Market Opportunities Expanding for Agricultural Trade and Investment in Africa

- by Michael E. Johnson, Stephen Morgan and Jarrad Farris

- 2/6/2023

Highlights

- Africa is likely to become a key emerging market for international trade and investment over the coming decades. Multinational corporations are positioning themselves to benefit from the growing demand for goods and services on the continent.

- The launch of the African Continental Free Trade Area (AfCFTA) could help further expand these opportunities through greater economic integration, intraregional trade, and investment among member countries.

- Africa faces challenges related to agricultural trade and investment, which may inhibit the full potential of the AfCFTA.

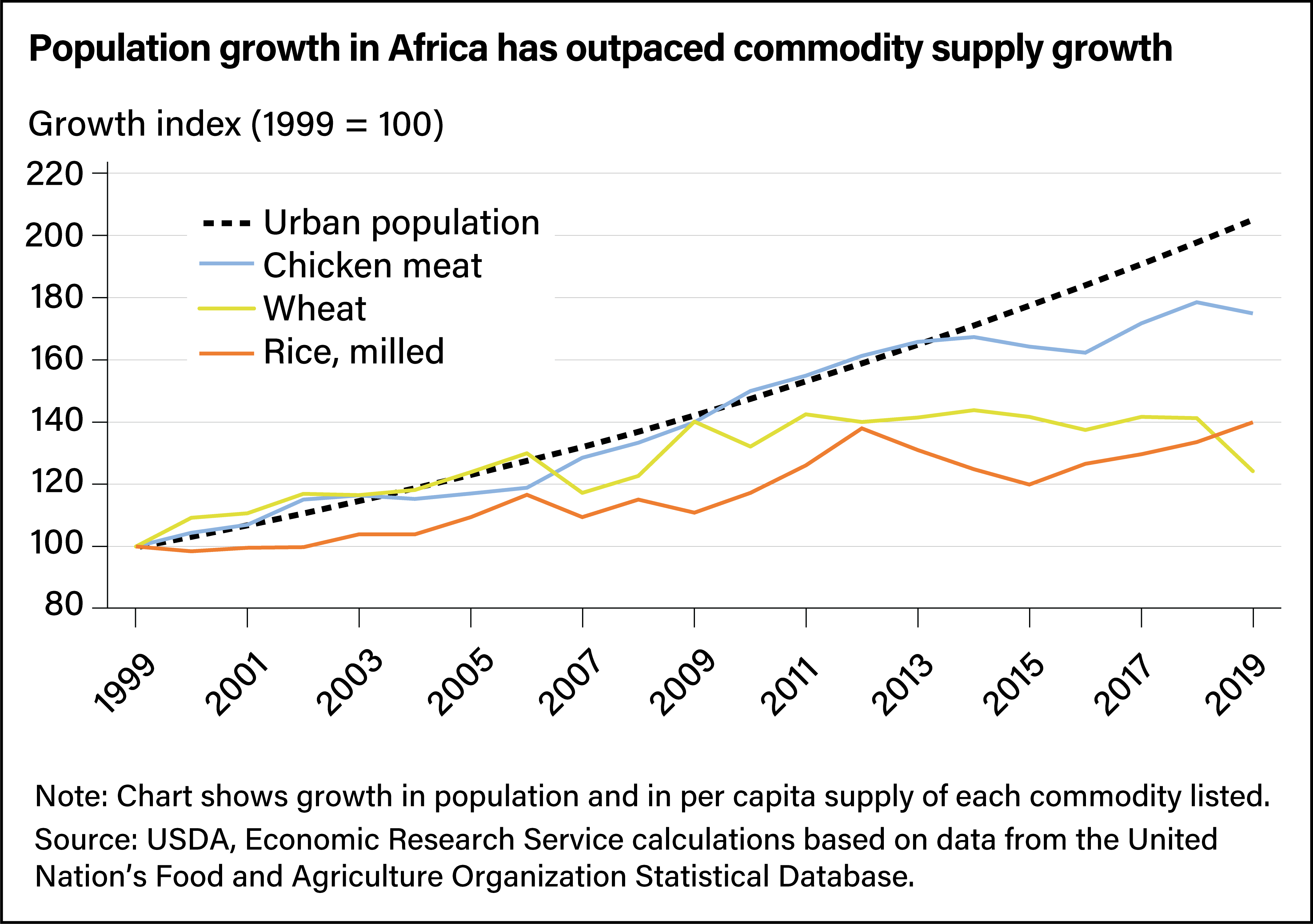

Many African countries have become increasingly important destinations for global trade and foreign investment. The continent has more than 1.4 billion people, and the population is expected to continue growing at some of the fastest rates in the world. The United Nations projected Africa could become the most populous geographic region in the world by the end of this century, reaching up to 3.4 billion people. Compounding the effects of population growth on the future demand for agricultural imports is the even faster rate of urbanization on the continent. By 2050, the share of the total population living in urban areas is projected to be a majority as the number of urban dwellers more than triples from what it is today. With rising urbanization comes shifts in consumer preferences. Urban consumers typically buy foods more convenient for their lifestyles such as prepared foods or meals at restaurants. As incomes also rise in urban settings, consumers seek a greater diversity of food in their diet, especially animal-based protein, prepared cereals, fats and sugars, and fruits and vegetables. Current production trends indicate Africa’s agricultural output alone will not be enough to feed the region’s growing population.

Projected changes in demographic, income, and food demand patterns in Africa offer potential opportunities for trade and investments in African agriculture and agri-food value chains—the processes connecting food production, delivery, and the consumer. The African Continental Free Trade Area (AfCFTA), which launched January 1, 2021, is expected to help expand these opportunities through economic integration, intraregional trade, and investment among member countries. The economic transformation of the continent combined with changes in demographics and consumer preferences are projected to help the region to become an economic powerhouse for global trade and investments. Researchers at USDA’s Economic Research Service (ERS) are assessing these trends and prospects for economic transformation in Africa, beginning with an exploration of investment flows in the lead-up to AfCFTA’s launch as well as current emerging trends of agricultural trade.

Trade Patterns and Opportunities

The AfCFTA offers the opportunity for African countries to diversify their exports, attract foreign direct investments, accelerate income growth and development, and ultimately trade more with the world. Trading under the AfCFTA agreement has been slow to ramp up since its 2021 launch. Negotiations are still ongoing on additional issues related to the agreement, such as tariffs, intellectual property, and investment protocols. According to the AfCFTA Secretariat, as of December 2022, 44 of the 54 signatory countries had ratified the agreement.

