Cattle production is the most important U.S. agricultural industry, consistently accounting for the largest share of total cash receipts for agricultural commodities. In 2024, U.S. cattle production represented about 22 percent of the $515 billion in total cash receipts for agricultural commodities. With rich agricultural land resources, the United States has developed a beef industry that is largely separate from its dairy sector. The U.S. beef industry is unique when compared with countries (like India) that produce beef from water buffalo, which are used as dual-purpose animals. In addition to having the world's largest fed-cattle industry, the United States is also the world's largest total consumer of beef—primarily high-value, grain-fed beef. The U.S. beef cattle industry is often divided into two production sectors: cow-calf producers and cattle feeding.

U.S. Cattle Production

Cattle Cycle

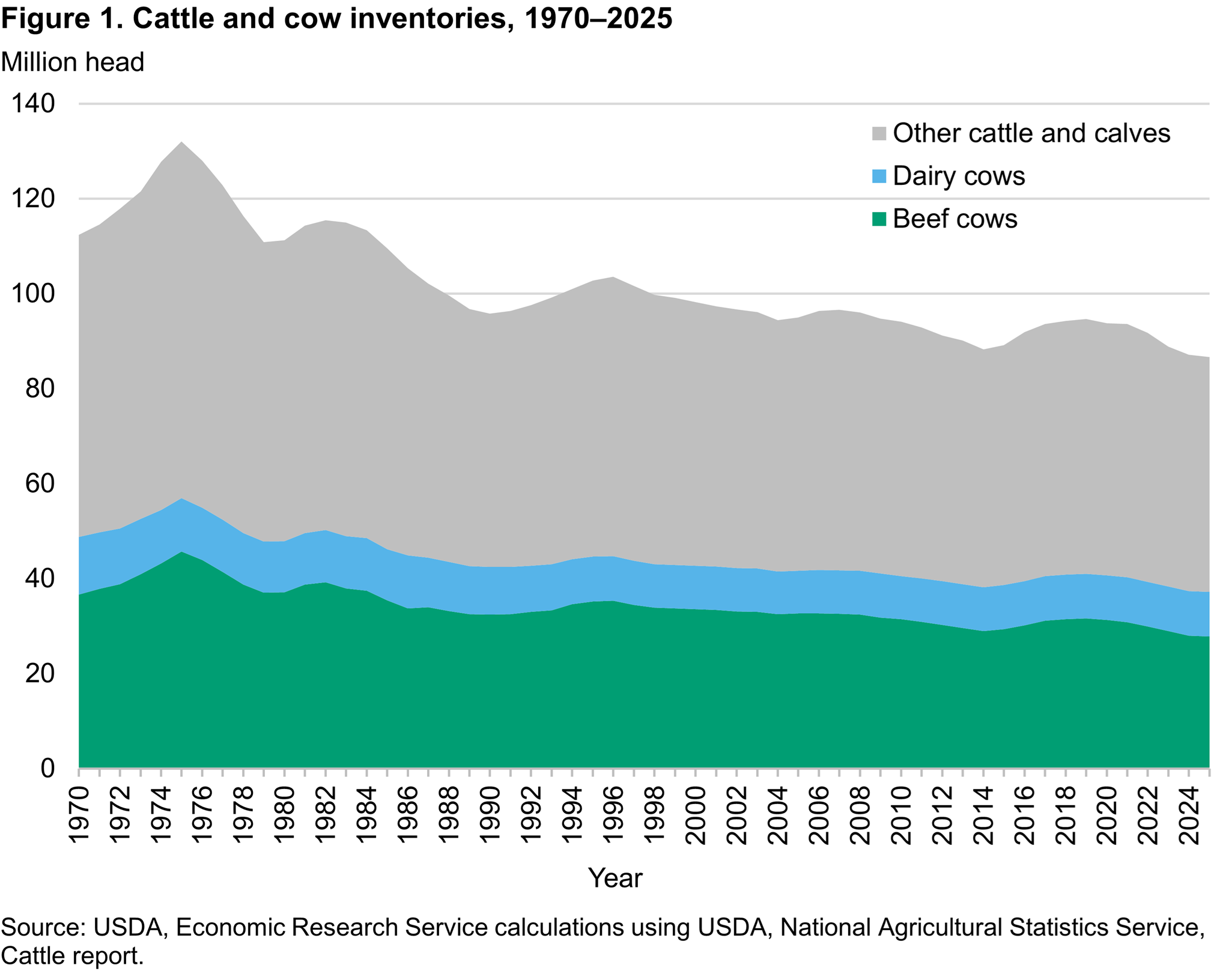

The cattle cycle describes a period of time (8–12 years) when the national cattle herd—the total number of all cattle and calves—begins its first year of growth after a period of decline. Then, the herd size will peak after several years of growth, or expansion, and then it will decline for several years before it starts to expand again, starting a new cycle. It is influenced by the combined effects of: cattle prices and input costs that drive cow-calf producer profitability; the gestation period for cattle; the time needed for raising calves to market weight; and climate conditions. Specifically, if cattle prices and producer revenues are expected to rise, producers may expand their herds; if revenues are expected to decline substantially, producers might reduce their herds by culling older cows and keeping fewer heifers to replace or add to older cows in their herd. Also, cow-calf producers’ response to profit fluctuations may appear delayed because of the lengthy gestation period for cattle, relative to hogs and poultry. The total number of beef cattle in the United States is highly dependent on the stage in the cattle cycle.

Adverse climate, like persistent dry conditions leading to drought, can diminish pasture conditions and reduce harvested feed supplies, which can alter a cycle’s direction and duration. For example, the last full cattle cycle began in 2004 with 94.4 million head of cattle and calves, including both beef and dairy cattle. The herd expanded for 3 years to 96.6 million head, until increasing feed and energy prices caused producers to reduce their herds. Then, drought conditions decreased pasture and forage availability, forcing producers to further cull cows and limit heifer retention at a more rapid pace, increasing contraction from 2011 through 2014.

