Pasture, Rangeland, and Forage Drive Increased Participation in Federal Crop Insurance Program

- by Dylan Turner and Francis Tsiboe

- 6/6/2024

Farmers use the Federal Crop Insurance Program (FCIP) as a tool to manage revenue variations attributable to yield and price fluctuations. While traditional field crops like corn, soybeans, and wheat historically have accounted for most of the acres insured by the program, forage crops now make up an increasing portion. The Federal program includes the Pasture, Rangeland, and Forage insurance plan, which covers producers when a lack of precipitation occurs that can result in a loss of forage for grazing or for hay. Increasing participation in this plan has contributed to the majority of growth in FCIP-insured acreage over the last several years. However, the relatively lower value of forage means its contribution to other measures of participation is less prominent.

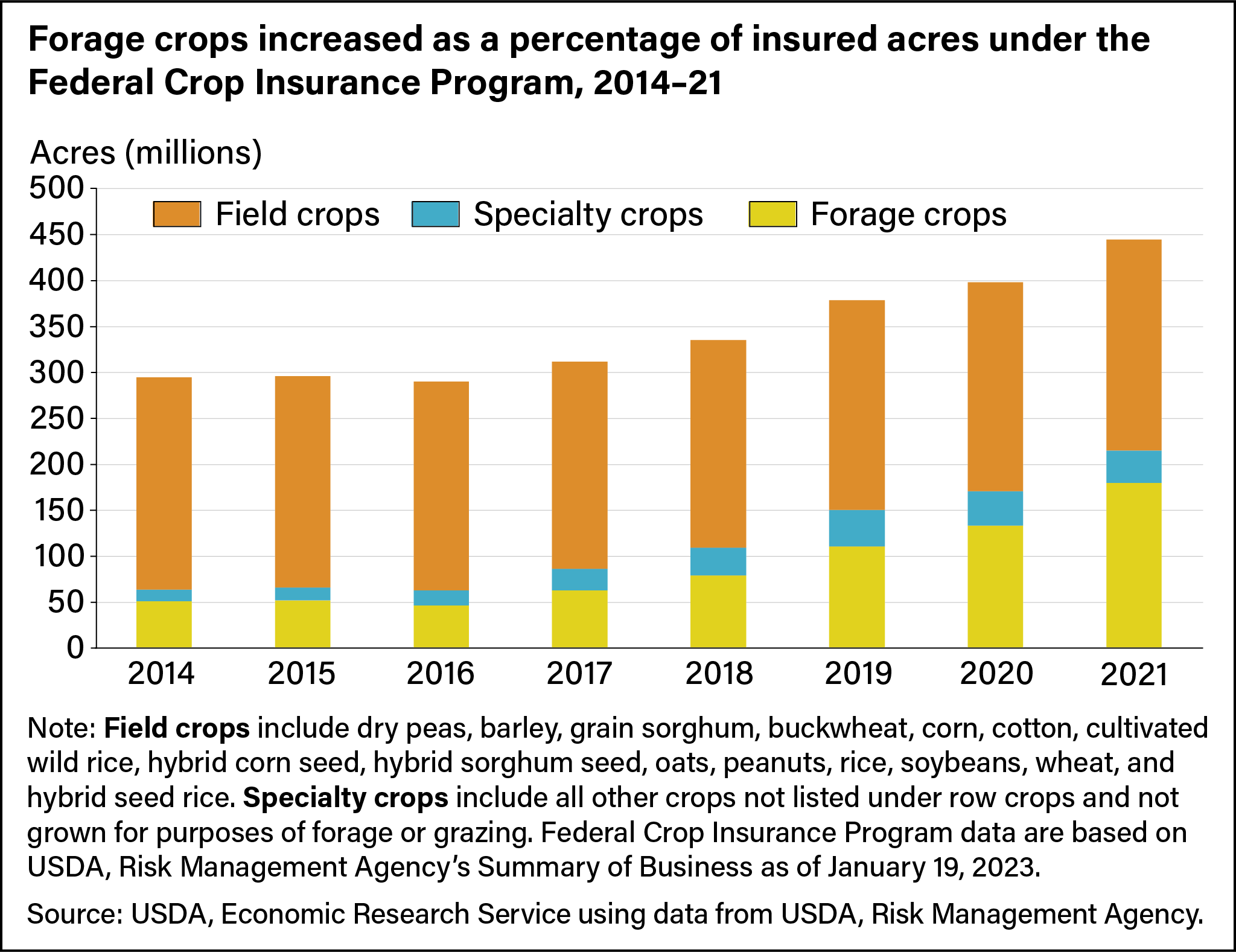

Acreage in the Federal Crop Insurance Program grew from just under 300 million acres in 2016 to about 450 million acres in 2021, led by increases in covered forage crops acreage. In 2016, field crops represented 78 percent of total insured acres, and forage crops represented 16 percent. By the 2021 crop year, field crop coverage declined relative to other categories, representing 52 percent of insured acres, and forage crops increased to 40 percent of insured acres. Specialty crop coverage, which historically has represented a small share of insured acres, also increased, rising from 16 million insured acres in 2016 (6 percent of total) to 35 million insured acres in 2021 (8 percent of total).

Although crop insurance plans have been available for forage crops since the early 2000s, traditional policies are designed for crops that have a defined planting and harvesting window, making it easy to measure production across years. Alternatively, forage grows differently depending on location, and the same pasture or rangeland can be grazed or cut multiple times in a crop year, making it difficult to measure productivity for purposes of setting an insurance guarantee. Additionally, traditional policies provide financial protection for the entire crop year, but ranchers may have only small windows during the year in which livestock are grazing, after which insurance is not necessary.

The Pasture, Rangeland, and Forage plan, which was introduced in the 2007 crop year, solved some of the issues associated with applying traditional crop insurance plans to forage production. This plan provides protection against a loss of forage due to a single peril (lack of precipitation) and uses a rainfall index to determine precipitation for coverage purposes. That means farmers do not need to provide a measure of actual on-farm production or loss of production when the area is covered by the plan. The insurance plan also allows producers to select 2-month-long index intervals that define when the insurance policy is active, which helps producers to insure only when precipitation is most critical to their operation. Although several other insurance options have remained available for forages, about 95 percent of the insured acreage for forages from 2014 to 2021 was enrolled in the Pasture, Rangeland, and Forage plan.

