U.S. demand for coffee stimulates imports from Latin America

- by Constanza Valdes and Steven Zahniser

- 9/26/2024

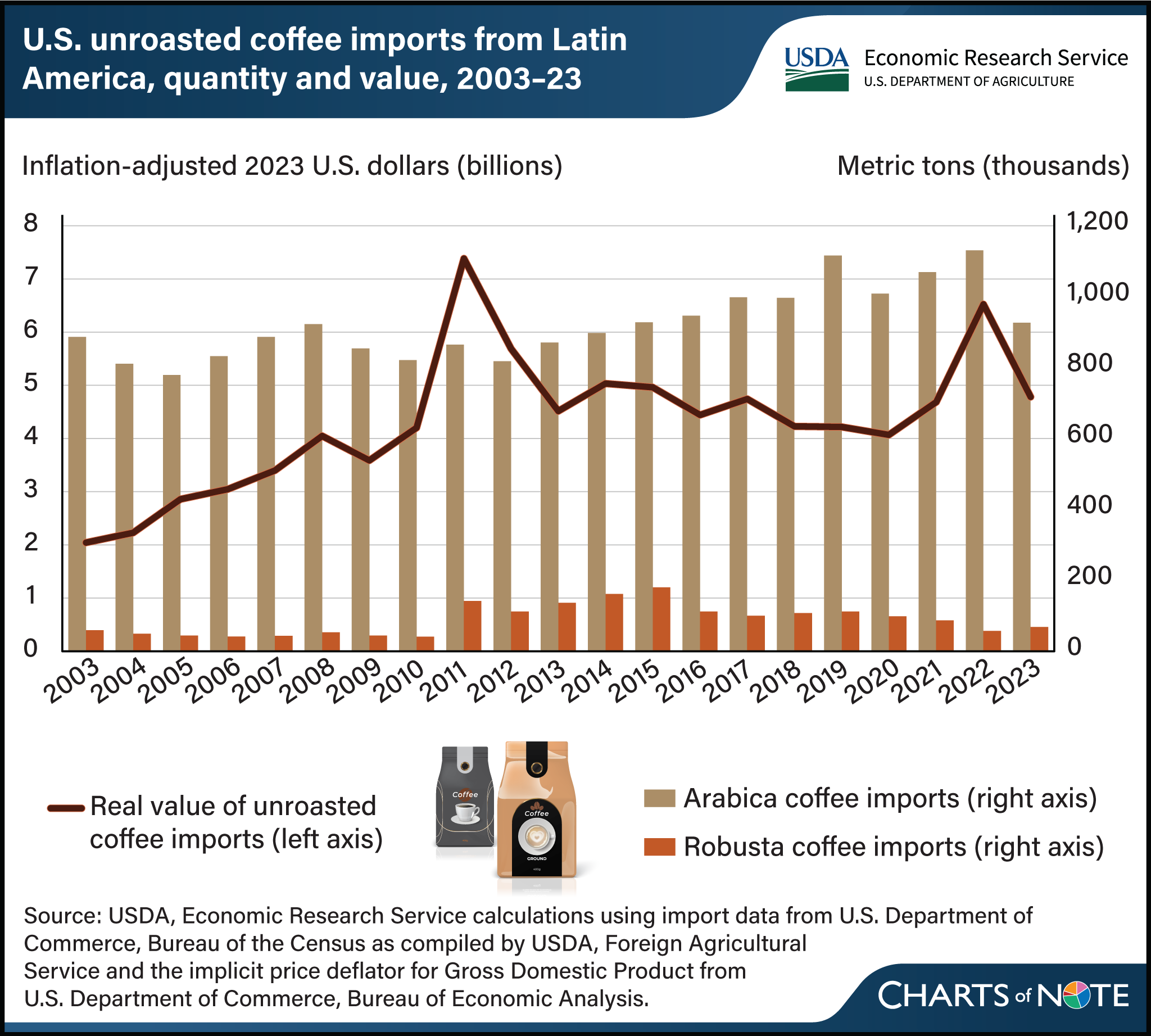

Coffee is the fifth-largest bulk export commodity by value, accounting for about 7 percent of total global bulk agricultural exports, per Trade Data Monitor. The United States is the world’s second leading importer of coffee (both Arabica and Robusta varieties). In 2023, about 80 percent of U.S. unroasted coffee imports came from Latin America (valued at $4.8 billion), principally from Brazil (35 percent) and Colombia (27 percent). Historically, more than 92 percent of U.S. coffee imports have been of the less acidic, higher quality Arabica variety, which commands a premium relative to Robusta coffee. Both Brazil and Colombia are major global producers of Arabica-variety coffee beans, though import shares have declined in recent years. In 2023, lower fertilizer use in Colombia and a drought in Brazil adversely affected coffee production in those countries, placing upward pressure on prices. The decline in unroasted coffee’s share of U.S. imports from Latin America has been partially offset by increased imports of roasted and freeze-dried coffee. During the 2003–23 period, U.S. import volumes of unroasted coffee from Latin America grew 1.5 percent annually. More information may be found in the USDA, Economic Research Service report Changes in U.S. Agricultural Imports from Latin America and the Caribbean.