Since Brexit, United Kingdom’s Agricultural Trade With European Union Remains Strong; Opportunities for U.S. Exports Emerge

- by Adam Gerval and Jeremy Jelliffe

- 12/5/2023

Highlights

- After the United Kingdom (U.K.) left the European Union (EU) in 2020 in a process known as “Brexit,” the EU remains the U.K.’s largest trading partner for agricultural and related goods. While trade linkages continue, new agreements have opened opportunity for other potential trading partners.

- The U.K. is both an exporter and an importer of high-value, consumer-oriented agricultural and agriculture-related products. It is the world’s fifth-largest importer of agricultural and related goods and a large market for U.S. products.

- The export value of U.S. agricultural and related products to the U.K. more than doubled from 1990 to 2022. Imports of forest products, primarily wood pellets used for power generation, reached double-digit growth in recent years.

- Since Brexit, barriers to trade with the U.K. gradually are being removed, which is expected to reverse the slowing in U.K. exports to the United States in the coming years.

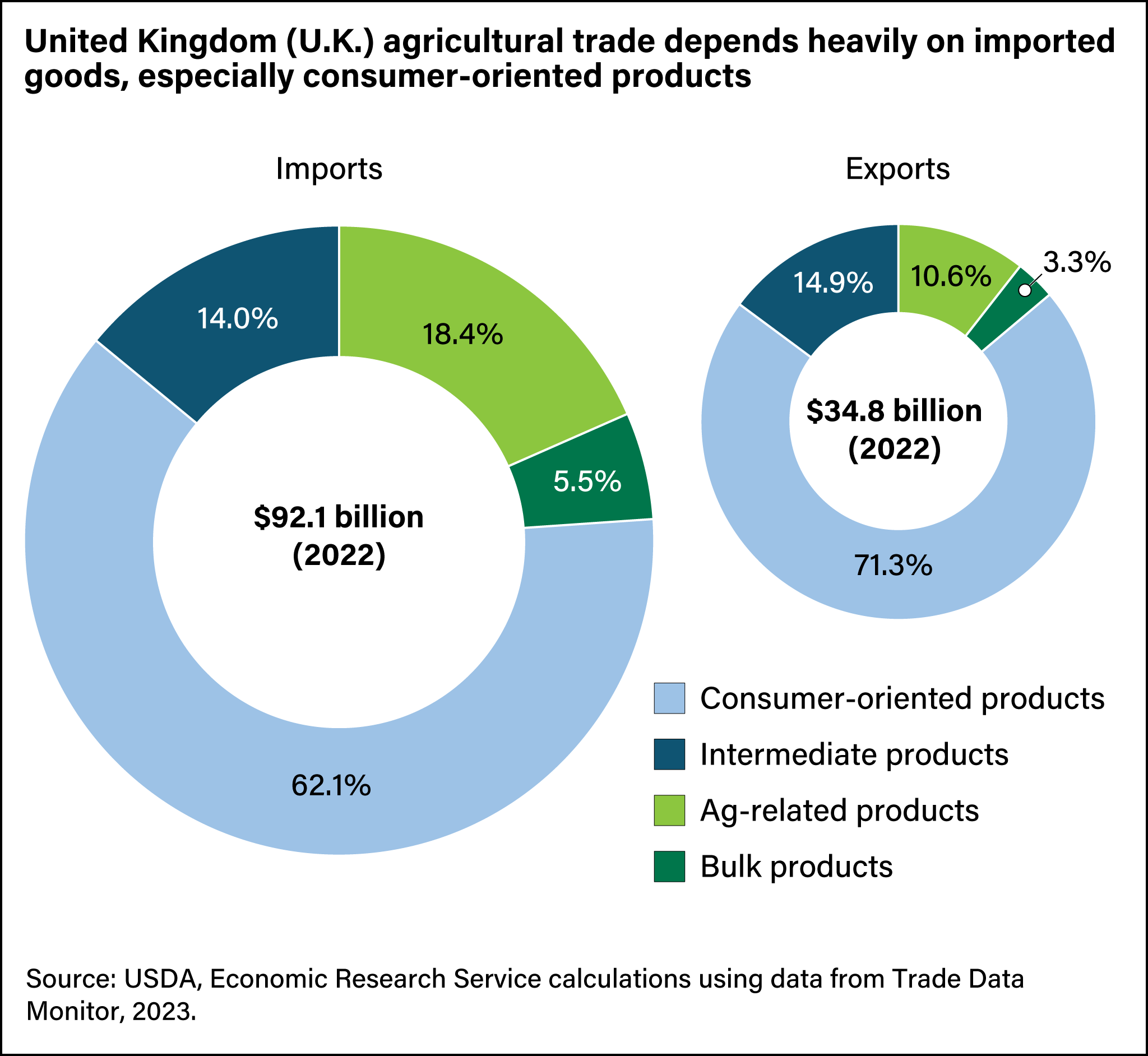

The United Kingdom (U.K.) is the fifth largest importer by value of agricultural products in the world. Comprising England, Northern Ireland, Scotland, and Wales, the U.K. has a limited capacity to produce agricultural and related products, relying on imports to meet the demands of its population. Agricultural production contributes less than 1 percent of the total value of the U.K. economy. In 2022, the U.K. imported $92.1 billion in agricultural and related goods and exported $34.8 billion, less than half the value of imports. Most of the goods imported by the U.K. are high-value consumer products, with distilled spirits, dairy products, and processed foods including seafood among the largest groups. Climate change has fostered demand for a new generation of agricultural-related products, such as wood pellets to replace coal, for which the United States has emerged as a major supplier.

Despite the U.K.’s departure from the European Union (EU) in 2020, a move commonly referred to as “Brexit,” strong U.K.-EU trade linkages continue. The EU remains the U.K.’s largest trade partner, providing more than 70 percent of the U.K.’s agricultural imports. However, new trends are emerging, opening trade with other areas of the world.

Brexit Doors Swing Open for Other Agricultural Trading Partners

As a member of the EU, the U.K. was party to the bloc’s trade negotiations and trade accords with other EU member countries. The U.K. and its non-EU trade partners rolled over many of these EU agreements into the post-Brexit era. In the short-term, the U.K. has pursued membership in a number of trade agreements that are expected to expand its export market access and sources of agricultural imports.

