Had it been in effect in 2016 and 2017, the Tax Cuts and Jobs Act would have lowered average Federal income tax rates for farm households

- by James Williamson

- 4/11/2019

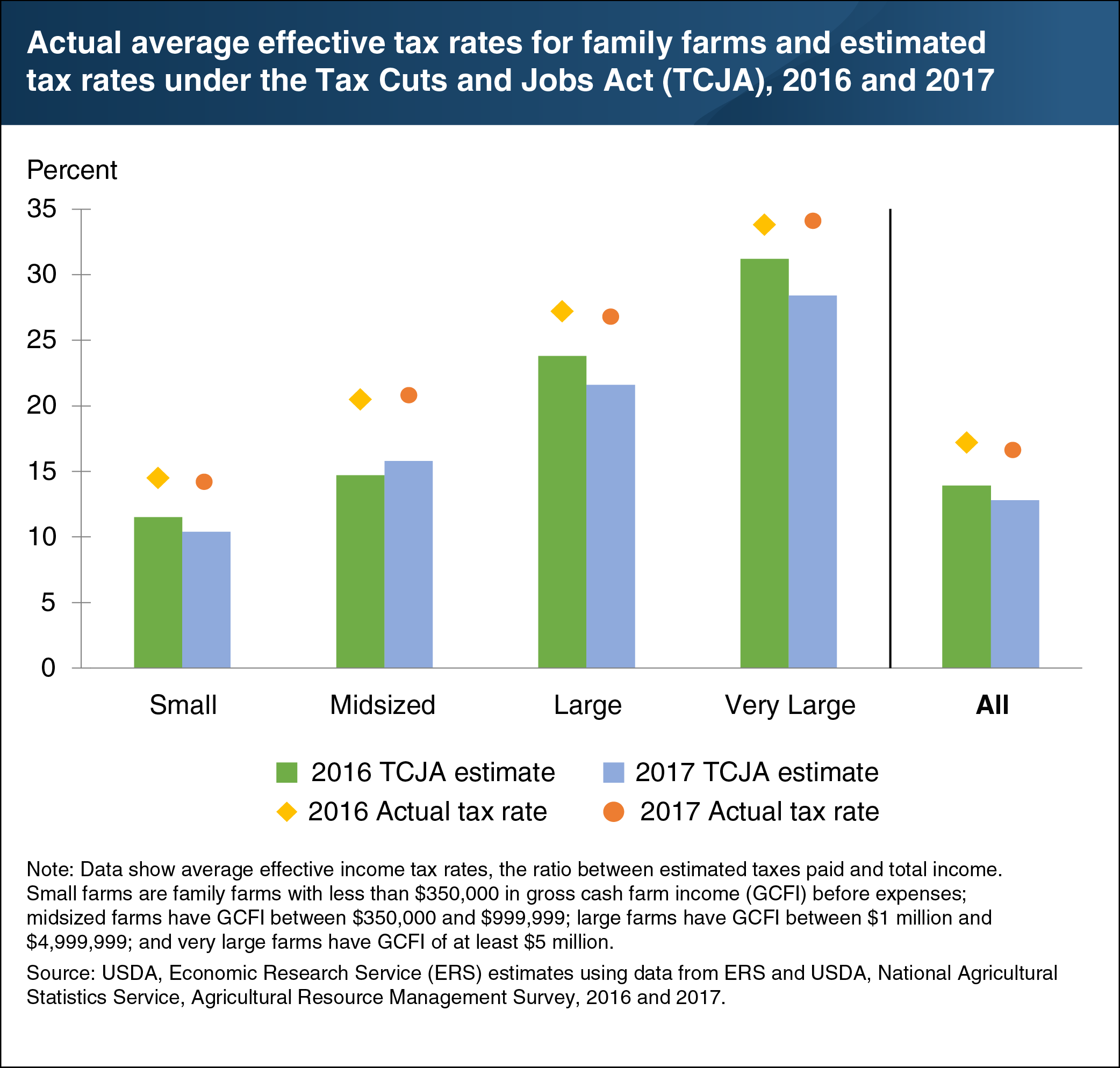

The Tax Cuts and Jobs Act (TCJA), enacted in December 2017, eliminates or modifies many itemized deductions and tax credits, while lowering Federal income tax bracket rates on individual and business income. Had the TCJA been in place in 2016, family farm households would have faced an estimated average effective tax rate of 13.9 percent, compared to the actual 17.2 percent effective tax rate that year. Had the TCJA also been in effect in 2017, the average effective tax rate would have been 12.8 percent, more than a percentage point lower than had it been in effect in 2016. By comparison, the actual effective tax rate in 2017 was 16.8 percent. The estimates vary by farm size. For example, small family farms would experience the lowest average effective tax rates, at 11.5 percent in 2016 and 10.4 percent in 2017. Only midsized family farms would have experienced an increase in their average tax rate, from 14.7 percent in 2016 to 15.8 percent in 2017. Those rates are still below the actual tax rates midsized farms experienced: 20.5 percent in 2016 and 20.8 percent in 2017. This chart updates data found in the June 2018 ERS report, Estimated Effects of the Tax Cuts and Jobs Act on Farms and Farm Households. For more on this topic, see “The Tax Cuts and Jobs Act Would Have Lowered Average Income Tax Rates for Farm Households between 2016 and 2017” in the April 2019 edition of Amber Waves.

We’d welcome your feedback!

Would you be willing to answer a few quick questions about your experience?