- U.S. Rice Production and Trade

- Marketing and Use of Rice

- U.S. Rice Policy

- Global Rice Production and Trade

Rice is the primary staple food for more than half the world's population, and Asia, Sub-Saharan Africa, and South America are the largest consuming regions. The bulk of global rice is classified as Oryza sativa, a plant species that is believed to have originated in Asia from the Graminaceae (grass) family. Although rice is produced over vast areas of the world, the physical requirements for growing it are limited to certain areas. Economically sound production typically requires high daytime temperatures and cooler nights during the growing season, a plentiful supply of water applied as needed, a smooth land surface to facilitate uniform flooding and drainage, and a subsoil hard-pan that inhibits percolation (downward movement of water through the rice bed). Four major types of rice are produced and traded worldwide (table 1).

| Type | Where grown | Percent of global rice trade |

|---|---|---|

| Indica | Tropical and subtropical regions such as India, Pakistan, Thailand, Vietnam, Burma, Cambodia, the Philippines, Indonesia, Malaysia, southern China, and Brazil | 62–66 |

| Aromatic (jasmine and basmati) | Primarily Thailand, Vietnam, Cambodia, India, and Pakistan | 23–25 |

| Japonica | Regions with cooler climates such as Japan, North Korea, South Korea, certain regions of China, California, the European Union, Russia, Australia, and Egypt | 9–10 |

| Glutinous and other specialty rice types | Primarily Thailand, Vietnam, Cambodia, and Laos | 2-3 |

| Source: USDA, Economic Research Service calculations. | ||

U.S. Rice Production

Four regions produce almost the entire U.S. rice crop:

- Arkansas Grand Prairie;

- Mississippi Delta, (parts of Arkansas, Mississippi, Missouri, and Louisiana);

- Gulf Coast (Texas and Southwest Louisiana); and

- Sacramento Valley of California.

Each of these regions normally specializes in a specific type of rice, referred to in the United States by length of grain, i.e., long, medium, and short. U.S. long-grain varieties typically cook dry and separate, whereas U.S. medium- and short-grain varieties are typically moist and clingy or sticky. In general, long-grain production accounts for approximately 75 percent of U.S. rice production, medium-grain production accounts for about 24 percent, and short-grain accounts for the remaining approximate 1 percent. In 2021, the United States produced 191.6 million hundredweight (cwt) of rough rice, down 16 percent from 2020 but still slightly above the 2019 crop. The 2022 rice crop of 160.4 million cwt was also 16 percent below a year earlier, with drought in California a major factor behind declining U.S. rice production in both 2021 and 2022.

U.S. long-grain rice production is concentrated in the South (e.g., Arkansas typically grows 56–58 percent of the U.S. long-grain crop.) California is the main producer of medium-grain rice, typically growing 70–77 percent of the crop, although Arkansas grows a substantial amount of medium-grain rice, especially in years when California is experiencing drought. Louisiana typically harvests a much smaller quantity of medium-grain rice. Short-grain rice is almost exclusively grown in California. All U.S. rice is produced in irrigated fields, achieving some of the highest yields in the world. Rice producers in the United States can seed aerially in flooded fields, or they can drill or broadcast (scatter) seed into dry fields. California producers seed primarily by air directly into flooded fields. Most producers in the Delta drill or broadcast seed into dry seedbeds, whereas growers in southwest Louisiana and on the Texas Gulf Coast seed both aerially into flooded fields and drill or broadcast seed into dry seedbeds.

