Poultry Expected To Continue Leading Global Meat Imports as Demand Rises

- by Matthew Miller, Adam Gerval, James Hansen and Grace Grossen

- 8/1/2022

Highlights

- Global poultry imports are projected to reach 17.5 million metric tons in 2031.

- Sub-Saharan Africa is projected to remain the top global importer of poultry.

- Brazil is projected to remain the top global exporter of poultry.

- The United States’ share of the world’s poultry exports is projected to decline from 26 percent in 2021 to 24 percent in 2031.

Over the past two decades, poultry has become the most consumed livestock commodity in the world, especially in developing and emerging markets where production prospects have been relatively limited. As demand for poultry products grew in these markets during the period from 2001 to 2021, global imports increased. Poultry is expected to remain the world’s largest imported livestock commodity by volume over the next 10 years. To meet rising demand, a number of countries increased domestic poultry production. Brazil, the United States, the European Union, and Thailand emerged as major poultry exporters. Brazil is the world’s leading poultry exporter and is projected to remain in the top position through 2031. The United States, however, is expected to lose market share throughout the coming decade.

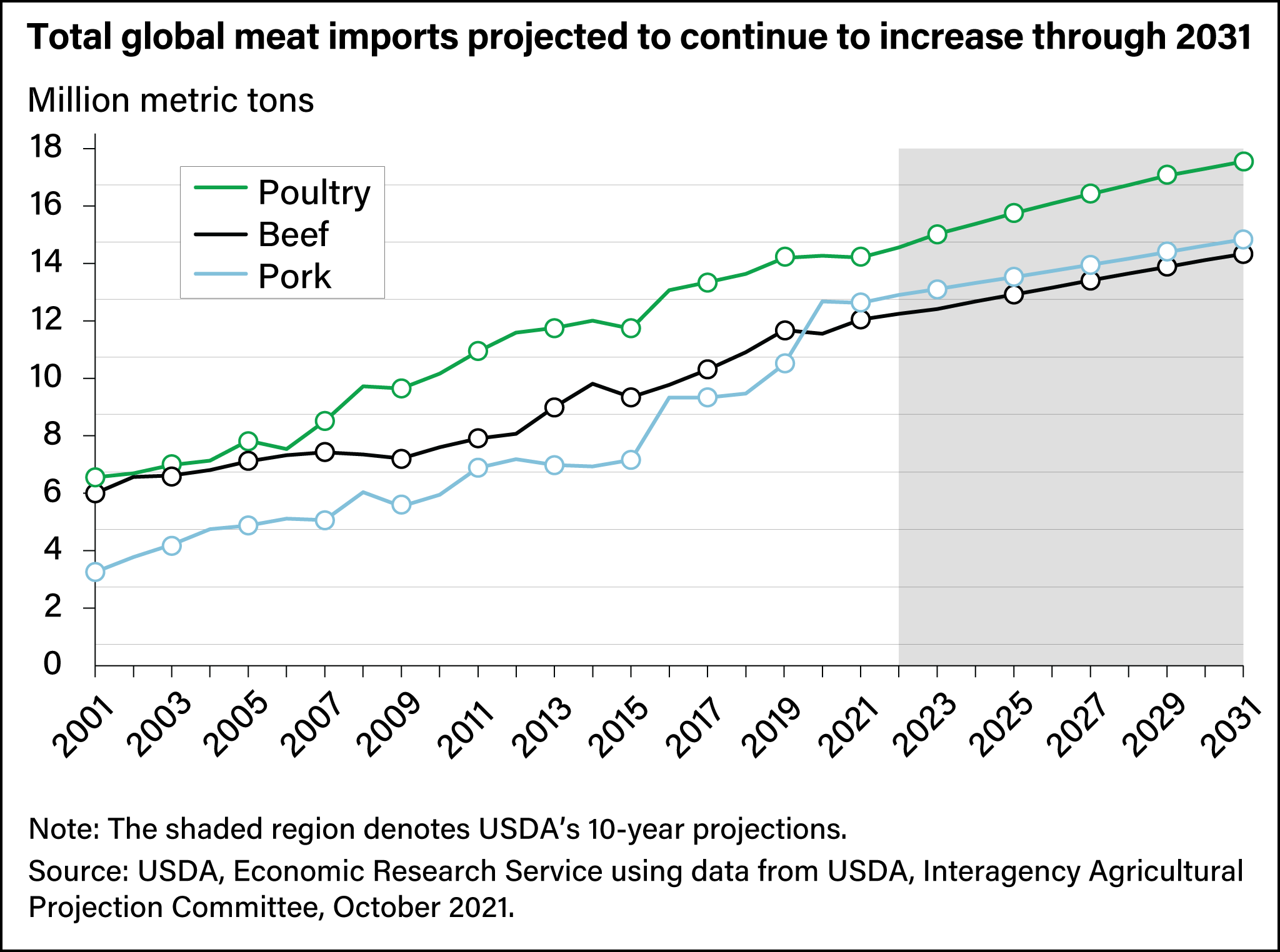

The impact of global integration of commodity markets on agriculture is especially visible in livestock commodities. Meat trade—including poultry imports—has expanded significantly since 2001. Total imports of livestock commodities, including poultry, pork, and beef increased 117 percent from 2001 to 2021 and are projected to continue to grow through 2031. USDA’s 10-year Agricultural “Baseline” Projections, based on the release of the October 2021 World Agricultural Supply and Demand Estimates (WASDE), indicate that by 2031 total meat imports will increase to 46.7 million metric tons.

