Brazil’s Currency Depreciation and Changing Macroeconomic Conditions Determine Agricultural Competitiveness and Future Growth

- by Constanza Valdes, Kim Hjort and Ralph Seeley

- 10/5/2020

Highlights

- Even though Brazil recently experienced one of its worst economic recessions—based on the depth and length of the economic downturn—implementation of favorable agricultural and macroeconomic policies helped the country emerge as an even stronger agricultural exporter.

- Extended periods of currency depreciation have sharpened the competitiveness of Brazilian agricultural exports in global markets.

- Faster depreciation of Brazil’s currency during the next decade could lead to faster growth in Brazilian exports than expected in <em>USDA Agricultural Projections to 2029</em>.

Brazil’s Macroeconomic Policies Position It as a Strong Global Agricultural Competitor

Brazil has made a significant transformation from being an exporter of tropical agricultural products such as coffee, sugar, and cacao in the 1960s and 1970s to becoming a major global supplier of soybeans, corn, cotton, sugar, coffee, orange juice, and meat in the 2000s. Brazil is now one of the chief competitors of the United States in international markets for many of these commodities. The growth of the Brazilian agricultural sector proceeded through a series of economic expansions, contractions, and crises that prompted the country’s government to adopt credit, tax, and price policies that stimulated the agricultural sector and ultimately increased the competitiveness of Brazilian agricultural exports.

The growth of Brazilian agriculture is rooted in the development strategy adopted in the mid-1960s that emphasized technologies and farm management practices best suited to tropical latitudes. The Brazilian Government provided fiscal and financial support to agriculture during the 1970s and 1980s, in particular through large amounts of subsidized credit. From the mid-1990s onward, with higher world prices for agricultural commodities, Brazil’s sustained agricultural growth has been largely investment-driven, marked by rising foreign investment and increased influence of multinational corporations in production agriculture and food processing.

After 1994, economic reforms, more open trade, and flexible exchange rate regimes in Brazil created an environment that helped the country’s agricultural sector flourish. With a more stable and open economy, Brazil reaped returns from government-sponsored breeding of varieties of crops and livestock suited to the climate and soil conditions of tropical plains (savannah), known as the Cerrados. By expanding its agricultural frontier into the Brazilian savannah, the country soon became one of the world’s top producers of soybeans, corn, cotton, and meat. During the first decade of the 21st century, the Brazilian Government sought to increase its agricultural competitiveness by reducing production costs, improving market access, and expanding infrastructure. Because of these developments, the Brazilian agricultural sector emerged as a key contributor in Brazil’s economy. Primary agricultural production contributed 8 percent of the country’s gross domestic product (GDP) in 2019, and the whole agro-industrial processing and distribution sector accounted for 32 percent of Brazilian GDP.