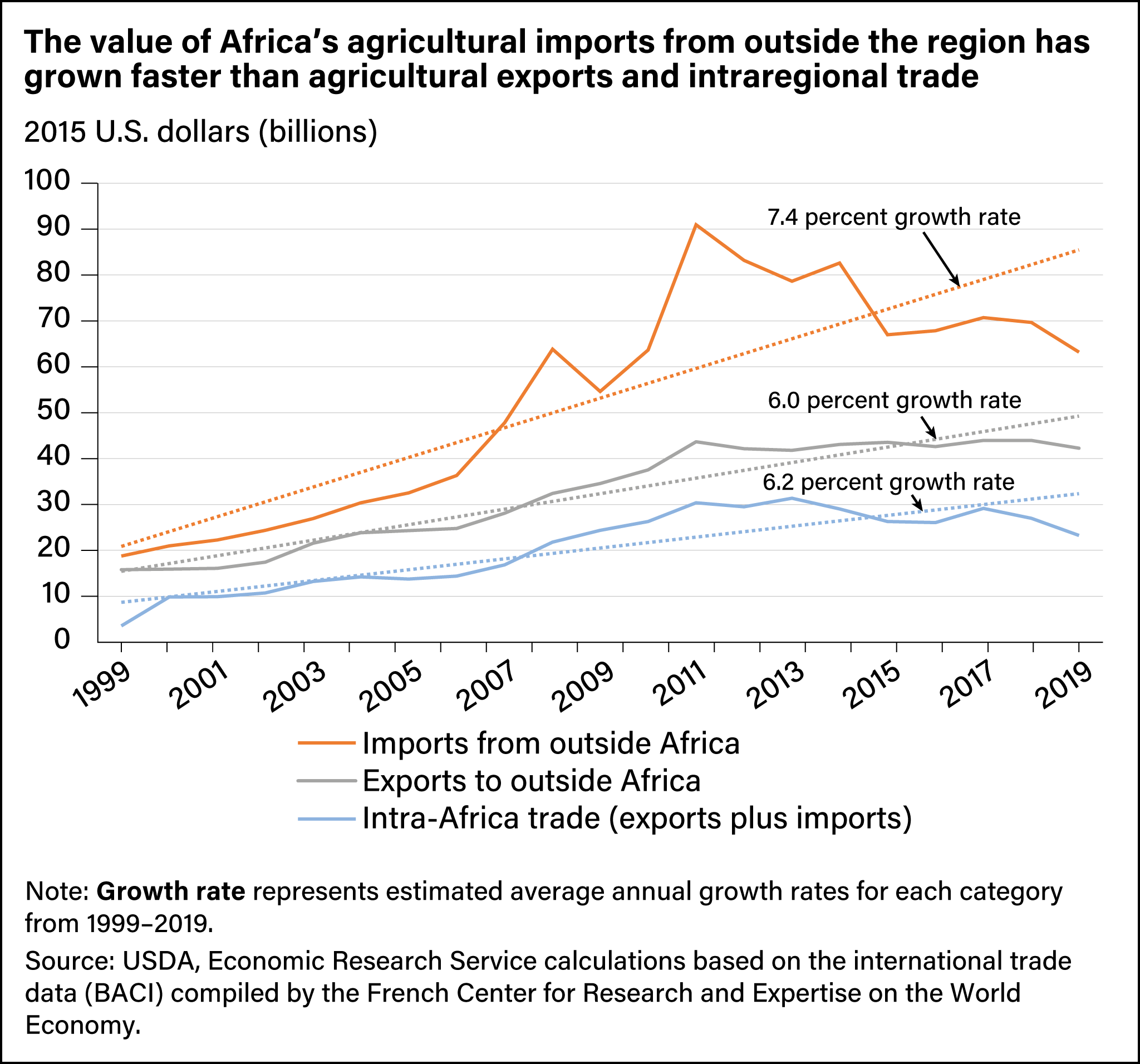

Agricultural trade in Africa has been consistently growing over time and import demand has been particularly strong. Between 1999 and 2019, the value of agricultural imports in Africa grew at an average annual rate of 7.4 percent compared with a 6.0 percent growth rate for agricultural exports (see chart below). Over the same period, intraregional trade (trade with other African countries) also has been growing, a trend that is expected to continue to accelerate with AfCFTA’s implementation. In fact, ERS researchers found evidence this already had been occurring before AfCFTA and among some of Africa’s existing subregional free trade areas.

Africa traditionally has been a leading importer of bulk agricultural commodities such as wheat, corn, rice, and soybeans. Imports of cereals and oilseeds play a significant role in food security in the region and form a staple part of many diets, including feed for livestock. Because of the dependency on imports for food security in some countries, sudden and substantial price changes in these bulk commodities can increase food insecurity in a country. According to ERS’ International Food Security Assessment, 2022–32, the additional number of people considered food insecure worldwide rose by 41.7 million in 2022 as a direct consequence of recent events including the Coronavirus (COVID-19) pandemic and Russia’s military invasion of Ukraine. These events led to rising global commodity prices, affecting especially sub-Saharan Africa—which has the highest prevalence of food insecurity in the region—and North Africa, where cereal imports from the Black Sea Region are significant. For sub-Saharan Africa, ERS projects bulk grain imports to grow by 4.9 percent per year, totaling 152 million tons by 2032.