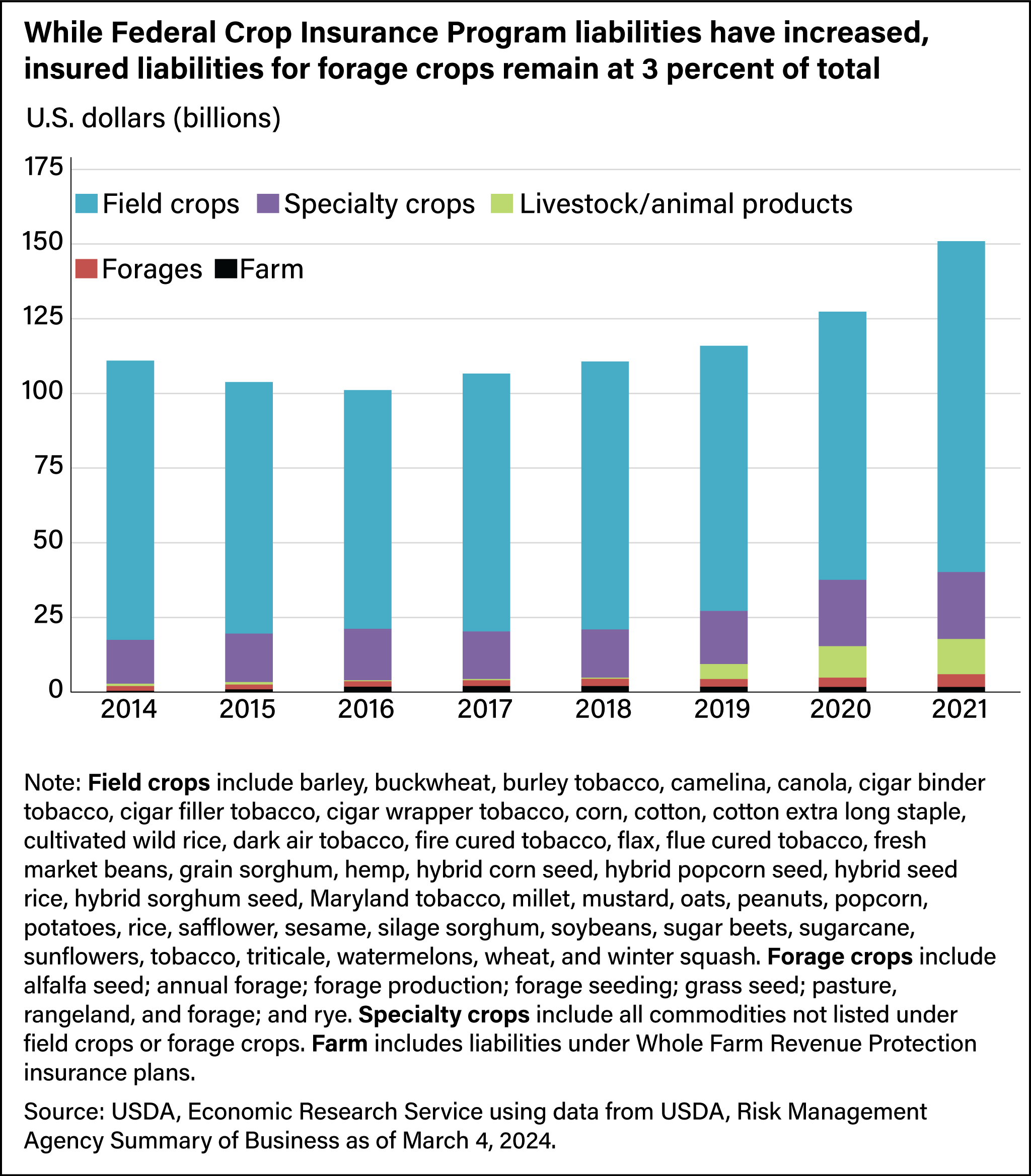

However, the plan’s increasing contribution is comparatively small when participation is measured by looking at the value of the insured commodity—called the insured liability— instead of by acreage. Unlike measures of acreage, liabilities capture commodity price changes and the variation in crop values among different commodity types. Not adjusting for inflation, total insured liabilities grew from $101 billion in 2016 to $151 billion in 2021, a 50-percent increase. Although growth in insured liabilities was similar to the growth in insured acreage over this time period, pasture, rangeland, and forage crops—whose value per acre is less than that of field crops or specialty crops—contributed a smaller share to the increase in liability. Forage crops had insured liabilities of $1.79 billion in 2016 (see chart below), which represented about 1.8 percent of insured liabilities for that year. By 2021, insured liabilities for the Pasture, Rangeland, and Forage plan had grown to $4.3 billion but still represented about 3 percent of total insured liabilities.

This article is drawn from:

- Turner, D., Tsiboe, F., Baldwin, K.L., Williams, B., Dohlman, E., Astill, G., Raszap Skorbiansky, S., Abadam, V., Yeh, D.A. & Knight, R. (2023). Federal Programs for Agricultural Risk Management. U.S. Department of Agriculture, Economic Research Service. EIB-259.

You may also like:

- Hrozencik, R.A., Perez-Quesada, G. & Bocinsky, K. (2024). The Stocking Impact and Financial-Climate Risk of the Livestock Forage Disaster Program. U.S. Department of Agriculture, Economic Research Service. ERR-329.

We’d welcome your feedback!

Would you be willing to answer a few quick questions about your experience?