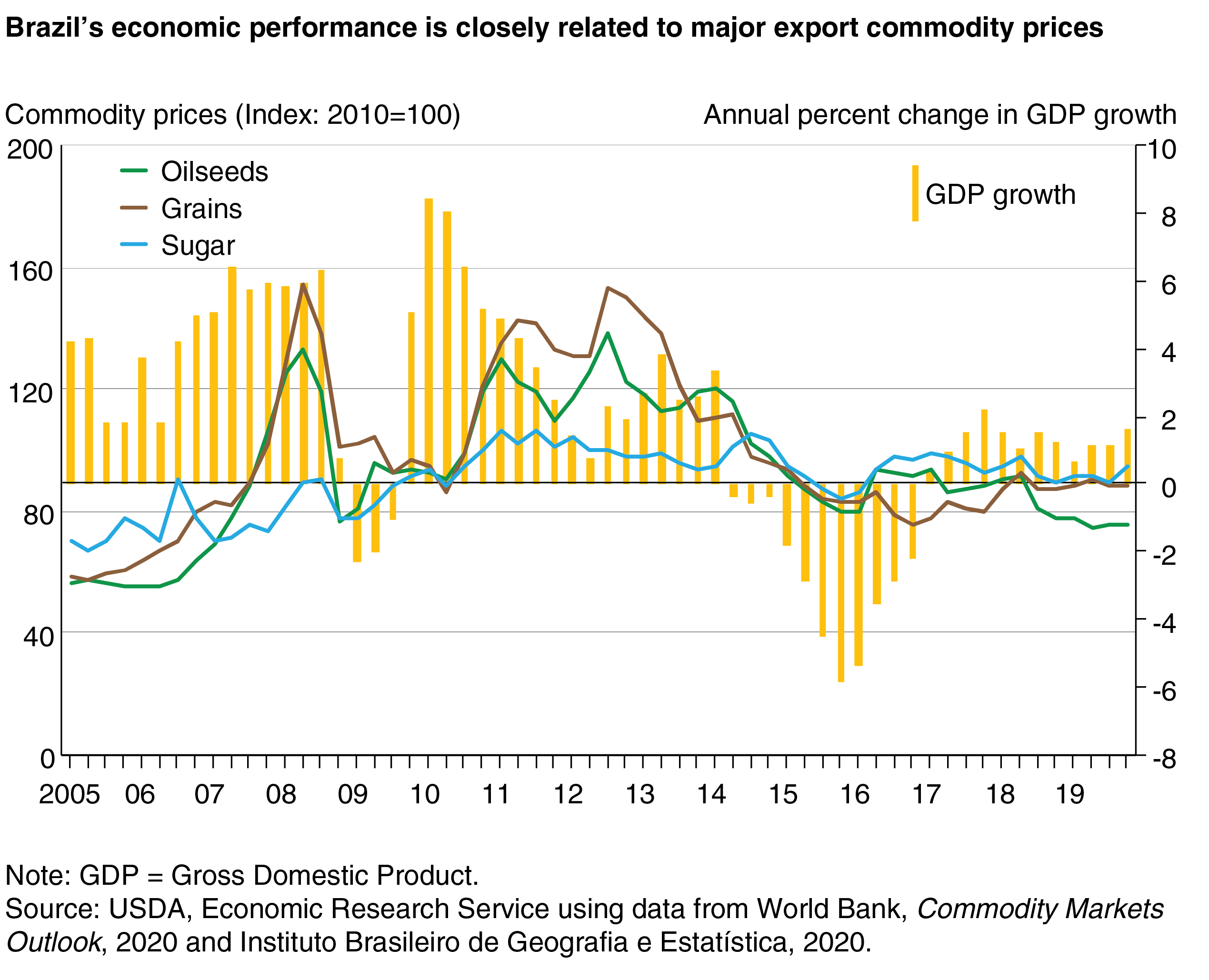

From 2005-11, the Brazilian economy grew quickly, driven by rising commodity prices for agricultural exports and low-interest international credit. Following this period of rapid growth, the fall in commodity prices in 2012 for some of Brazil’s key export commodities (such as soybeans, grains, raw sugar) led to a slowdown and eventually a downturn in economic growth (see figure below). During the decline in international commodity prices that preceded the recession, growth in farm output was aided by increased rural credit subsidies issued by the Brazilian Government to offset shrinking private credit and maintain production incentives and profitability. This led to even more production and lower prices, while Brazil was able to expand exports and expand its diversification of markets.

Brazil has experienced many economic crises, and the country’s history is punctuated by economic volatility. The recession that began in mid-2014 and ended in 2016 was at the time called the country’s worst recession in decades, as Brazil’s GDP decreased 3.8 percent in 2015 and 3.5 percent in 2016. The Brazilian economy started its recovery with GDP growth of 1.3 percent in 2017 and 2018 and subsequent growth of 1.1 percent in 2019 (see figure below).

Despite adverse economic conditions, production increases and yield growth during the 2014-16 recession allowed the Brazilian agricultural sector to contribute to GDP growth. Through a stimulation of farm-related industries such as fertilizer and machinery, the agricultural sector was both a catalyst for reviving the economy and a counterbalance to the contraction of the industrial and service sectors. Rising foreign investment in crop production, fertilizer compounding, and technological dissemination contributed to yield increases and higher levels of agricultural output.

Rising production increased the sector’s ability to grasp export opportunities, such as the growing demand for feedstuffs in China and other foreign markets. Brazil’s soybean production closely rivals that of the United States, with each accounting for about one-third (33-36 percent) of world production. Brazil is also the world’s third-largest corn producer, with about 8 percent of global production.

