Use of Federal Risk Management Programs Varies Widely by Specialty Crop

- by Sharon Raszap Skorbiansky and Gregory Astill

- 11/7/2022

Highlights

- Farmers’ use of Federal risk management programs is highly specific to the crops grown. Some crops (such as dry beans and peas) had more than 90 percent of acreage covered in 2017, while others (such as hazelnuts and lettuce) had less than 1 percent of acreage covered.

- The Federal Crop Insurance Program (FCIP) and the Noninsured Crop Disaster Assistance Program (NAP) use differs among specialty crops, depending on where the crops are grown.

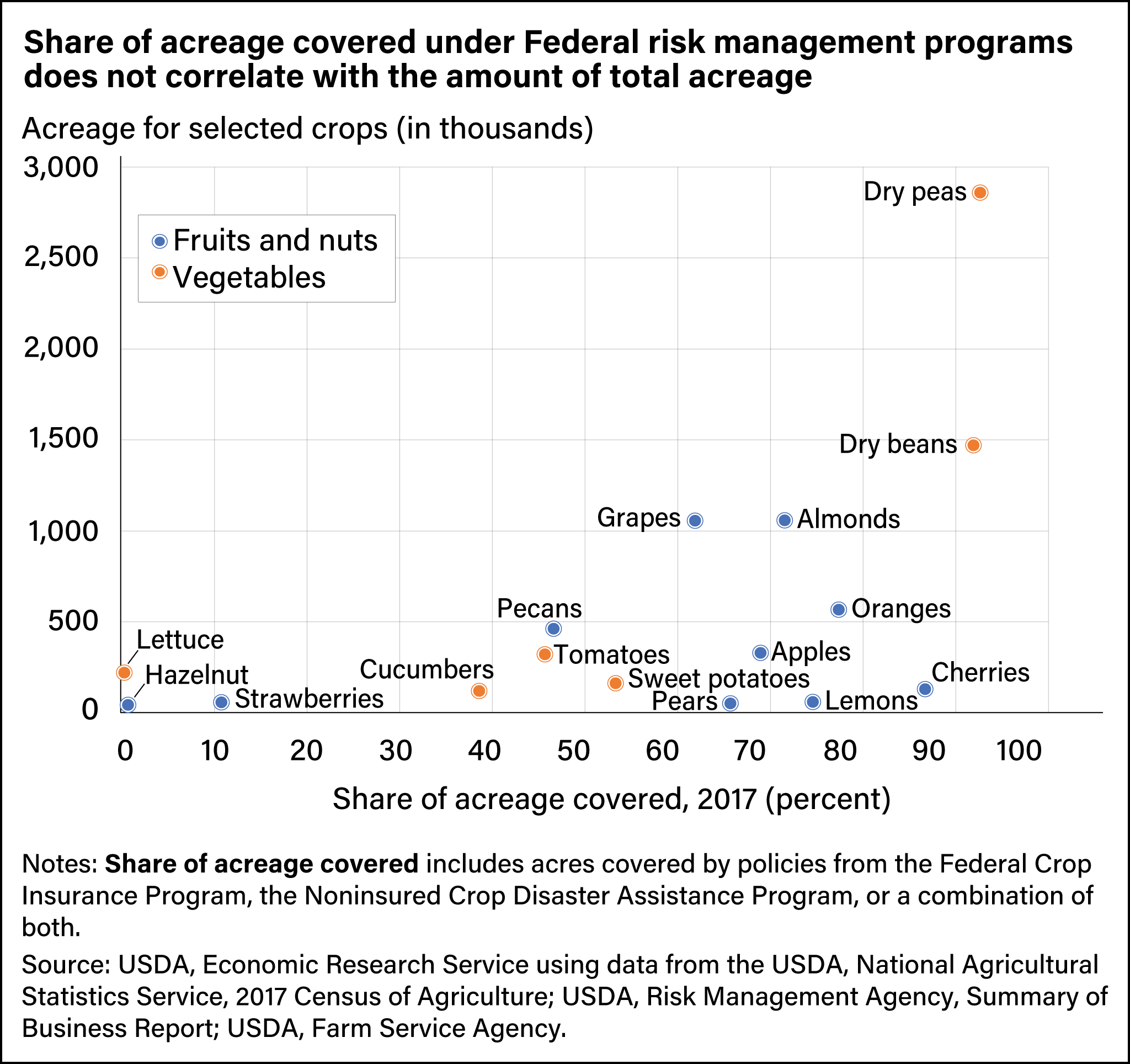

- Despite high acreage outliers, total acreage is not correlated with whether a crop will have a high share of acres under a risk management program. Instead, high-value crops are likely to be insured, and crops with low levels of production risk are less likely to be insured.

Specialty crop producers in the United States grow a wide variety of fruits, vegetables, tree nuts, and horticultural nursery crops. These crops face many of the same production issues as major field crops, such as susceptibility to weather damage. Plus, they have their own limitations such as concentration in geographic locations best suited for their cultivation, limitations on herbicide and pesticide options available—especially organic crop producers—and in many markets a low number of buyers and sellers, making it difficult for growers to gather price data.

In addition, specialty crop producers have historically had fewer Federal risk management tools to manage risk than producers of major field crops. Since 1994, provisions in successive Farm Bills expanded USDA risk-management products for specialty crops, but challenges remain.

Federal Crop Insurance Programs Offer Risk Management Tools

The Federal Government provides two subsidized and permanent multiperil risk management programs. The USDA, Risk Management Agency (RMA) provides the Federal Crop Insurance Program (FCIP) in counties where sufficient data are available to create an actuarily sound policy. In counties where FCIP policies are unavailable, the USDA, Farm Service Agency provides the Noninsured Crop Disaster Assistance Program (NAP). RMA also offers pilot crop insurance to test programs under development for vulnerabilities. One such pilot is the Whole-Farm Revenue Protection, which allows growers to insure revenue for an entire farm under one policy.

