Ukraine’s Rise in Grain and Sunflower Seed Market Share Limited by Ongoing War

- by Megan Husby, Bryn Swearingen, Matthew Miller and James Hansen

- 5/16/2024

Highlights

- Before Russia’s war against Ukraine, Ukraine’s agricultural sector experienced significant, sustained production and export growth, making the Nation a top-five barley, corn, wheat, and sunflower seed exporter.

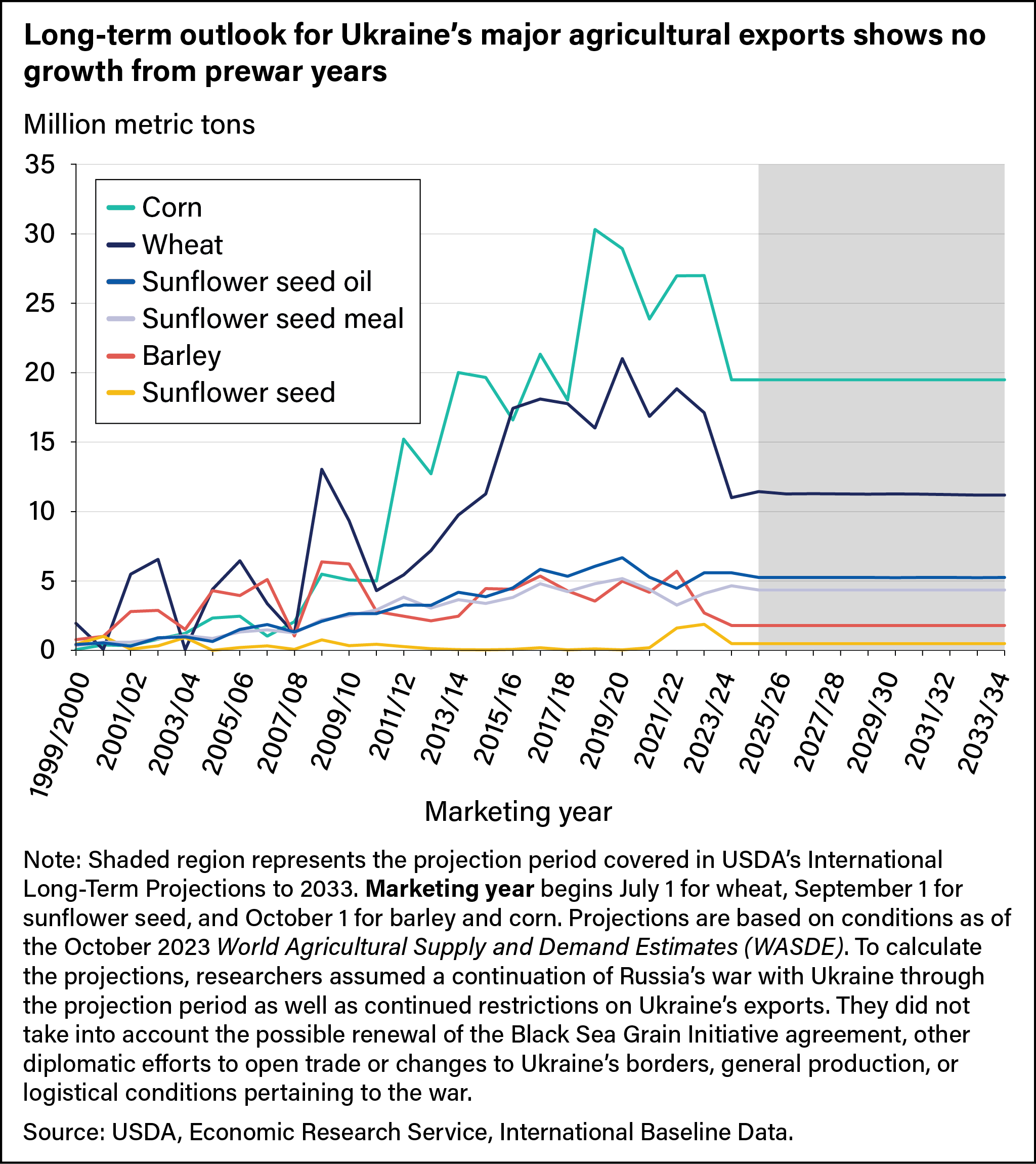

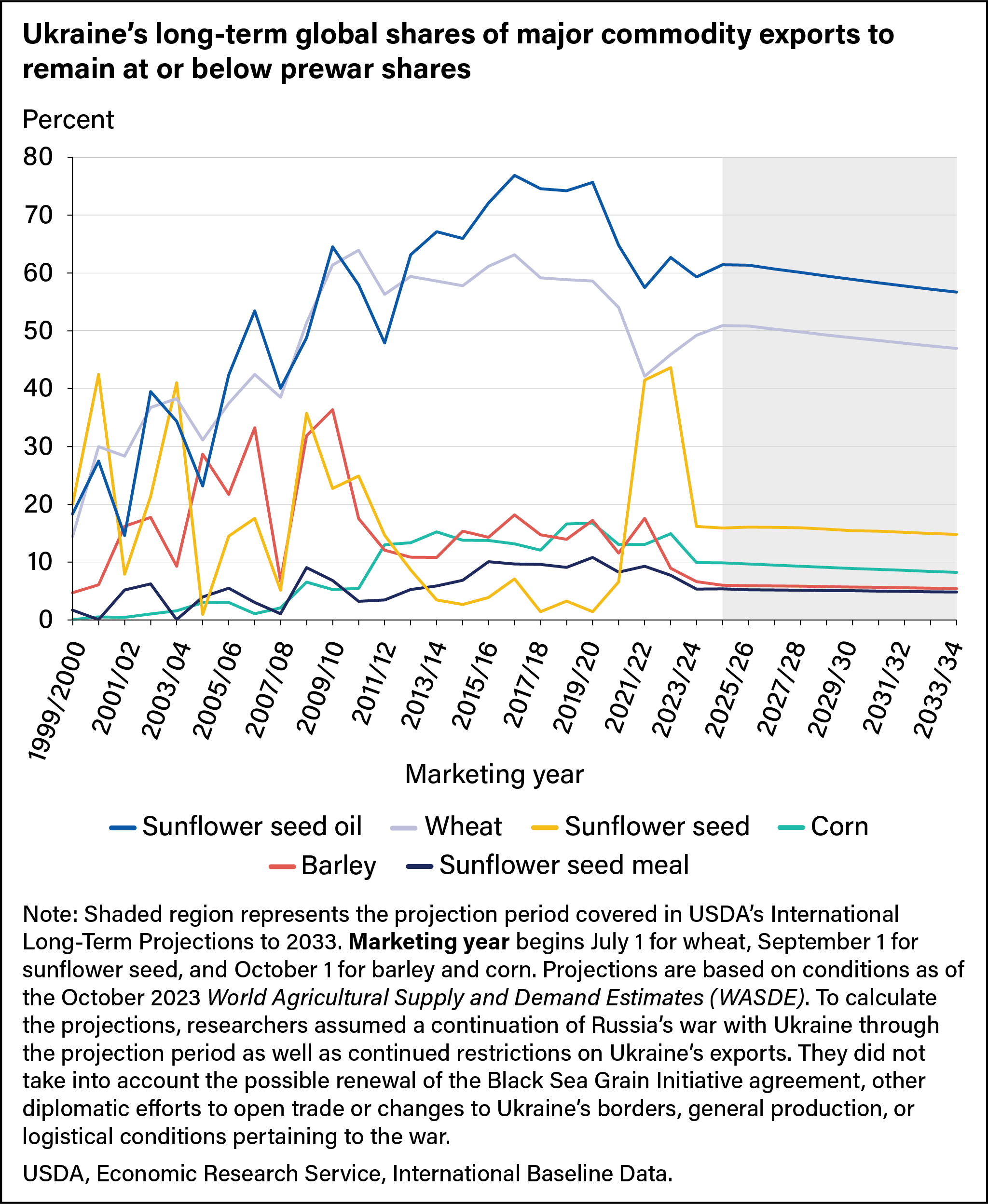

- Over the next decade, Ukraine’s grain and sunflower seed exports are projected to stabilize at lower levels than before the conflict and to demonstrate little or no growth.

- Uncertainties surrounding the duration of the war—combined with projected price increases in key inputs and fuel, shortages in labor and inputs, infrastructure and field damage, and restricted trade—dim prospects for Ukraine’s agricultural growth potential over the next decade.

Since declaring its independence from the former Soviet Union in 1991, Ukraine has become a top global supplier of several agricultural commodities. Corn, wheat, and sunflower seed products are vital crops in Ukraine’s farm sector and key to its rise as a leading agricultural exporter. Ukraine is a major exporter of grain and sunflower products, particularly in Europe, Asia, and the Middle East. However, Russia’s current war against Ukraine is challenging Ukraine’s grain and oilseed sectors. With prewar production levels still not being met, Ukraine’s ability to meet rising global demand is uncertain.