The United States has typically exported bulk commodities to Africa. However, with Africa’s rising incomes and growing populations, combined with increasing urbanization, demand has increased for consumer-oriented agricultural products such as beverages, prepared cereals, poultry meat, and dairy products, and for intermediate goods such as soy meal, vegetable oils, and other feeds. The import share of these products in Africa has risen faster than bulk commodities (see chart below). Together, consumer-oriented and intermediate agricultural goods accounted for 44 percent of U.S. agricultural exports to Africa in 2017–19, up from 29 percent in 1999–2001. Recent ERS research also shows this to be true in Africa’s rural areas, where incomes and employment patterns may have changed.

One of the most significant areas of U.S. agricultural export growth to Africa has been in poultry meat. Demand for poultry meat, especially chicken, in urban areas has grown almost in tandem with urban population growth (see chart below). At this rate, ERS projects sub-Saharan Africa to remain the top global importer of poultry over the next 9 years, with import volumes reaching more than 2.5 million metric tons per year by 2031. Increasing demand for poultry—a relatively affordable source of protein—is expected to combine with relatively low levels of domestic production to drive import demand.

A principal goal of the AfCFTA is to increase intraregional trade on the continent, which has the potential to shape the future of agricultural trade with the rest of the world if trade with external partners is also liberalized. So far, trade in agricultural consumer-oriented goods within the region has been increasing. These goods explain about half of intra-Africa agricultural trade and much of its growth over the last two decades. The growing shift in intra-Africa agricultural trade toward higher value consumer goods reflects growing demand and could provide an opportunity for external trading partners, including the United States.

Investment Patterns and Opportunities

Although AfCFTA’s framework for guiding investment protocols is not finalized, the agreement is expected to promote private investment that spans economic sectors and national borders. Through more open markets, investors in one AfCFTA member country are likely to have better access to consumers in other African member countries. The free trade agreement is expected to harmonize regulatory requirements across borders, which could make it less expensive for African countries to do business across the region. New opportunities for investment in food production, processing, and delivery across Africa are expected to benefit the food and agricultural sector as incomes and populations continue to rise.

Africa has lagged other regions as a global destination for foreign direct investment (FDI), and European investors have accounted for most of the foreign direct investment in the region. However, investment from Asia and Latin America has increased in the past two decades, with investments from China increasing rapidly. Comparing across 5-year averages, ERS estimates that Asia’s share of FDI to Africa increased from 18 percent in 2004–08 to more than 30 percent in 2014–18. In the past, much of the investment (80 percent) flowed into northern and southern Africa. However, FDI has started to increase to other subregions. Eastern Africa, for example, saw an eightfold increase on average of FDI inflows over the past decade—from $4 billion annually in 2004–08 to $32 billion annually in 2014–18.

