Growth in Mexico’s Horticultural Exports to the United States Continued Even as New U.S. Food Safety Laws Took Effect

- by Gregory Astill, Belem Avendaño Ruiz and Steven Zahniser

- 10/21/2024

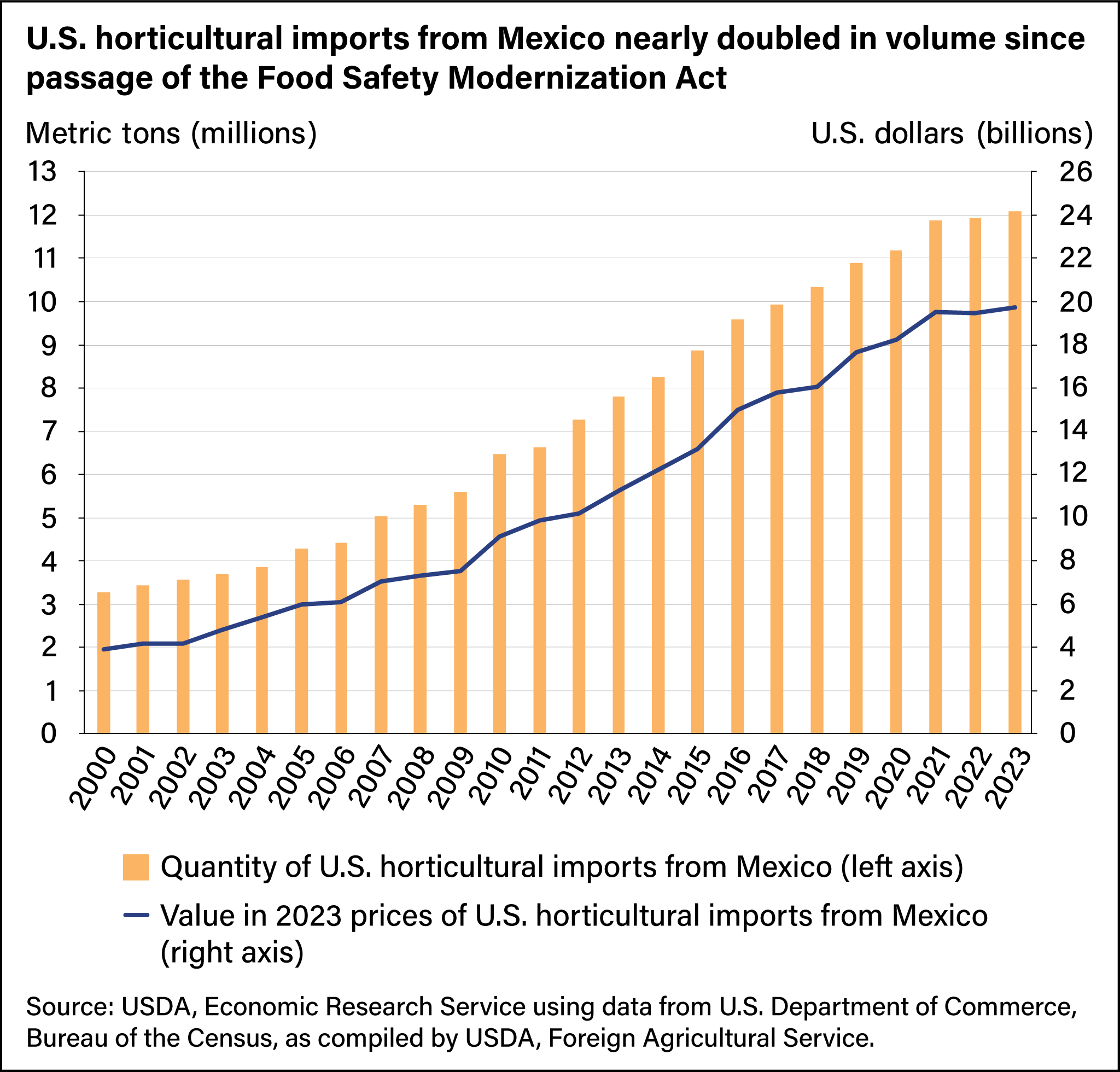

Mexico is the largest single source of U.S. horticultural imports. In 2023, Mexico supplied 63 percent of U.S. vegetable imports and 47 percent of U.S. fruit and nut imports. To sell their produce in the United States, Mexico’s growers must meet U.S. regulations, including those in the Food Safety Modernization Act (FSMA), which was enacted in 2011 with staggered compliance dates that began in 2016. The law ensures safety of the U.S. food supply chain from growing to processing to transportation, whether on U.S. or foreign soil. Because FSMA provided a framework for Mexico’s horticultural sector to address food safety concerns, the law does not appear to have disrupted Mexico’s access to the U.S. horticultural market. From 2000 to 2023, annual U.S. horticultural imports from Mexico in real terms (inflation adjusted, measured in 2023 dollars) increased more than fourfold from $3.9 billion to $19.7 billion, corresponding to a compound annual growth rate of 7.3 percent. On average during that period, the United States was the destination for 91 percent of Mexico’s total annual horticultural exports.

Mexico’s horticultural exporters face unique risk when it comes to food safety. Many of Mexico’s produce companies rely on the export market for most of their earnings, and some supply only the export market. If a producer in Mexico were to sell produce that led to an outbreak of foodborne illness in the United States, all of Mexico’s exporters for that commodity could be affected because of the difficulty in tracking the contamination’s origin. While the introduction of the FSMA standards could potentially benefit Mexico’s exporters by reducing the risk of an outbreak, the extent to which the sector’s firms would be able to comply with the new requirements was uncertain. However, the importance of Mexico’s produce sector to its economy served as an advantage. The governmental entity responsible for food safety in Mexico, known by the acronym SENASICA, also works to ensure the sector’s competitiveness as it relates to international trade. Following FSMA’s implementation, organizations within SENASICA worked to provide training and outreach to