Russia’s invasion of Ukraine in February 2022 increased global market uncertainty at a time when commodity prices were already high. Food price inflation has receded since the record highs set in March 2022. However, food prices are still high compared with their historical norms because of factors such as high labor costs, severe weather events, supply chain disruptions, and global conflicts. War-related uncertainty is expected to continue to affect export markets, especially low-income countries that historically depend on imports from the Black Sea region.

Productivity Gains Drove Ukraine’s Farm Sector Growth

Ukraine’s agricultural productivity is rooted in the exceptionally fertile black soil covering roughly 56 percent of its territory. As the country transitioned from a Soviet-era planned economy to a market-based economy, economic instability also affected Ukraine’s agricultural productivity. Over time, grain and oilseed production in Ukraine recovered and around 2000, output began to increase steadily. Several factors contributed to this growth, including modernization of farm inputs and improvements in farm management efficiencies.

Ukraine's adoption of higher-quality seeds, improved fertilization methods, and increased use of modern farming machinery have significantly increased crop yields, leading to higher agricultural productivity. The higher-quality imported seed varieties possess desirable traits such as improved drought tolerance and higher yielding. When combined with optimized fertilization and modern equipment, seed cultivation and harvesting processes are enhanced, leading to increased crop yields per acre. From 2000 to 2021, sunflower seed, wheat, and corn yields increased by between 102 percent and 155 percent, outpacing Russia’s productivity gains. Before the war, Ukraine’s 10-year yield averages for corn, barley, sunflower, and wheat ranged from 27 percent to 47 percent higher than Russia’s 10-year yield averages during the same period. For all commodities except sunflower seed, however, Ukraine’s average yield is still below that of the European Union (EU).

After independence, Soviet farms were converted into collective agricultural enterprises, but the Soviet management style and structure continued. Land reform in Ukraine later led to a shift toward private ownership of agricultural land and a new type of agricultural operator emerged that focused on profit maximization, reported USDA, Economic Research Service (ERS) economists in the 2017 publication, Changing Crop Area in the Former Soviet Union. Corporate farms consolidated into large-scale agricultural holdings that focused on improving overall performance, creating efficiency gains across all aspects of farming. Those gains allowed large farms to reduce per-unit costs, resulting in a sharp rise in productivity in grains (particularly corn) and oilseeds. For instance, data from the State Statistics Service of Ukraine showed that in 2022 farms larger than 3,000 hectares produced more than 27 percent of the country’s corn even though they made up 1.2 percent of Ukraine’s total corn enterprises.

Russia’s War on Ukraine Hampers Crop Production Growth

The war has created many challenges for the Ukraine farm sector, jeopardizing gains in productivity made in the prior two decades. Ukraine farmers have faced power outages, theft, shortages of labor and materials needed for inputs, infrastructure damage, and active warfare threats. Debris left from shelling and mined fields poses a hazard for farmers trying to sow, cultivate, and harvest. As a result, prospects for growth in Ukraine's grain and oilseed sectors are limited over the next decade, according to USDA’s International Long-Term Projections to 2023, also called the International Baseline. Long-term growth in production of barley, wheat, and sunflowers is expected to be especially constrained because a substantial share of these crops is grown in areas directly affected by the war. USDA also monitors Ukraine’s near-term production and export forecast in a separate set of estimates, the World Agricultural Supply and Demand Estimates (WASDE). The data referenced in this article reflect the International Baseline alone (see blue box below: Making Sense of USDA International Projection Data).

