Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in 2020

- by Tia M. McDonald and Ron Durst

- 4/2/2021

Created in 1916, the Federal estate tax is a tax on the transfer of property from a deceased person to their heirs at death. Because it applies only to that portion of an estate’s value that exceeds an exemption amount, the tax has never affected a large share of estates.

Moreover, legislation enacted over the last several years has greatly reduced the scope of the tax. The tax exemption has increased from $675,000 in 2000 to $11.58 million in 2020. Under present law, the estate of a person who at death owns assets in excess of the exemption amount must file a Federal estate tax return. However, only returns that have an estate above the exemption after deductions for expenses, debts, and bequests to a surviving spouse or charity are subject to tax at a rate of 40 percent.

Two additional provisions further reduce estate tax liability for those estates that must file an estate tax return: portability and special use valuation. The portability provision applies specifically to married couples and allows a spouse whose taxable estate is less than the exemption amount ($11.58 million in 2020) to transfer any unused portion of their exemption to their surviving spouse. This unused portion is then added to the surviving spouse’s exemption amount, applicable at the time of their death. This provision allows married couples to more fully use their combined exemption amounts. The special use valuation provision allows farmland to be taxed at its value under actual use, rather than its potential use, as long as the land will continue to be used in agriculture for the next 10 years. The reduction in an estate’s value from the special use valuation provision was capped at $1.18 million in 2020.

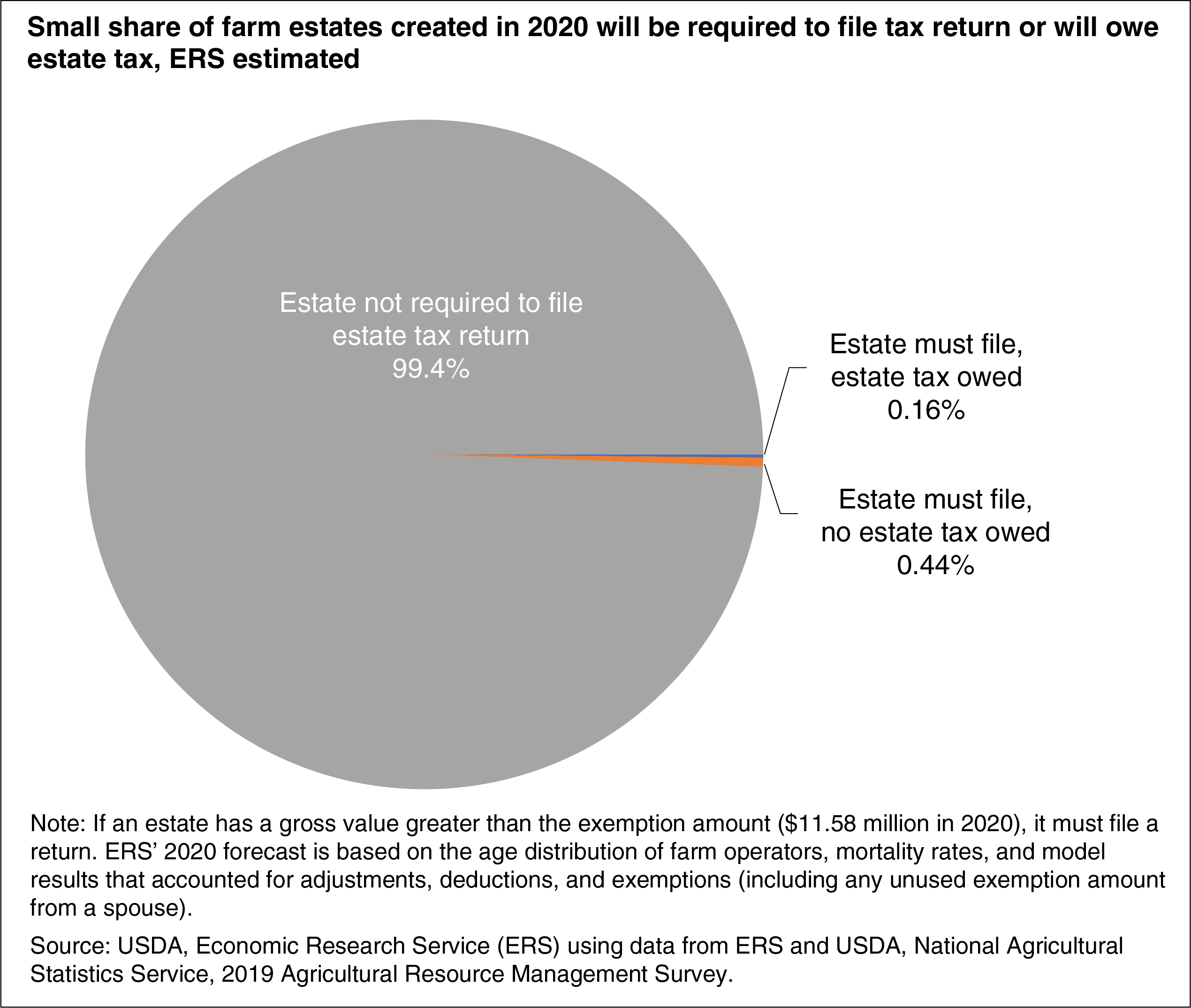

Using the latest data from the 2019 Agricultural Resource Management Survey (ARMS) and actuarial tables that report the probability of death by age, USDA’s Economic Research Service (ERS) provides detailed information on the application of Federal estate taxes to agriculture on its Federal Estate Tax Topic Page. ERS estimated that approximately 31,000 principal farm operators died in 2020. Of those estates, an estimated 189 (0.6 percent) will be required to file an estate tax return, and only 50 (0.16 percent) will owe Federal estate taxes. Total Federal estate tax liabilities from farm estates owing taxes were forecasted to be $130.2 million in 2020 from a total estimated estate value of $56.3 billion. Total tax savings resulting from the special use valuation was estimated to be $20.7 million that year.

The share of farm estates required to file a tax return or owe taxes varies by farm size. ERS estimated that less than 0.05 percent of small family farm estates would owe Federal estate taxes. Small family farms have gross cash farm income (GCFI) less than $350,000. Of mid-sized and large farm estates—farms with GCFI between $350,000 and $5 million—an estimated 2 percent will owe Federal estate taxes. Of very large farm estates, farms with GCFI over $5 million, about 8 percent will owe Federal estate taxes.

This article is drawn from:

- Federal Tax Issues - Federal Estate Taxes. (n.d.). U.S. Department of Agriculture, Economic Research Service.

You may also like:

- Federal Tax Issues - Federal Tax Policy Issues. (n.d.). U.S. Department of Agriculture, Economic Research Service.

- Farm Household Income and Characteristics. (n.d.). U.S. Department of Agriculture, Economic Research Service.

- Williamson, J. & Bawa, S.G. (2018). Estimated Effects of the Tax Cuts and Jobs Act on Farms and Farm Households. U.S. Department of Agriculture, Economic Research Service. ERR-252.