From 2001 to 2021, global poultry imports rose an average of 4 percent a year, reaching 14.2 million metric tons in 2021. USDA projects poultry imports to grow to 17.5 million metric tons by 2031. In comparison, pork imports are projected to increase to 14.8 million metric tons by 2031, and beef imports are expected to rise to 14.3 million metric tons.

Explaining Poultry’s Recent Growth

Chickens mature and reach market weight more quickly than other livestock and convert feed to meat more efficiently than larger animals. In addition, chickens can be raised in small spaces, so producers can raise poultry in a variety of environments including small plots of land. These advantages help make poultry production more feasible and affordable than beef and pork for farmers in developing countries and emerging markets.

However, poultry production has not kept up with the rise in consumption in many countries, particularly in sub-Saharan Africa. The discrepancy between production and consumption has driven demand for poultry meat from 69 million metric tons in 2001 to almost 128 million metric tons in 2021. This represents almost an 86-percent increase—averaging 3 percent a year—in global consumption during those 20 years. Over the past 10 years, however, growth in demand slowed to 2 percent annually and is projected to continue at that rate through 2031.

Developing and emerging markets have led most of the growth in poultry consumption over the past 10 years. Consumption increased by 5 percent in West Africa, 4 percent in North Africa, 3 percent in Mexico, and 4 percent in the Republic of the Philippines. These annual growth rates are projected to remain near these levels over the next 10 years and are expected to contribute to the largest increase in poultry import demand and trade.