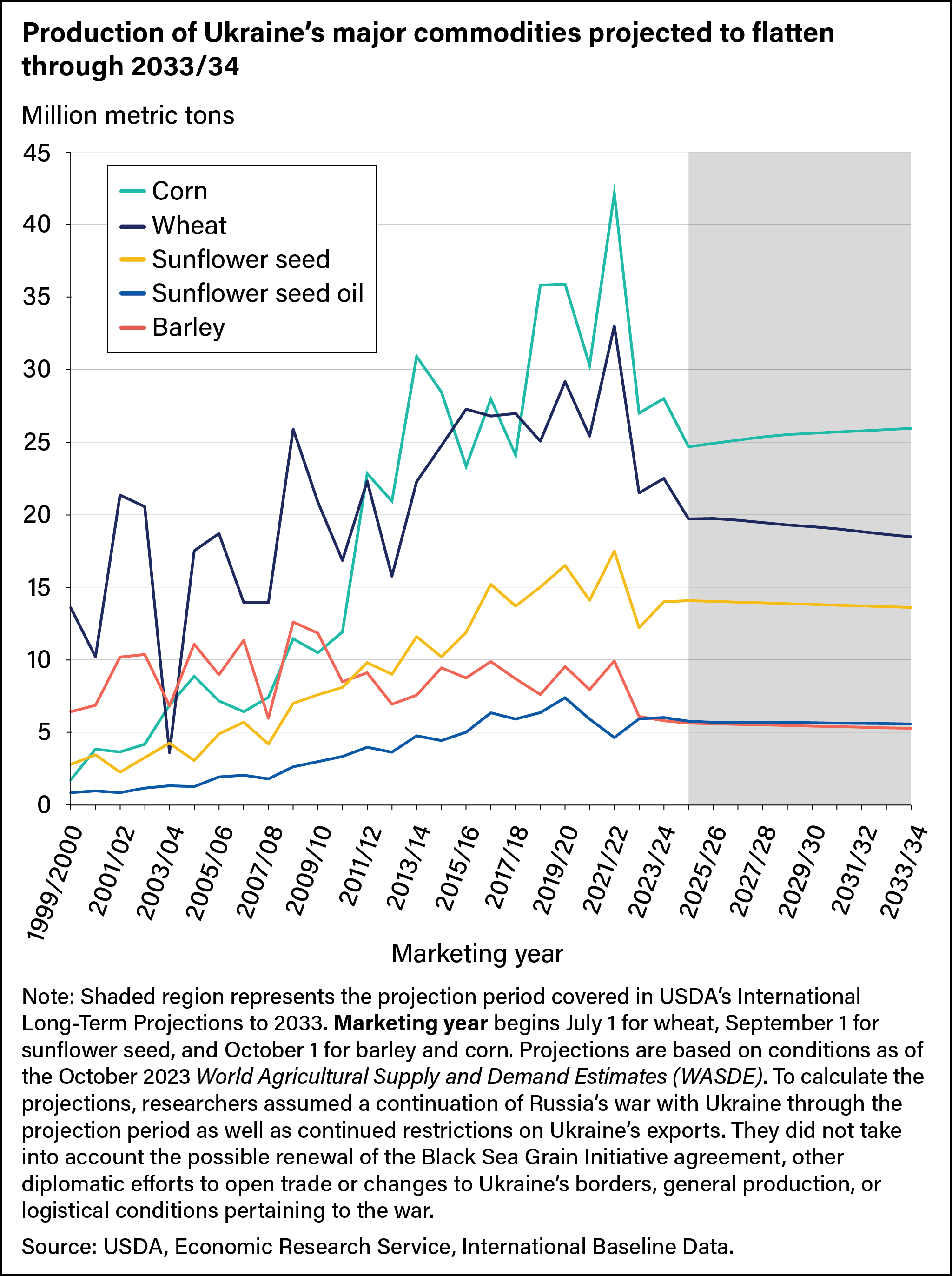

In the decade before the war, Ukraine’s corn production doubled from 21 million metric tons in the 2012/13 marketing year (a period that corresponds with a crop’s harvesting and marketing) to 42 million metric tons in 2021/22. Since the onset of the war, corn production has dropped considerably. Wheat and barley production also expanded in the period leading up to the war and similarly dropped off as conflict engulfed the country. In the 2023/24 marketing year, Ukraine’s wheat production fell, making it the second-smallest wheat crop on record in 10 years, after the 2022/23 crop. Likewise, the decrease in barley production was the second-largest decline in production volume since Ukraine gained its independence. USDA International Baseline projections implied minimal growth in corn production in the coming decade, although levels still would be noticeably lower than the prewar average production level of 36 million metric tons. Of all grains, barley production was expected to decline the most. Similarly, wheat production was projected to decline well below its 2019/20–2021/22 production average of 29 million metric tons.

