Southeast Asia Projected To Remain Top Rice Exporter

- by Nathan Childs, John Dyck and James Hansen

- 2/21/2013

Highlights

- The growth rates of both production and consumption of rice in the Southeast Asia region have been slowing.

- The large surplus of production over regional demand in Southeast Asia is likely to continue for the next decade.

- Southeast Asia, the world’s dominant rice export region, has an important role in determining world rice prices and food security in regions that depend on rice imports, such as Sub-Saharan Africa.

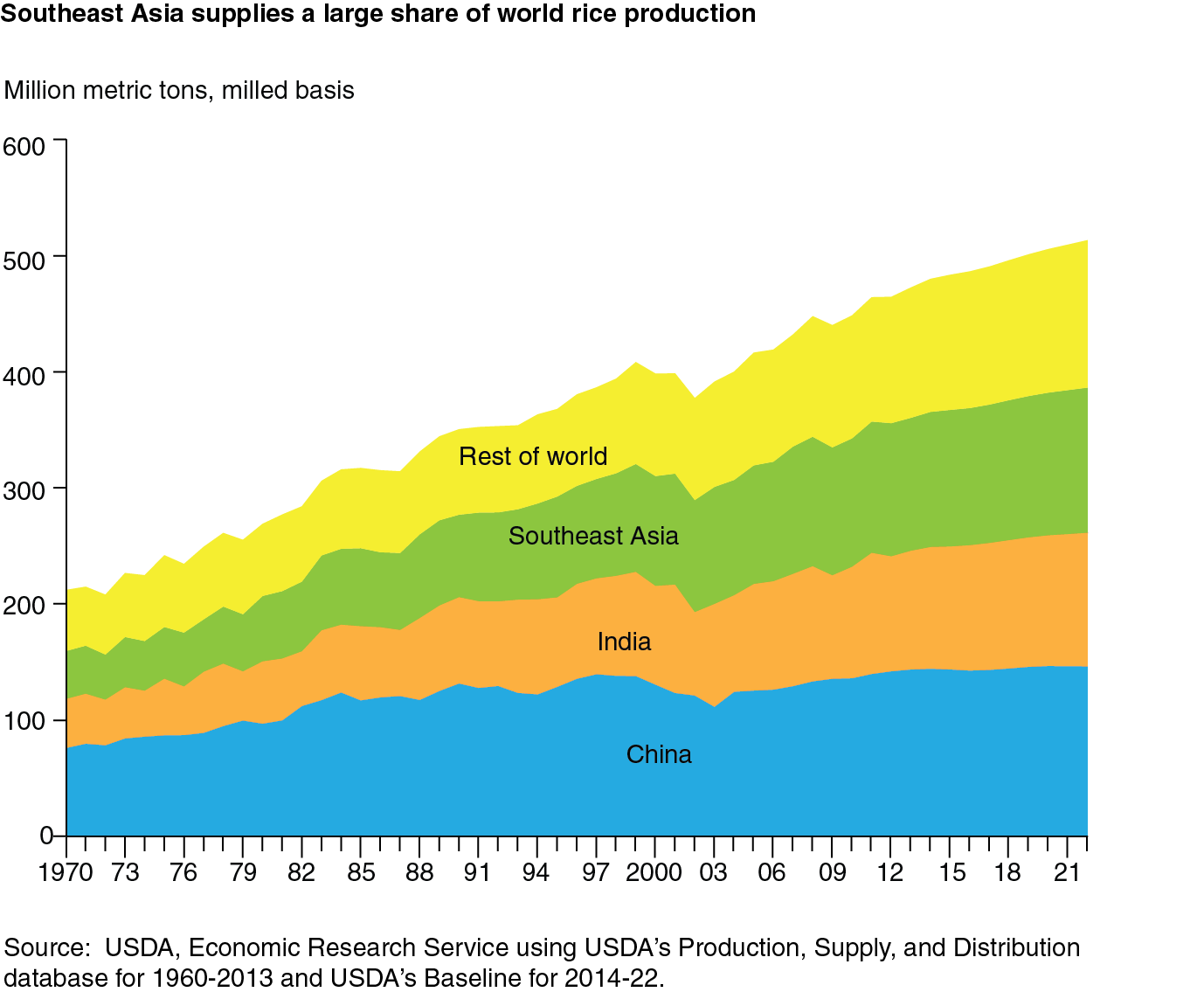

Rice, after wheat, is the world’s most consumed food grain, with global consumption reaching 444 million metric tons in 2011. While most rice is consumed in the countries where it is produced, rice trade has been growing. The world’s largest source of rice exports is Southeast Asia (especially Thailand and Vietnam), where production exceeds consumption. According to the USDA Baseline, this trend is projected to continue.