By late 2013 and early 2014, grazing conditions improved and feed prices decreased. However, as each year’s calf crop shrank (as the number of beef cows declined), progressively fewer feeder calves were placed in feedlots and, subsequently, fed to a particular weight and marketed for slaughter. These combined effects increased feeder calf prices, which helped to improve cow-calf profitability. A 7-year liquidation of the national cattle herd ended January 1, 2014, at 88.2 million cattle and calves, which was the smallest herd size since 1952. Since then, the cattle herd has grown to a peak of 94.7 million head in 2019. As of January 1, 2025, the herd has decreased by 8 percent since the peak to 86.7 million cattle head. The USDA, National Agricultural Statistics Service (NASS) provides information on cattle inventory in its semi-annual Cattle reports.

Download chart data in Excel format.

Cow-Calf Operations

Cow-calf operations mainly maintain a herd of beef cows for raising calves. Most calves are born in spring and weaned at 3 to 7 months. Following the weaning stage, calves can move through the value chain in several different ways. Some of the female calves (heifers) and male calves (bulls) may be retained in the herd or sold to another producer. If additional pasture forage is available at weaning, then some calves may be retained for further grazing and growth until the following spring when the calves would be sold. Throughout the United States, cow-calf operations are located on land that is not typically suited or needed for crop production. These operations depend on range and pasture forage conditions, which in turn depend on the area’s variations of average rainfall and temperature. Beef cows graze on forage from grasslands to maintain themselves and raise a calf with very little, if any, grain input. The cow is maintained on pasture year-round, as is the calf until the calf is weaned. Based on USDA, NASS 2022 Census of Agriculture data, the average beef cow herd is about 47 head. Operations with 50 or fewer head likely coexist alongside other income streams, or the operations provide supplemental income to off-farm employment. Operations with 100 or more beef cows compose 10.5 percent of all beef operations and 60.5 percent of the beef cow inventory.

Cattle Feeding

When calves are weaned, producers must decide if they should retain some heifers and bull calves to replace older cows and bulls or to expand their herds. The remaining bulls are castrated to become steers, and together with the remaining heifers not kept in the herd for breeding, are sold into the feeding system for slaughter. This marks the beginning phase of beef production. There are different ways for these new steers and heifers designated for slaughter to grow to market weight. After being weaned, the calves may enter a stocker program, where the calves will graze on grass for 3 to 4 months before being placed in a feedlot. Another option is to move calves into a 30- to 60-day preconditioning program. Within this program, the calves go through an animal health protocol (for deworming, dehorning, and vaccinating) so calves can then be started on feed to ensure they are healthy in the next stage of the value chain. Another option is for the calves to be backgrounded for 90–120 days, placed in pens or lots—and fed dry forage, silage, and grain before entering a feedlot.