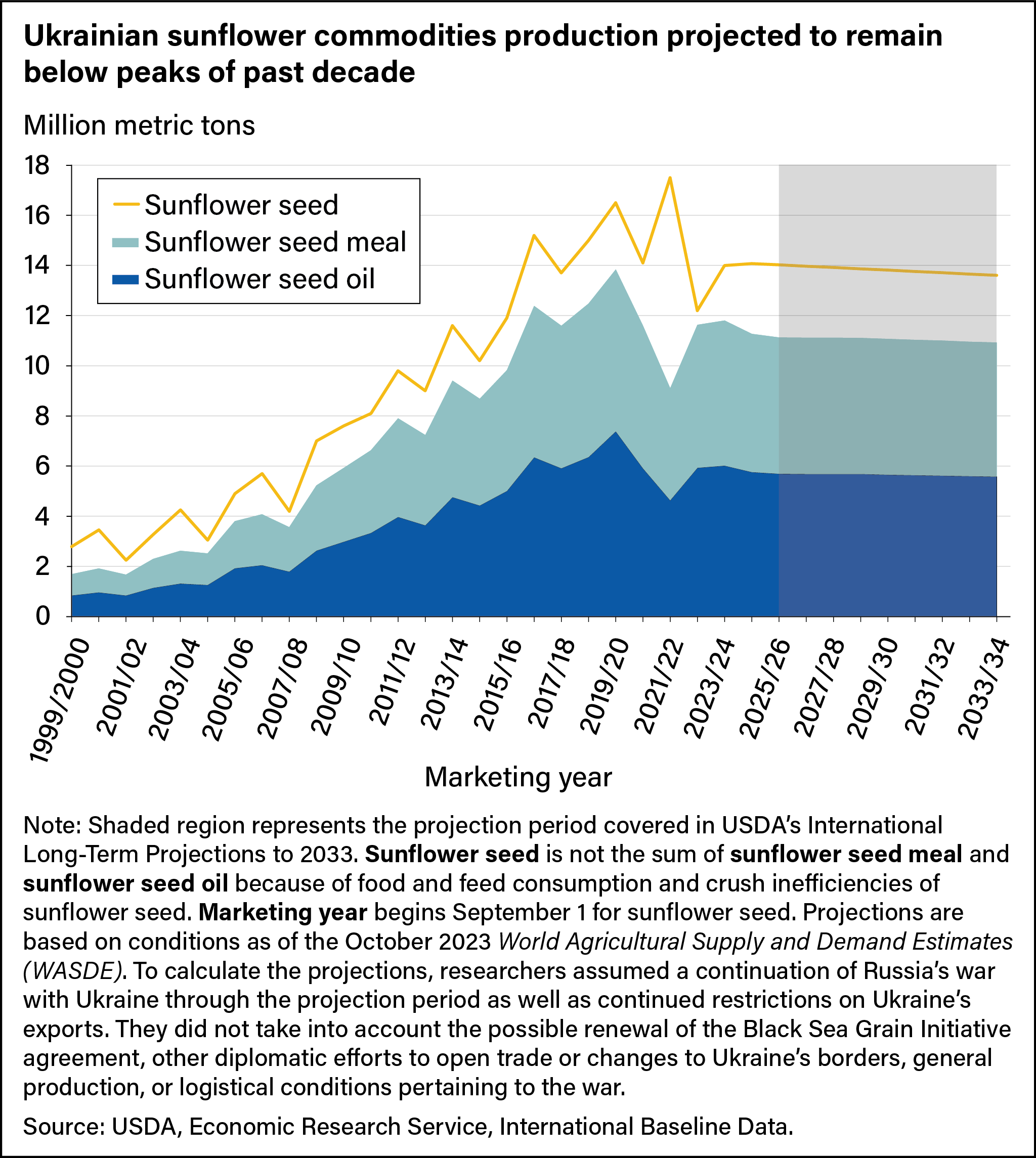

Sunflower seed is one of Ukraine's most important crops, and the country has been the top global producer over the last two decades. During this time, Ukraine's sunflower seed harvest was mostly processed or “crushed” into meal and oil to produce higher-value products for export. In 2022, war-related disruptions threatened the crushing industry's viability. Since that time, despite ongoing disruptions, Ukraine has increased sunflower seed meal and oil production, although expectations for growth are subdued. The USDA International Baseline projected sunflower seed production in Ukraine to remain relatively flat over the projection period, hovering below the 2019/20–2021/22 production average. Sunflower seed oil and sunflower seed meal production also were expected to remain relatively flat as domestic crushing operations continue to face war-related constraints.