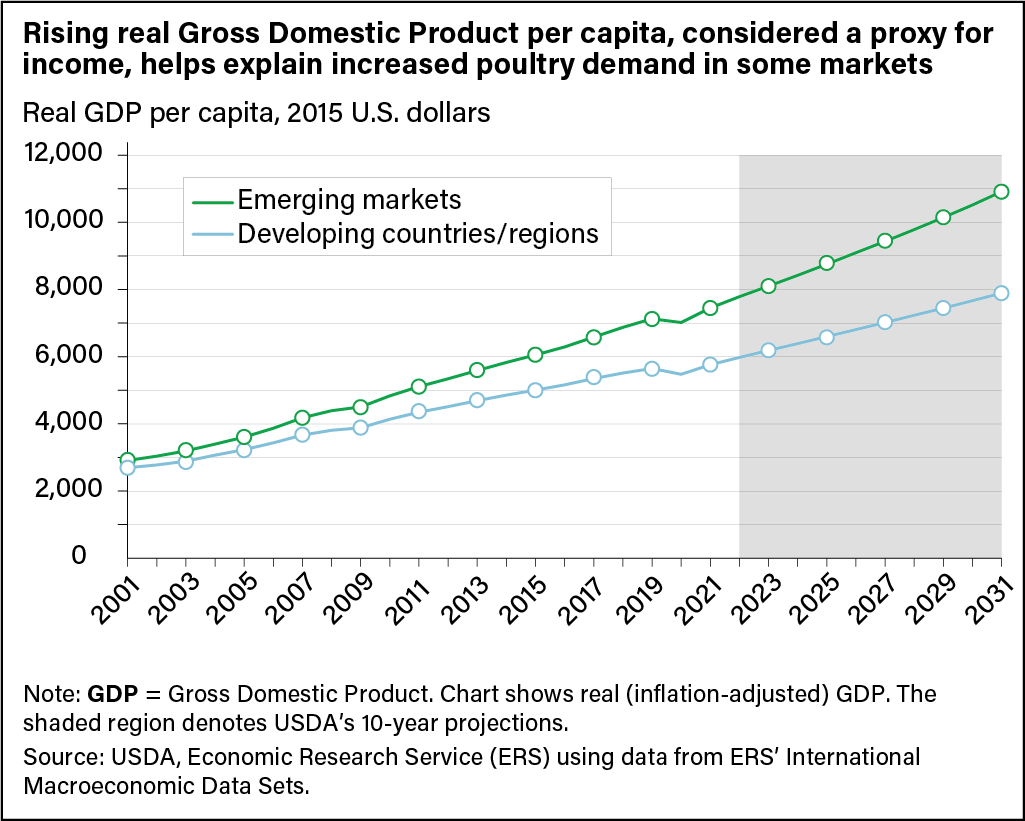

Rising demand for poultry products and the related increase in poultry imports can be attributed to a variety of factors. A central component is a rise in real Gross Domestic Product (GDP) per capita in emerging and developing economies. Real GDP is GDP adjusted for inflation, and real GDP per capita is a proxy for income. As incomes have risen, consumers have bought more animal-based proteins. Poultry, particularly chicken, provides an efficient solution to evolving patterns in consumption. Additional factors influencing poultry’s import growth include population and urbanization trends in many developing economies and emerging markets such as Southeast Asia and sub-Saharan Africa. As urban areas in these regions grow denser in population, poultry provides consumers an affordable protein source that is more readily available than other meats.