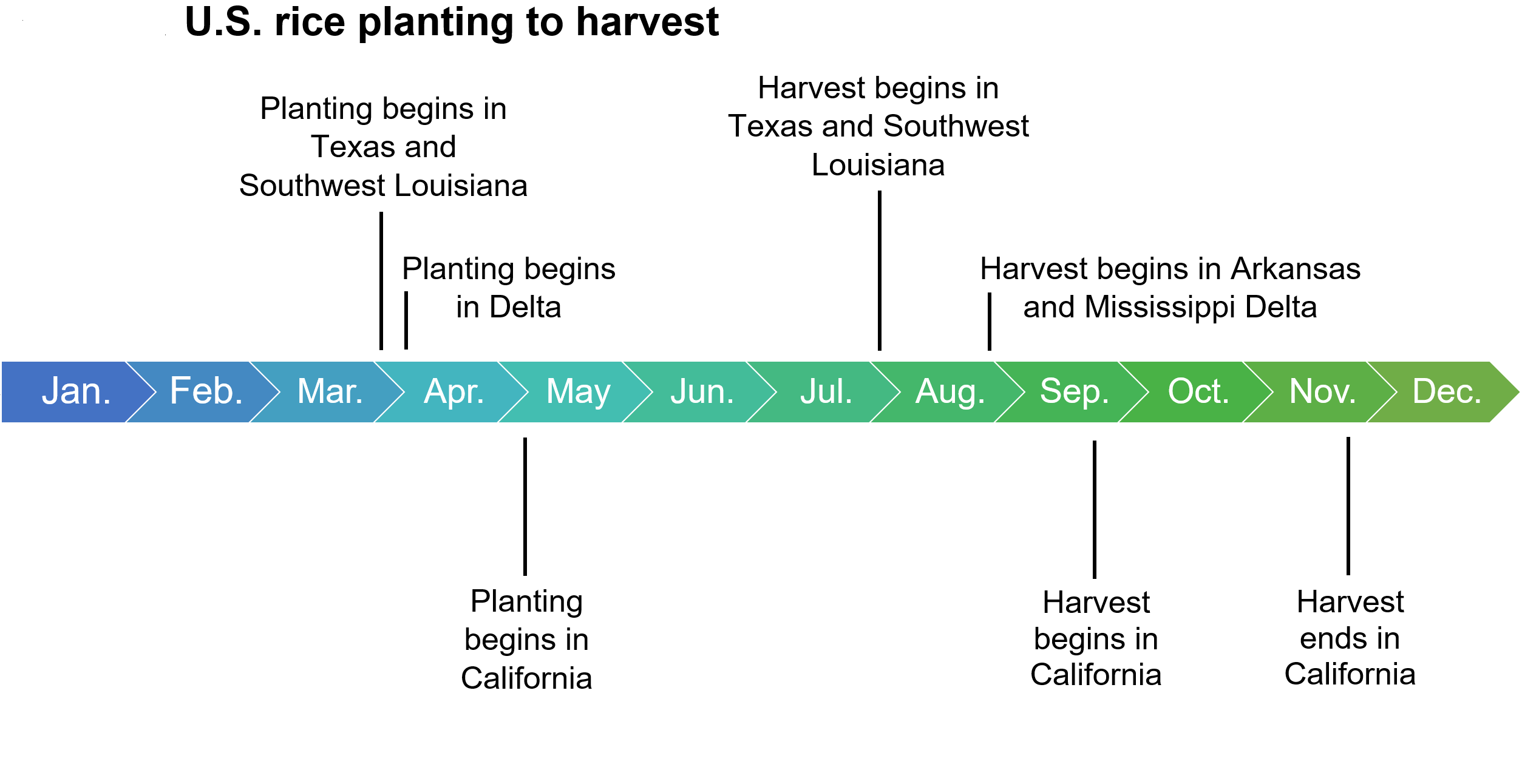

Marketing years vary by State. The marketing year in Texas and Louisiana begins July 1, in Arkansas and Mississippi August 1, in Missouri September 1, and in California October 1. Some producers in Texas and southwest Louisiana are able to reflood their fields after harvest and achieve a partial second or "ratoon" crop from the stubble remaining in the field after the first-crop harvest.

Figure 1. U.S. rice from planting to harvest

In 1981, the United States planted the largest all-rice acreage to date, more than 3.8 million acres. During the rest of the 1980s, participation in acreage-reduction programs, along with typically low prices, pushed the number of planted acres down for most years in the decade. Yields per acre for long-, medium-, and short-grain rice have steadily increased since the 1970s. Yields per acre are typically higher in California than in the South, largely due to the normally different yields achieved by the varieties grown in each region. As a result of severe drought and low reservoir levels, California rice plantings dropped almost 22 percent in 2014 and declined almost 4 percent in 2015. The State’s rice area increased in 2016, but did not return to predrought levels (for more discussion, see the commodity focus in USDA, Economic Research Service’s (ERS) Rice Outlook: April 2018. California’s 2021 and 2022 rice plantings were sharply reduced by severe drought as well, with 2022 plantings the lowest since 1958. Substantial rainfall in late 2022 and early 2023 and the spring snowmelt returned California’s rice plantings in 2023 to pre-2021 levels.