Although war uncertainties could lead to outcomes that deviate strongly from those projected in USDA Agricultural Projections to 2033, grain and sunflower sectors have significantly lower production levels than before the war. Even so, Ukraine’s projected production still was expected to outpace domestic consumption, allowing the Nation to remain a top-10 global supplier of grains, sunflower seed, and sunflower seed products.

Price Competitiveness Drives Export Expansion

Price competitiveness is vital to the ability of Ukraine to maintain and grow its global grain and oilseed market shares. The country’s proximity to the major markets of Asia, Europe, and the Middle East provides an advantage over other exporters. Additionally, Ukraine joined the World Trade Organization (WTO) in 2008, created a strategic partnership with China in 2011, and signed a trade agreement with the EU in 2014. These actions have lowered trade barriers, making it more economical for Ukraine to export grain and oilseeds to partner nations. Reduced transaction costs and more favorable trading terms have allowed Ukraine to gain market share steadily since 2000. According to WTO statistics, Ukraine’s agricultural exports grew an annual average 5.6 percent during the 2012–2021 period. In 2021, agricultural goods represented 41 percent of Ukraine’s $68 billion in total exports.

A special article in ERS’s January 2023 edition of the Wheat Outlook showed that grain and oilseed prices in Ukraine were lower than in other global markets because of a buildup of stocks. Russia blocked Ukraine’s port access, restricting exports and increasing transaction costs. As a result, stock levels rose and prices fell. Diplomatic efforts to open trade through the Black Sea Grain Initiative eased the ability to export, allowing a drawdown in stocks. Even so, Ukraine grain producers continue to face low prices. The combination of higher-than-normal supplies and above-average transaction costs, particularly freight costs that reflect higher insurance premiums intended to cover war-related risk, is keeping market prices low for Ukraine’s grain and oil crops. Recently, Ukraine’s leaders worked with private insurers to create specialized insurance products that reduce war-related risk premiums, and that is helping to ease freight costs. However, low prices continue to affect planting decisions for the new marketing year. Expectations that the next decade’s production will remain lower than before the war contribute to projections for reduced levels of exportable supplies over that time and for as long as grain and oilseed transportation remains restricted.

War Curbs Potential for Ukraine’s Market Share of Grains, Sunflower Seed

Before the war, more than 90 percent of Ukraine’s agricultural products were exported through seaports. Russia’s blockade of Ukraine ports trapped grain and oilseed products that are vital to many developing countries in the Middle East and north Africa. The United Nations responded to the global food security concern with the rollout of the Black Sea Grain Initiative in July 2022 to allow Ukraine’s grain and oilseed exports to move through the three main ports of Odesa, Yuzhny, and Chornomorsk. Under the agreement, Ukraine expanded agricultural exports to about 6.3 million metric tons a month by December 2022 from about 1.2 million metric tons at the start of the initiative. According to Trade Data Monitor statistics, the Black Sea Grain Initiative succeeded in increasing exports, but Ukraine’s agricultural export volume still was 11 percent below the prewar 3-year average. In July 2023, Russia unilaterally withdrew from the trade initiative, raising concerns that Ukraine’s ability to export by sea would again be severely restricted. However, Ukraine developed and expanded alternative means of agricultural shipments through its river ports and established a new corridor in Ukraine that uses neighboring countries’ territorial waters to reach its deep seaports. Export volume through the new corridor is now surpassing the peak reached under the Black Sea Grain Initiative despite Russia's threat that it will view any approaching ship as a combatant. Although the new corridor has restored Ukraine's export capacity from the three main Black Sea ports, market uncertainty is expected to continue as long as the risk of Russia targeting and damaging Ukraine's export infrastructure continues.

Grain sectors had experienced significant export growth before the war. From 2012/13–2021/22, Ukraine’s corn exports grew 148 percent to become the sixth largest corn exporter in the world. Wheat exports grew 227 percent during this time, and barley exports grew 167 percent, making Ukraine the fourth largest barley supplier in the world. However, in 2022/23, corn, wheat, and barley exports declined considerably because of the war. By 2023/24, corn and barley exports decreased even further from their 2021/22 levels. Barley exports fell by the most percentage-wise of all of Ukraine’s grain and oilseed crops. With war-related uncertainties, USDA’s long-term projections indicated that Ukraine’s corn, wheat, and barley exports will not have recovered to prewar levels before the end of the coming decade.