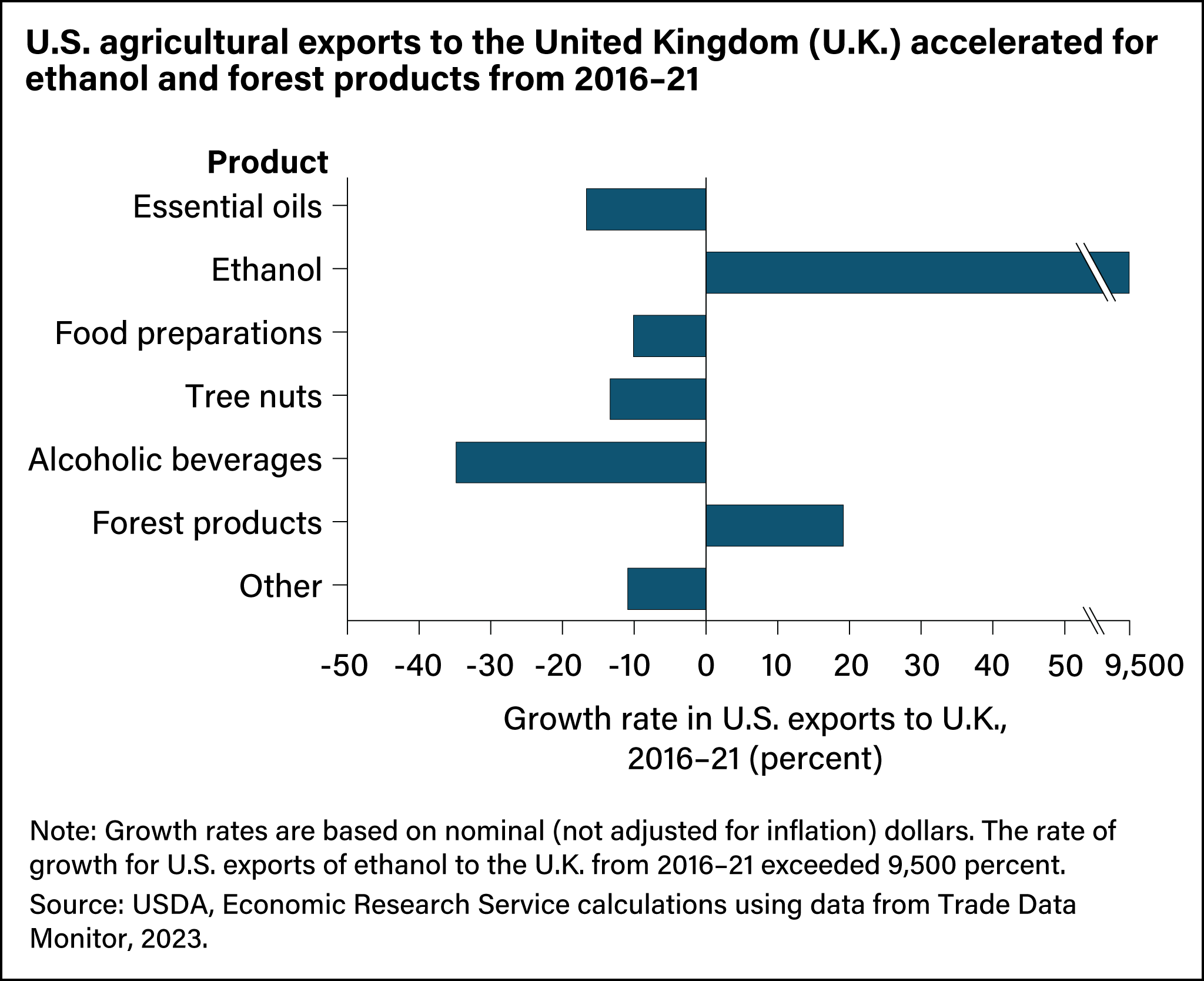

After the U.K. left the EU, its agricultural import sources grew more diverse. Products from China, the United States, and Brazil now serve as primary sources of import growth after increasing a combined average of 55 percent from 2021 to 2022. Since Brexit, China’s and Brazil’s agricultural export revenues to the U.K. each rose more than $1 billion, and total U.K. agricultural and related imports have increased nearly $14 billion. Most of the growth in the U.K.’s imports is attributable to biofuels such as ethanol and wood pellets for energy use; agricultural commodities such as soybeans, coffee beans, and raw sugarcane; and consumer products such as alcoholic beverages (beer, wine, whiskeys, and sparkling wine) and juices. The United States has established a share of the U.K. market for several of these increasingly popular products.