Growth in global rice consumption has been slowing, as consumers in much of Asia increasingly diversify their diets and turn to other foods. A simultaneous slowdown in production growth raises concerns about the ability to meet future demand. Throughout the world, consumers, especially in low-income households, face financial stress when rice prices rise, while most producers benefit from higher prices.

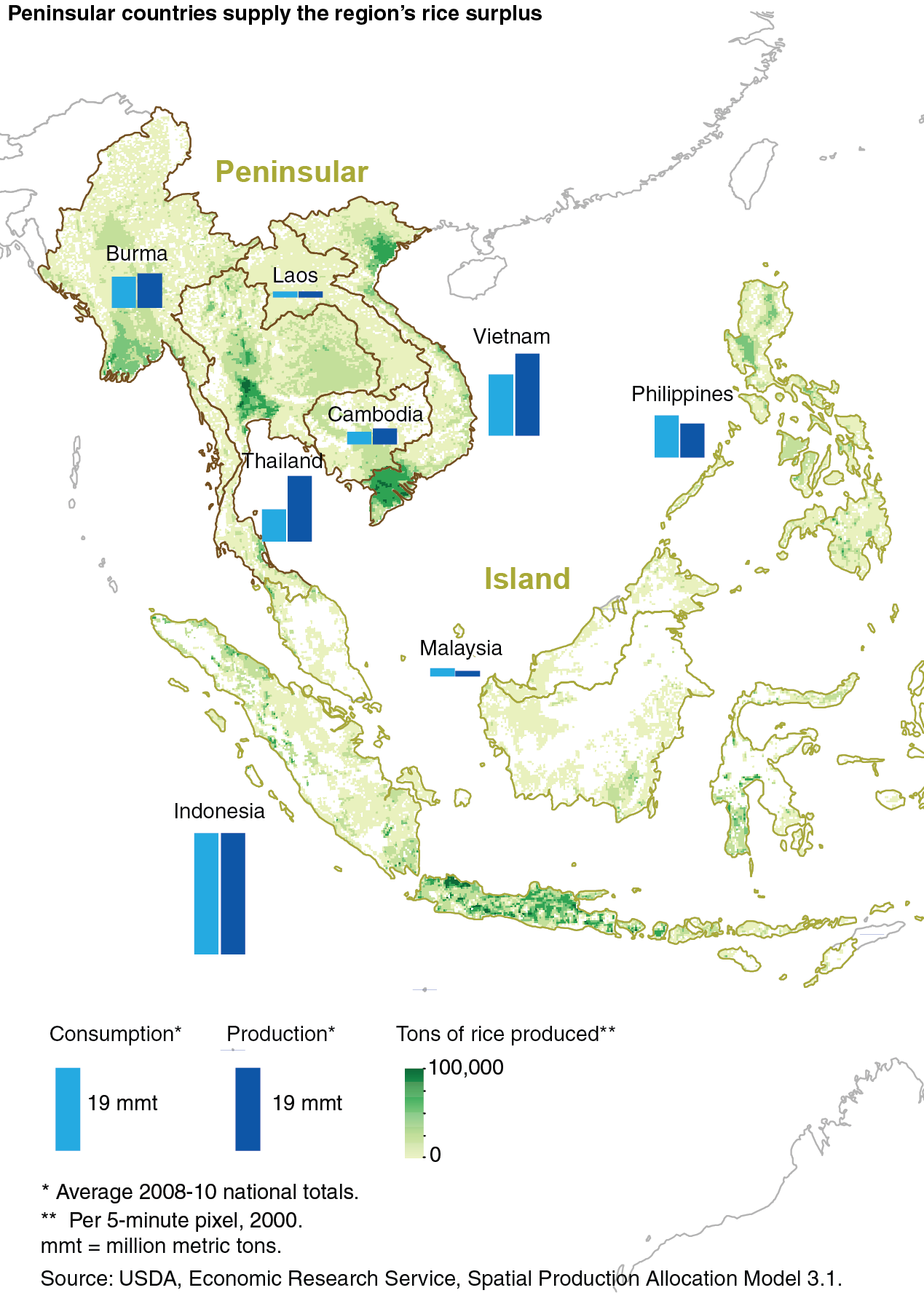

Despite slow growth in production, Southeast Asia has a large rice surplus and is likely to continue to supply needs in the rest of the world. Southeast Asia contains the world’s largest rice-exporting countries (called “Peninsular” in the map) and major rice-importing countries (called “Island”). The Peninsular countries supply the Island countries but have additional rice to send outside the region. Rice demand is likely to grow slowly across all of Southeast Asia over the next decade, which could free up more supplies to send to countries outside the region.

Supply Grows Slowly as Markets Favor Better Tasting, Lower Yielding Rice Types

Globally, rice production grew at a slower rate in the last two decades than in the 1970s and 1980s. This also applies to rice production in Southeast Asia. Production growth is dependent on yield growth and growth in area harvested. Southeast Asia has little potential for expanding rice fields. Most rice area is in paddies in which crops grow in standing water for part of a crop season. Paddy land needs to be flat and accessible to water sources. Most land of this type is already in use by rice farmers, and it will be difficult to find more in most countries of Southeast Asia.

Area harvested can also be increased by growing more than one crop of rice per year on the same land. Double- and triple-cropping are possible in tropical areas, where water, rather than temperature, is the limiting factor. In addition to putting greater pressure on water and labor, multiple rice crops on the same land are associated with greater incidence of pests and diseases. In southern Vietnam, the risk of disease has prompted the government to strongly discourage triple-cropping. Nevertheless, if prices are favorable and the water supply is sufficient, multiple cropping of rice can increase production. In recent years, double cropping has expanded the rice harvest area in Thailand. Further increases in multiple cropping are anticipated. The rate of increase, however, is expected to be slower than in the past, unless higher rice prices encourage producers to expand the area allocated to rice.