Mexican growers. Also, the large number of stakeholders were able to share the costs and knowledge of complying with FSMA, across the supply chain and across different crops. Moreover, many companies, especially those with more workers, already had food safety programs in place or in process before the law was enacted. The remaining firms did so during FSMA’s first 9 years (2011–19).

To meet FSMA’s requirements for food safety, Mexico’s horticultural companies made changes to equipment, invested in new infrastructure, and implemented monitoring programs featuring improved sampling techniques, many of which were aimed at ensuring a supply of clean water throughout the production process. Larger companies (with 300 to 1,000 seasonal workers) were found to be more likely to have modified their food safety activities to meet FSMA requirements. Challenges for adoption, even for larger companies, included gaining access to laboratories accredited to test samples and ensuring adequate training for food safety managers and workers. Still, efforts by Mexico’s growers to comply with FSMA helped them secure access to the U.S. market, with few, if any, major interruptions in exports, even during the depths of the Coronavirus (COVID-19) pandemic.

This article is drawn from:

- Zahniser, S., Avendaño Ruiz, B. & Astill, G. (2023). How Mexico’s Horticultural Export Sector Responded to the Food Safety Modernization Act. U.S. Department of Agriculture, Economic Research Service. ERR-319.

You may also like:

- Zahniser, S., Johnson, W. & Valdes, C. (2023). Changes in U.S. Agricultural Imports From Latin America and the Caribbean. U.S. Department of Agriculture, Economic Research Service. AES-124-01.

- Zahniser, S. (2022). COVID-19 Working Paper: U.S.-Mexico Agricultural Trade in 2020. U.S. Department of Agriculture, Economic Research Service. AP-97.

- Astill, G., Minor, T., Thornsbury, S. & Calvin, L. (2019). U.S. Produce Growers' Decisionmaking Under Evolving Food Safety Standards. U.S. Department of Agriculture, Economic Research Service. EIB-210.

- Astill, G., Minor, T., Calvin, L. & Thornsbury, S. (2018). Before Implementation of the Food Safety Modernization Act's Produce Rule: A Survey of U.S. Produce Growers. U.S. Department of Agriculture, Economic Research Service. EIB-194.

We’d welcome your feedback!

Would you be willing to answer a few quick questions about your experience?