U.S. Rice Exports

The United States is a consistent, timely supplier of high-quality rice in both the long- and combined medium- and short-grain global markets. Although the United States accounts for less than 2 percent of global rice production, it ships almost 5 percent of global exports and is currently the fifth-largest exporter. Exports are thus important to the U.S. rice industry, with 40–45 percent of the crop currently exported each year.

Download chart data in Excel format

U.S. rice exports include:

- Rough (unmilled rice)

- Parboiled rice

- Brown rice

- Fully milled (white) rice.

Milled rice (including brown rice and parboiled rice) currently accounts for 52–56 percent of U.S. rice exports, followed closely by rough rice. Rough rice exports began a long-term increase in the mid-1990s as several countries in Latin America—primarily Mexico and Central American countries—reduced support to producers and opened their markets to imported rice. The United States initially faced little competition in these predominately rough rice markets, typically accounting for 95–100 percent of their rice imports. However, since 2010, South American exporters have shipped substantial amounts of milled rice to these markets, and more recently rough rice as well, and now account for 30–80 percent of rice imports in several of these markets.

In addition, since 2008, the United States has shipped rice to Colombia (rough and milled rice) and Venezuela (rough rice), where U.S. exports also face increasing competition from South American exporters, primarily from Brazil, Paraguay, and Uruguay. Except for shipments to Cuba from Vietnam, the Asian exporters typically ship little rice to Latin America. Historically, the United States has been the only major exporter that allows rough rice exports, although most South American exporters, all medium-sized exporters, shipped some rough rice to Central and other South American countries. In addition, since 2020, Brazil has shipped substantial quantities of rough rice to Mexico and increased its rough-rice sales to Central America. Paraguay has also recently shipped rough rice to Mexico and has expanded its rough-rice sales to Central America. Outside Latin America, Cambodia regularly ships rough rice to neighboring Vietnam.

Demand for U.S. parboiled rice began a long-term decline in the mid-1990s, with the European Union (EU) and the Middle East accounting for most of the sales and the decline. The United States also exports processed rice products such as rice cakes, rice mixes, and cereal, although these products remain a very small share of U.S. rice exports. The United States annually exports small quantities of broken kernel rice as well, typically accounting for almost 2 percent of total export volume.

Download chart data in Excel format

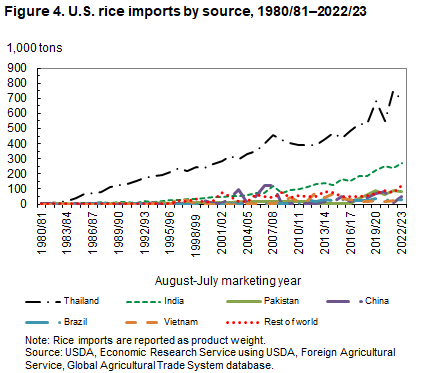

U.S. Rice Imports

U.S. rice imports have tripled since 2001/02. Most U.S. rice imports are specific aromatic varieties from Asia, with jasmine from Thailand and basmati from India and Pakistan. Since 2011, South American exporters have shipped 15,000–40,000 tons of non-aromatic, long-grain milled rice to the United States annually, mostly due to competitive prices. In addition, in 2018 China returned as a supplier of medium-grain rice to Puerto Rico, a U.S territory. Also, in 2022/23, Australia shipped about 38,600 tons of medium- and short-grain milled-rice to the United States due to a drought-reduced crop in California. Since 2019/20, the United States has imported (on average) more than 14 percent of its total supply of rice, up from 10 percent for 2014/15–2018/19.

Download chart data in Excel format

Marketing and Use of Rice

Five different products can be produced from rough rice: hulls, bran, brown rice, whole kernel milled rice, and brokens. Brokens are separated into three categories based on descending size: second heads, screenings, and brewers.

