Compliance incentives under the 2014 Farm Act would be lower without link to crop insurance premium subsidy

- by Roger Claassen

- 11/1/2017

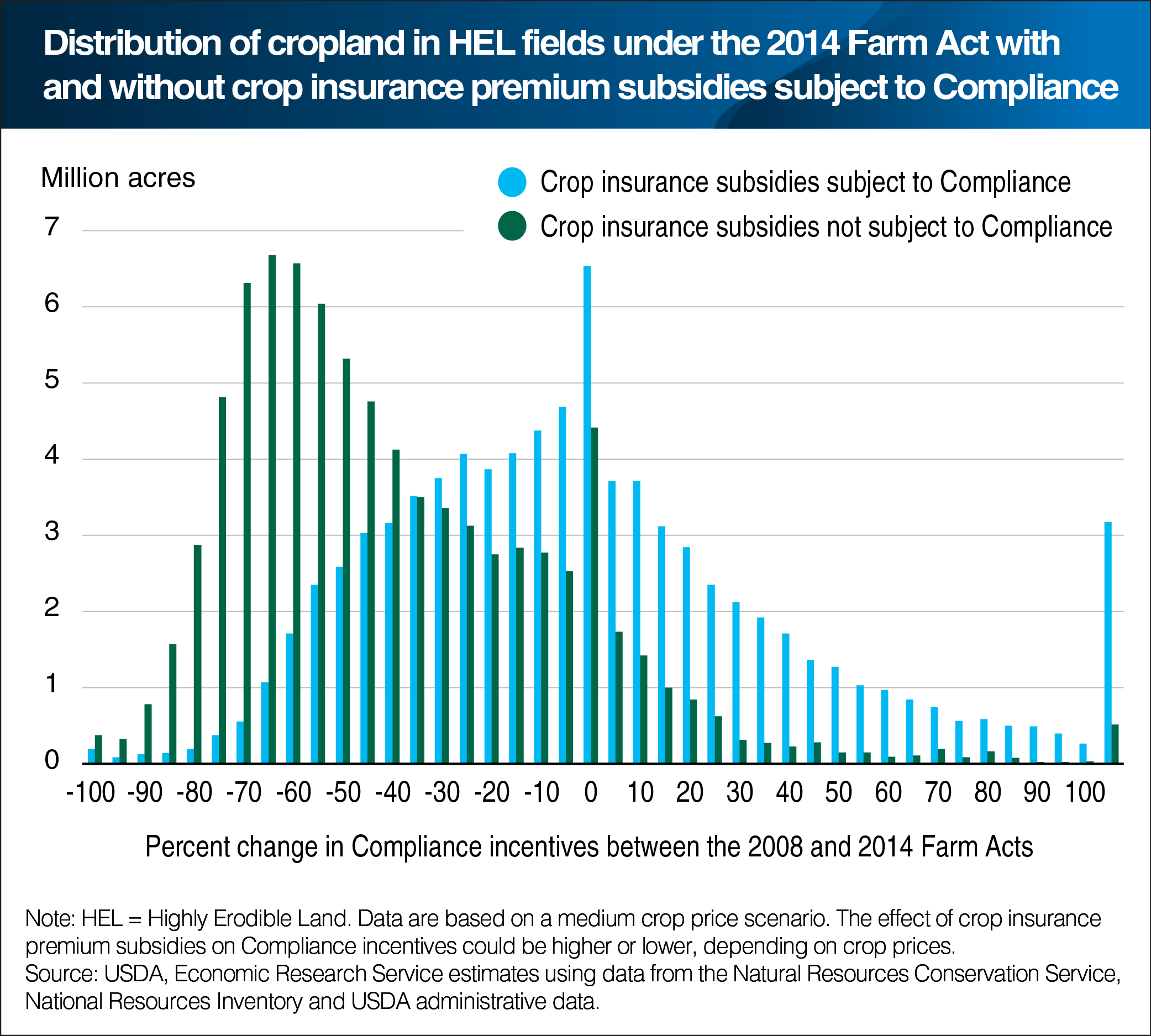

To be eligible for most U.S. farm program benefits, participating farmers must apply soil conservation systems on cropland that is particularly vulnerable to soil erosion. The 2014 Farm Act re-linked crop insurance premium subsidies to this provision, known as Highly Erodible Land Compliance (HELC), for the first time since 1996. These premium subsidies account for a significant share of Compliance incentives—typically between 30 and 40 percent, depending on crop prices. The 2014 Act also included major changes in other Compliance-linked programs, including the elimination of Direct Payments, a large program under the 2008 Farm Act. On individual farms, Compliance-linked benefits could be higher or lower than they would have been under a continuation of the 2008 Act. Under the 2014 Act (blue bars), ERS researchers estimated that less than 10 million acres are on farms that would have experienced a 50-percent or larger decline in Compliance incentives between the two Farm Acts given crop prices similar to 2010 levels. If premium subsidies were not subject to Compliance (green bars), more than 40 million acres of cropland in HEL fields would be on farms where Compliance incentives would decline by 50 percent or more. This chart appears in the July 2017 Amber Waves feature, "Conservation Compliance in the Crop Insurance Era."

We’d welcome your feedback!

Would you be willing to answer a few quick questions about your experience?