New Farm Act links commodity program payments to market conditions

- by Anne Effland

- 6/2/2014

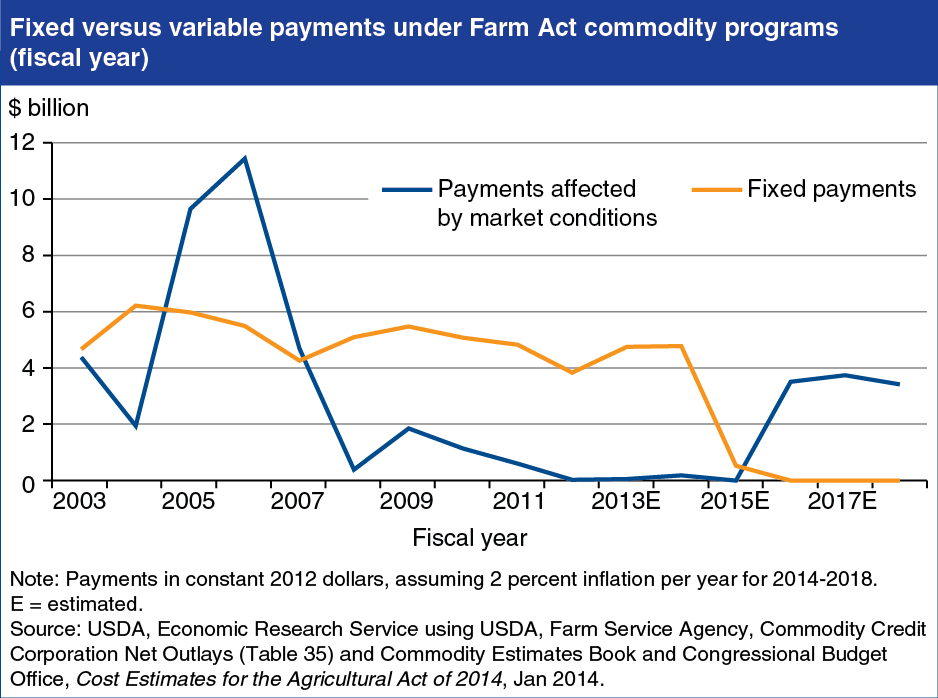

Changes enacted in the Agricultural Act of 2014 will shift future crop commodity payments away from the repealed Direct Payments (DPs) program, in which annual producer payments were based on fixed historical acreage and yields (base) and legislated payment rates, and toward new programs where payments are linked to variable market and production conditions. Over the last 5 years, fixed DPs made up the bulk of commodity program payments, because crop prices were generally above levels needed to trigger payments through other programs, such as Countercyclical Payments (CCP) (also repealed), and marketing assistance loans (which continue). Producers with historical base acres of covered commodities (wheat, feed grains, rice, oilseeds, and pulses) now have the option to enroll in new programs—Price Loss Coverage (PLC) or Agriculture Risk Coverage (ARC). Under both programs, payments are triggered by variable current conditions: PLC payments when market prices fall below legislated reference prices (similar to the repealed CCP program); ARC payments when revenues (affected by both prices and yields) fall below revenue benchmarks based on moving average revenues. Payments under these two new programs are projected to total from 3.8 to 4 billion dollars annually. Find this chart and additional information on crop commodity programs under the new Farm Act in Agricultural Act of 2014: Highlights and Implications: Crop Commodity Programs.