U.S. poultry products hold leading positions in both international and U.S. meat commodity markets—supported by competitive production structures, modern poultry genetics, abundant domestic feed resources, and strong consumer appeal. In 2024, total poultry sector sales were $70.2 billion, up from $67.4 billion in 2023. Broilers accounted for the majority of poultry sector value in 2024, with $45.4 billion. This value was an increase of 5.8 percent from 2023. Benchmark broiler prices were up about 5 cents year over year in 2024. The value of turkey production declined from $6.7 billion in 2023 to $3.7 billion in 2024. Average wholesale prices for whole-hen turkeys in 2024 were the lowest in 5 years. The value of egg production in 2024 was $21.0 billion, up 17.7 percent from 2023. This value reflected elevated prices in 2024.

Production

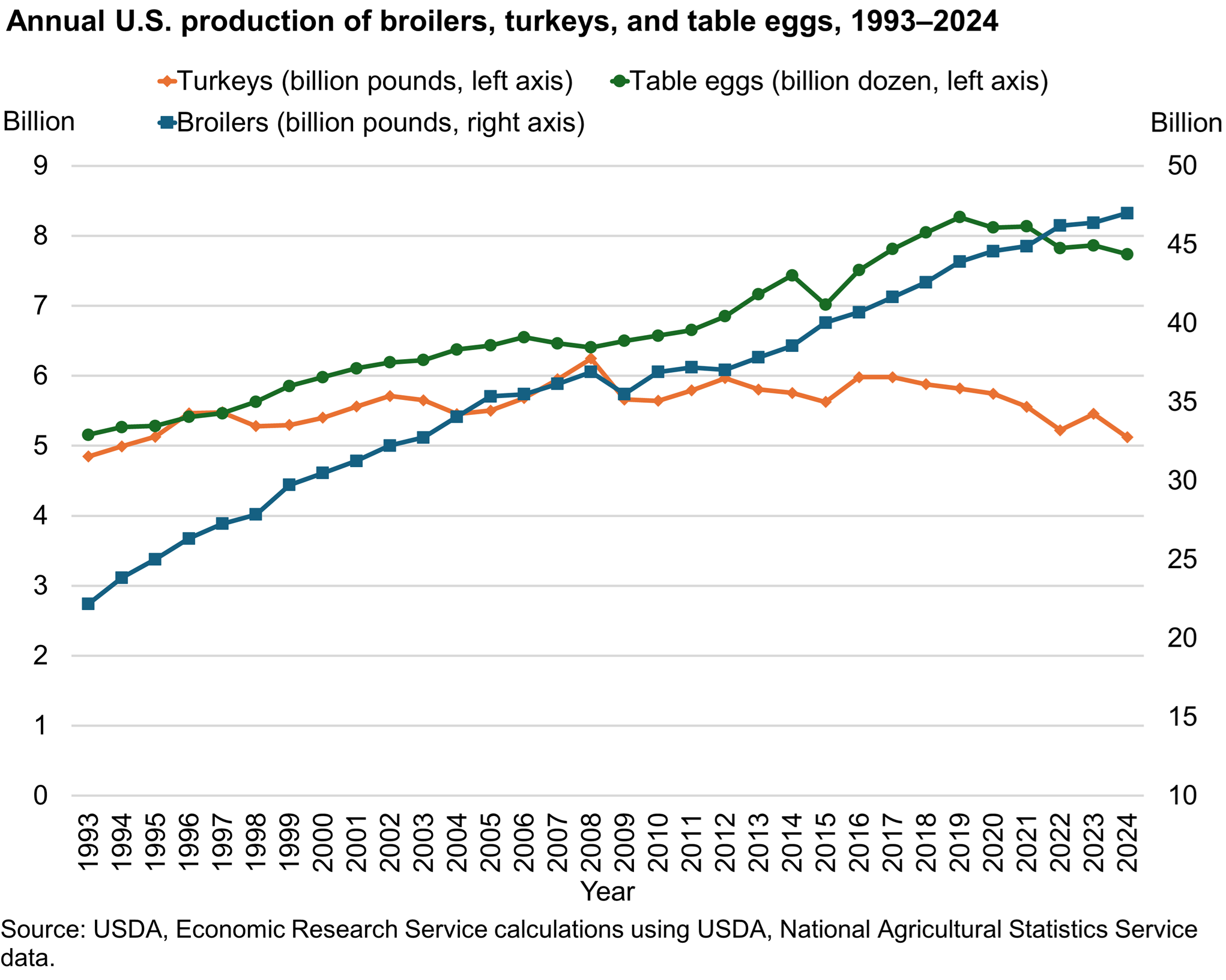

U.S. Poultry production mostly expanded from 2015 through 2024, as producers sought to meet domestic and foreign consumer demand. Broiler production expanded by 17.3 percent and table-egg production increased by 10.3 percent. Turkey production in 2024 was down 9.0 percent from 2015.

Download chart data in Excel Format.

U.S. poultry production has a competitive global advantage due to abundant domestic feed resources, primarily soybean meal and corn. Feed is generally the most significant production cost across livestock, and poultry converts feed to human food products (meat and eggs) more efficiently than larger livestock. Modern poultry genetics have driven a dramatic increase in poultry-feed conversion over time, requiring less feed (and duration) to produce market-ready birds (and eggs) and resulting in highly competitive product prices.

Commercial poultry production starts with primary breeder birds selected to lay fertile eggs for hatching on the basis of desirable genetic traits. These birds’ progeny become breeders that eventually produce birds used directly for meat or table-egg production. The period during which breeders grow to reach reproductive maturity can be 4.5 to 6 months after hatching and is generally longer for turkeys.

Timeframes vary for harvesting meat from broilers or turkeys and table eggs from layer chickens. Market-broiler chickens are generally slaughtered before they reach 2 months of age, while turkeys often reach 4 months before slaughter. Table-egg-type chickens begin laying at about 4 to 4.5 months of age and start a cycle that can last 14–15 months, with additional production cycles optional after a molting period.

U.S. poultry firms vertically integrate more production stages than other livestock producers—with feed production, fertile egg and chick production, and slaughter often residing under the same firm. Production contracts are also common, where the services of growers who house and manage birds, for example, may be contracted by an integrated poultry firm in exchange for a fee per bird.

