What Does Exchange Rate Appreciation Mean for Export Competitiveness?

- by Kari E.R. Heerman

- 6/1/2015

The U.S. dollar exchange rate critically determines the price of U.S. goods abroad and imported goods at home. Changes in the exchange rate are thus a key determinant of changes in U.S. agricultural trade. After a long period of relative weakness, the real and nominal value of the U.S. dollar has recently strengthened relative to many trading partners’ and competitors’ currencies. If this shift persists, the outlook for U.S. agricultural exports and imports may depart from recent trends.

The Economic Research Service’s (ERS) Agricultural Exchange Rate Data Set tracks exchange rate developments with quarterly updates of monthly and annual U.S. dollar exchange rate information, including projections for several months ahead. The data set includes two types of information: country exchange rates and agricultural commodity exchange rate indices. Country exchange rates are provided in both nominal and real terms. The nominal exchange rate is simply the purchase price of a dollar in terms of foreign currency. The real exchange rate adjusts the nominal rate for differences in the growth of prices, and is thus the measure used to evaluate the competitiveness of U.S. exports abroad. Commodity indices are weighted average exchange rates, where a country’s weight represents its importance as an export market or a competitor.

Recent Exchange Rate Movements

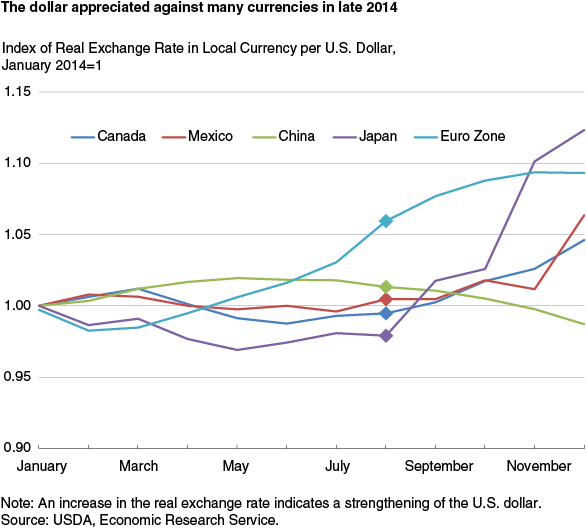

The real dollar exchange rates of the top four markets for U.S. agricultural exports plus the Euro zone are shown below. Each country’s exchange rate is divided by its January 2014 value so they can be compared. Since August 2014, the dollar has appreciated in real terms by 4 percent against Canada; 6 percent against Mexico and the Euro Zone, 7 percent against Korea, and 15 percent against Japan. The dollar depreciated very slightly against China.

Like any price, the exchange rate is driven by supply and demand: greater demand for the dollar raises its price relative to other currencies. The recent appreciation has largely been driven by U.S. policy and global factors that have increased demand for dollars needed for investment and business activity in the United States. The robust recovery of the U.S. economy in contrast to economic stagnation elsewhere makes it an advantageous destination for business and financial investment, while ongoing conflict in Russia and the Middle East attract investors to the safety of U.S. markets. Additionally, the expectation of higher U.S. interest rates raises the prospect of higher returns.

What Does This Mean for Agricultural Exports?