Depreciation of Brazil’s Currency Benefits Brazil’s Export Sector

As is the case in many developing countries that rely upon exports, the exchange rate policies of Brazil have influenced the country’s agricultural exports. Exported Brazilian commodities are priced in dollars. A depreciation of Brazil’s currency (the Brazilian real, denoted BRL) allows producers in Brazil to sell at higher prices in Brazilian currency to match a given U.S.-dollar price in world markets. Thus, accelerated depreciation of Brazil’s currency would prompt an expansion of Brazilian agricultural output and exports and lead to lower international commodity prices. Farm inputs such as chemical fertilizer and agrochemicals are imported, so depreciation also raises production costs for Brazilian farmers by increasing the effective price of imported inputs that are priced in dollars. As shown in the figure below, sugarcane is more dependent on imported inputs such as nitrogen fertilizers and chemicals, so as the real depreciates, costs rise to negate an increase in expected revenue. However, for the other commodities shown in the figure, devaluation of the currency results in a net increase in expected revenue, leading to higher expected returns (profitability).

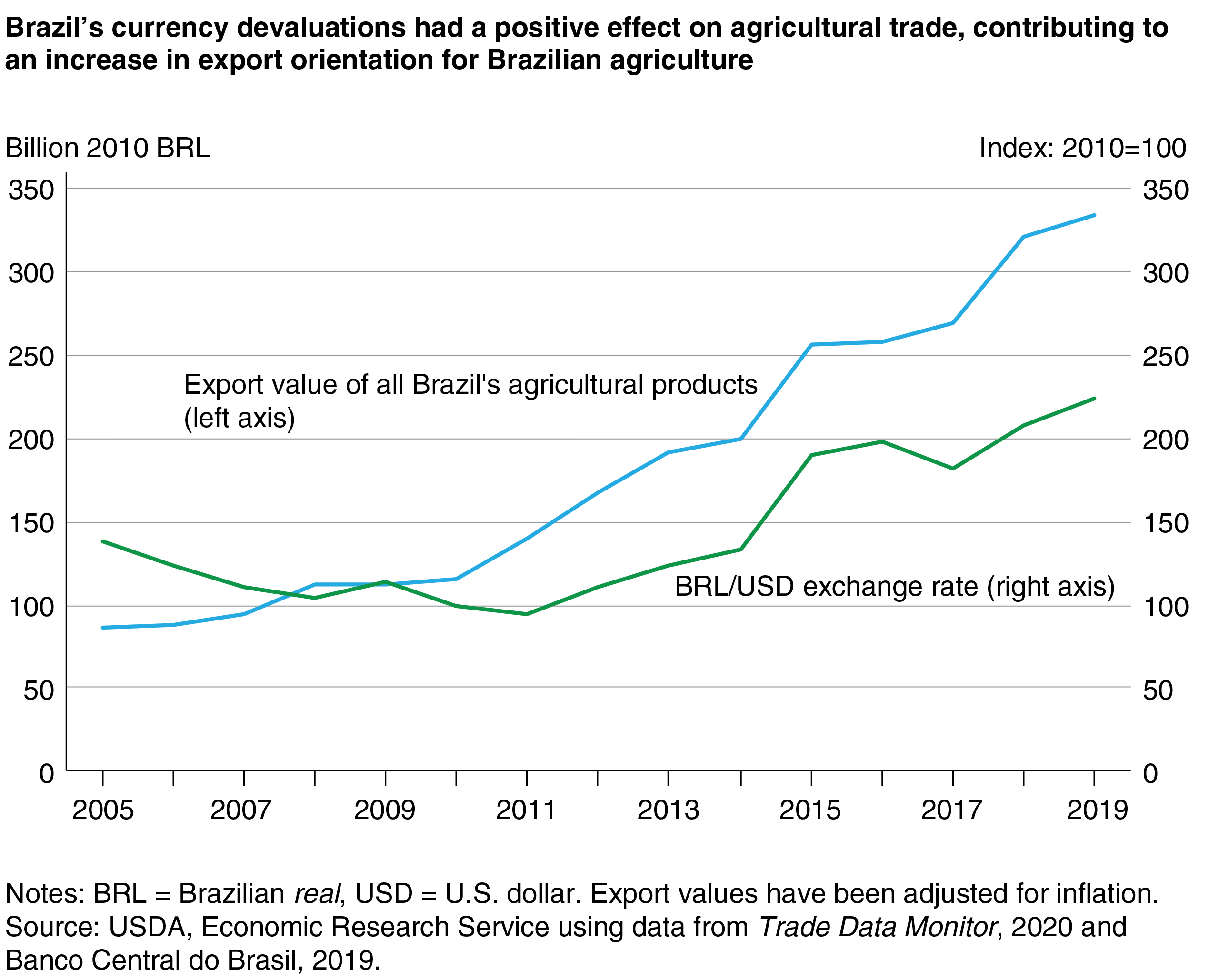

Brazil’s currency devaluations have positively affected agricultural trade, contributing to Brazilian agriculture’s increasing export orientation with each recession (see figure below). Brazil’s total merchandise exports responded favorably to the devaluation and grew 6.7 percent between 2015 and 2019, while total imports declined, reflecting the overall slowdown of the domestic economy. Brazilian exports of manufactured goods did not respond to the depreciation during 2011-14 because of slowdowns in the growth of foreign demand. However, Brazil’s agricultural trade surplus was robust, even as the non-agricultural trade balance deteriorated.