A feedlot provides a confined area for feeding steers and heifers on a ration of grain, silage, hay, and/or protein supplement to produce a carcass that will meet the USDA quality grade of Select or better for the slaughter market. The USDA, Agricultural Marketing Service (AMS) grades beef as whole carcasses in two ways: (1) quality grades for tenderness, juiciness, and flavor; and (2) yield grades for denoting the amount of usable lean meat on the carcass. The quality grades are Prime, Choice, and Select. The length of time a calf spends in a feedlot can range from 90 to 300 days depending on the weight and age of the calf at the time of placement, genetics, weather, feed rations, and desired carcass grade. Average gain is from 2.5–4 pounds per day on about 6 pounds of dry-matter feed per 1 pound of gain. Although most of a calf's nutrients come from grass until the calf is weaned, feedlot rations are generally 70–90 percent grain and protein concentrates.

Cattle feeding operations are concentrated in the Great Plains region but are also located in parts of the Corn Belt, Southwest, and Pacific Northwest regions. Feedlots with sales of 1,000-head or fewer comprise most of U.S. feedlot operations, but these smaller feedlots manage a relatively small share of total fed cattle marketed for slaughter. Further, based on the 2022 Agricultural Census, feedlots with sales of 1,000 or more cattle on feed represent 7 percent of total feedlots, but they market about 88 percent of fed cattle. Feedlots with sales of 5,000 or more cattle on feed market around 77 percent of fed cattle. The industry continues to shift toward a small number of very large, specialized feedlots that are focused on raising high-quality cattle for a particular market—such as markets requiring cattle that are not treated with hormones and not fed beta agonists. USDA, NASS provides monthly Cattle on Feed reports.

Policy

Federal Government assistance provided to the cattle sector is limited to emergency measures approved for a specific scope and time period. Federal assistance addresses the needs of producers suffering losses due to: drought, hot weather, disease, insect infestation, flood, fire, hurricane, earthquake, severe storms, extreme cold, or other natural disasters. See the Disaster Assistance Programs section of USDA's Farm Service Agency (FSA) website for information on current programs.

The sector trends toward fewer and large enterprises, which brings environmental issues to the forefront of public policy regarding the U.S. livestock industry. As animal density (i.e., the number of animals per unit of land area) increases, so do concerns about air and water quality, the occupational health of livestock workers, and waste management. The U.S. Environmental Protection Agency reports the environmental requirements for the production of livestock in Animal Feeding Operations.

Any product that is used as an animal-feed ingredient is regulated by the U.S. Food and Drug Administration (FDA). The FDA Center for Veterinary Medicine distributes uniform feed-ingredient definitions and feed-labeling standards to ensure the safe use of animal foods.

Cattle are also affected by other government policies and programs related to animal health, food safety, and mandatory price reporting.

U.S. Beef and Cattle Trade

Trade

Based on estimates from the USDA, Foreign Agricultural Service’s Production, Supply and Distribution data, the United States continues to be the world’s largest beef producer and consumer, by total volume, since the series began in 1960. To support consumer demand, the United States is the second largest importer, a majority of which is destined for blending into ground beef. Also, overseas demand for high quality beef has allowed the United States to sit among the top four exporting countries since the series began.