Consumption

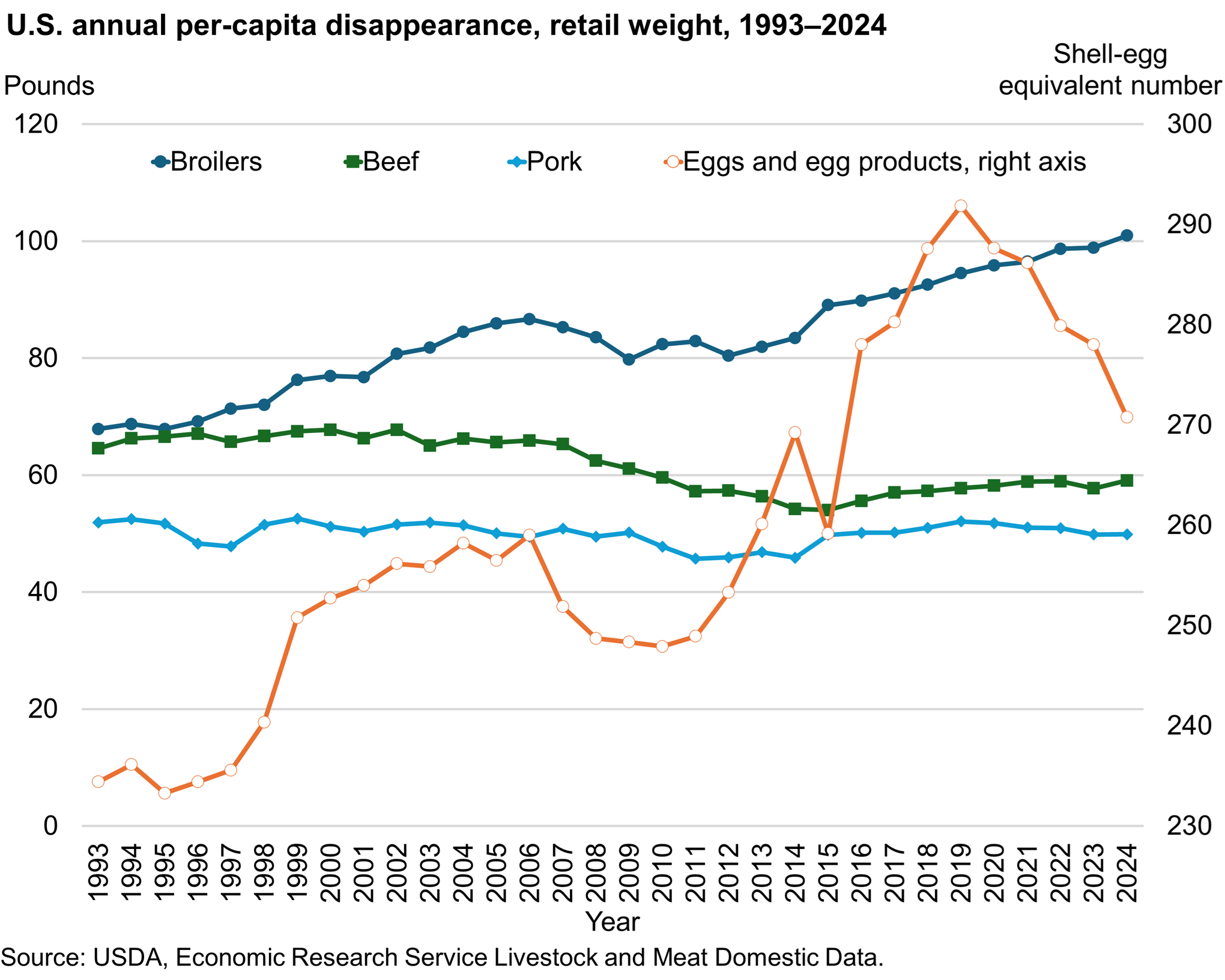

U.S. poultry meat consumption has trended up and displaced a substantial amount of red-meat consumption in recent decades, in part because of favorable prices and health recommendations. The chart below shows these changing consumption trends by comparing one measure of poultry-meat consumption (estimated retail disappearance) with the same measure for red-meat consumption, including beef and pork. The chart also includes egg and egg-product disappearance. USDA, Economic Research Service-published disappearance statistics are a proxy for consumption, measuring supplies available for marketing in a given period. Meat disappearance equals production less net exports and net changes in cold storage. Retail disappearance also subtracts an estimate of meat components that are not typically sold with meat at retail, such as certain bone portions and skin.

Download chart data in Excel format.

