Despite fluctuations, U.S. sorghum exports address global demand for feed grain

- by Michael E. Johnson

- 4/10/2025

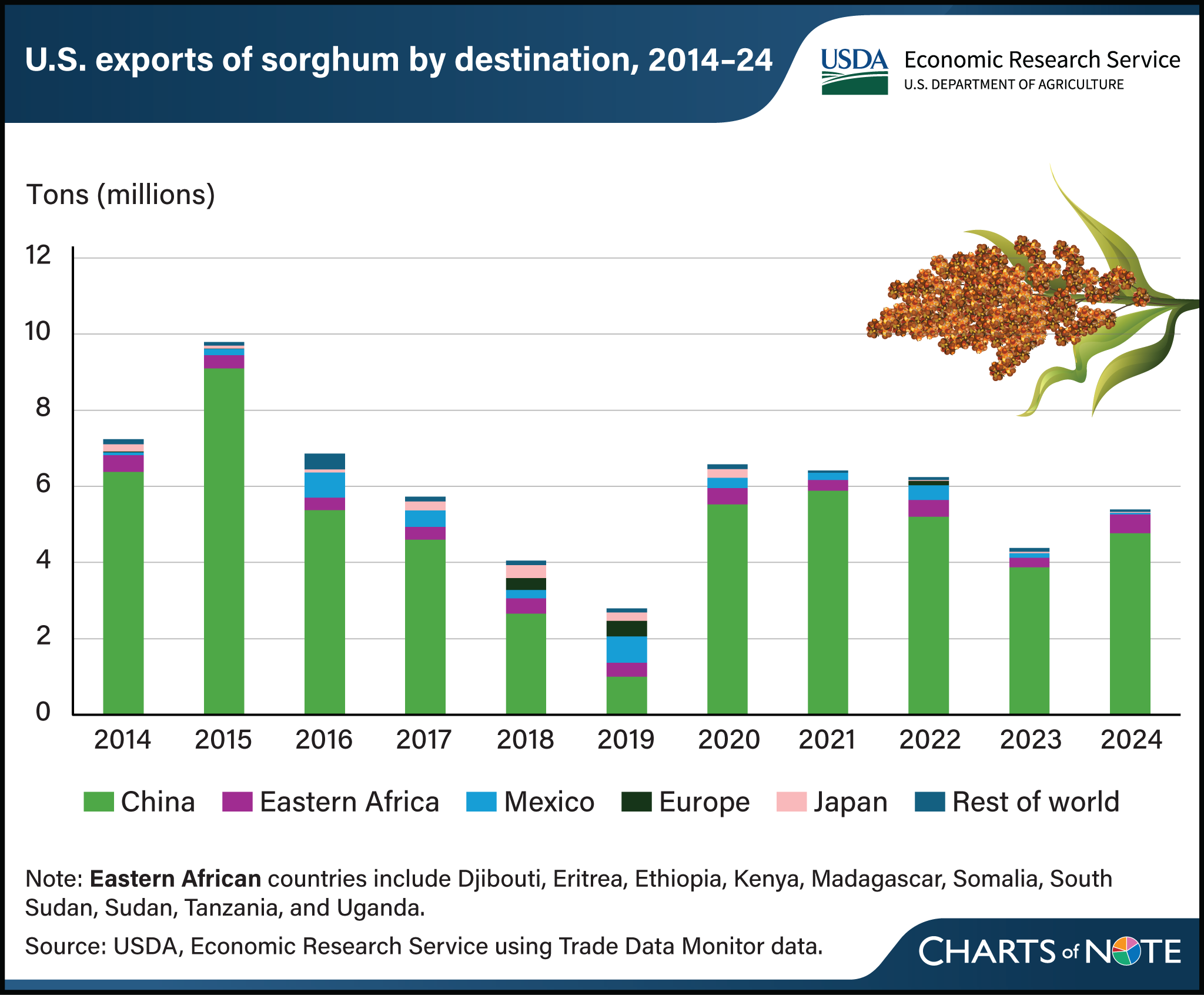

As global consumption of chicken meat increases, demand for feed grains also is growing. This presents an opportunity for major feed-exporting countries such as the United States to increase exports of feed grains, including sorghum. U.S. sorghum export volumes fluctuated over the last decade but rose to 5.4 million tons in 2024 from 4.4 million in 2023, as the grain’s use rose in international broiler feed preparations. Unlike corn and wheat, which are also traded for human consumption, sorghum is primarily traded as a feed grain. Also, as demand for corn heats up from the biofuel sector, demand for sorghum as a substitute for corn in feed formulas has increased. Moreover, improvements in sorghum cultivars have reduced tannin levels, enhancing the grain’s palatability and substitutability for corn. In the 2024/25 marketing year, the United States is projected to supply more than 50 percent of global sorghum trade. Although the level of U.S. sorghum exports for feed use has fluctuated over the last decade, China and Mexico have been the dominant destinations. However, some European countries also have been among the top U.S. sorghum destinations. As global broiler production expands with rising populations and income, demand for sorghum and other feedstuffs is projected to rise and continue to provide export opportunities for U.S. sorghum. This chart appears in the USDA, Economic Research Service report, Demand for Alternative Feed Grains for Broiler Production in an Era of Global Price Uncertainty: The Case of Sorghum, published in April 2025.