Organic Dairy and Beef Producers Face Limited Markets, Feed Grain Shortages

- by Sharon Raszap Skorbiansky

- 11/22/2022

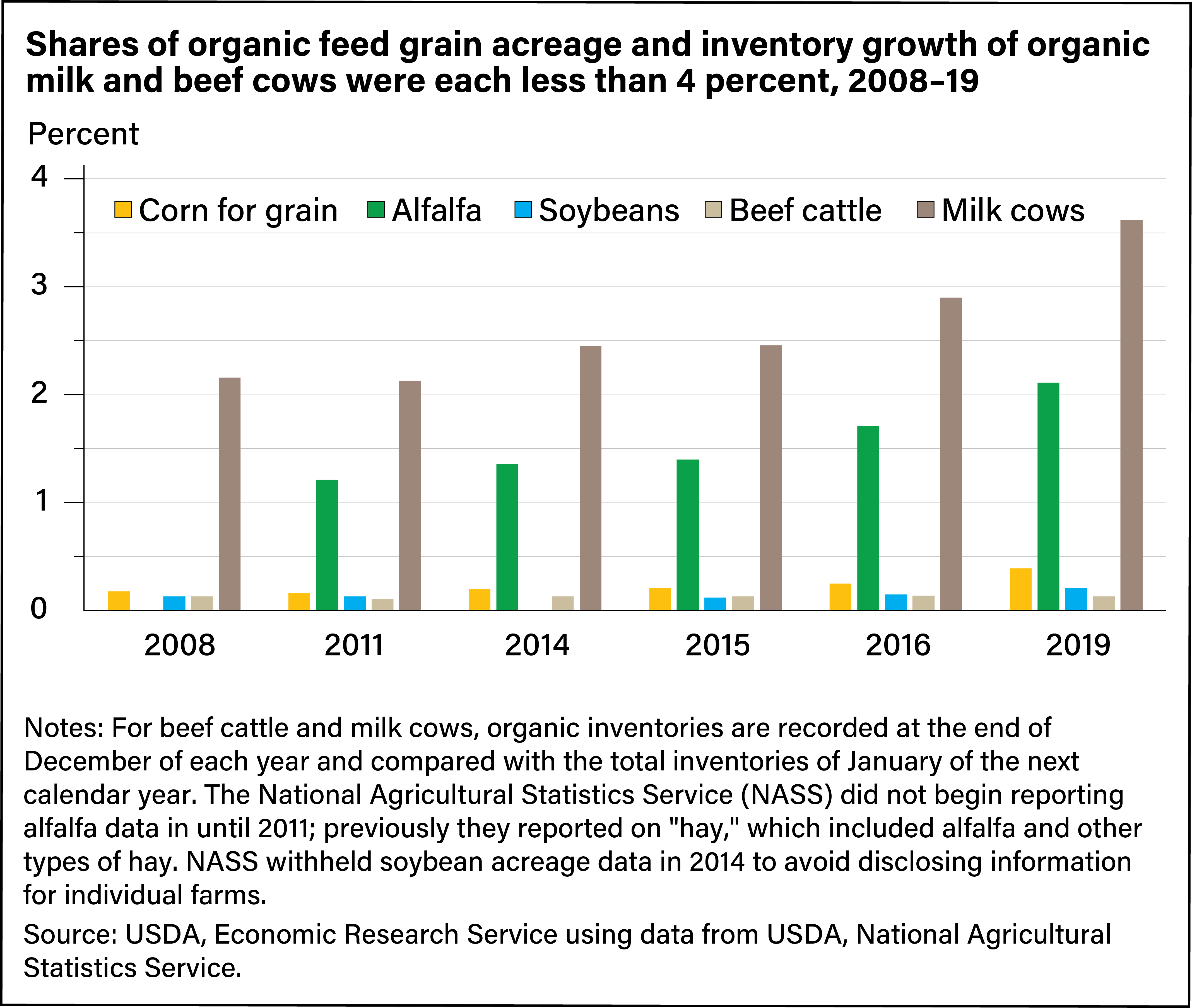

Despite increasing U.S. consumer demand for organic animal products such as meat and milk, the total market share of organically certified animals, as well as of organic forage and feed concentrates, remained low between 2008 and 2019 compared with total herds and acreage. In 2019, organic dairy cows accounted for 3.6 percent of the total dairy herd, and organic corn for grain accounted for 0.4 percent of total corn for grain harvested acreage. By comparison, 9.5 percent of harvested vegetable acres were cultivated organically in 2019 (the most recent year for which complete data are available).

To be certified as organic, dairy and beef cattle must eat a diet consisting of certified organic pasture and feed. However, shortages of organic feed are a key impediment to the expansion of organic livestock products. Researchers at USDA, Economic Research Service identified several characteristics of current organic livestock and feed markets that may be acting as barriers to entry and are slowing domestic growth.

Degree of buyer concentration

When markets have few buyers, an imbalance of market power can result. For example, the alfalfa markets in the Midwest and East have a high degree of buyer concentration. Dairies in these regions grow their own alfalfa and forage, so they have less need to buy those products from nearby farms. Alfalfa is bulky and expensive to transport, and with few buyers, organic alfalfa growers may have difficulties finding new buyers and may face depressed local procurement market prices.

Buyer and seller commitment

If the buyer and producer have credible commitments to work together, they are less likely to default on their arrangement. With low commitment comes the risk that the other party will not fulfill its part of the deal and that contract renegotiation may occur when market prices change. This risk can deter growers interested in transitioning to organic agriculture from or making investments in infrastructure needed to handle organic products. After seeing consistently higher price premiums for organic dairy products for several years, some dairies transitioned from conventional to organic production, expanding the available supply of organic milk. This increase in the supply prompted some organic processors to add temporary fees to their contracts for milk delivery, and other processors terminated their contracts, forcing producers to find new buyers for their products. Corn, soybeans, and alfalfa in the Midwest and East also can exhibit low buyer commitment. For example, corn and soybean buyers can substitute for other organic grains and oilseeds or buy imported feed crops if the price difference is sufficient to warrant the switch.

Primary exchange mechanism and price transparency

Vertical integration is a business strategy in which operations control various stages of production, such as dairy farmers growing forage for their cows instead of buying it from other producers. Contracting and vertical integration are common in markets with few buyers and sellers—known as thin markets—because they ensure a steady supply for buyers and a guaranteed price. Even so, they also limit what others can know about the market. Readily available data allow producers to make more informed decisions on whether to enter or exit a market. Producers considering a transition to organic must anticipate whether demand will support prices high enough to justify the upfront costs of transition, extra production costs, and lower yields. All the markets researchers examined had low levels of price transparency. Prices in the organic beef market were especially volatile with low price transparency, relatively few buyers and sellers, and high levels of vertical integration. Meanwhile, due to the low number of transactions, there is no price reporting for alfalfa in the Midwest and East portions of the country.

This article is drawn from:

- Hadachek, J., Saitone, T.L., Sexton, R.J., Raszap Skorbiansky, S., Thornsbury, S. & Effland, A. (2022). Organic Feed Grains and Livestock: Factors That Influence Outcomes in Thinly Traded Markets. U.S. Department of Agriculture, Economic Research Service. ERR-303.

We’d welcome your feedback!

Would you be willing to answer a few quick questions about your experience?