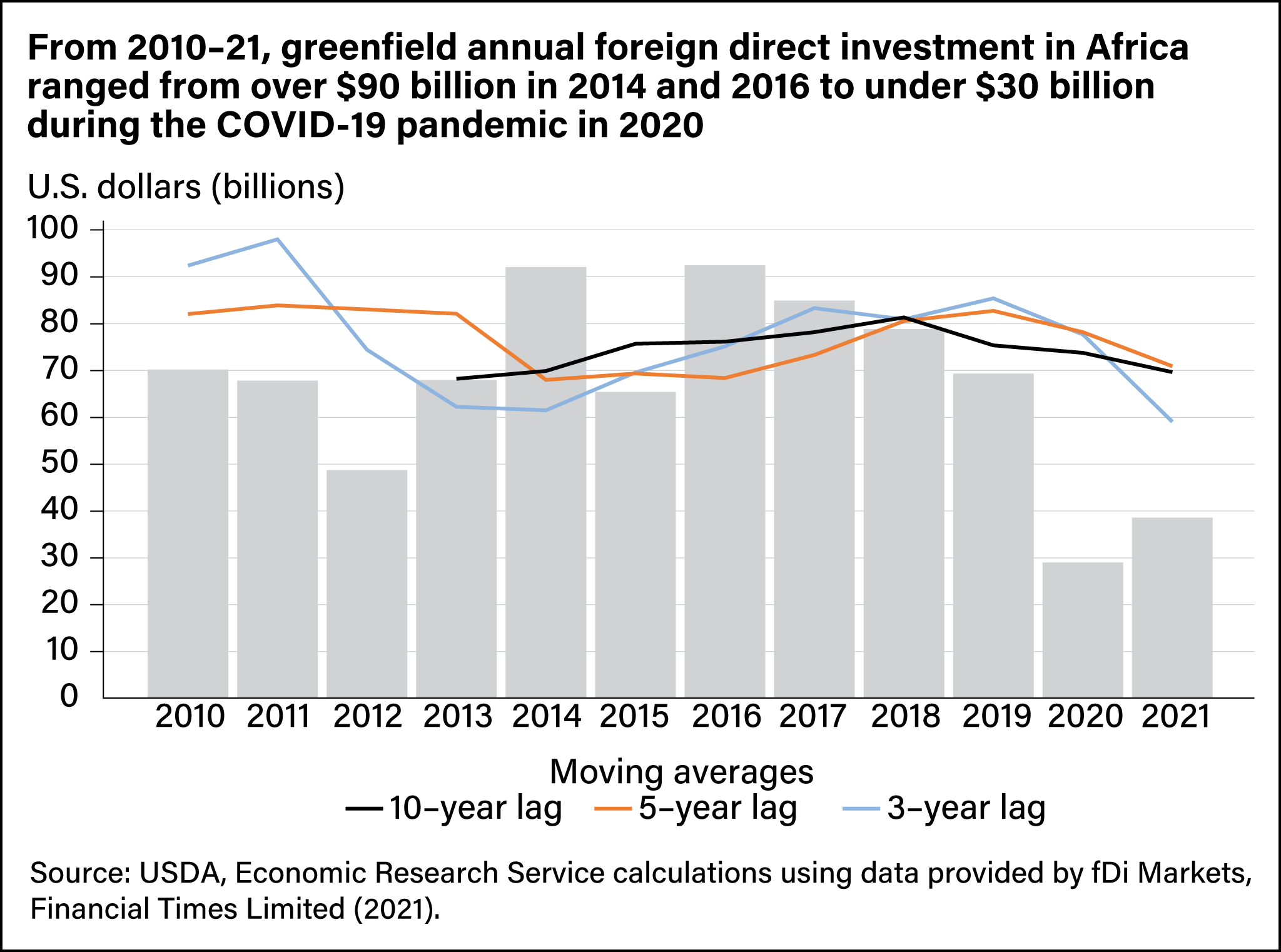

One subset of total FDI is greenfield FDI, which is when firms make investments to start a new venture or subsidiary in another country. Because greenfield FDI is a new investment, these flows can provide insight into investor sentiment and how private investors view opportunities in Africa. Drawing on data provided by fDi Markets, Financial Times Limited, ERS researchers determined that about $75 billion to $80 billion a year in greenfield foreign direct investment entered Africa before the COVID-19 pandemic (see chart below). With the onset of the pandemic, these flows declined to under $30 billion in 2020. Greenfield FDI flows in Africa improved marginally in 2021, but remained well below historical trends for the continent, highlighting a substantial pandemic-related gap in private sector investment.

Many African countries rely heavily on agriculture for their economic development and food security strategies, so investment in the food and beverage sector would benefit Africa’s economies. Although investment flows in the food and beverage sector are a small part of total greenfield FDI (3–5 percent), they are one mechanism to build and extend agricultural value chains in Africa. AfCFTA trade and investment provisions also could help cross-border opportunities for production, processing, marketing, and wholesale and retail activities.