The FCIP was introduced in 1938. Initially, it covered only wheat losses, but it was expanded over the years to cover major field crops and some specialty crops in major producing areas. The Government created FCIP to protect growers against a variety of natural causes of loss, such as drought, hail, excessive heat and cold, heavy rains and flooding, hurricanes, earthquakes, or insect infestation and plant disease. The Federal Crop Insurance Reform and Department of Agriculture Reauthorization Act of 1994 emphasized the need to expand crop insurance to specialty crop growers. FCIP now covers about 80 specialty crops.

Under FCIP, growers select a type of policy and level of coverage. Policies are yield-based or revenue-based. FCIP coverage ranges from 50 percent to 85 percent of expected yield or revenue (known as the insurance guarantee), depending on the policy. The expected yield is generally based on the grower’s historic average of up to 10 years. To the extent that a grower’s actual yield or revenue fall below the insurance guarantee, an indemnity payment is made. For example, if an apple grower signs up for a yield-based policy at 50-percent coverage with an average historic yield of 30,000 pounds per acre, the grower would receive an indemnity payment if the yield were to fall below 15,000 pounds per acre. If the grower signed up for a coverage level of 60 percent, the grower would receive an indemnity payment if the yield fell below 18,000 pounds per acre. Revenue protection policies work similarly to yield policies, but growers are also protected from changes in the harvest price from a projected price.

The FCIP is actuarially sound, meaning that, on average, total premiums equal or exceed total indemnity payments. It is necessary for RMA to have a substantial amount of data available to create an actuarially sound insurance product for a commodity in a specific location. In many counties, there are not enough producers of some specialty crops to provide the data required to create FCIP products.

The Noninsured Crop Disaster Assistance Program, introduced in 1996, is modeled after FCIP yield-based policies, with coverage levels from 50 percent to 65 percent. Unlike FCIP, where premiums can vary according to risk, NAP’s service fees and premiums are fixed. Farmers cannot purchase NAP when a permanent FCIP policy is available to them, but NAP policies can be combined with RMA pilots, whole-farm, or weather-index products.

Using acreage data from 2017, and FCIP and NAP data from 2015 to 2020, USDA, Economic Research Service researchers examined the use of these two Federal programs to manage the risks of specialty crop production.