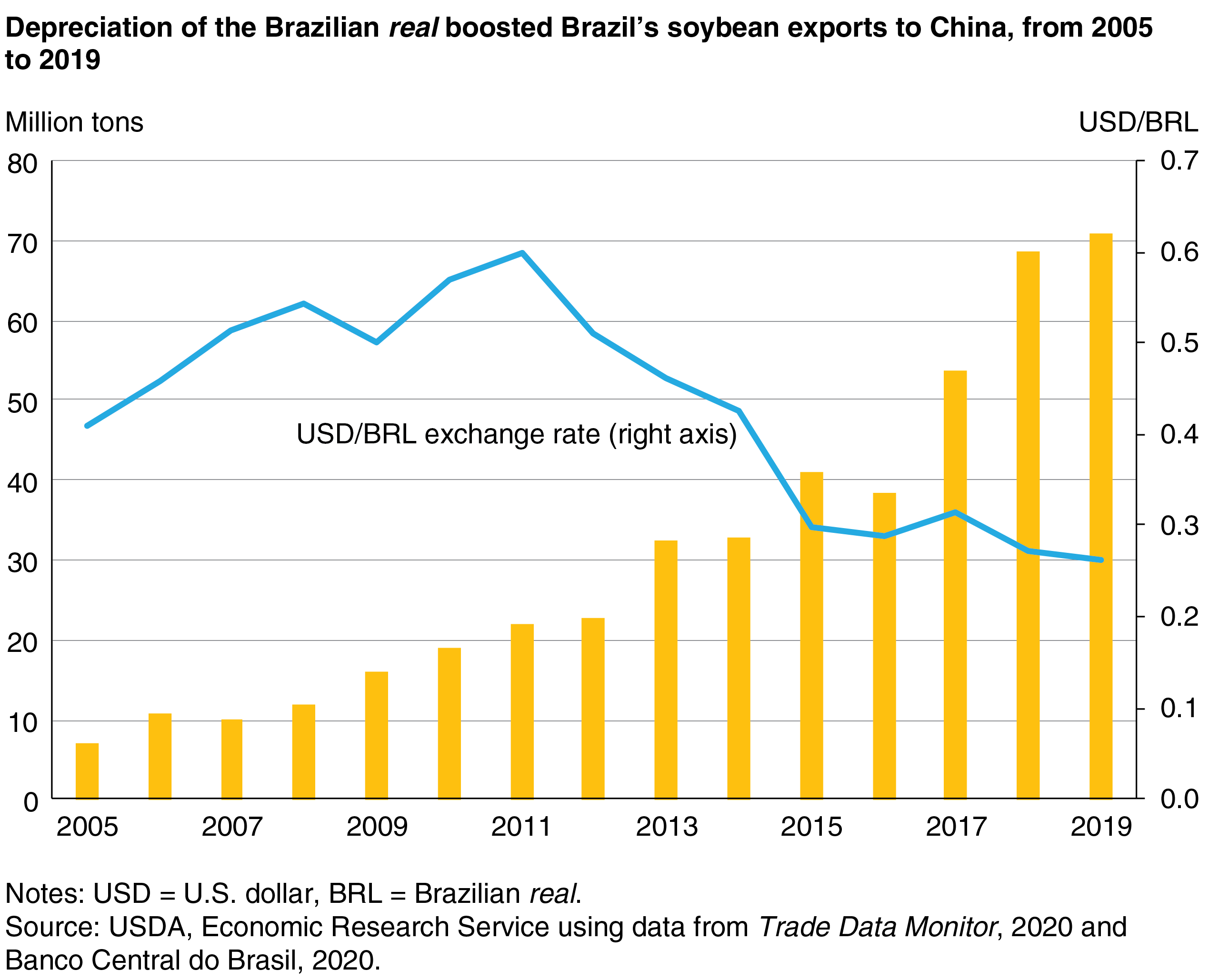

The soybean sector has benefited the most from the effects of the currency devaluations that followed various economic crises. Brazil’s devaluations prompted farmers to plant additional area to soybeans, increasing production. Exports rose significantly, resulting in Brazil’s emergence as the world’s largest soybean exporter. During 2005-19, Brazil exported an annual average of 42 million metric tons of soybeans and 18 million metric tons of corn. China’s increasing demand for soybeans played a key role in stimulating growth in Brazil’s agricultural exports. Brazilian exports are likely to continue to grow significantly, particularly if rising demand from China further boosts Brazilian exports, including the United States. Total Brazilian soybean exports to China increased from 7.2 million metric tons in 2005 to 68.6 million metric tons in 2019, aided by the substantial depreciation of the real (see figure below).

As exchange rates kept Brazil’s commodities competitively priced overseas, China’s growing demand for Brazil’s soybeans—among other commodities—spurred growth in Brazil’s agricultural exports after the 2014-16 recession. China is now also a top market for Brazilian soybean meal, corn, sugar, cotton, coffee, and meat. China remains Brazil’s major trading partner, as the destination for 30 percent of Brazilian exports and the source of 20 percent of Brazilian imports. Brazil’s export sales to China increased further when China imposed higher tariffs on U.S. agricultural products in 2018. By contrast, Brazil’s exports to other important markets (such as the European Union and the MERCOSUR trading bloc of Brazil, Argentina, Paraguay, and Uruguay) decreased. Manufactured exports grew much more slowly, reflecting sluggish international demand and the difficulties inherent in rapidly restructuring manufacturing production.

What Scenarios Lie Ahead for Brazilian Agriculture?

Understanding how economic conditions affect Brazilian agriculture is important for assessing prospects for U.S. agricultural exports, considering the size and growth of the Brazilian agricultural sector, its share of world markets, and its effect on global supply chains. A recent ERS report explores the role of macroeconomic variables by simulating the impact of policy-driven currency depreciation and sustained macroeconomic growth on future levels of Brazilian agricultural output and trade.

The USDA Agricultural Projections to 2029, released in February 2020, suggest further growth in Brazilian agricultural production and exports over the coming decade. Separate simulations show this growth could accelerate if the real weakens more than previously expected. Alternatively, stronger economic growth in Brazil could lead to more domestic meat consumption and more domestic use of feedstuffs such as corn and soybean meal.

