4 billion in 2025. The 2024 expense measure is forecast to have decreased by $9.0 billion (2.0 percent) compared with 2023. Expenses are forecast to further decrease by $2.5 billion (0.6 percent) in 2025. With this projected 2-year decline, the expenses are forecast to fall to their lowest level in real terms since 2021.

See data tables on production expenses.

Download chart image | Chart data

Spending on feed, labor, and livestock/poultry purchases are expected to represent the three largest categories of spending in 2025. Feed expenses, the largest single expense category, are forecast at $69.4 billion in 2024 and $62.4 billion in 2025, falling to the lowest level in real terms since 2007.

In contrast, labor expenses (including noncash employee compensation) are forecast to be a record high in 2025, rising $2.9 billion (5.9 percent) in 2024 to $51.7 billion. They are forecast to rise by an additional $1.8 billion (3.6 percent) to $53.5 billion in 2025.

Livestock and poultry purchases are also projected be at a record high. The 2024 forecast includes growth by $4.5 billion (10.4 percent) to $47.4 billion. Growth is forecast to continue albeit at a slower rate in 2025, with an expected increase of $3.1 billion (6.5 percent), which put them at a record-high $50.5 billion.

Several other expense categories are forecast to notably change in 2025:

- Fertilizer expenses are expected to continue a declining trend from 2022, with an additional $3.6-billion (11.1 percent) decline to $29.2 billion.

- For pesticide expenses (spending on agricultural chemicals and application costs), the decreasing price trend that started in 2022 is expected to continue in 2025, driving pesticide expenses down by $1.2 billion (6.0 percent) to $18.1 billion.

- Seed expenses are projected to rebound in 2025, after a $0.7-billion (2.6 percent) decline projected for 2024. In 2025, the expenses are forecast to increase by $1.1 billion (4.2 percent) to $27.7 billion. Both the decline in 2024 and the increase in 2025 are largely explained by projected changes in planted acreage.