The first stage of milling removes the hull, producing brown rice that can be cooked and consumed. The next stage removes the bran layer, leaving whole-kernel milled white rice but creating some broken kernels as well. Most of the bran is used in animal feed.

Prior to milling, rough rice may be parboiled, a process of soaking the rice in water and steaming it under intense pressure. Parboiling makes the rice less likely to break during milling and pushes nutrients from the bran layer into the kernel. Parboiled rice typically sells at a premium compared to regular milled rice.

The United States has five or six different grades and grade requirements for rough rice, brown rice, milled rice, and all three classifications of broken kernel rice (i.e., second-heads, screenings, and brewers). In general, the grading requirements are based on maximum limits for seeds and heat-damaged kernels, paddy kernels, red rice and damaged kernels, and chalky kernels, as well as requirements for color, well-milled kernels, and minimum milling requirements. Red rice consists of whole or large broken kernels of rice, with a substantial amount of red bran.

Care is necessary throughout the production, drying, storage, milling, and marketing phases to minimize the number of broken kernels, which sell at a considerable discount to whole-kernel rice. Virtually all rice purchased by U.S. consumers or sold to U.S. restaurants is whole-kernel milled rice. However, 15–17 percent of the U.S. crop is currently exported annually as rough (unmilled) rice and is eventually milled in the importing country. For more information, see U.S. Standards for Rice.

Long-term growth in rice use in the United States is partly a result of the United States changing ethnic composition, with high per capita rice-consuming groups increasing their shares of the U.S. population. Rising demand for gluten-free and continued introduction of new rice-based products have also contributed to growth in domestic use. Domestic uses of rice include food for human consumption (both direct food use and processed foods), beer, and pet food.

In most other countries, increases in rice consumption can largely be attributed to population growth, especially in countries where rice is a staple food item—primarily in Asia and much of Latin America. In Sub-Saharan Africa, both strong population growth and rising per capita use are boosting total rice consumption. However, global per capita rice consumption has been decreasing as countries have become more developed and their populations have begun to eat more meat and fewer staple grains.

For additional discussion, see The Rice Market in South Korea and Haiti's U.S. Rice Imports.

U.S. Policies Affecting Rice Producers

Under Title I of the Agricultural Act of 2018, the USDA’s Farm Service Agency (FSA) operates two crop commodity programs first authorized in the Agricultural Act of 2014 Farm Act, Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC). In addition to PLC and ARC, USDA, FSA operates the much older Marketing Assistance Loan Program, which is the descendant of the commodity loan program established under the Agricultural Adjustment Act of 1938, but with significant changes made beginning in 1985. Rice growers primarily use the PLC program.

Producers who hold base acres of rice and other covered commodities are eligible to enroll in the PLC program on a commodity-by-commodity basis. Payments are made when the market-year average price falls below the effective reference price. The statutory reference prices for rice set in the 2018 Farm Act are as follows:

Table 2. Statutory reference prices, 2018 Farm Act

| Long-grain rice | $14.00 per hundredweight |

| Southern Medium and short Grain | $14.00 per hundredweight |

| Temperate Japonica (California) 1/ | $17.30 per hundredweight |

1/ The effective reference price for the 2022 crop is $17.79 per hundredweight.

The loan rate for all rice crops is set by the 2018 Farm Act at $7.00 per hundredweight.

Source: USDA, Economic Research Service using USDA, Farm Service Agency, Agriculture Risk Coverage program data, and Price Loss Coverage program data.

See more information on U.S. Farm Policy

Global Rice Production and Consumption

Globally, the top rice-producing country is China, followed by India.