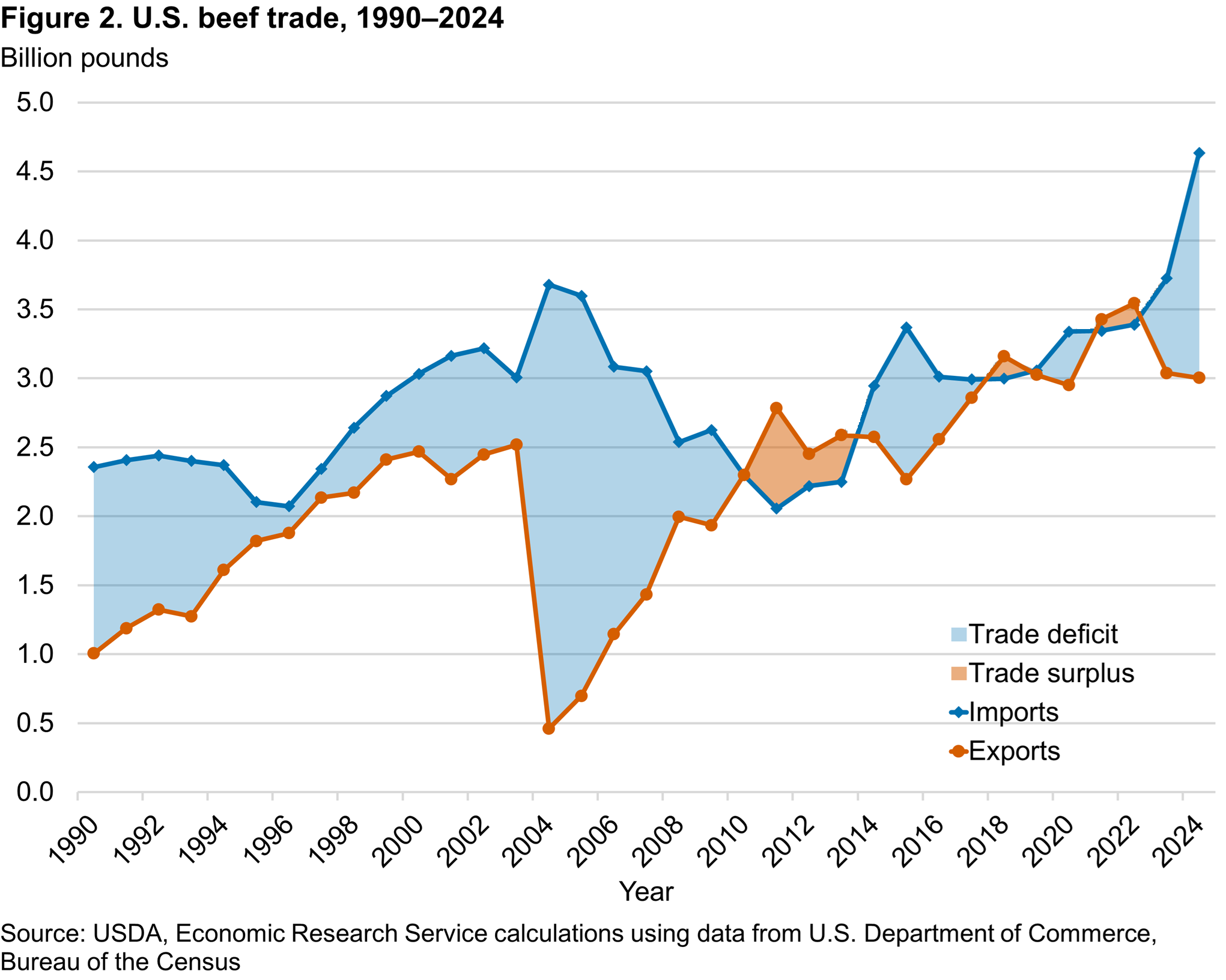

The year-to-year variation in U.S. beef imports and exports is correlated with the U.S. cattle cycle. When the size of the cattle herd begins to contract, more domestic cows are slaughtered, adding more lean trimmings (90 percent lean) available for grinding into ground beef. Further, there will likely be more heifers added to feedlots adding fattier trimmings (50 percent lean) need to blend with leaner trimmings from cows. However, as the herd contraction slows down and begins the process of expanding, fewer cows and heifers are destined for slaughter. This has the effect of growing demand for imported lean beef trimmings. For additional information on the dynamics of imported beef products and how they change over time, see the special article, “An Assessment of U.S. Beef Imports” in Livestock, Dairy, and Poultry Outlook: July 2023.

The amount of U.S. beef exported is mainly affected by volume of domestic beef production, which reflects the current stage in the cattle cycle. Similarly, beef traded in the global marketplace responds to the volume of beef produced around the world. See UDSA, ERS Sector at a Glance web page for information on the cattle cycle.

Download chart data in Excel format.

Bovine Spongiform Encephalopathy Effects on U.S. Cattle and Beef Trade

In May 2003, the United States banned Canadian cattle imports following Canada's first case of bovine spongiform encephalopathy (BSE). In July 2005, U.S. imports of Canadian cattle resumed for cattle younger than 30 months old (for immediate slaughter or for finishing in a U.S. feedlot). In November 2007, USDA expanded cattle imports to include live cattle of all ages from Canada and any other country that was recognized as presenting a minimal risk of introducing BSE into the United States. Currently, Canada is the only minimal-risk country designated by the United States. All animals born after Canada's 1997 feed ban are eligible to be imported into the United States. For the latest requirements for exporting U.S. live animals and animal products by country destination, visit USDA's Animal and Plant Health Inspection Service (APHIS) animal and animal product export information. Also, for the latest information about importing live animals into the United States, visit animal and animal product import information.