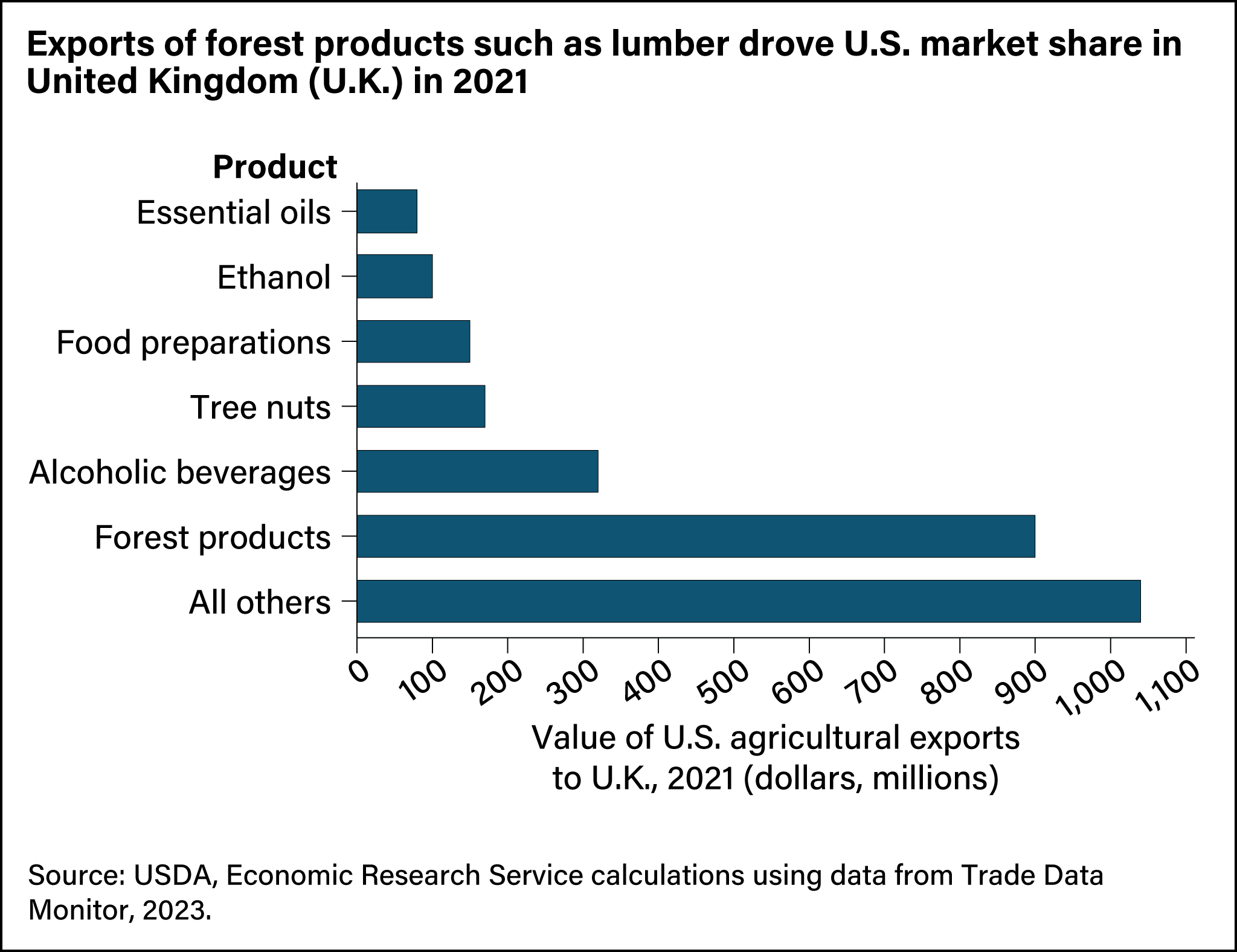

Brexit and Climate Change Ignite U.S.–U.K. Trading Relationship

While the composition of the U.S. export basket to the U.K. has remained relatively consistent since 1990, the overall value and volume has increased. The value of U.S. agricultural and related products to the U.K. more than doubled from $1.19 billion in 1990 to $3.01 billion in 2022. As a major producer of forest products such as wood pellets and lumber, the United States provided $1.28 billion of the $9.53 billion in forest products the U.K. imported in 2022. The United States also is the largest single-country supplier of fuel ethanol to the U.K., with exports valued at $162 million in 2022. Beer, wine, spirits, various nuts, and soybeans are the other primary U.S. commodities exported to the U.K.

Forest products represent the largest commodity group the U.K. imports from the global market, and the United States is the largest supplier. Wood pellets, assembled casks, and various hardwood lumbers such as white oak, poplar, and walnut made up nearly a third of all U.S. agricultural exports to the U.K. in 2022 and drove an increase in the U.S. market share in the U.K. Many U.K. power stations have transitioned to burning biomass, mainly wood pellets, rather than coal to meet greenhouse gas reduction targets. The U.K. is now the world’s predominant importer of wood pellets, accounting for 46 percent of global wood pellet imports in 2022. The United States provided 64 percent of the U.K.’s wood pellet imports in 2022.