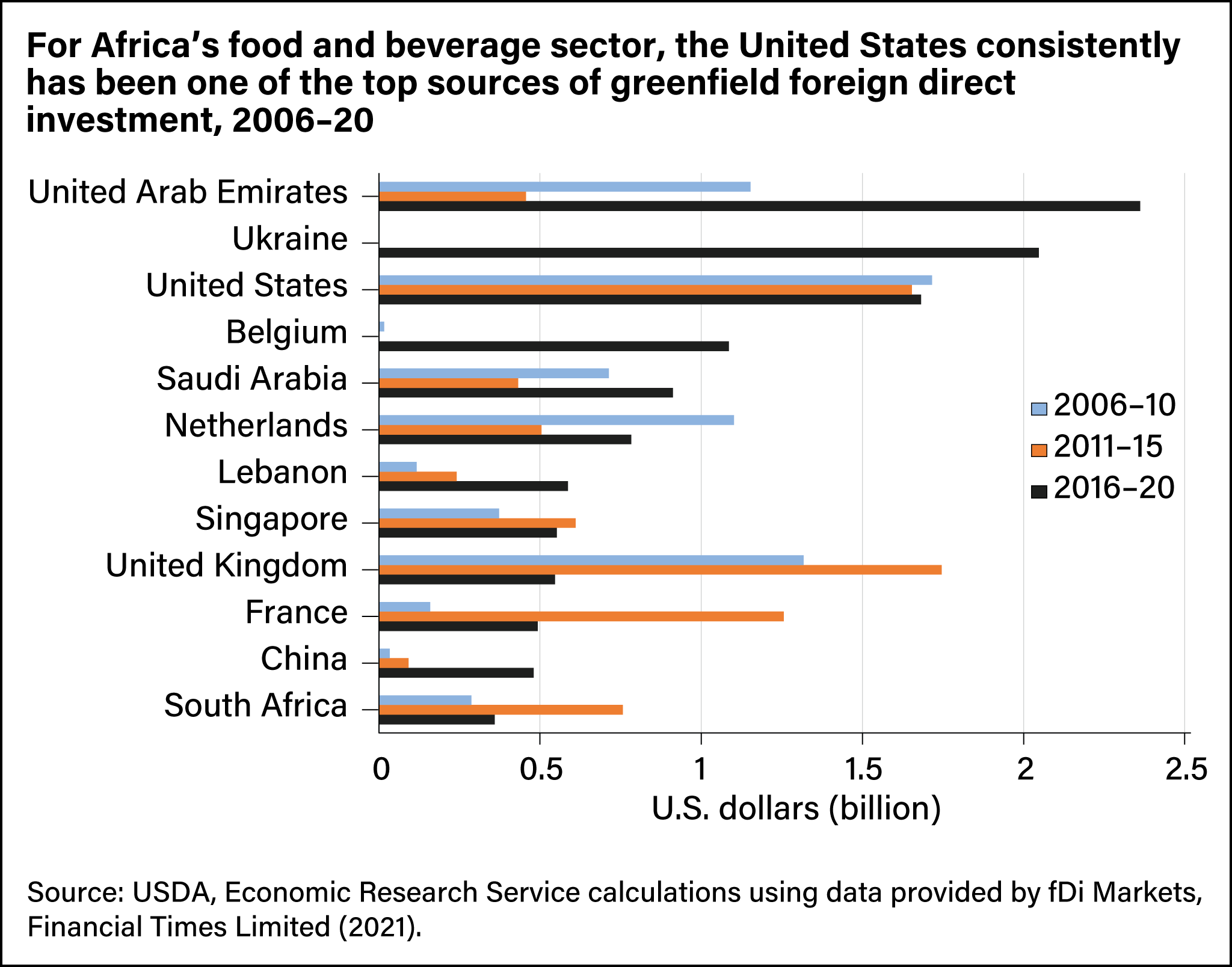

In 2016–20, the United Arab Emirates, Ukraine, the United States, and Belgium were the largest investors in the food and beverage sector in Africa (see chart below). U.S. food and beverage greenfield FDI has been particularly consistent since 2006, ranging between $1.5 billion and $2 billion during each 5-year period since then. Notably, China’s greenfield FDI activity in this sector reached just under $500 million in 2016–20, less than a third of the $1.7 billion from the United States.