Trade

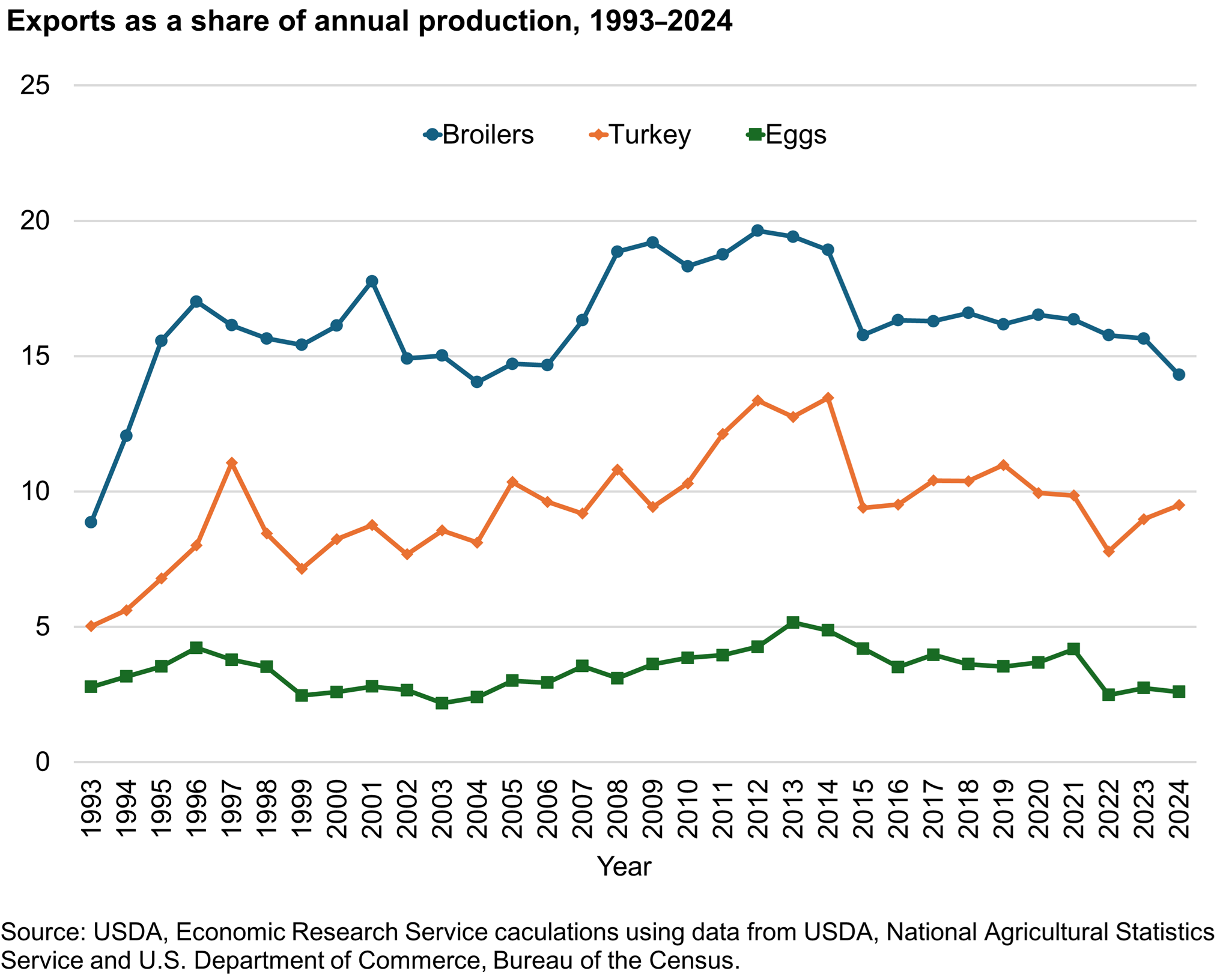

Trade impacts the U.S. poultry sector’s profitability by altering domestic supplies and prices from what they would have been without foreign markets. In 2024, 14.3 percent of domestic broiler production was exported, making broilers the most export-oriented of the major U.S. poultry commodities. In 2024, 9.5 percent of domestic turkey-meat production was exported, and 2.6 percent of domestic egg production (including both hatching and table eggs) was exported.

The majority of U.S. broiler exports by weight are leg quarters and other products categorized as dark chicken meat, and Mexico is the most significant foreign market for broiler meat. Mexico is also the destination for most U.S. turkey exports, typically as cut-up parts shipped fresh or chilled for use for further processing. The largest markets for U.S. egg exports are Mexico and Canada.

Download chart data in Excel format.

For more summary statistics of the poultry sector, download Poultry Sector Summary Statistics.