Ethanol prices fall as demand contracts

- by Steven Ramsey, David W. Olson and Thomas Capehart

- 5/7/2020

Scroll down for the link to the higher definition image.

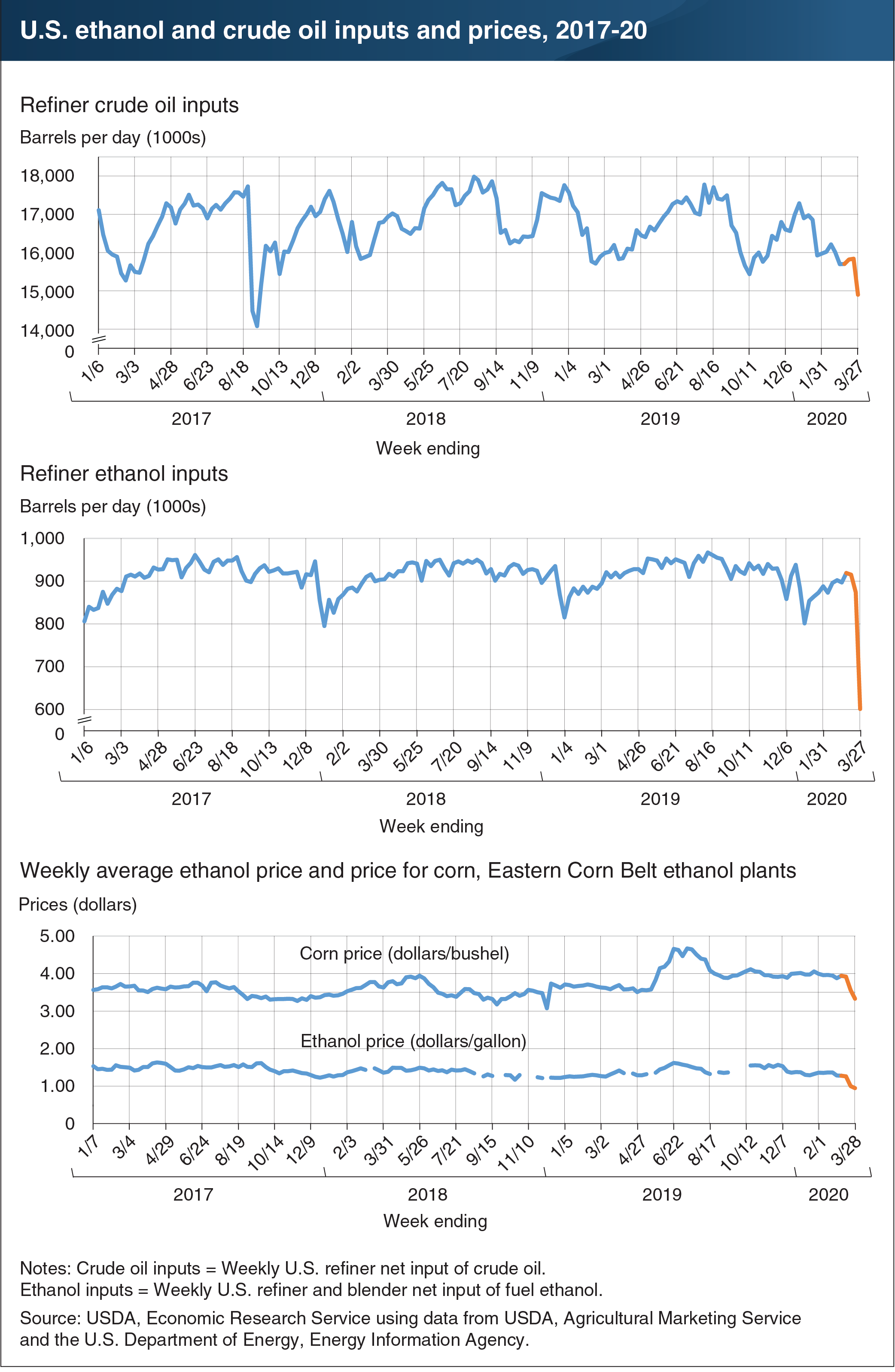

The Renewable Fuel Standard (RFS), first established by the Energy Policy Act of 2005, requires specified volumes of renewable fuels be used to reduce greenhouse gas emissions and expand the nation’s renewable fuels sector. Corn-based ethanol is the primary fuel used to meet the standard. During the last full corn marketing year (2018/19), ethanol accounted for approximately 10 percent of the gasoline consumed in the United States. Over the same period, approximately 5.4 billion bushels of corn, or about 38 percent of total use, were consumed for ethanol. Recently, consumption of gasoline has plummeted due to COVID-19-related travel restrictions, leading to significant declines in both ethanol demand and prices. Although the RFS has ensured that the smaller volumes of gasoline being consumed contain approximately 10 percent ethanol, usage of crude oil at U.S. refineries (U.S. refiner net input of crude oil) fell about 5 percent during March, and consequently, ethanol blending (U.S. refiner and blender net input of fuel ethanol) dropped by approximately 318,000 barrels per day—down 35 percent—over the same period. Ethanol and corn prices have fallen concurrently: at Eastern Corn Belt (ECB) ethanol plants in Illinois, the weekly average price received for gasoline fell about $0.33/gallon (down 26 percent), while the price paid for corn fell about $0.61/bushel (down 15 percent) during March. This chart is drawn from the Economic Research Service’s U.S. Bioenergy Statistics topic page and Feed Outlook for April 2020.