Pork stocks unlikely to build to pre-COVID levels in 2021

- by Mildred Haley

- 3/26/2021

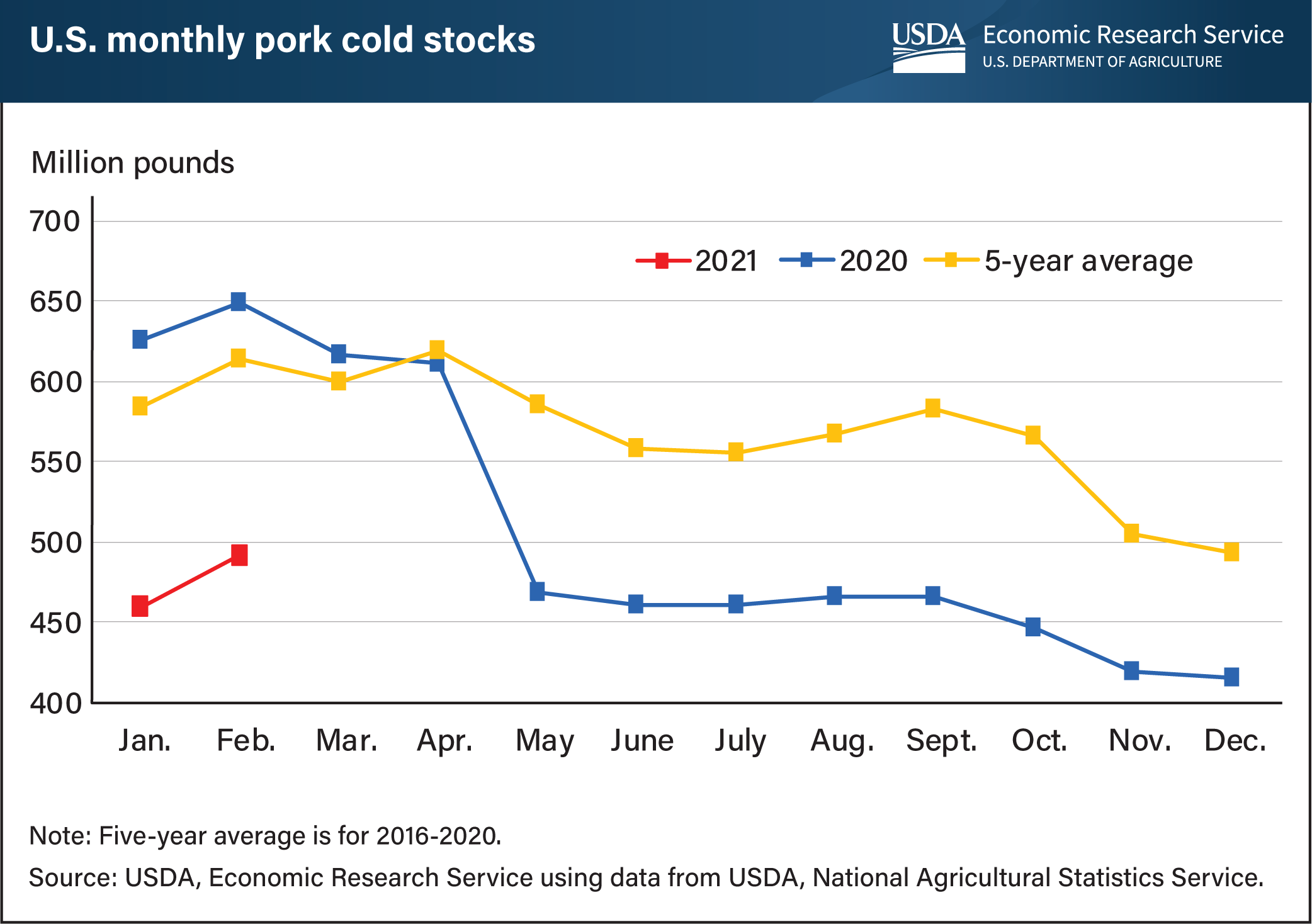

The recently released USDA Cold Storage stocks report showed February 2021 ending stocks of pork in the United States at 491 million pounds, more than 24 percent below levels in February 2020. With USDA forecasting 2021 hog prices to average more than 29 percent above prices last year, it is unlikely pork stocks will build to pre-COVID-19 levels in 2021. Pork stocks have remained significantly below year-earlier levels since last spring, in response to turbulence in the U.S. pork processing sector related to the COVID-19 pandemic. In May 2020, stocks fell more than 23 percent from April 2020 levels because of major disruptions in pork production that included several temporary processing plant shutdowns. In February 2021, ending volume represented about 22 percent of February's estimated federally inspected pork production. A more typical stocks-to-production ratio for February is about 29 percent. USDA is forecasting prices of live equivalent 51-52 percent lean hogs to average about $56 per hundredweight, 29 percent higher than hog prices averaged in 2020. The increase reflects, in part, expectations for continued robust consumer demand for pork products. Lower levels of pork stocks could limit the price-moderating role that stocks have played in the past, in the event of unforeseen spikes in pork prices. This chart is drawn from USDA, Economic Research Service’s Livestock, Dairy and Poultry Outlook, March 2021.