Simultaneously, in December 2003, the discovery of the first U.S. BSE case in a dairy cow imported from Canada led many U.S. trading partners to restrict some U.S. beef products or to completely ban all U.S. beef and cattle. Two more cases of BSE in the United States were subsequently reported—in Texas (June 2005) and in Alabama (March 2006). The reported BSE cases significantly altered U.S. beef export patterns in 2004. Japan, South Korea, China, and various other countries ceased importing U.S. beef and beef products for several years. Although Mexico and Canada initially closed their borders to U.S. beef imports, they reopened trade within a matter of months.

In 2011, U.S. beef exports reached 2.8 billion pounds in carcass-weight equivalents, which surpassed 2003’s historic record of 2.5 billion pounds. In 2013, the World Organization for Animal Health upgraded the United States’ BSE status to “negligible risk”—the highest status available—based on the U.S. history with the disease, the implementation and enforcement of the U.S. feed ban, and the USDA, BSE surveillance system. For the latest details on the export eligibility and requirements for U.S. beef to specific countries, see USDA, Food Safety and Inspection Service (FSIS) Import & Export Library.

Want more information?

- Economic Impacts of Feed-Related Regulatory Responses to Bovine Spongiform Encephalopathy(Livestock, Dairy, and Poultry Outlook, September 2008).

- An Economic Chronology of Bovine Spongiform Encephalopathy in North America (Livestock, Dairy, and Poultry Outlook, June 2006).

- Did BSE Announcements Reduce Beef Purchases?(Report No. ERR-34, December 2006)

Information on BSE from other USDA agencies:

