Commercial banks and the Farm Credit System dominate farm sector lending

- by Dipak Subedi and Anil K. Giri

- 8/7/2024

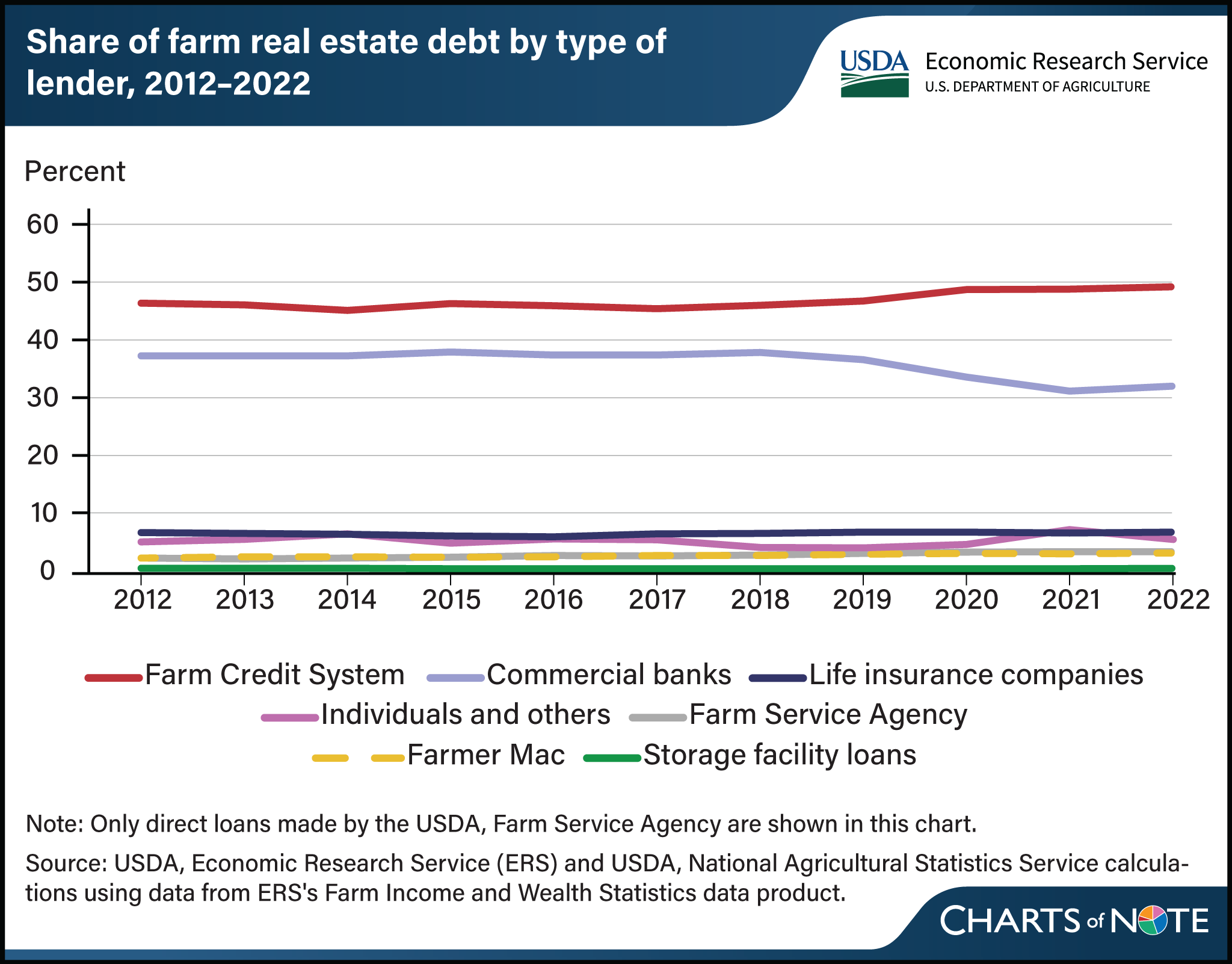

Commercial banks and the Farm Credit System together held about 80 percent of farm real estate debt during the last 11 years, making them the primary lenders to the U.S. agricultural sector. In 2022, the Farm Credit System—a nationwide network of borrower-owned lending institutions and specialized service organizations—provided almost half of all the real estate loans made to the sector, and commercial banks provided 32 percent of agricultural real estate loans. USDA’s Farm Service Agency provides loans directly to producers and in 2022 accounted for less than 4 percent of real estate loans. Other lenders include life insurance companies (7 percent), individuals and others (5 percent), and storage facility loans (less than 1 percent). Farmer Mac, which, like the Farm Credit System, is a Government-sponsored enterprise created by Congress to bring capital to agricultural markets, accounted for about 3 percent of total loans. This chart updates information in the USDA, Economic Research Service report Debt Use by U.S. Farm Businesses, 2012–2021, published in June 2024.