The Tax Cuts and Jobs Act estimated to decrease effective tax rates across farm commodity specializations had the law been in effect in 2016

- by James Williamson

- 8/22/2018

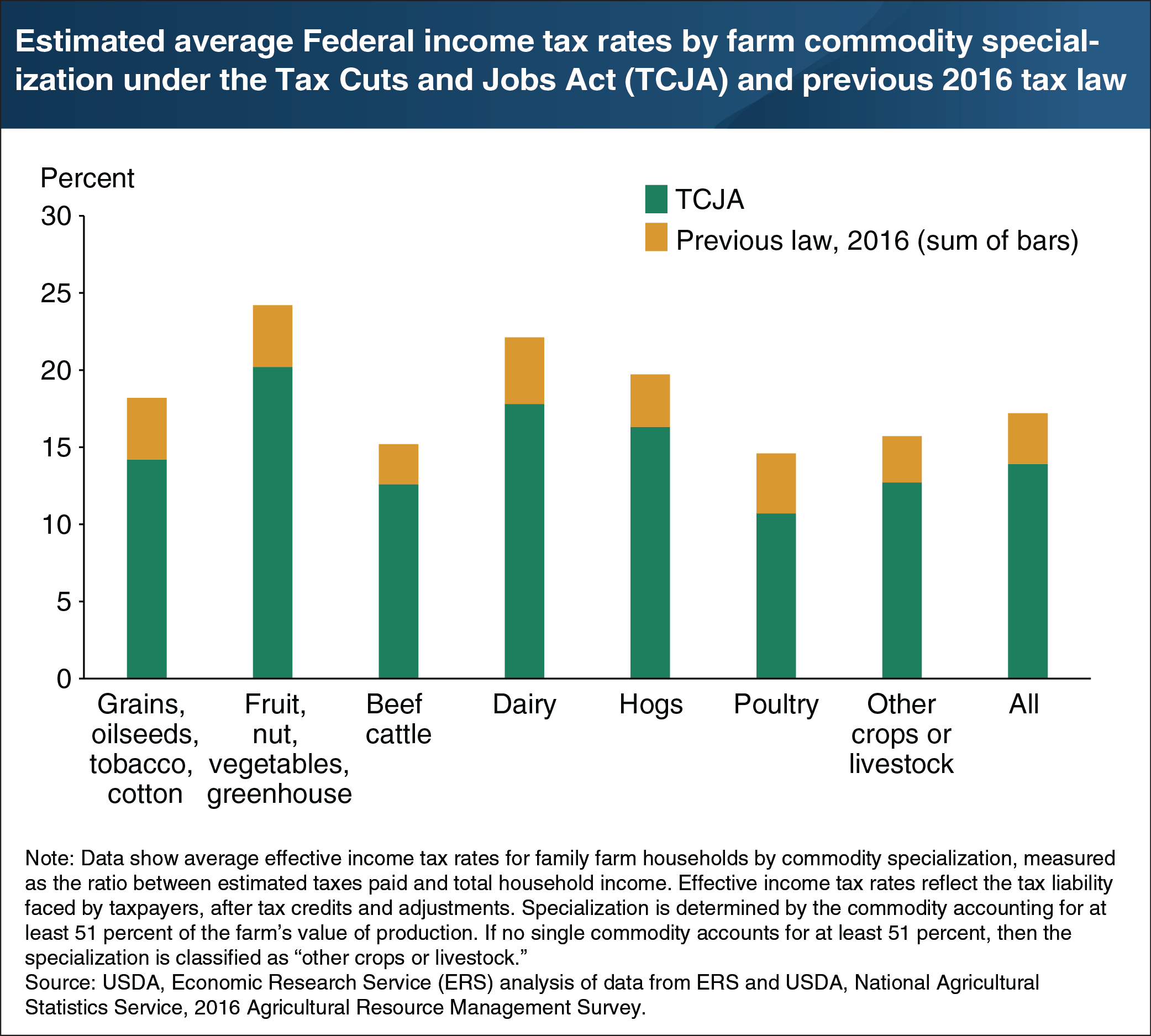

The Tax Cuts and Jobs Act (TCJA) of 2017 eliminates or modifies many itemized deductions and tax credits, while lowering tax bracket rates on individual and business income. Had the TCJA been in place in 2016, ERS estimates that family farm households would have experienced a decline of 3.3 percentage points on average in their effective tax rate—the share of income paid in taxes after tax credits and adjustments are taken into account. The effects of the TCJA vary across specializations. Dairy producers would have experienced the largest decline at 4.3 percentage points. This was largely due to the new TCJA deduction for business income, since dairy farmers tend to earn a higher share of total household income from the farm business. Producers of beef cattle, which represented the greatest number of farms of any specialty in 2016, would have experienced the smallest decline at 2.6 percentage points. Beef cattle producers generally operate small farms with farm income making up a lower share of their total household income, which results in smaller tax reductions than for farm households with a higher share of farm income. This chart uses data found in the June 2018 ERS report, Estimated Effects of the Tax Cuts and Jobs Act on Farms and Farm Households.