Brazil’s emergence as a competitor for the United States in global agricultural markets is rooted in currency depreciation

- by Constanza Valdes, Kim Hjort and Ralph Seeley

- 10/14/2020

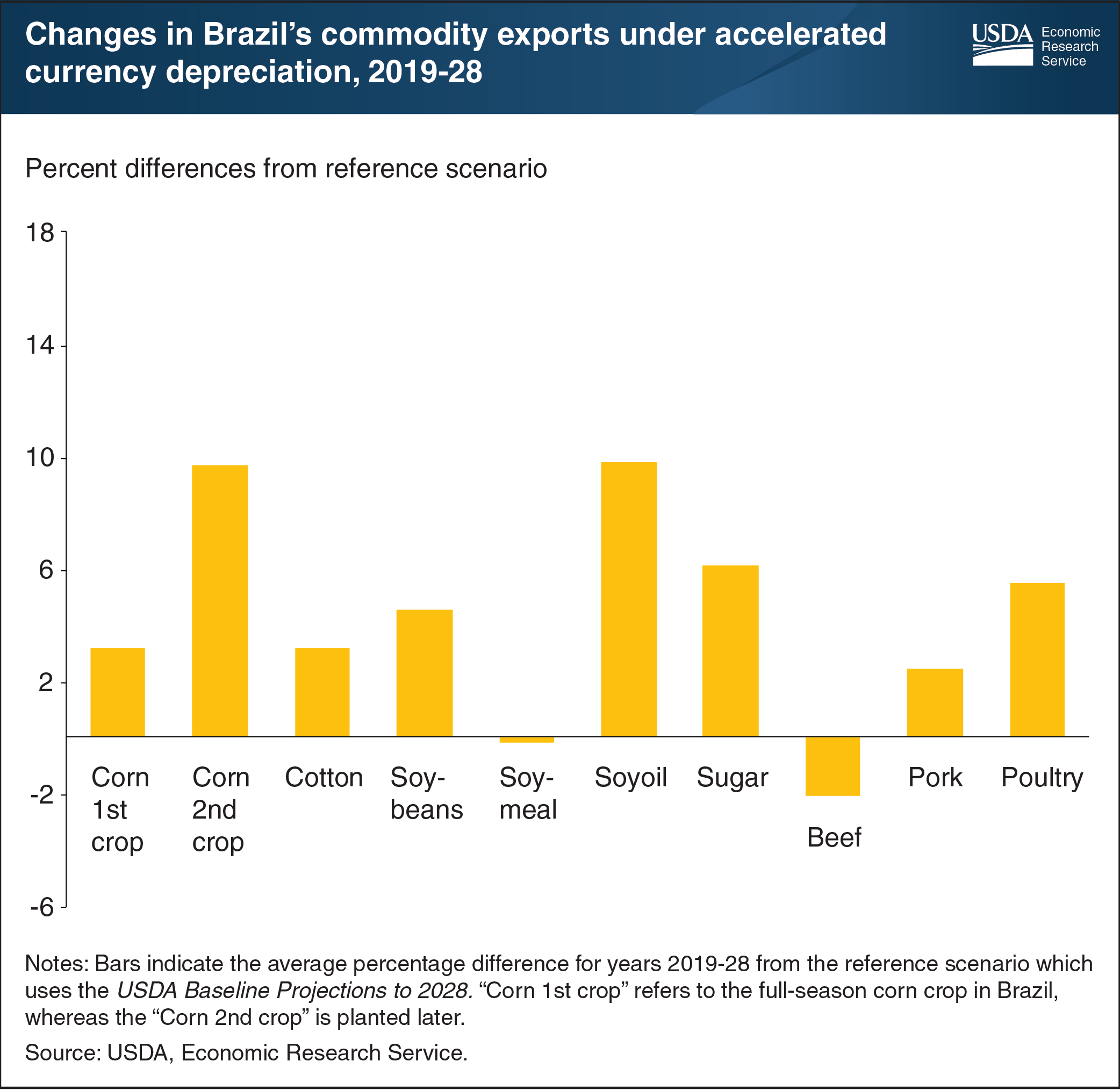

Brazil has emerged as a major competitor for the United States in global agricultural markets, and is now the world’s third largest exporter of agricultural products behind the European Union (EU) and the United States. Brazil’s macroeconomic policies—currency devaluation, in particular—have played an important role in its position as one of the top exporters of agricultural products, including soybeans, corn, cotton, sugar, coffee, orange juice, and meat. Because exported Brazilian commodities are priced in dollars, depreciation of Brazil’s local currency, the real (BRL), has meant that Brazilian farmers have received more BRL for each dollar of export revenues. Export sales therefore have become more profitable, thus encouraging expansion of cropland and adoption of techniques to increase productivity. Brazilian agricultural production and exports, which are poised to continue flourishing over the next decade, according to the USDA Agricultural Projections to 2029 report, could grow even faster under accelerated currency depreciation. Simulations show that if the BRL weakens more than previously expected, exports of major commodities could be an aggregate 5.6 percent greater than previously projected, with Brazil’s exports increasing for each major commodity except beef and soybean meal. This chart is drawn from Economic Research Service (ERS) report, Brazil’s Agricultural Competitiveness: Recent Growth and Future Impacts Under Currency Depreciation and Changing Macroeconomic Conditions, and was highlighted in the ERS October issue of Amber Waves, in the feature article, “Brazil’s Currency Depreciation and Changing Macroeconomic Conditions Determine Agricultural Competitiveness and Future Growth.”

We’d welcome your feedback!

Would you be willing to answer a few quick questions about your experience?