Historically, Ukraine has been a top sunflower seed meal and oil exporter, capturing a large percentage of the global market share. In 2021/22, war-related activity severely limited Ukraine’s ability to crush sunflower seed, so exports of unprocessed or bulk sunflower seed exports ended up exceeding prewar levels. When domestic crushing increased in 2023/24, bulk sunflower seed exports fell markedly because more bulk sunflower seed was being processed into meal and oil. USDA’s International Baseline data projected sunflower seed exports to remain relatively flat over the coming decade, along with meal and oil. By 2033, Ukraine was projected to capture an increasing portion of global trade in bulk sunflower seed and about half of the global trade in sunflower seed meal and oil.

Implications for Ukraine Importers: A 10-Year Outlook

Over the International Baseline’s 10-year projection period, Ukraine’s agricultural exports were expected to remain constrained by the ongoing conflict. Leading importing countries would then turn to other suppliers, decrease consumption of the goods Ukraine produces, or increase their own domestic production.

Wheat

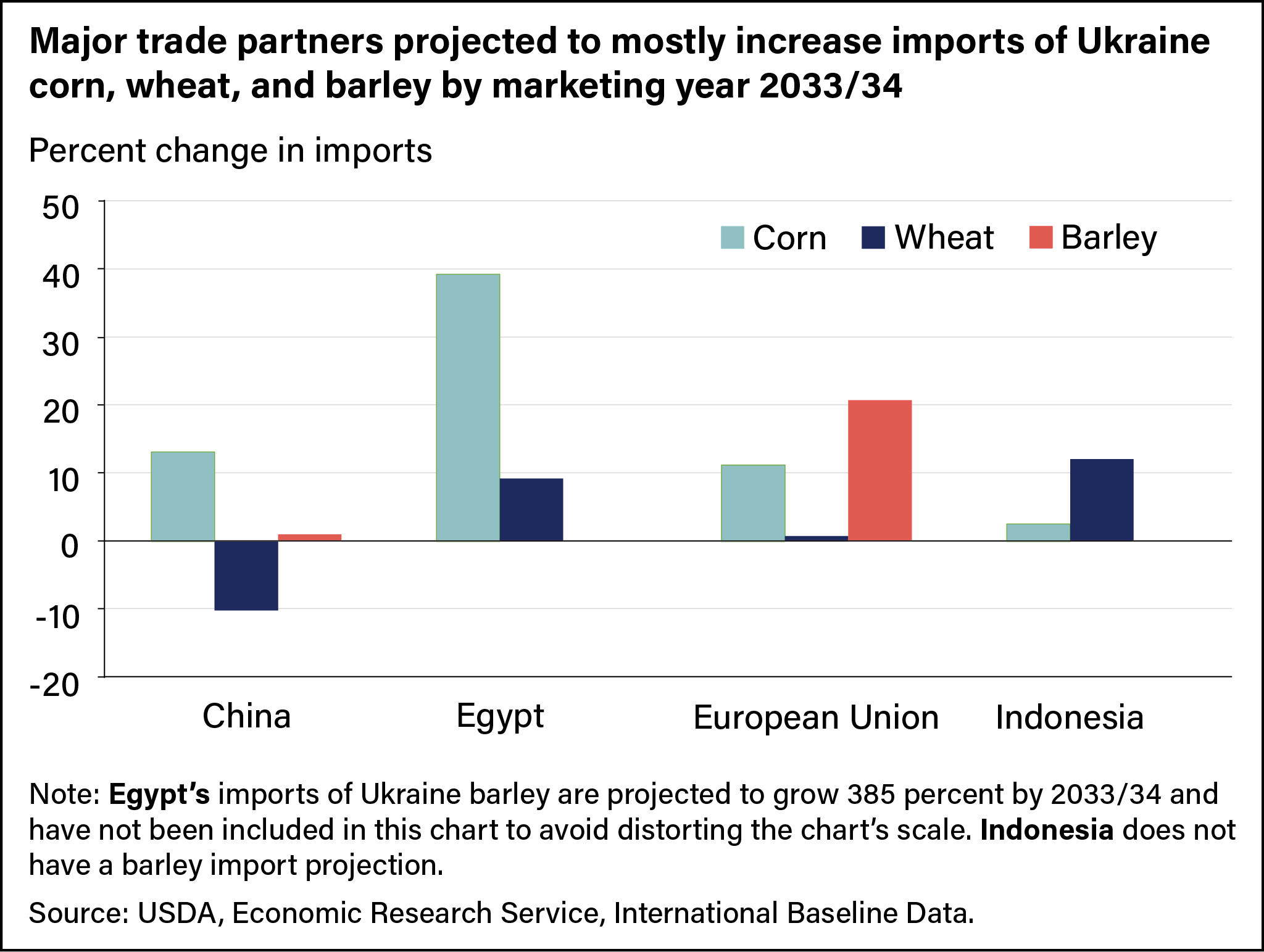

In 2021, Egypt and Indonesia imported more than 30 percent of Ukraine’s wheat, but that declined to 10 percent in 2023 as both countries sought alternative suppliers. The EU and Russia covered most of Egypt’s imported wheat needs while Ukraine’s exports were limited and would be the leading wheat exporters over the projection period. Russia’s share of global wheat exports was expected to rise to 22 percent, and the EU’s share was expected to grow to 19 percent. Indonesia’s imports were also projected to increase over the next 10 years. To make up for Ukraine’s limited exports, Indonesia turned to Australia and Canada for wheat in 2022 and 2023. Australia and Canada’s wheat exports were subsequently projected to rise over the next decade. China’s wheat imports rose in 2023/24 after production quality issues limited domestic supply but were projected to fall by 2033.

Corn

China accounted for more than 30 percent of Ukraine’s corn exports in 2021. USDA’s long-term projections indicated China’s corn imports would continue to increase through the 2033/34 marketing year. With Ukraine’s exportable supplies limited in 2023, China has increasingly purchased corn from Brazil. At the same time, Brazil’s corn exports were projected to experience robust growth with the expectation that it would continue to supply a sizable and growing share to China. Egypt’s corn imports also were expected to increase over the coming decade, driven by increased demand for feed grains as poultry production expands. Ukraine accounted for 22.5 percent of Egypt’s supplies in 2021, but this share dropped to 15 percent in 2022 as Egypt, like China, bought more of its corn from Brazil. In 2023, Ukraine’s share of Egypt’s corn imports rose again, to over 35 percent, but Egypt’s overall imports declined because of smaller crops in Argentina and the EU.