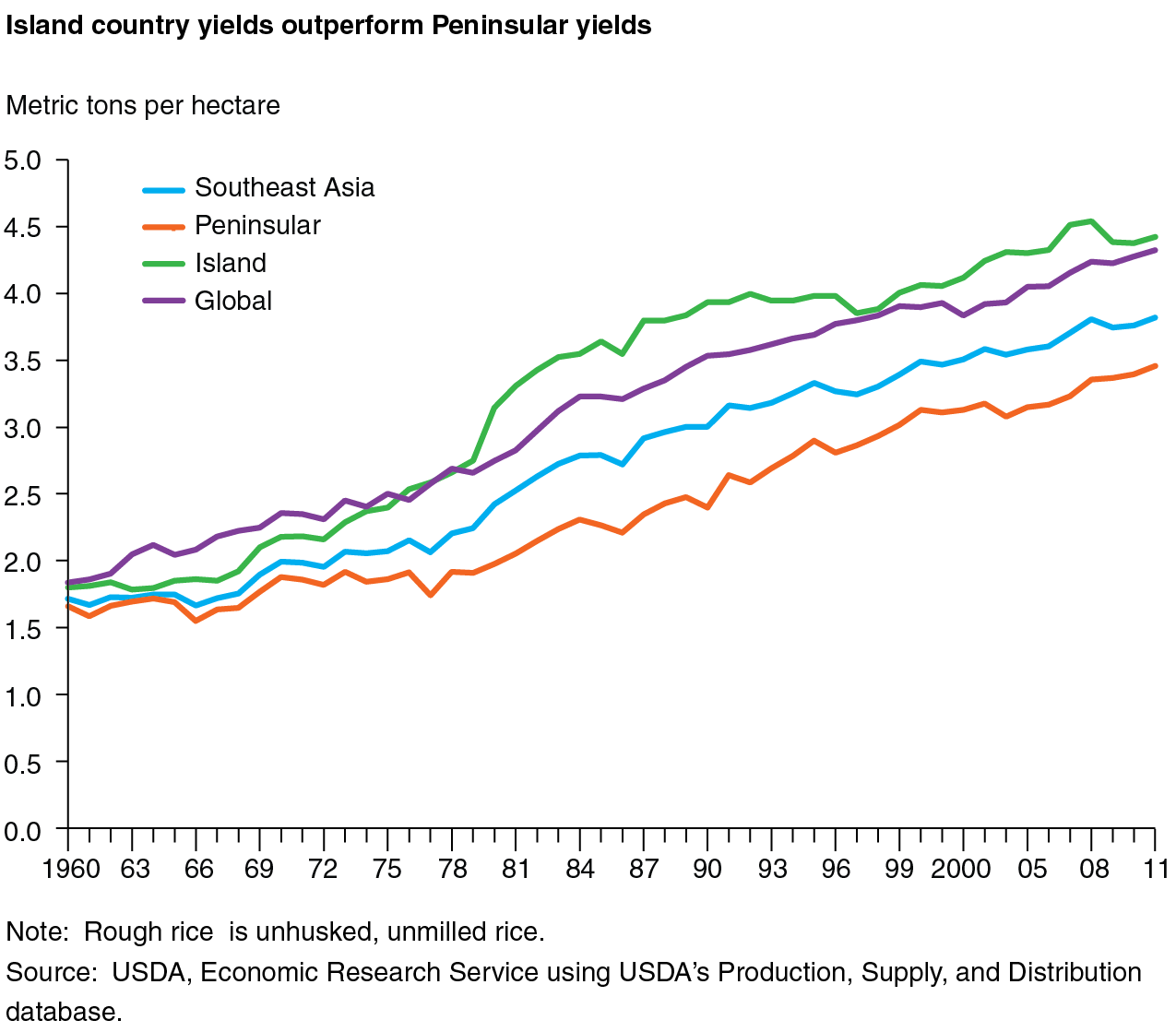

Yield growth in the region has also slowed in recent years (see box, “The Green Revolution”). Yields depend on soil, climate, and weather conditions, but management choices can have an effect as well. Greater use of fertilizer and chemical inputs can increase yields, up to a point. Yields can be increased through careful management, including timing of the planting and harvest, and weed control. But management choices such as these often involve higher costs or more time and expertise.

Another way to increase yields is through crop breeding, but hybrid rice programs illustrates some of the barriers to adoption of new varieties. Hybrid seeds greatly boost yields for crops like corn and rice. Rice, however, is a self-pollinated plant, unlike corn, which is cross-pollinated. This makes rice breeding and seed propagation using hybrid techniques more difficult and time-consuming, and seed costs are high. Reports from Indonesia, the Philippines, and Burmaindicate that some farmers find hybrid seed prices too high, and that hybrid yields are lower than anticipated because of problems with inputs, water, or extreme conditions. Market prices for hybrid rice are reportedly lower than for traditional varieties because consumers prefer the taste of the traditional varieties. Unlike in China, where hybrid rice seeds dominate the long grain rice sector, hybrid seeds have not taken off commercially in most of Southeast Asia.

Average rice yields in most of the rice-exporting Peninsular countries (Burma, Thailand,Vietnam, Cambodia, and Laos) are below the world average. This is partly attributed to farmerbehavior in Thailand, normally the largest rice-exporting country. Thai farmers have typicallyplanted