In 2016–20, investments into the grains and oilseed subsector were the highest among sectors, totaling more than $3 billion. Sugar and confectionery products followed at more than $2.4 billion, and food and beverage stores came in at just under $2 billion. More than half of U.S. greenfield FDI from 2016–20 was in the subsectors of soft drinks and ice as well as sugar and confectionery products. For U.S. greenfield investment in Africa during that time, about 15 percent was in the grains and oilseed subsector.

Remaining Challenges

Africa faces several challenges related to agricultural trade and investment that could inhibit the full realization of the AfCFTA’s goals to promote greater economic integration and increased intraregional trade and investments on the continent.

First, intra-African trade faces higher costs compared with other regions. AfCFTA represents an opportunity to reduce trade costs by lowering different types of trade barriers among countries within the region. Lowering tariffs and non-tariff measures, harmonizing regulatory systems, and supporting market institutions and infrastructure under AfCFTA are expected to help cut these costs over time.

Second, some African countries are reliant on natural resources for export revenue and foreign exchange, and as a driver of economic growth. However, dependence on natural resource exports can leave countries vulnerable to macroeconomic shocks that affect commodity prices and, consequently, agricultural trade. Recent ERS research highlighted how dependence on oil exports affected trade and consumption in sub-Saharan Africa during the COVID-19 pandemic. For example, consumption and imports of rice, wheat, and poultry all declined from pre-pandemic levels.

Third, maintaining agricultural productivity growth is important to meet increasing food and fiber demand in Africa. It allows farmers to produce commodities with fewer resources, which can reduce unit costs and, subsequently, agricultural prices. A slowdown in the growth of agricultural productivity is likely to prolong Africa’s dependence on food imports. Recent ERS research showed a slowdown in agricultural productivity growth in sub-Saharan Africa throughout the 2010s, suggesting growth in output has relied mostly on expanding inputs such as the amount of land under cultivation.

The benefits from AfCFTA for Africa and for global agricultural trade are expected to grow as the agreement is implemented even as challenges remain to be addressed. Ultimately, while all trading partners will benefit from continued economic and population growth in Africa, the region will likely play a large role in shaping global agricultural markets.

This article is drawn from:

- Miller, M., Gerval, A., Hansen, J. & Grossen, G. (2022, August 1). Poultry Expected To Continue Leading Global Meat Imports as Demand Rises. Amber Waves, U.S. Department of Agriculture, Economic Research Service.

- Sauer, C. (2022, October 3). Rural Tanzanians Turn to Processed Food and Meals Away From Home as Incomes Rise and Employment Patterns Shift. Amber Waves, U.S. Department of Agriculture, Economic Research Service.

- Gerval, A. & Hansen, J. (2022, September 26). Sub-Saharan Africa’s Reliance on Oil Exports Leads to Decline in Agricultural Imports During Pandemic. Amber Waves, U.S. Department of Agriculture, Economic Research Service.

- Farris, J., Morgan, S. & Johnson, M.E. (2022). COVID-19 Working Paper: The COVID-19 Pandemic and Changes in Greenfield Foreign Direct Investment in Africa. U.S. Department of Agriculture, Economic Research Service. AP-106.

- Johnson, M.E., Farris, J., Morgan, S., Bloem, J., Ajewole, K. & Beckman, J. (2022). Africa’s Agricultural Trade: Recent Trends Leading up to the African Continental Free Trade Area. U.S. Department of Agriculture, Economic Research Service. EIB-244.

- Morgan, S., Farris, J. & Johnson, M.E. (2022). Foreign Direct Investment in Africa: Recent Trends Leading up to the African Continental Free Trade Area (AfCFTA). U.S. Department of Agriculture, Economic Research Service. EIB-242.

- Zereyesus, Y.A., Cardell, L., Valdes, C., Ajewole, K., Zeng, W., Beckman, J., Ivanic, M., Hashad, R.N., Jelliffe, J. & Kee, J. (2022). International Food Security Assessment, 2022–32. U.S. Department of Agriculture, Economic Research Service. GFA-33.

We’d welcome your feedback!

Would you be willing to answer a few quick questions about your experience?