Barley

China imported more than 50 percent of Ukraine’s barley crop in 2021. Over the projection period, China was forecast to maintain its barley imports. With Ukraine barley supplies limited, the EU and Australia were expected to cover China’s demand.

Sunflower seed and related products

Ukraine's bulk sunflower seed exports dominated trade flows through the EU and Turkey in 2023. USDA’s International Baseline data projected Turkey’s sunflower seed imports would remain relatively flat over the next decade, while the EU’s total sunflower seed imports were expected to increase slightly. In 2023, Ukraine’s sunflower oil exports were notably lower than in 2021, with shipments to India projected to decline the most. India received sunflower seed oil from Argentina, the EU, and Russia to help offset the loss of supplies from Ukraine. USDA’s long-term data projected that India’s total sunflower seed oil imports would grow over the projection period. With limited supplies available from Ukraine, India was expected to continue to turn to alternative sunflower seed oil suppliers to meet domestic demand. Since the war began, China also received significantly fewer shipments from Ukraine than in previous years and secured some sunflower seed oil and sunflower seed from Russia and Kazakhstan. China’s sunflower seed imports were projected to remain steady over the next decade, while sunflower oil imports were forecast to rise.

EU Imports

USDA’s International Baseline Data projected an increase in EU imports over the projection period for corn, wheat, and barley. In 2022, Ukraine was the source of 39 percent of the EU’s wheat imports, 40 percent of barley imports, and 50 percent of corn imports. Barley and wheat shares were up significantly from 6 percent in 2021 because countries in the EU can receive grain across the Ukraine border by rail, river, and road. These modes of transportation became a major pathway for Ukraine’s exports in 2022, when the EU accounted for more than half of Ukraine’s exports of barley, corn, wheat, sunflower seed oil, and sunflower seed. Despite objections from producers and attempts at restricting imports, the EU remained a key destination for Ukraine’s exports in 2023.

This article is drawn from:

- International Baseline Data. (n.d.). U.S. Department of Agriculture, Economic Research Service.

- Dohlman, E., Hansen, J. & Chambers, W. (2024). USDA Agricultural Projections to 2033. U.S. Department of Agriculture, Economic Research Service. OCE-2024-01.

You may also like:

- Liefert, O., Liefert, W.M. & Luebehusen, E. (2013). Rising Grain Exports by the Former Soviet Union Region. U.S. Department of Agriculture, Economic Research Service. WHS-13A-01.

We’d welcome your feedback!

Would you be willing to answer a few quick questions about your experience?