low-yielding varieties that take a long time to mature but whose aroma, taste, andappearance command a premium in the world market. These varieties are grown in rainfedconditions without full irrigation systems and with relatively little fertilizer. Low input costsand high output prices make these rice types profitable.

Post-harvest losses--in the field, as well as in transport, processing, and storage--remain highin most Southeast Asian rice economies. Milling separates the rice husk and bran from thepolished grain. A low milling rate means that less polished rice is available from a given amountof harvested paddy rice. Cambodia, in particular, suffers from inefficient milling.

Some of the rice losses currently incurred in Southeast Asia can be avoided. Several countriesare aiming to improve drying and storage and to make milling more efficient. The success ofany such effort would increase the rice supply.

Rice Demand Grows Slowly in a Region Where Rice Consumption Is Already High

Rice is used primarily as a staple food grain. Table rice, served at meals in homes and restaurants,is a basic part of most Asian food systems. Table rice use in Southeast Asia appears to begrowing very slowly. Other uses for rice--including feed for livestock and processing--appearto be growing more quickly, although data on other uses are scarce.

Table use can be calculated as rice eaten per person times the number of people. Populationgrowth has slowed markedly in Southeast Asia. Families there increasingly aim for having justone or two children, especially in urban areas, because children are expensive to educate andhouse. Population growth rates in the coming decade are expected to be below 2 percent peryear throughout most of Southeast Asia.