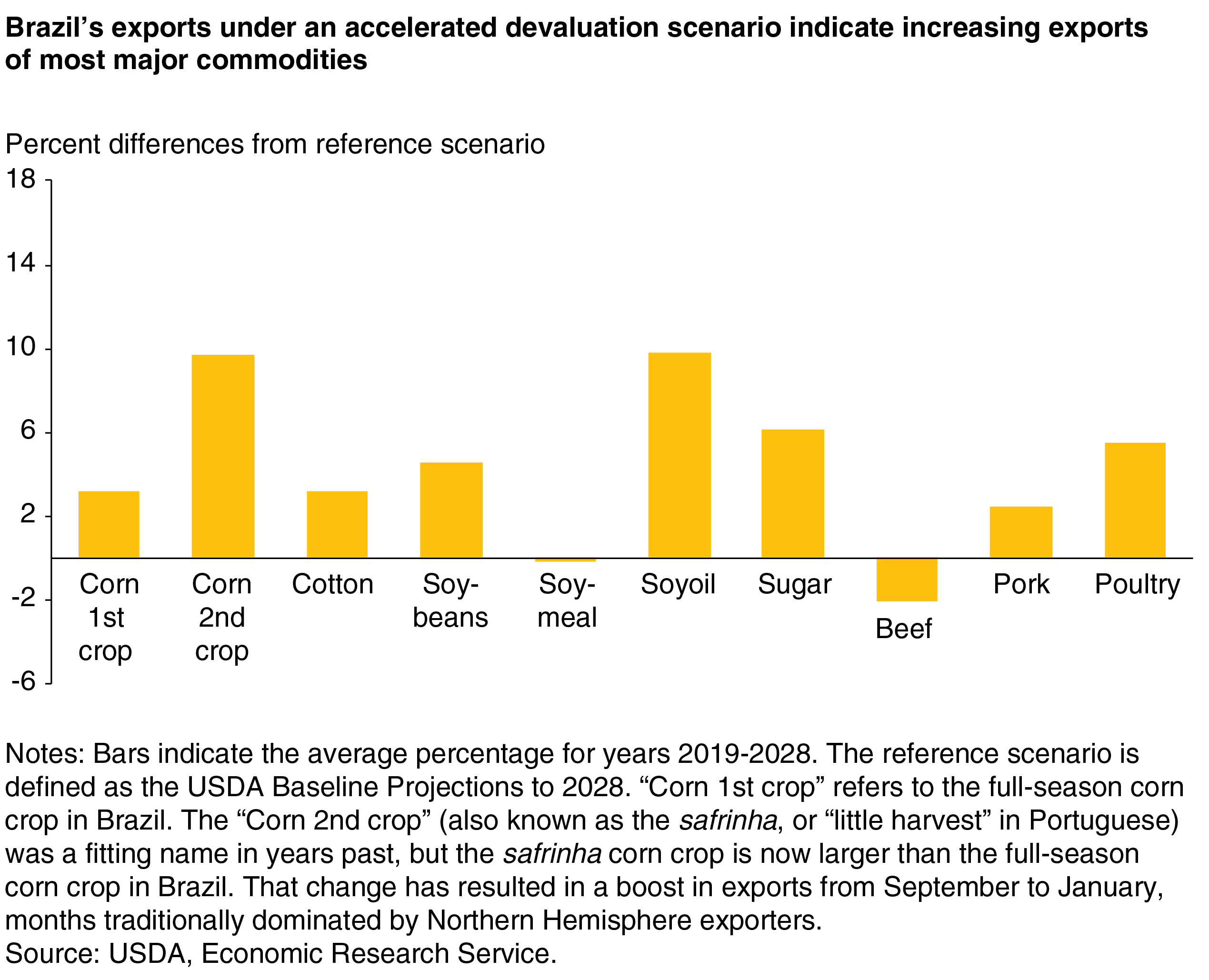

Two simulated macroeconomic scenarios (accelerated currency depreciation and sustained economic growth) are depicted in the figure and table below. Key findings from these scenarios show:

- Faster depreciation of the real could lead to even faster growth in Brazilian exports than projected in USDA’s 10-year projections. Simulations show Brazil’s exports of major commodities could be in aggregate 5.6 percent greater and international prices 2.7 percent lower by 2028, compared with USDA projections released in February 2020.

- Changes in net returns would divert cropland from sugarcane to soybeans and corn, yet a reduction in fuel imports would induce greater use of sugarcane to produce ethanol.