Retaliatory Tariffs Dilute U.K.’s Exports of Spirits to the United States

U.S. alcoholic beverage exports to the U.K. grew at an average annual rate of 2 percent over the last two decades and were once a major export to the U.K. Recently, however, they have declined after peaking in 2015. A 2018 trade dispute led to the lowest levels of U.S.-U.K. alcoholic beverage trade in 2020–21. During this period, major U.S. trading partners including the EU and the U.K. imposed retaliatory tariffs on a wide range of U.S. exports, slowing U.S. exports of high-value consumer products, including alcoholic beverages. In 2018, when the U.K. was still a member, the EU established duties on American whiskeys, and the United States imposed an equivalent 25-percent retaliatory tariff on products from the EU and U.K. The United States and U.K. suspended these tariffs in early 2022, and trade disruptions between the U.K. and its partners are expected to hinge less on EU’s disputes in the future.

The U.K. also exports agricultural and food products, and several trends emerged from 2016 to 2022. The U.K.’s exports increased to the EU and other countries including China, Singapore, and Australia, while U.K. exports to the United States decreased. An exception is for alcoholic beverages, as the U.K. is a top supplier to the United States. Despite its decreasing share of the U.S. market—falling from 20.9 percent in 1990 to 11.5 percent in 2022—alcoholic beverage exports posted average annual growth of 4.2 percent in the last two decades. A primary driver of this trend has been consumer demand for high-end single-origin spirits from the U.K. During the Coronavirus (COVID-19) pandemic, the value of U.K. whiskey and gin exports to the United States fell 18.4 percent from 2019 through 2021, part of a larger 36.4-percent drop in U.K. alcohol exports to the U.S. The U.K. regained some of that value in 2022 with a 27.6 percent year-over-year increase from 2021. This followed the removal of retaliatory tariffs, more recent agreements for wine trade, and mutual recognition of certain distilled spirits. Specific-product trade agreements have occurred since the United States began trade negotiations with the U.K. in May 2020, although a timeline to complete a U.S.-U.K. trade agreement is not yet clear. Another example includes trade of livestock commodities, in which steps have been taken to reapprove U.K. beef and lamb exports to the United States for the first time in more than 20 years. With the resolution of differences in the risk assessment of bovine spongiform encephalopathy, also known as “mad cow disease,” the United States reauthorized U.K. beef imports at the end of 2021. The United States removed restrictions on U.K. lamb in January 2022, which is expected to generate nearly $50 million in additional trade to the United States over the next 5 years.

In a post-Brexit environment, the U.K.’s agriculture and food trade could shift toward areas in which it holds a comparative advantage and toward meeting consumer demand for high-value specialty products. The coming years present new opportunities for U.K. partnerships and expansion of trade into the island nation. In the case of the United States, strong demand for wood products, as well as a shared language, perceived affordability, quality of products, familiarity, and established import-export history translate into an optimistic outlook from across the pond. However, uncertainty may continue to exist for some time about the U.K. economy, current U.K.-U.S. negotiations, and the future trading relationship between the United States and the U.K.

This article is drawn from:

- Jelliffe, J., Gerval, A., Husby, M., Jarrell, P. & Williams, B. (2023). United Kingdom Agricultural Production and Trade Policy Post-Brexit. U.S. Department of Agriculture, Economic Research Service. EIB-250.

You may also like:

- European Union - Brexit and U.S. Agricultural Trade. (n.d.). U.S. Department of Agriculture, Economic Research Service.

- Morgan, S., Arita, S., Beckman, J., Ahsan, S., Russell, D., Jarrell, P. & Kenner, B. (2022). The Economic Impacts of Retaliatory Tariffs on U.S. Agriculture. U.S. Department of Agriculture, Economic Research Service. ERR-304.

We’d welcome your feedback!

Would you be willing to answer a few quick questions about your experience?