Meanwhile, table use of rice per person is steady or declining. Southeast Asian consumers eat large amounts of rice. When their incomes rise, they choose to buy other foods, diversifying their diets. For example, broiler consumption in Southeast Asia increased by over 40 percent in the last decade--much faster than rice (16 percent). Household surveys indicate declining rice consumption per person in Thailand, Indonesia, and Vietnam, especially in urban areas, which are increasingly where people live. With population growth slowing, total table use of rice in the region is expected to fall eventually.

Processed foods and beverages made from rice include traditional alcoholic drinks and ricenoodles, as well as many new products using rice as ingredients. Broken rice kernels are oftenused as an animal feed and are an important part of feed rations for pigs and chickens in Thailandand Vietnam (data limitations make it difficult to estimate the size and consumer trend of theprocessing and feed markets for rice). Although such uses are much smaller than table rice use,anecdotal evidence suggests that they account for current growth in rice consumption. This isexpected to continue to be the case, particularly if prices for corn, which competes with riceas a feed, and for wheat, which competes in noodle and baking uses, are high relative to riceprices.

USDA’s Baseline Projects a Robust Surplus in Southeast Asia

According to 2012 USDA Baseline projections, Southeast Asia will continue to ship large riceexports over the next decade. Island country imports are projected to increase, but less thanPeninsular country exports. Regional production is projected to increase about 1 percent peryear, more slowly than in the past decade, because area harvested is expected to increase(0.3 percent per year) more slowly in all countries. Yields are projected to rise throughoutthe region at about the same rate (0.9 percent per year) as in the last decade. The projectionsassume normal weather and a continuation of current government policies.

Government policies have changed in recent years. Thailand’s paddy pledging program hasintensified support for rice production by committing the government to buying most rice atprices well above historical levels. Thus, the Thai Government, not the market, is the primarybuyer. This is likely to encourage farmers to increase production without as much regard toquality characteristics as in the past, and Thai yields are likely to rise.

Indonesian and Philippine officials have announced their intention to achieve self-sufficiencyin rice. The USDA Baseline projections show some production growth in both countries inthe next decade, but not enough to achieve self-sufficiency. If through some combinationof increased production and decreased consumption the Philippines or Indonesia do movetoward self-sufficiency, the region’s net rice exports would be higher than currently projected.This could lead to lower prices in the world market where U.S. rice competes with SoutheastAsia’s rice.

El Niño weather events reduce normal monsoon rainfall, especially in the Island countries, andcan reduce Southeast Asia’s exports to the rest of the world for a year or two. Because there isno firm pattern to the occurrence of El Niño events, they are not reflected in USDA’s Baselineprojections. However, they present a downside risk to Southeast Asia’s exports.

Although these and other uncertainties could lead to a range of outcomes different from USDA’s2012 projections, rice consumption in Southeast Asia (and in the rest of Asia) is likely to growmore slowly than in the past. This reduces upward pressure on prices, which in turn lowers theincentive for the region’s farmers to increase production. The USDA Baseline projects growingdemand for Southeast Asian rice in Africa, the Middle East, and other areas. Production growthin Southeast Asia, though slower than in the past, is projected to continue to satisfy the addeddemand in the rest of the world. The region’s rice surplus is likely to meet global needs becauseof the fundamental factor that demand for rice in Southeast Asia itself is weakening.

Although these and other uncertainties could lead to a range of outcomes different from USDA’s 2012 projections, rice consumption inSoutheast Asia (and in the rest of Asia) is likely to grow more slowly than in the past. This reduces upward pressure on prices, which inturn lowers the incentive for the region’s farmers to increase production. The USDA Baseline projects growing demand for SoutheastAsian rice in Africa, the Middle East, and other areas. Production growth in Southeast Asia, though slower than in the past, is projectedto continue to satisfy the added demand in the rest of the world. The region’s rice surplus is likely to meet global needs because of thefundamental factor that demand for rice in Southeast Asia itself is weakening.

This article is drawn from:

- International Baseline Data. (n.d.). U.S. Department of Agriculture, Economic Research Service.

- Baldwin, K.L., Childs, N., Dyck, J. & Hansen, J. (2012). Southeast Asia's Rice Surplus. U.S. Department of Agriculture, Economic Research Service. RCS-12l-01.

We’d welcome your feedback!

Would you be willing to answer a few quick questions about your experience?