U.S. imports of animal fats, greases, and processed oils surge to meet demand from biomass-based diesel production

- by Maria Bukowski and Bryn Swearingen

- 8/21/2024

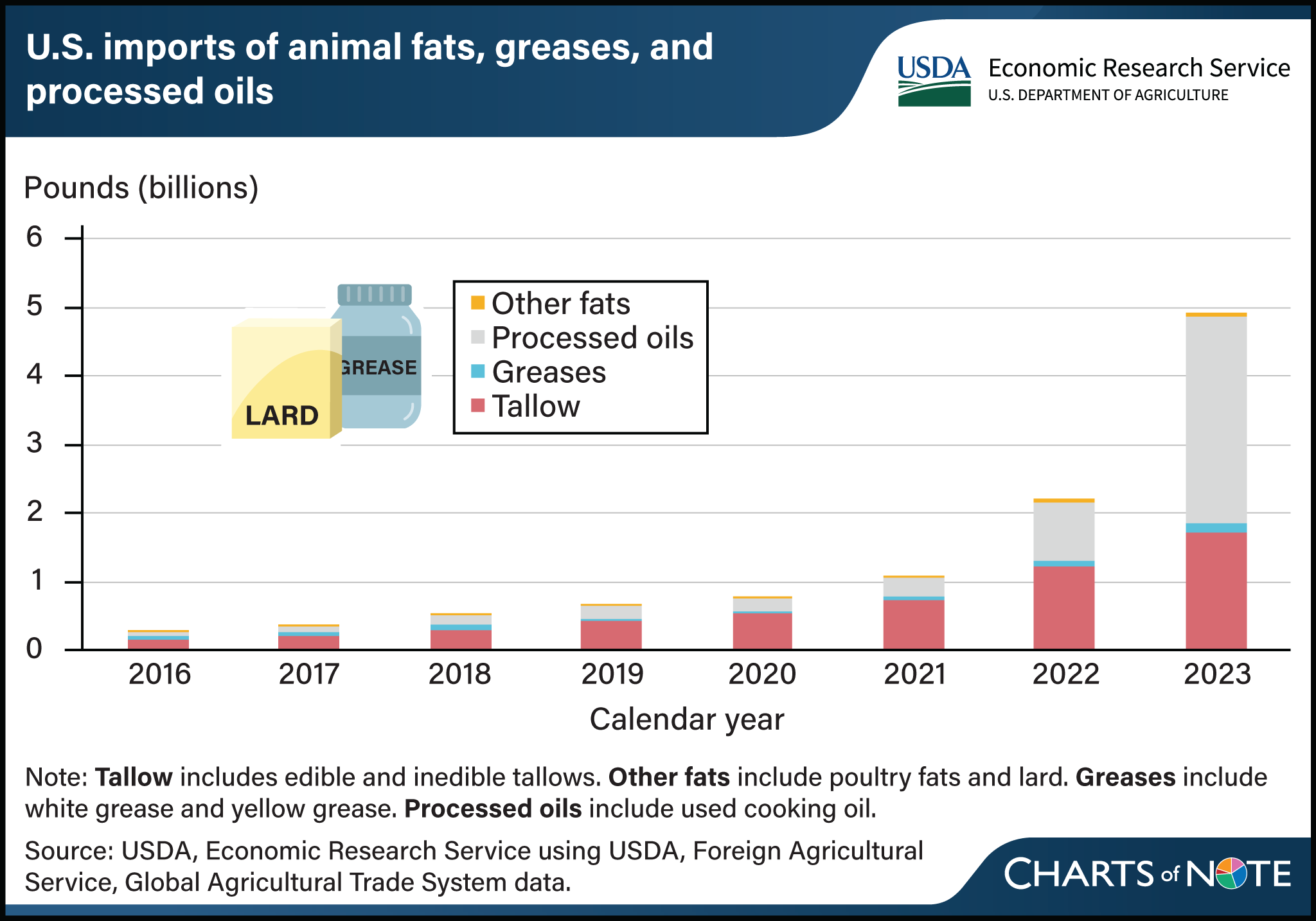

U.S. imports of animal fats (edible tallow, inedible tallow, lard, and poultry fats), greases, and processed oils—including used cooking oil—skyrocketed to nearly 5.0 billion pounds in 2023 from 2.2 billion pounds in 2022. This surge in imports has been driven by rising domestic production of biomass-based diesel (fuels derived from animal fats and vegetable oils) to meet U.S. Federal and State policies aimed at reducing greenhouse gas emissions. These policies sparked new demand for animal fats, processed oils, and grease and have boosted imports, especially processed oil imports commonly known as used cooking oil (UCO). Processed oil imports doubled to 3 billion pounds from 2022 to 2023 as China emerged as the top supplier. U.S. tallow imports also have increased, largely on expanded sourcing from Australia, Canada, Brazil, and Argentina. With stronger tallow and processed oil imports, the share of animal fats, waste oils, and greases as a portion of total oil and fat-related used in biomass-based diesel production has increased to 36 percent from 31 percent in 2021, while vegetable oil’s share has declined. As biofuel use continues growing, this structural shift in biomass-based diesel production and import markets is expected to affect the domestic use and trade flows of animal fats and vegetable oils. This chart is drawn from a Special Article in USDA, Economic Research Service’s Oil Crops Outlook: July 2024. See also this Chart of Note on biomass-based diesel production, published August 8, 2024.

We’d welcome your feedback!

Would you be willing to answer a few quick questions about your experience?