Where Poultry Imports Increased and Where They Are Projected To Grow

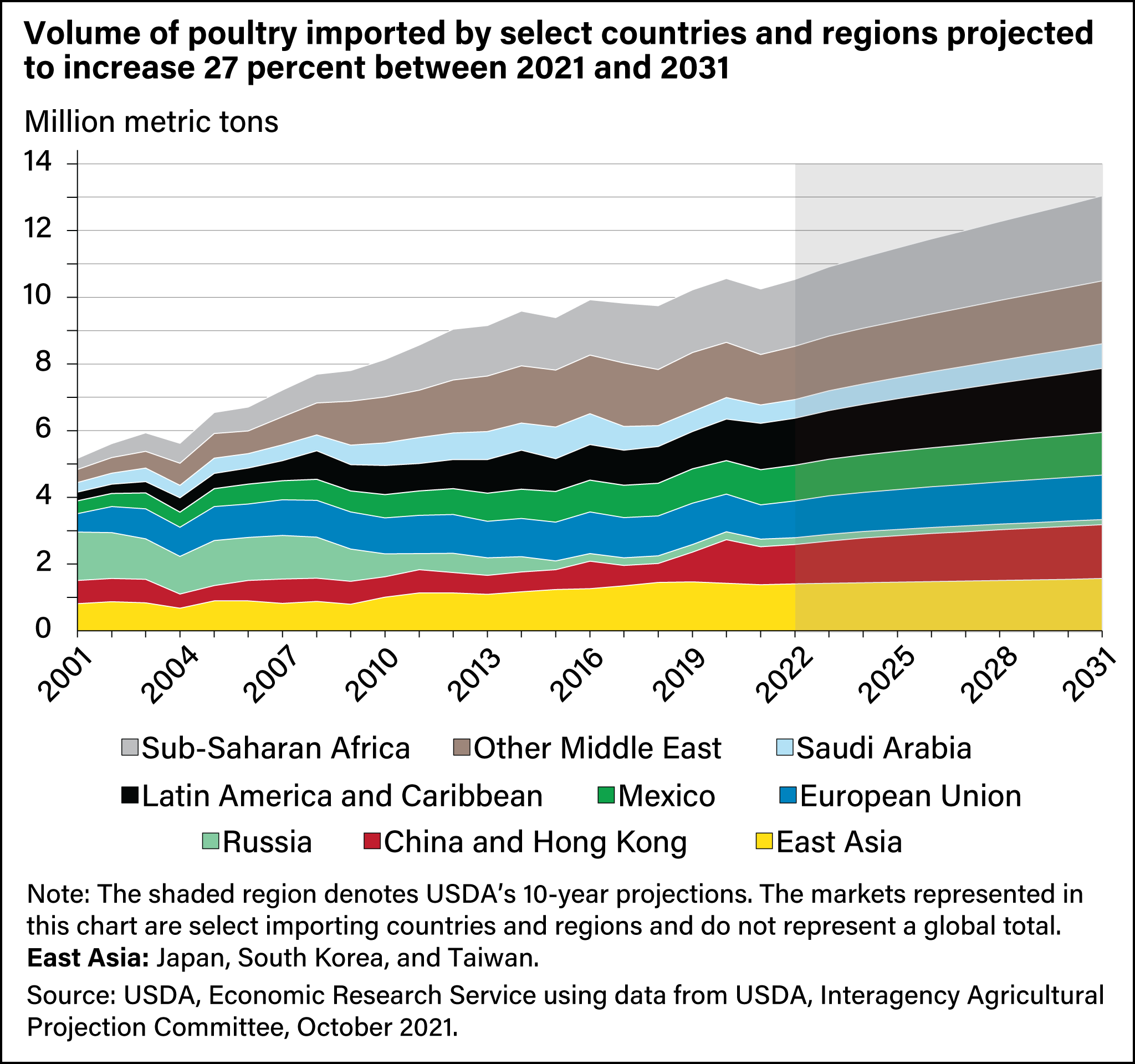

From 2001 to 2021, poultry imports increased most in sub-Saharan Africa, expanding from 0.33 million tons to 1.96 million metric tons. Latin American and Caribbean countries accounted for the second-largest increase in poultry imports, increasing a total of 1.13 million metric tons. A similar increase in imports accompanied growth in poultry consumption for the “Other Middle East” region, led by the United Arab Emirates and Iraq. Conversely, Russia’s poultry imports dropped by 1.22 million metric tons in the 20-year period.

From 2022 to 2031, poultry import volumes by select major importers are projected to increase 24 percent. The regions exhibiting the strongest projected increases are developing countries and emerging markets, including sub-Saharan Africa (up 27 percent), the Other Middle East region (up 18 percent), Mexico (up 21 percent), Latin America and the Caribbean (up 36 percent), and China and Hong Kong (up 37 percent).

Russia is the only select importer showing a projected decrease (25 percent) in poultry imports even though poultry accounted for more than 50 percent of Russian meat consumption in 2020. This is primarily due to an import quota set in 2021 aimed at combating declining production after an avian flu outbreak.

Sub-Saharan Africa is projected to remain the top global importer of poultry at 2.54 million metric tons annually by the year 2031. Characterized by growing populations, increasing urbanization, and rising per capita income, sub-Saharan Africa is an increasingly significant poultry importer. Countries such as South Africa, Ghana, and Angola—some of the most highly urbanized countries in the region—account for more than half of poultry imports to the region. In 2021, the region accounted for 19 percent of the global trade, and USDA projects that to increase to 20 percent by 2031. The rise in imports has been driven by the affordability of poultry meat as a protein source, but also the collapse of poultry production for many countries. Before 2001, Ghana and Angola had strong poultry sectors, but the 26-year civil war in Angola and surges in production costs for items such as feed and energy in both countries led to a decline in production capacity. Since the collapse of the Angola and Ghana poultry sectors, foreign supplies have satisfied about 90 percent of poultry meat demand in both countries. In South Africa, the government, seeking to protect domestic producers from cheaper imports, placed duties on poultry meat entering the country. That move curtailed poultry exports to South Africa, particularly those from the United States. In 2015, South Africa replaced the duties with a tariff-rate quota, which led to an 18-percent increase in South African poultry imports from 2015 to 2020.

