Fuel Ethanol Use Expanding Globally but Still Concentrated in Few Markets

- by Steven Ramsey

- 6/5/2023

In the last 20 years, global consumption of ethanol for transportation fuel has increased because of growing demand in the United States and a small number of other countries. For the last 10 years, about 37 percent of U.S. corn production went into making ethanol, which is directly blended with motor gasoline in almost all markets. As global motor gasoline consumption has grown, so has ethanol consumption. The adoption of Government policies intended to reduce dependence on fossil fuels and support domestic agricultural industries has contributed to expanding ethanol use. Further, in recent years, ethanol’s use as an economical blending feedstock to produce higher grades of finished gasoline has driven consumption even higher.

Before the onset of the Coronavirus (COVID-19) pandemic and its related travel restrictions, global motor gasoline use grew 74 percent from 1980 to 2018, with consumption outside the United States nearly doubling, according to the U.S. Department of Energy and USDA, Foreign Agricultural Service. In 2018, global motor gasoline consumption was estimated at about 403 billion gallons, and 260 billion of those gallons were by non-U.S. countries. Fuel ethanol consumption, meanwhile, grew from about 1.2 billion gallons in 1981 to 27.6 billion gallons in 2018. Much of this growth was attributable to a combined increase of 21.1 billion gallons in the United States and Brazil. Expanding consumption in the rest of the world, however, was greater in relative terms, having grown from 10.7 million gallons to 5.3 billion gallons, or almost 50,000 percent. U.S. consumption of fuel ethanol has rebounded but not yet returned to pre-COVID levels. Fuel ethanol use has also recovered elsewhere, such as the European Union and Canada, where consumption is now estimated to exceed pre-pandemic levels.