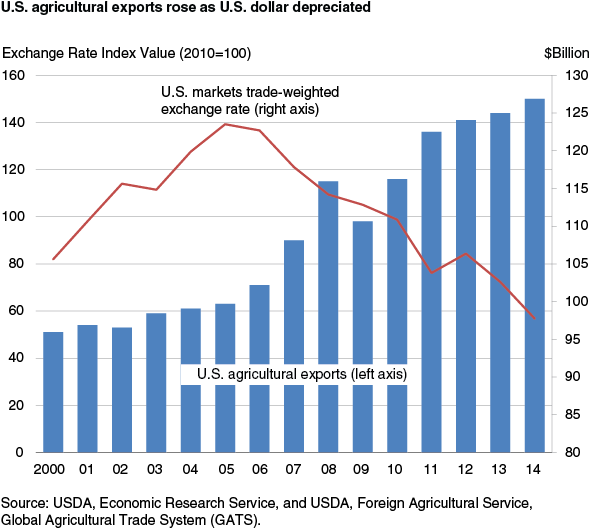

Although the degree of influence varies across products, a strong dollar tends to make exports less competitive because it raises their prices relative to exports from other countries. The markets exchange rate index is a measure of the average value of a dollar in our most important agricultural export markets. In this index, each country’s real exchange rate is weighted by its share of U.S. exports. Just seven countries: Canada, Mexico, China, Japan, Korea, Hong Kong, and Taiwan comprise two-thirds of the weight in this index. While many other factors determine export flows, a rising dollar will put pressure on U.S. export competitiveness abroad.

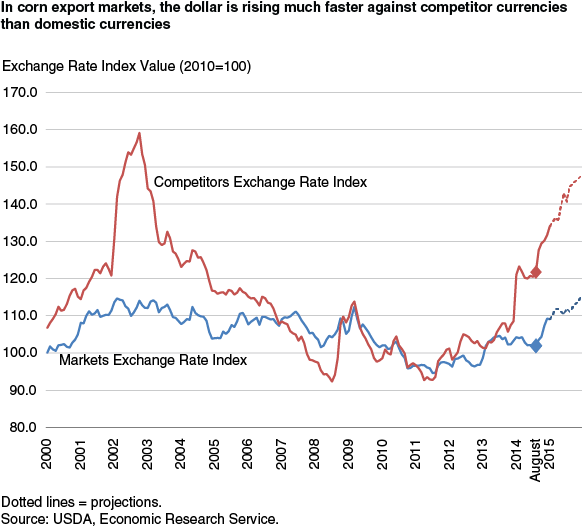

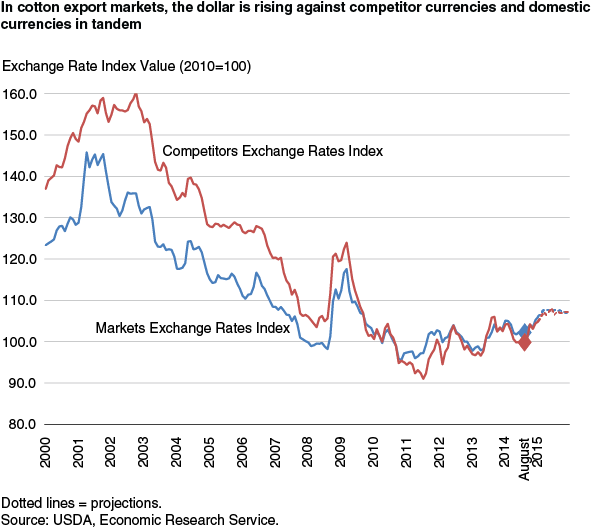

ERS also publishes markets exchange rate indices for individual agricultural products as well as a “competitors” exchange rate index, which use each country’s share of global exports as weights. This index reflects the evolution of the average value of a dollar relative to our competitors. The markets exchange rate index reveals differences in how real dollar appreciation affects these commodities. The monthly total agricultural markets exchange rate index appreciated by 5 percent between August 2014 and February 2015; in contrast, the corn markets index appreciated 7 percent and the cotton index rose only 3 percent during the same period. A large and widening gap exists between the markets and competitors indices for corn; there is almost no gap for cotton. This difference suggests that the appreciating dollar is a much larger source of comparative disadvantage for corn exports than it is for cotton.

Conclusion

The U.S. exchange rate has appreciated in recent months, and global economic and political conditions suggest a continuation of this trend. In the February 2015 Outlook for U.S. Agricultural Trade, the USDA lowered its agricultural trade surplus forecast for 2015 to $22.5 billion, the lowest since 2007, in part because of the rising dollar. While exchange rates are critical to U.S. competitiveness abroad, they are less important for some U.S. agricultural products that are differentiated from competitors by their quality, their innate characteristics, or the efficiency with which they are supplied to foreign consumers.

This article is drawn from:

- Agricultural Exchange Rate Data Set. (n.d.). U.S. Department of Agriculture, Economic Research Service.