Beef Exports

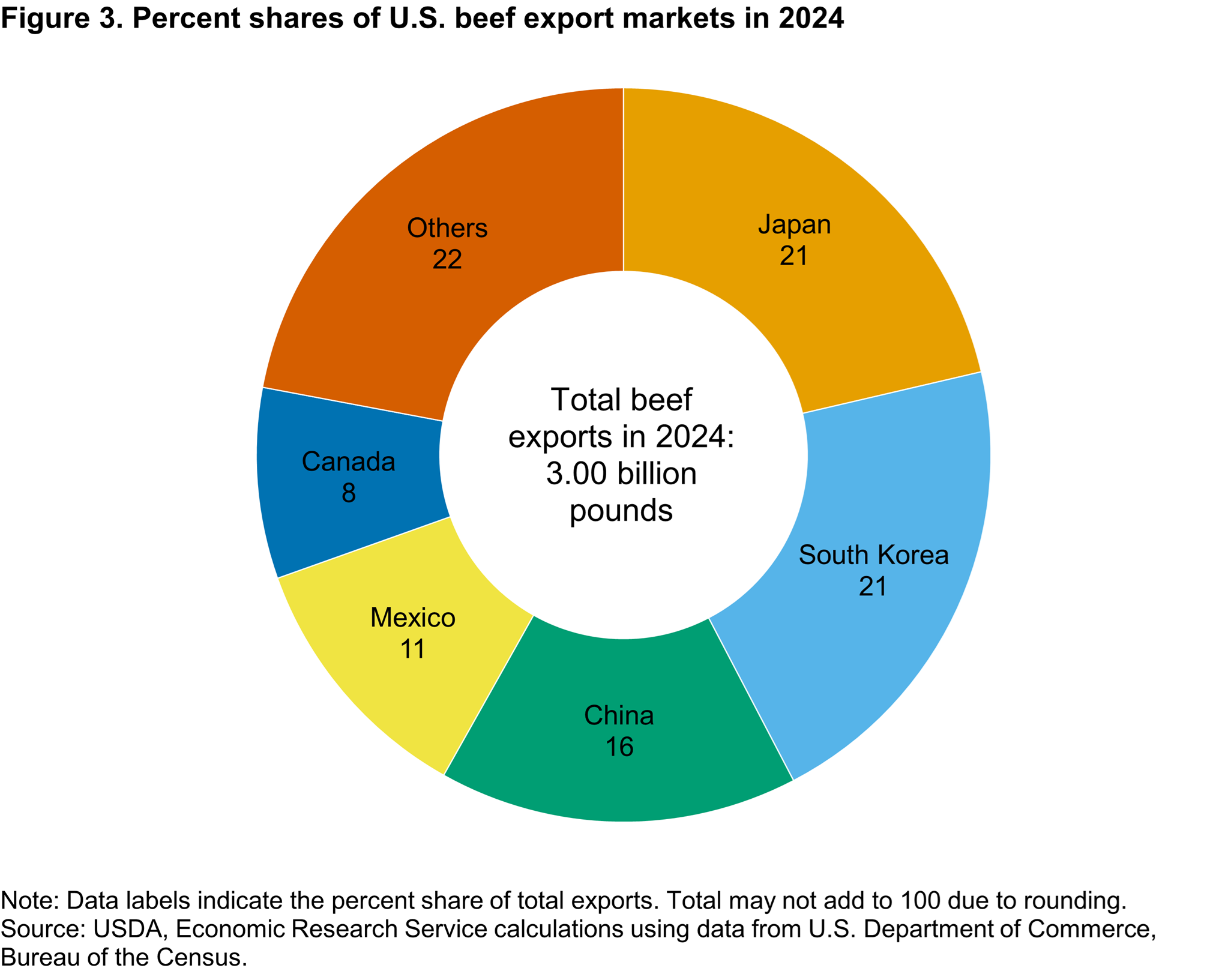

In 2024, U.S. beef exports slowed for the second year since setting a record in 2022. Beef exports dropped to 3.003 billion pounds, about 1 percent below 2023 levels and a 15-percent decline from the record set in 2022. The main reasons for the decline were less domestic beef production since 2022, robust domestic demand, and expensive U.S. beef prices relative to competitors in overseas markets.

In 2024, the top five U.S. beef export markets comprised 78 percent of total beef exports (by volume): Japan, South Korea, China, Mexico, and Canada. The two largest beef markets accounted for about 42 percent of U.S. beef exports (Japan and South Korea). The third largest market was China, accounting for 16 percent of beef exports. Mexico and Canada combined to account for nearly 20 percent of total U.S. beef exports.

Download chart data in Excel format.