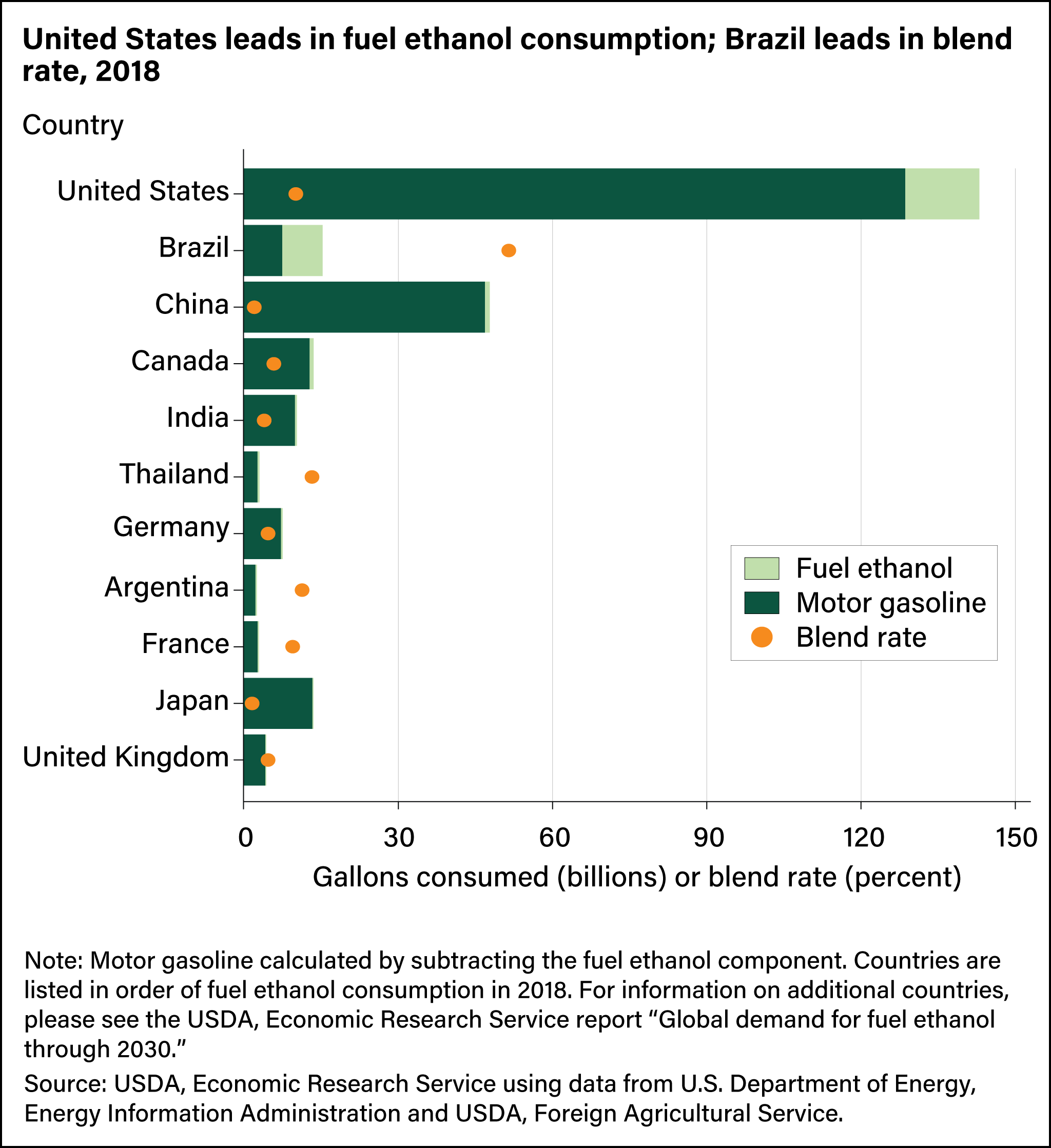

The growth in global fuel ethanol consumption has not been universal, and most countries do not use fuel ethanol. In the countries that do, the amount consumed varies. Brazil was the world’s largest consumer from 1981 to 2002 and the second largest, behind the United States, from 2003 to 2018. Excluding the United States and Brazil, China was the largest consumer of fuel ethanol from 2002 to 2018. In 2018, ethanol for fuel use in Brazil was 7.9 billion gallons, more than eight times that of China (960 million gallons) and Canada (790 million gallons), the two next largest consumers. Combined, Brazil, China, and Canada accounted for 35 percent of global fuel ethanol consumption and 73 percent of all non-U.S. consumption in 2018. Adding in the next 7 largest fuel ethanol consumers—India, Thailand, Germany, Argentina, France, Japan, and the United Kingdom—these 10 countries consumed about 11.7 billion gallons in 2018, or about 43 percent of global consumption. Countries outside of the 11 largest fuel ethanol consumers accounted for 5 percent of global consumption in 2018. So, while fuel ethanol consumption has grown in many markets, the bulk of consumption remains concentrated in a handful of markets.

Global fuel ethanol consumption also varies in terms of blend rates—the ratio of the fuel ethanol volume to the combined fuel ethanol and motor gasoline volume. The blend rate in the United States has remained around 10 percent for much of the last decade. As of 2018, the global effective blend rate (excluding the United States) was about 5 percent. That rate is skewed by the high use of fuel ethanol in Brazil, where ethanol is used either at high-blend levels or directly as a fuel. Excluding the United States and Brazil, the global effective blending rate is about 2 percent. Blending rates vary widely by country, with only a handful of countries blending ethanol at 10 percent or higher, and the remaining countries blending at a low rate or not at all. Blend rates, along with motor gasoline market size and consumption trends, are expected to determine the future path of ethanol demand.

This article is drawn from:

- Ramsey, S., Williams, B., Jarrell, P. & Hubbs, T. (2023). Global Demand for Fuel Ethanol Through 2030. U.S. Department of Agriculture, Economic Research Service. BIO-05.

You may also like:

- Corn and Other Feed Grains. (n.d.). U.S. Department of Agriculture, Economic Research Service.

- Bioenergy. (n.d.). U.S. Department of Agriculture, Economic Research Service.

- Valdes, C., Hjort, K. & Seeley, R. (2016). Brazil's Agricultural Land Use and Trade: Effects of Changes in Oil Prices and Ethanol Demand. U.S. Department of Agriculture, Economic Research Service. ERR-210.

- Toasa, J. (2009). Colombia: A New Ethanol Producer on the Rise?. U.S. Department of Agriculture, Economic Research Service. WRS-0901.

We’d welcome your feedback!

Would you be willing to answer a few quick questions about your experience?