| Country | Annual average production, milled basis (million tons) | |

|---|---|---|

| China | 147.691 | |

| India | 125.038 | |

| Bangladesh | 35.511 | |

| Indonesia | 34.360 | |

| Vietnam | 27.099 | |

| Thailand | 19.529 | |

| Burma | 12.530 | |

| Philippines | 12.249 | |

| Japan | 7.591 | |

| Pakistan | 7.530 | |

|

1 ton = 2,204.62 pounds. Source: USDA, Foreign Agricultural Service, Production, Supply and Distribution database. |

||

| Country | Annual average consumption, milled basis (million tons) 1/ | |

|---|---|---|

| China | 153.683 | |

| India | 109.166 | |

| Bangladesh | 36.733 | |

| Indonesia | 35.367 | |

| Vietnam | 21.450 | |

| Philippines | 15.400 | |

| Thailand | 12.700 | |

| Burma | 10.367 | |

| Japan | 8.183 | |

| Nigeria | 7.333 | |

|

1 ton = 2,204.62 pounds. 1/ Includes a residual component that accounts for post-harvests losses in processing, marketing, and transporting. Source: USDA, Economic Research Service using USDA, Foreign Agricultural Service, Production, Supply and Distribution database. |

||

Global Rice Trade

Rice Exports

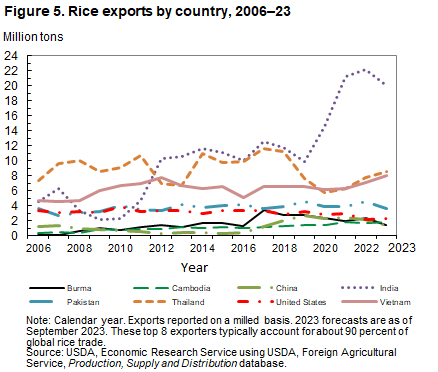

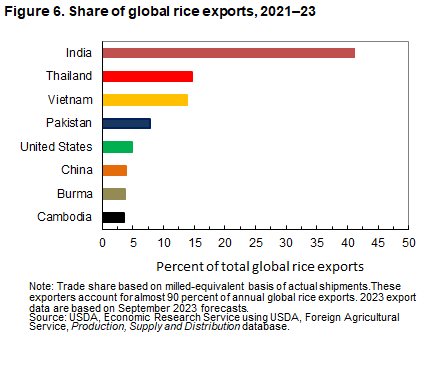

Since 2012, India has been the largest global rice exporter, currently shipping more rice annually than the combined shipments of the next three largest exporters. India’s rice exports increased by almost 49 percent in 2020 and then rose 46 percent more in 2021 to more than 21 million tons before peaking in 2022 at 22.1 million. India’s exports are projected to decline in 2023 and 2024 due to Government imposed export restrictions. The next largest rice exporters are Thailand, Vietnam, Pakistan, the United States, China, Burma, and Cambodia, which, along with India, account for a combined 90 percent of the global rice trade. Cambodia started increasing exports in 2009 and are currently near-record high. China substantially increased its exports in 2017 and returned as a major exporter in 2018, although shipments have recently declined. In contrast, U.S. rice exports dropped by 26 percent in 2022 due to a small crop and uncompetitive prices. Thailand’s exports dropped substantially in 2019 and 2020, and despite some expansion, have remained well below past levels. Pakistan’s exports dropped 20 percent in 2023 due to severe flooding in the summer of 2022.

Download chart data in Excel format

Download chart data in Excel format

Global Rice Imports

On the global rice import side, Sub-Saharan Africa remains the largest rice importing region, slightly exceeding total imports by all of Asia and accounting for around 30 percent of global imports. The Middle East remains a large global import market, accounting for more than 70 percent of the region’s rice consumption. Southeast Asia is also an important import market, showing recent growth after years of stagnation as the region’s production expanded. The Philippines is the largest rice importer in Southeast Asia and is currently the largest global importer, importing almost 4 million tons annually. East Asia’s rice imports were boosted in 2021 and 2022 by China’s large purchases but imports for this region have since returned to a more normal level. South Asia is the smallest rice importing region in Asia, although Bangladesh’s imports can rapidly increase after a crop shortfall, as in 2017 and 2018 after a weather-reduced harvest and in 2021, after a weak harvest. Rice imports by South America are projected to expand around 13 percent in 2023, with Brazil accounting for most of the expected increase. From 2012–2022, South American imports were nearly flat due to flat-to-declining consumption in most countries’ growth and near-steady regional production. Both North America and the EU are currently importing record or near-record amounts of rice, although both regions have a low per capita rice consumption compared with Asia and Sub-Saharan Africa. These regions are large markets for Asian aromatic varieties, specialty rices that are high-priced and account for a growing share of global rice trade.