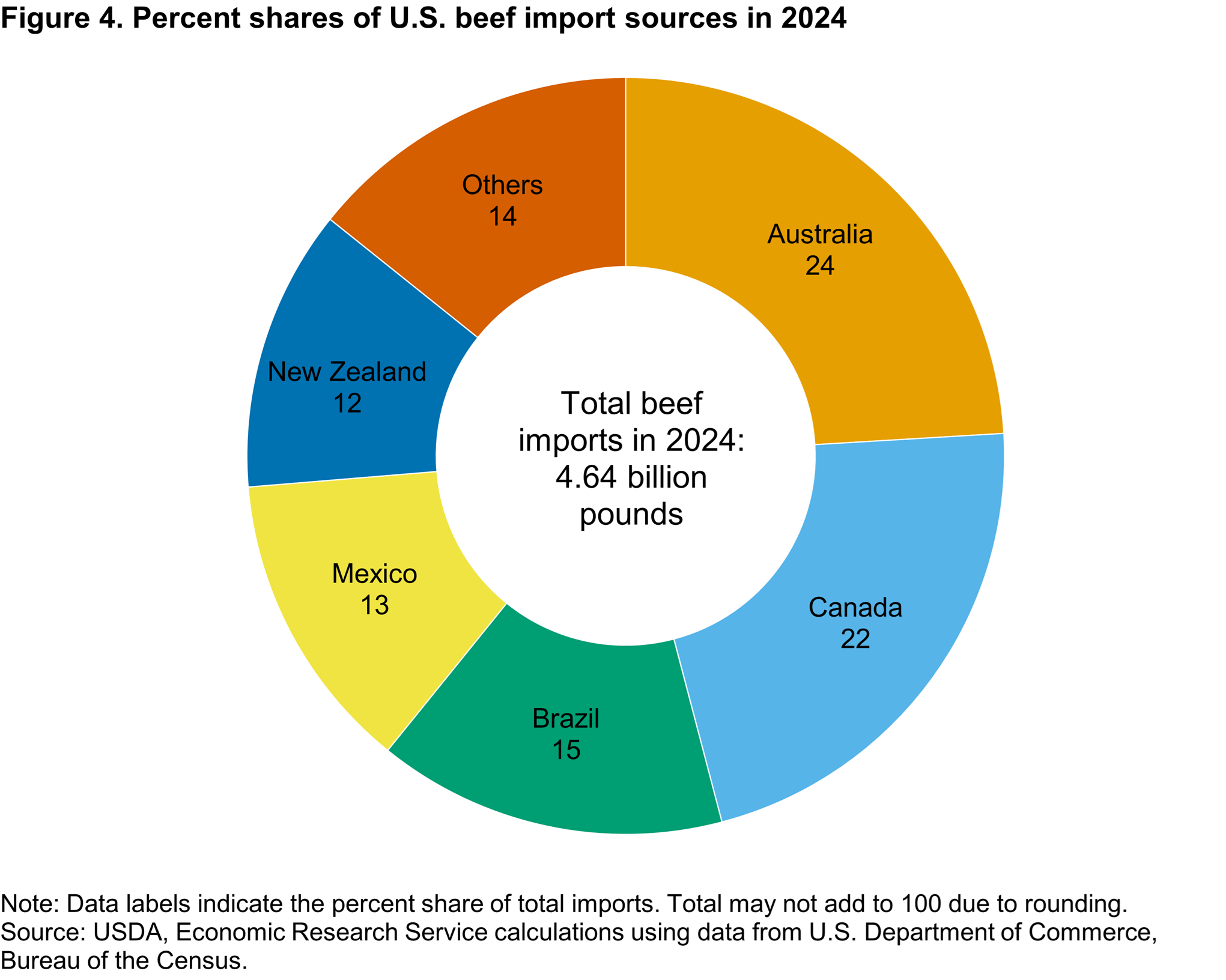

Beef Imports

U.S. beef imports set a new record in 2024 totaling 4.635 billion pounds, more than 24 percent above the previous record in 2023. Australia, the largest beef supplier, accounted for 24 percent of total U.S. beef imports in 2022. The U.S. second and third largest beef sources were Canada and Brazil, providing about 22 and 15 percent of U.S. beef imports, respectively. Mexico, the fourth major supplier, shipped 13 percent of U.S. beef imports. New Zealand, the fifth major source, supplied 12 percent of the U.S. beef import needs. In February 2020, the United States lifted the ban on fresh beef imports from Brazil. Since lifting import restrictions, imports from Brazil have grown more than four times.

There are specific tariff-rate quotas (TRQ) for Australia, New Zealand, Argentina, Uruguay, and other countries not otherwise listed. Specific to Australian beef, it enters the United States with no tariff and then a larger tariff of 21.1 percent is then applied to imports above the TRQ limit. All other beef imports within the TRQ enter at a minimal tariff rate of 4.4 cents per kilogram and then a larger tariff of 26.4 percent is then applied to imports above the TRQ limit. Beef imports from Canada and Mexico are exempt from the TRQ due to the U.S.-Mexico-Canada free trade agreement. For additional information, refer to the USDA, Foreign Agricultural Service (FAS) International Agricultural Trade Report: Reviewing the Tariff-Rate Quotas for U.S. Beef Imports.

Download chart data in Excel format.

