Business & Industry (B&I) Guaranteed Loans reduced risk of rural business failure

- by Anil Rupasingha, John Pender and Dennis Vilorio

- 1/21/2020

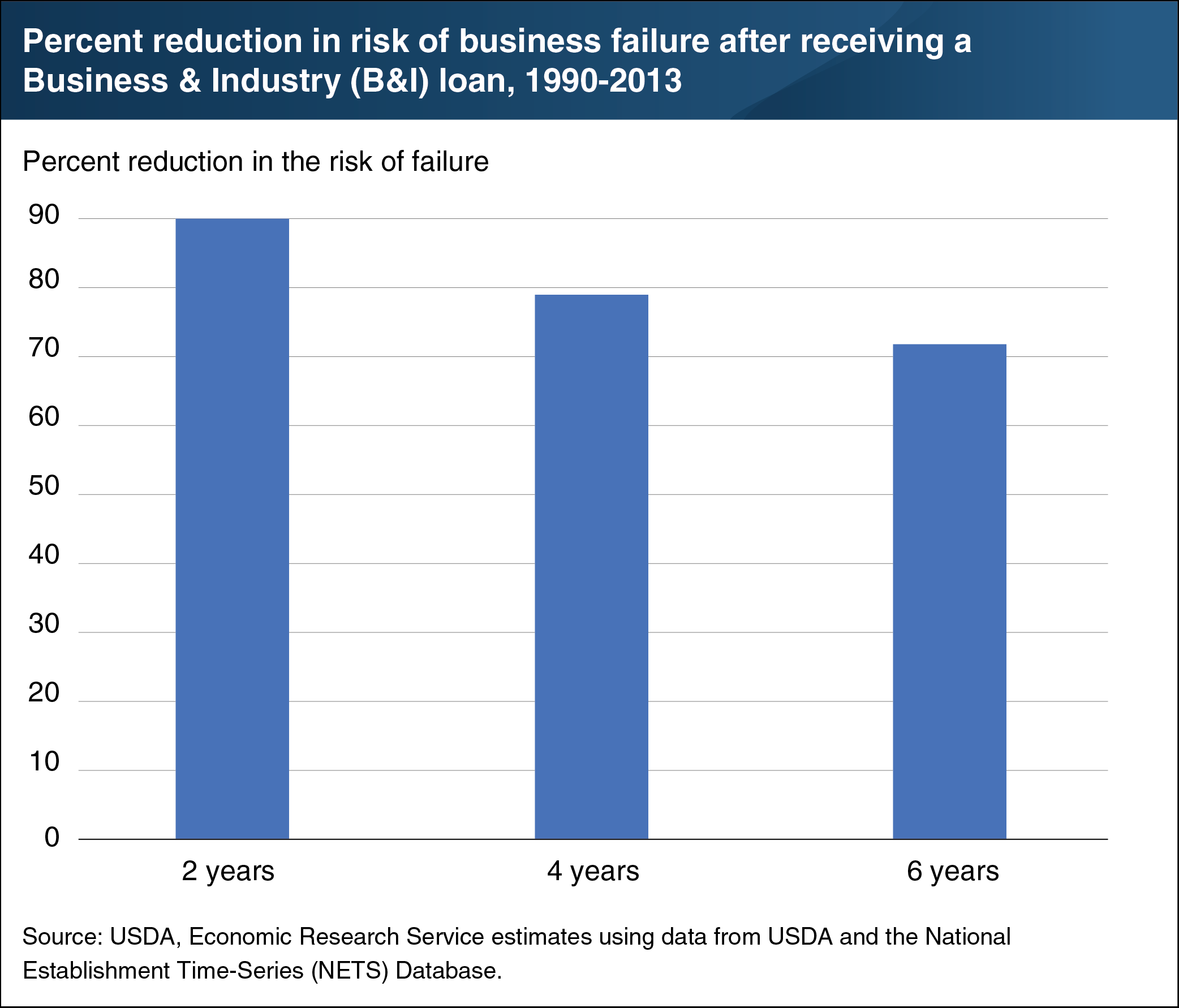

USDA’s Business and Industry (B&I) Guaranteed Loan Program guarantees loans to businesses in rural areas in partnership with private-sector lenders. By reducing lenders’ risk, the program encourages lenders to provide more generous terms or larger principal amounts, or to approve loans to rural businesses that they otherwise might not make. ERS researchers estimated business survival rates between 1990 and 2013 for B&I loan recipients and a comparison group of non-recipients similar to loan recipients. On average, 2 years after receiving a B&I loan, recipients were 90 percent less likely to fail in the next year than the group of similar non-recipients. The effect of B&I loans on survival rates declined with time. Nevertheless, 4 years after receiving a B&I loan, recipients were still 79 percent less likely to fail in the next year than similar non-recipients. And 6 years after receiving a B&I loan, recipients were 72 percent less likely to fail in the next year than similar non-recipients. The B&I Loan Program’s strong effects on business survival suggest that the program has helped retain existing jobs in local communities. This chart appears in the September 2019 Amber Waves finding, “Rural Businesses That Receive USDA Business and Industry Guaranteed Loans Less Likely To Fail.”