Wheat price volatility largely due to supply and demand shocks

- by Michael K. Adjemian

- 6/10/2014

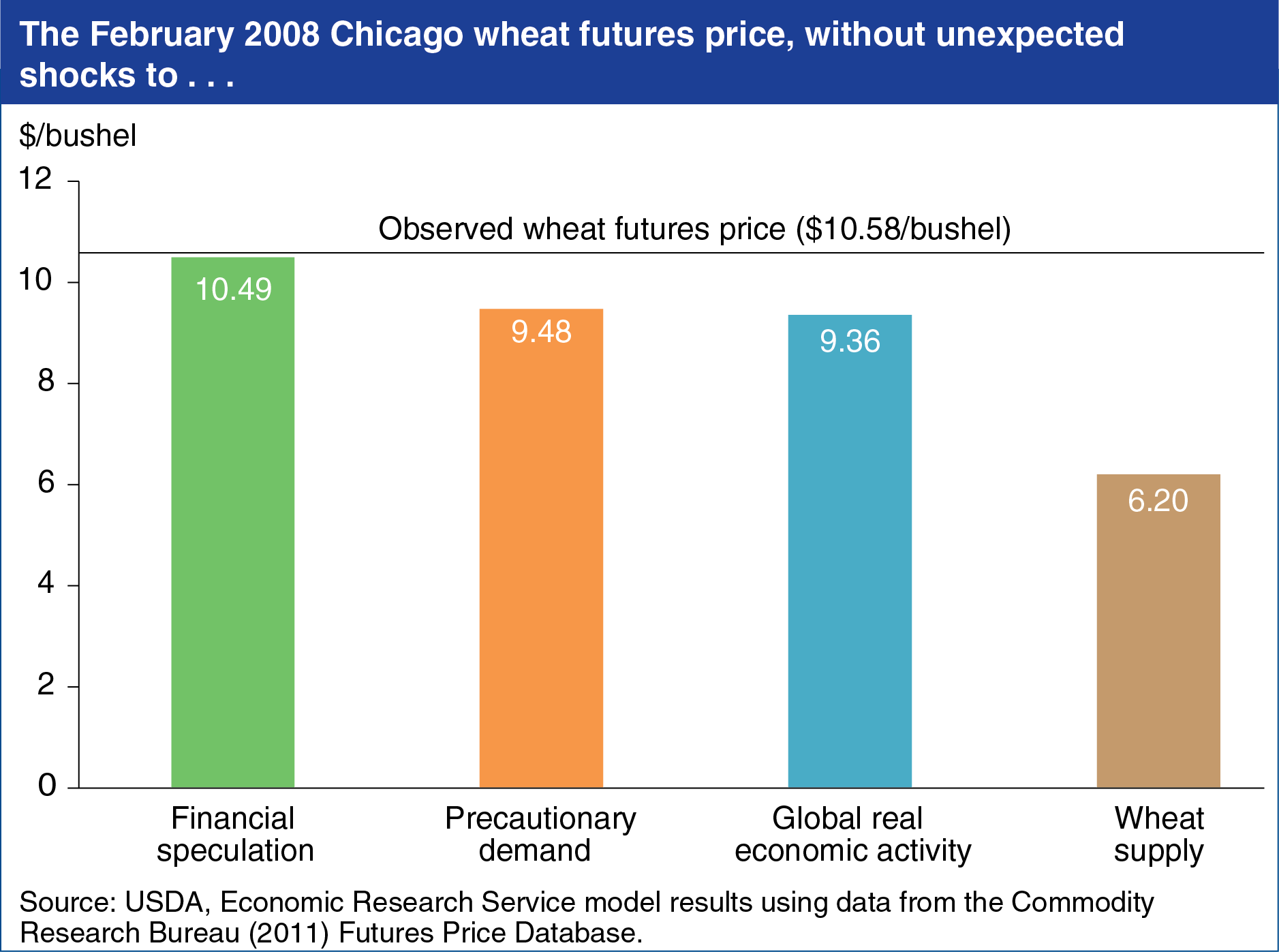

Over the last 5 years, wheat futures prices spiked and then crashed, with increased price volatility drawing the public’s attention. Recent ERS research indicates that the volatility has been primarily due to supply conditions specific to the wheat sector. Wheat supply shocks, such as weather events that lowered yields, were the dominant cause of price spikes between 1991 and 2011. Focusing specifically on the February 2008 price spike, the results showed that, depending on the class of wheat, wheat prices in that month would have been 40-62 percent lower in the absence of supply shocks affecting that year’s wheat crop. The second most important factor in the 2008 spike was shocks to precautionary demand —or incentives to hold commodity inventories associated with expectations about future prices. Wheat prices would have been 11-36 percent lower in the absence of these shocks. Demand shocks associated with fluctuations in global economic activity had a 9- to 12-percent price impact. The shocks attributable to financial speculators like commodity index traders had only a 1-percent impact on the peak wheat price in February 2008. Find this chart in “Wheat Prices Driven by Supply and Demand” in the June Amber Waves, with additional analysis in Deconstructing Wheat Price Spikes: A Model of Supply and Demand, Financial Speculation, and Commodity Price Comovement, ERR- 165.