Live Cattle Trade

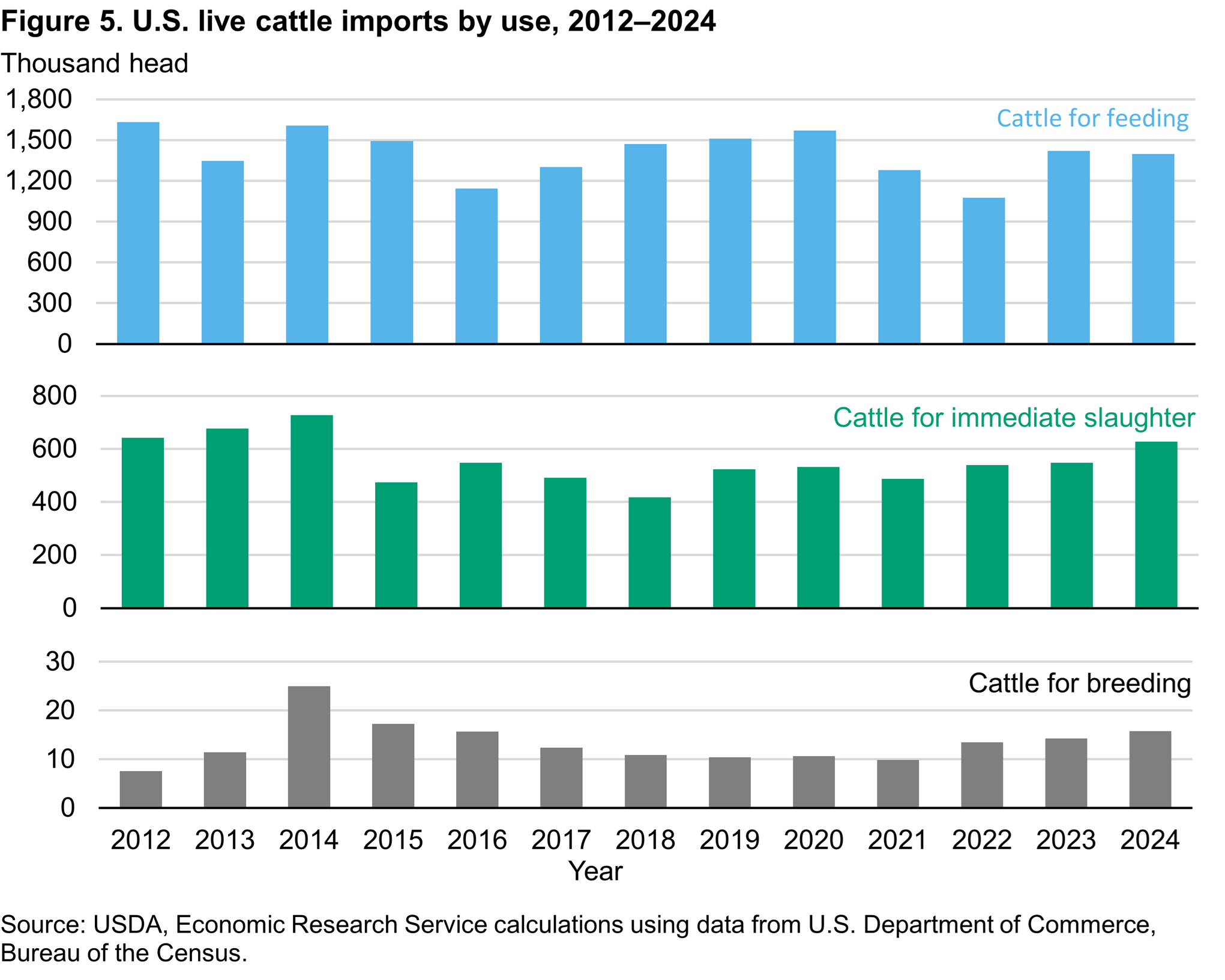

Traditionally, the United States imports more cattle than it exports. Canada and Mexico are the only significant cattle suppliers to the U.S. market because of their geographical proximity and because of how their cattle and beef sectors complement the U.S. sector. From 2020 to 2024, Mexico provided about 62 percent of U.S. cattle imports, and nearly all the imports were lighter-weight cattle intended for U.S. stocker or feeder operations. Of the cattle imported from Canada over the same time period, about 75 percent were designated for immediate slaughter; on average, 63 percent of these cattle were fed steers and heifers and 37 percent were cows and bulls. About 23 percent of the cattle imported from Canada went to U.S. feedlot operations. Lastly, nearly 2 percent of cattle imported from Canada were used for breeding.

Effective November 22, 2024, USDA implemented a restriction on the importation of cattle and bison originating from or transiting through Mexico upon discovery of New World Screwworm (NWS) in cattle in the Mexican state of Chiapas. On February 1, 2025, the USDA, APHIS announced the resumption of cattle and bison imports from Mexico under a new protocol. The handling of cattle imports under the new protocol constricted the flow of feeder cattle import volumes. After February 1st, it took 6 weeks for imports to grow to an average weekly import volume of about 68 percent of prior-year levels.

On May 11, 2025, USDA reinstated the suspension on the importation of cattle and bison originating from or transiting through Mexico. NWS was detected in remote farms with minimal cattle movement as far north as Oaxaca and Veracruz, about 700 miles away from the U.S. border. This import suspension will persist on a month-by-month basis, until a significant window of containment is achieved.

U.S. cattle exports are primarily destined for Canada and Mexico, but the volume exported and the relative percentages exported to North America and other destinations can vary year to year. From 2020 to 2024, the United States has primarily exported feeder cattle to both Canada (79 percent) and Mexico (12 percent), in addition to some breeding cattle. However, new markets for U.S. dairy and beef cattle for breeding have emerged the last 5 years. These markets include Vietnam, Turkey, Pakistan, Saudi Arabia, and Thailand.

For the latest trade data, see Livestock and Meat International Trade Data. These reports contain monthly and annual data for imports and exports of live cattle, hogs, sheep, and goats. The tables only display quantities. The beef and veal, pork, and lamb and mutton data are reported on a carcass-weight-equivalent basis. Breakdowns by country are included. For the current U.S. meat and animal trade outlook, see the USDA, ERS Livestock, Dairy, and Poultry Outlook report and the USDA, FAS semi-annual Livestock and Poultry: World Markets and Trade reports.

Download chart data in Excel format.