Index insurance programs have grown as a risk management tool in Sub-Saharan Africa

- by Karen Thome

- 9/21/2017

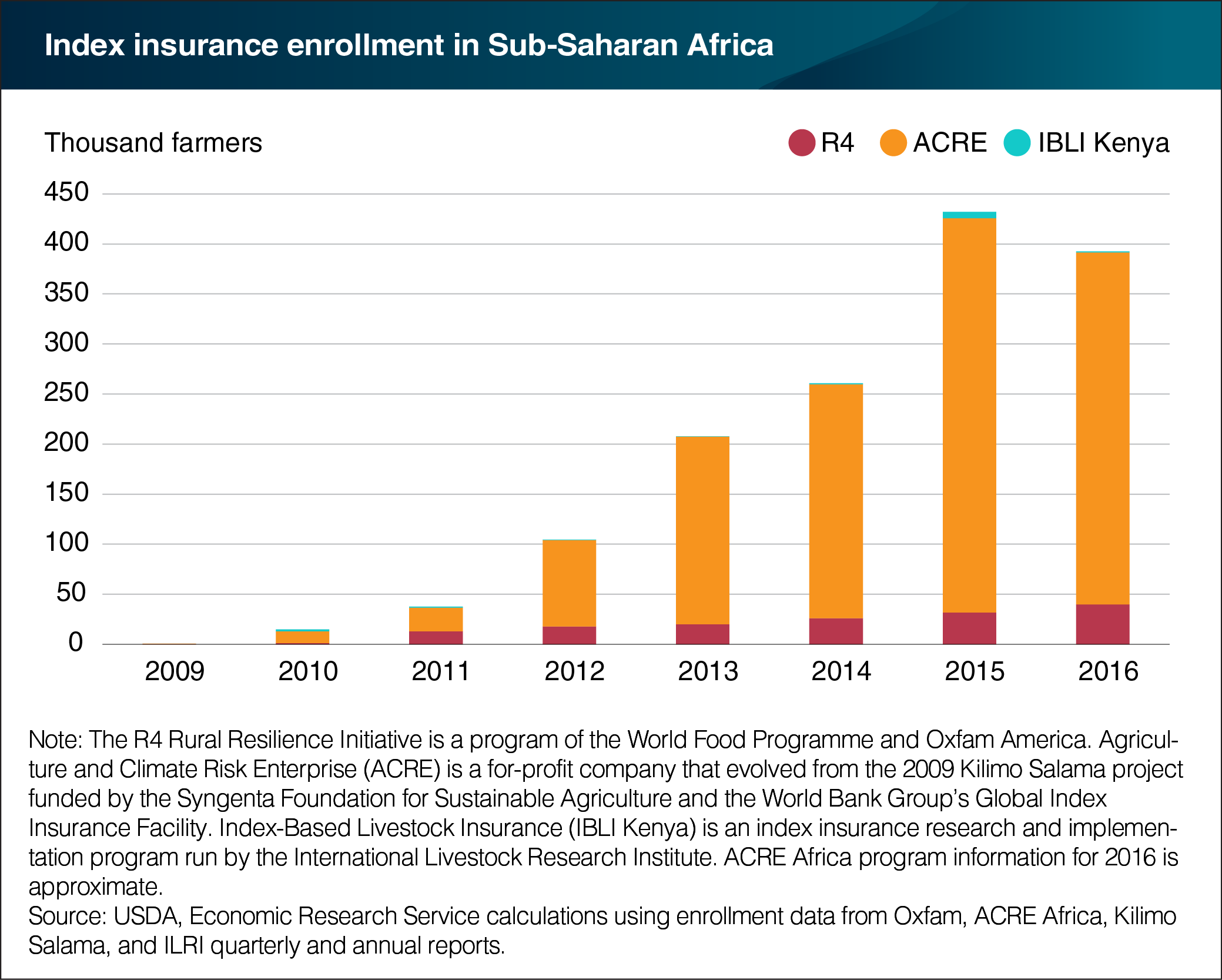

In the developing countries of Africa, most of the crop production needed to feed the region comes from smallholder farmers. But because of the risk of catastrophic loss, many of these farmers are unwilling to fully invest in inputs like machinery or better seeds, despite the potential to increase their average production and income. Index insurance (insurance based on a measure of weather that is highly correlated with farm-level losses), could help increase agricultural investments by allowing smallholder farmers manage their risk in places where traditional insurance might not be offered. Successful programs recently focused on developing countries include the R4 Rural Resilience Initiative, Agriculture and Climate Risk Enterprise (ACRE Africa), and Index-Based Livestock Insurance (IBLI) in Kenya. These programs, which have grown significantly since 2009 when fewer than 1,000 farmers were covered, have taken a holistic approach by offering index insurance alongside other risk management services and credit assistance. In 2016, nearly 400,000 farmers were covered. There is evidence that index insurance is improving farmer productivity and well-being in some developing country cases. In Senegal, insured R4 program participants increased rice production at 10 times the rate of uninsured control group farmers from 2013 to 2015. Index insurance is a promising approach to providing insurance and improving risk management, but it is still at the early stages of adoption and is available to only a small number of Sub-Saharan Africa’s 50 million farms. This chart appears in the ERS report, "Progress and Challenges in Global Food Security," released in July 2017.

We’d welcome your feedback!

Would you be willing to answer a few quick questions about your experience?