Use of Risk Management Program Is Specific to Crop and County

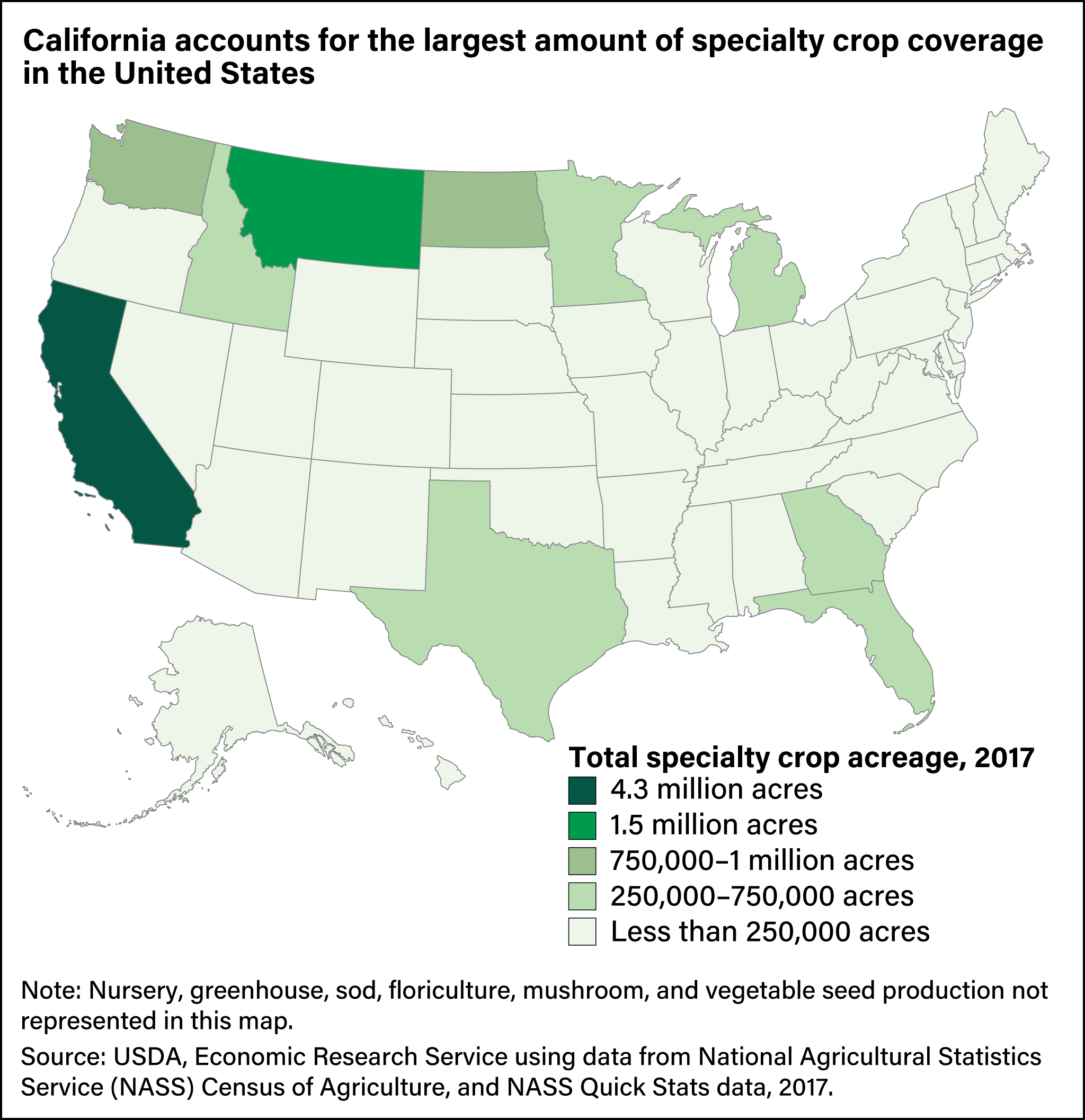

Specialty crops are grown across the United States, although some States have larger concentrations of production. California grows the largest share of U.S. fruits and nuts, with 61 percent of the country’s acreage in 2017, and the largest share of vegetables with 45 percent of acreage. Dry beans are grown mainly in Montana (35 percent of total U.S. acreage) and North Dakota (23 percent).