Where Poultry Exports Are Projected To Increase

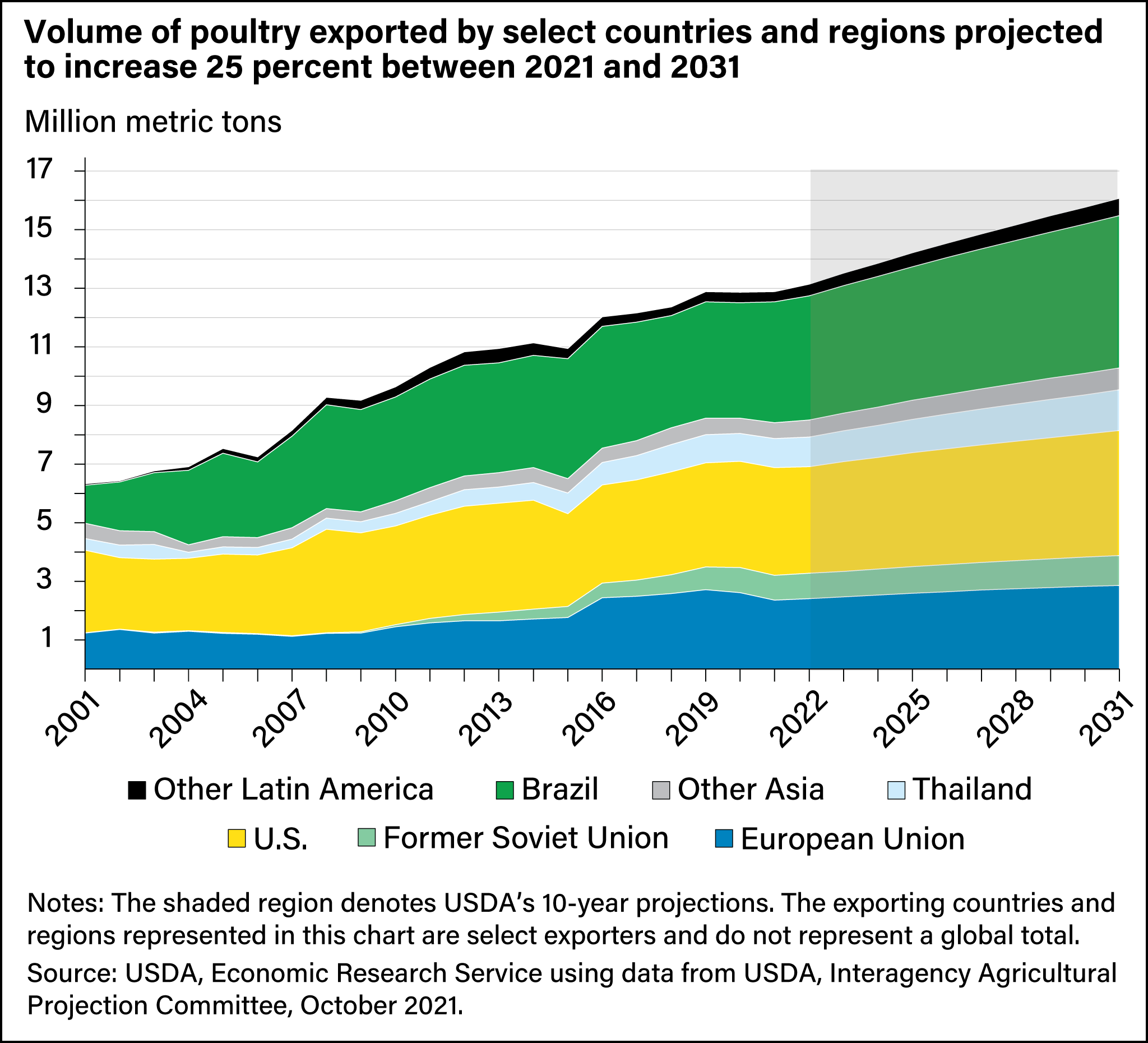

The three largest exporters (by volume) are Brazil, the United States, and the European Union (EU). Together, they accounted for 71 percent of world poultry exports in 2021, a share that is projected to remain mostly stable by 2031. The other four major export regions, “Other Latin America,” “Other Asia,” Thailand, and the former Soviet Union, accounted for 19 percent of world poultry exports in 2021. Their share is projected to increase slightly by 2031.

Brazil’s poultry exports grew rapidly between 2001 and 2021, and the country regained the title of the world’s largest poultry exporter in 2007. Increased domestic production of feedstuffs for poultry (feed grains and soybeans) helped boost Brazil’s expansion of poultry production. From 2015 to 2019, China accounted for an annual average of 13 percent of Brazilian poultry exports. By comparison, the United States shipped 1 percent of its poultry exports to China during that time. Brazil exports also have increased to European and Middle Eastern markets. Brazil is projected to remain the world’s leading poultry exporter, expanding to 5.2 million metric tons by 2031.

Similar to Brazil, the EU’s poultry export market grew from 2001 to 2021, although the region remains the world’s third-largest exporter. This growth is primarily due to import demand in sub-Saharan African markets such as Ghana and the Democratic Republic of Congo, as well as Hong Kong and Saudi Arabia.

Despite losing some export market share to Brazil, the United States remains the second-largest poultry exporter and is expected to remain so for the next 10 years. While U.S. poultry exports are expected to increase through 2031, the U.S. share of world poultry exports is projected to decrease slightly to 24 percent from 26 percent in 2021. The United States saw significant declines in exports to China during its 2018–19 trade dispute, with an average annual decline of 37 percent between 2015 and 2019 before rebounding in 2020. However, U.S. exports to Latin American countries, particularly Cuba, Guatemala, and Colombia, have expanded over the last decade. Exports to South Africa likewise increased as trade restrictions have eased since 2015. U.S. exports of chicken meat are principally in the form of dark meat, specifically leg quarters (the uncut leg and thigh).

This article is drawn from:

- Dohlman, E., Hansen, J. & Boussios, D. (2022). USDA Agricultural Projections to 2031. U.S. Department of Agriculture, Economic Research Service. OCE-2022-01.