In 2018, U.S. average farm real estate value remains near 2015 historic high

- by Daniel Bigelow

- 10/1/2018

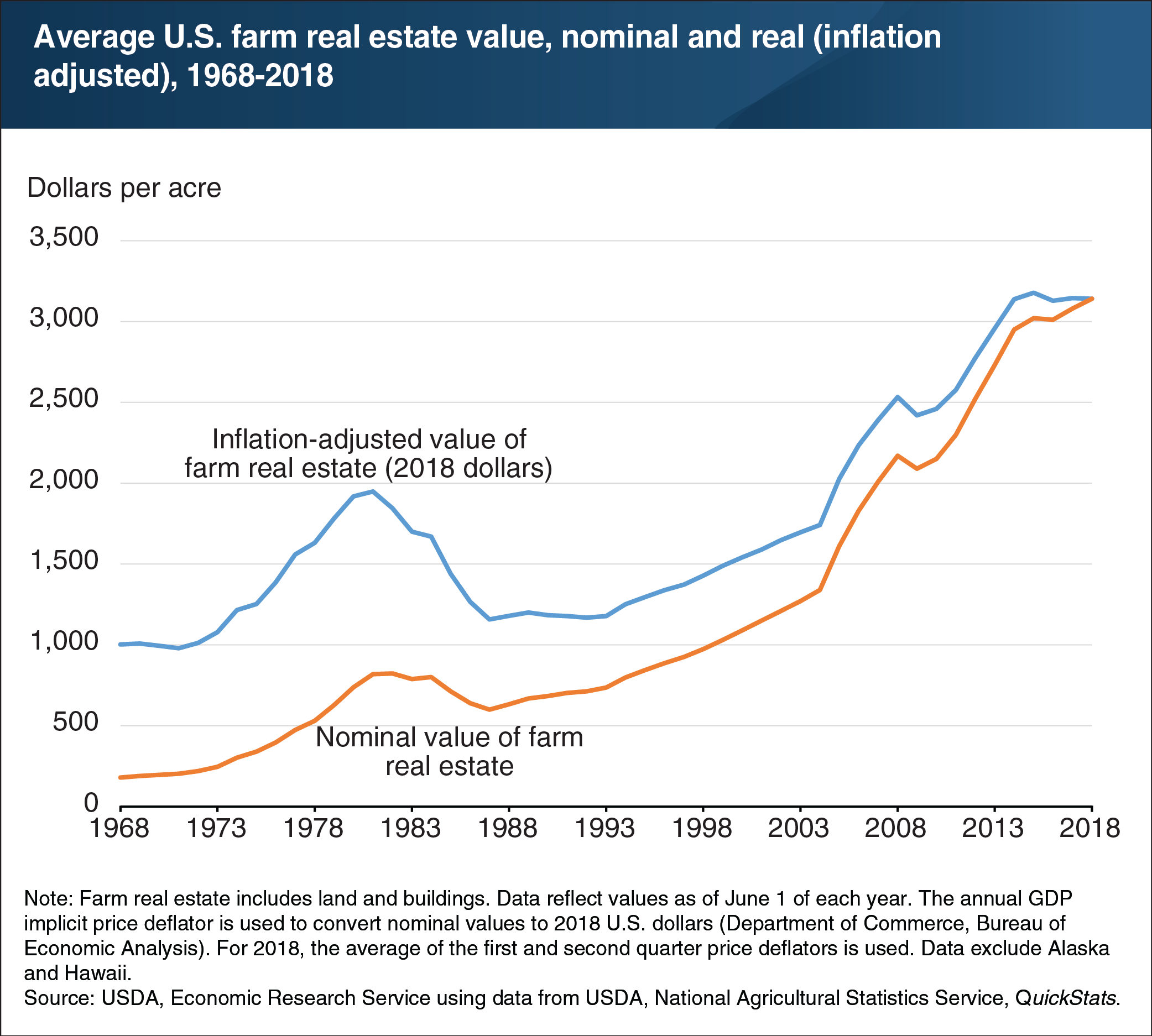

Farm real estate (including land and the structures on the land) generally accounts for over 80 percent of U.S. farm sector assets, and often serves as collateral for farm loans. The value of U.S. farm real estate is thus a critical barometer of farm financial performance. After a long period of appreciation following the farm crisis of the 1980s, farm real estate values have leveled off in recent years. ERS research indicates that, in general, the substantial growth in farm real estate values since 2000 was attributable to high farm earning potential and historically low interest rates. In 2000, after adjusting for inflation, average U.S. farm real estate values were $1,541 per acre—and reached a historic high of $3,178 per acre in 2015. By 2018, U.S. farm real estate values averaged $3,140 per acre, with the leveling off in recent years coinciding with declines in farm sector income. Regional variation is significant, owing to factors such as differences in regional production potential and the demand for land in alternative uses, such as residential housing. This chart appears in the ERS topic page for Farmland Value, updated September 2018.

We’d welcome your feedback!

Would you be willing to answer a few quick questions about your experience?