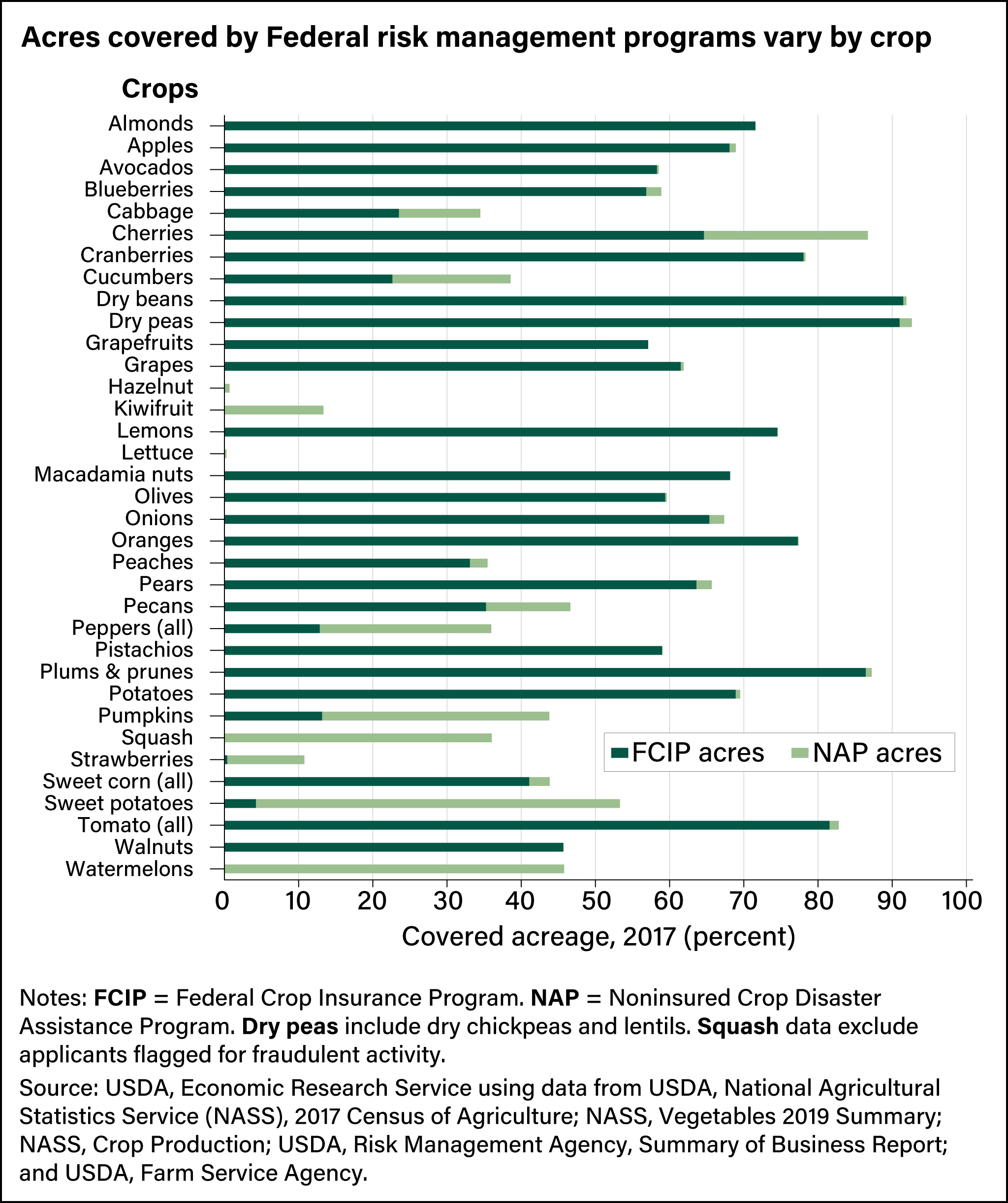

The share of acreage covered under a Federal risk management program differs across crops. For all types of specialty crops (fruits, nuts, vegetables, and field crops), there are some crops with more than 50 percent of acreage covered under the combination of FCIP or NAP. For example, dry beans and peas have more than 90 percent of acreage covered, cherries and plums and prunes about 87 percent, almonds and macadamia nuts about 70 percent, and onions and potatoes about 70 percent.