- Faster economic growth in Brazil would reduce its exports of beef and pork as domestic meat consumption would rise, narrowing the gap between red meat and chicken prices. Increased poultry exports, driven by the price competitiveness of the Brazilian product, reflect Brazil’s status as the world’s largest exporter of chicken meat. More Brazilian corn would be used as animal feed, and more soybeans would be processed to feed livestock. Corn exports would fall marginally, but soybean exports would not change substantially.

| Commodity | Exports in reference scenario, 2019-28 | Accelerated devaluation scenario, 2019-28 |

|---|---|---|

| Million metric tons | Percent change | |

| Beef | 2.5 | -2.1 |

| Corn | 39.5 | 12.9 |

| Cotton | 1.5 | 3.2 |

| Ethanol | 1.3 | -13.7 |

| Pork | 1.0 | 2.4 |

| Poultry | 5.5 | 5.5 |

| Rice | 1.1 | 8.3 |

| Soybeans | 80.2 | 4.5 |

| Sugar | 32.2 | 6.1 |

| Wheat | 0.8 | 3.1 |

| Source: USDA, Economic Research Service research results. | ||

Brazil’s Growing Presence in the Global Agricultural Market May Pose Stiffer Competition for U.S. Farmers

Macroeconomic policies have contributed to Brazil’s growing agricultural output and its emergence as a competitor for the United States in global agricultural markets, despite Brazil’s severe recession in 2014-16.

The combined actions of Brazilian farmers and the Brazilian Government’s agricultural and macroeconomic policies during the recession led to cropland expansion. This was accompanied by support programs and transportation projects that directly affected production and marketing costs, further enhancing Brazil’s export competitiveness. While extended periods of depreciation of the real have increased the competitiveness of Brazilian exports, other factors have also contributed to changes in the country’s agricultural markets. In particular, declining oil prices, rising demand for biofuels feedstocks, and changes in the macroeconomic conditions for Brazilian markets and competitors have influenced economic activity.

The results of the macroeconomic policy reforms show that the direction of Brazil’s exchange rate is an important determinant of its export competitiveness. Since Brazil is an important player in international markets, U.S. farmers producing competing products may face stiffer competition, potentially resulting in declining product prices and decreased U.S. commodity exports. USDA, Economic Research Service research results indicate that for Brazil, large areas of pastureland suited for agriculture remain, with further shifts in production patterns and increased yields projected to occur over the next few years. This would increase the sector’s ability to grasp export opportunities presented by the rising demand for feedstuffs in world markets.

COVID-19 Related Analysis of Research Findings Indicates the Country’s Economy and Agricultural Commodity Markets Remain Vulnerable

The COVID-19 crisis has abruptly reversed the 2017-19 economic recovery that was underway in Brazil. The country’s GDP is now forecast decline by 5.3 percent in 2020, with a concurrent reduction in domestic demand. Major concerns about the effects of COVID-19 on Brazilian agriculture have focused on how the pandemic would affect domestic grain and meat production, the rebound in domestic demand, and foreign demand for exported commodities. The health situation is threatening the recovery of per capita income as unemployment rises and economic activity in the manufacturing and service sectors decreases because of lockdowns. New demands from China regarding testing of meat products for the absence of COVID-19 will raise costs at Brazilian slaughterhouses. However, despite some disruptions at domestic and foreign ports, commercial agriculture has remained operational, and export activity in the first half of 2020 was robust, aided by a weaker currency (a 41 percent currency devaluation by June 2020, compared with a year earlier).

Future Brazilian agricultural export growth is tied closely to worldwide economic growth. The 2020 USDA baseline projected a long-term global trend growth in demand leading to greater demand for Brazilian commodities. With the Brazilian Government now providing higher domestic economic incentives to the agricultural sector in response to COVID-19, Brazil is expected to continue increasing its agricultural competitiveness over the next decade. However, the pandemic-induced domestic and global lockdowns and financial turmoil appear to have driven the Brazilian economy into a new recession of unknown contours—one that is accompanied by similar recessions across the globe. Consequently, the net effect of policy-driven measures to revive the economy and devalue the currency further are harder to assess and may be less successful than in the past because of reduced global demand.

This article is drawn from:

- Valdes, C., Hjort, K. & Seeley, R. (2020). Brazil's Agricultural Competitiveness: Recent Growth and Future Impacts under Currency Depreciation and Changing Macroeconomic Conditions. U.S. Department of Agriculture, Economic Research Service. ERR-276.

You may also like:

- Dohlman, E., Hansen, J. & Boussios, D. (2020). USDA Agricultural Projections to 2029. U.S. Department of Agriculture, Economic Research Service. OCE-2020-1.