Less than 1 percent of farm estates created in 2020 will owe estate tax

- by Tia M. McDonald and Ron Durst

- 4/14/2021

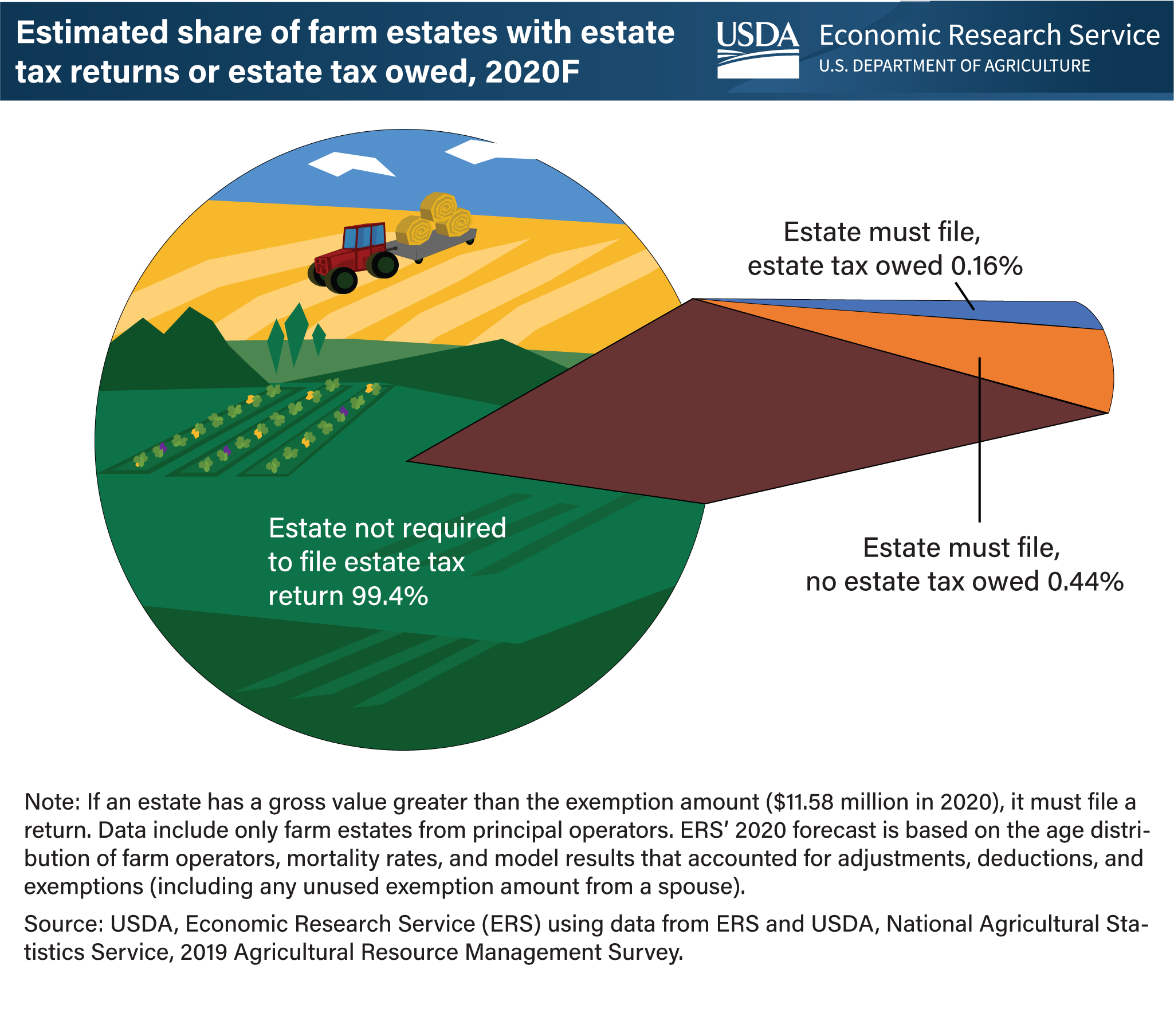

Created in 1916, the Federal estate tax is a tax on the transfer of property from a deceased person to their heirs at death. Legislation enacted over the last several years has greatly reduced the Federal estate tax by increasing the exemption amount from $675,000 in 2000 to $11.58 million in 2020. Under the present law, the estate of a person who owns assets above the exemption amount at death must file a Federal estate tax return. However, only returns that have an estate above the exemption after deductions for expenses, debts, and bequests to a surviving spouse or charity are subject to tax at a rate of 40 percent. Researchers from USDA, Economic Research Service (ERS) estimated that about 31,000 principal farm operators died in 2020. Of those estates, an estimated 189 (0.6 percent) will be required to file an estate tax return—and only 50 (0.16 percent) will owe Federal estate tax. Total Federal estate tax liabilities from farm estates owing taxes were forecasted to be $130.2 million in 2020 from a total estimated estate value of $56.3 billion. This chart appears in the April 2021 Amber Waves finding, “Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in 2020.”

We’d welcome your feedback!

Would you be willing to answer a few quick questions about your experience?