Whether farmers use FCIP or NAP depends on the crops they grow. For instance, almond production is geographically concentrated in California, and FCIP policies are available in all counties that produce almonds. Because NAP is available only in counties where FCIP is not available, and almonds are produced only in California, NAP covers no almond acres. On the other hand, cucumber production is spread across the country, and in many counties, there is not enough data on cucumbers for RMA to create actuarially sound FCIP policies. In those counties, NAP fills the insurance gap for cucumber producers.

RMA does not offer FCIP policies for hazelnuts, kiwifruit, lettuce, squash, watermelons, most leafy greens, herbs, spices, and root crops. Instead, some of these crops depend on NAP for risk management. For example, watermelon and squash both had slightly less than 50 percent of acreage enrolled in NAP policies in 2017, and kiwifruit had 13 percent of planted acreage.

For crops such as hazelnuts and lettuce, less than 2 percent of production area was covered. NAP provides protection against yield losses, not revenue losses, which may make policies less attractive to growers of crops that face fewer weather risks. In 1994, RMA examined the potential of strawberries as a candidate for multiperil crop insurance and found demand would likely be low because there are few production risks for strawberries in California. In 2017, about 10 percent of strawberry acreage was covered under the combination of FCIP and NAP.

From the specialty crops studied, Federal risk management programs are used most by producers of cherries, dry beans, dry peas, plums, prunes, and tomatoes. For those crops, FCIP or NAP covered more than 80 percent of acres in 2017. Except for sweet potatoes, all specialty crops with more than 50 percent of acres covered were covered predominantly by FCIP rather than NAP. However, NAP filled a gap for producers of cherries, pecans, watermelons, pumpkins, squash, cucumbers, peppers, cabbage, and raspberries.

Specialty crops with high acreage, such as dry beans, dry peas, grapes, and almonds, are typically highly covered by Federal risk management programs. Crops with a history of high acreage have a lot of past information, and policies have been available to them for longer periods of time. Even so, acreage levels and share of acreage covered generally are not correlated. For example, lettuce had 221,000 acres with almost no acreage covered, but pistachios had 248,000 acres and at least 72 percent of acreage covered. Instead, the share of covered acreage is a response to other factors, such as relative production risks or the value of the crop.

Specialty Crop Growers Manage Risk in Many Ways

Specialty crop producers use a variety of risk-mitigating strategies instead of or in addition to Federal programs. Those strategies include:

- diversifying their crop portfolio or relying on crop rotation to manage yield risk,

- building up their savings accounts and self-insuring,

- using forward contracts to guarantee quantities and the price sold after harvest,

- using specialized equipment or structures, such as high tunnels or greenhouses, or

- diversifying income with off-farm employment.

In deciding whether to enroll in Federal risk management programs, growers consider the added benefits compared with the costs of enrolling as well as other risk management tools. While Federal risk management programs are subsidized, customers of FCIP and NAP typically pay a signup fee and pay extra for added coverage. Applying for FCIP and NAP takes time. While crop insurance agents and FSA officers help producers with paperwork, some information can be provided by only the producers. The number of Whole-Farm Revenue Protection policies has been falling, possibly because of the complexity of the program and its related paperwork. In 2021, RMA announced the Micro Farm policy offered through WFRP to simplify record keeping for operations with approved revenues up to $350,000.

This article is drawn from:

- Raszap Skorbiansky, S., Astill, G., Rosch, S., Higgins, E., Ifft, J. & Rickard, B.J. (2022). Specialty Crop Participation in Federal Risk Management Programs. U.S. Department of Agriculture, Economic Research Service. EIB-241.