Grocery Store Prices Rose for the First Time in 3 Years in 2018

- by Annemarie Kuhns

- 3/13/2019

Food, on average, is the third largest consumer spending category behind housing and transportation, and rising food prices can have a significant effect on consumers’ pocketbooks. Fluctuations in food prices may trigger changes in the foods consumers buy, and these demand shifts have implications throughout the U.S. food system—from the farmer to the grocery store and restaurant.

Typically, food prices increase year to year by varying amounts in response to the rising cost of some inputs used by farmers, food processors, and food retailers and eating places—such as energy (for farm machinery, product transport, and food processing), feed, packaging materials, and labor. The past few years, however, have proved an anomaly to historic trends. Average prices for foods purchased at grocery stores (food at home) fell 1.3 percent from 2015 to 2016 and 0.2 percent from 2016 to 2017. Furthermore, although food-at-home prices rose from 2017 to 2018, the increase (0.4 percent) was still well below the 20-year historical annual average rise of 2.0 percent. Falling prices in 2016 and 2017 reflected increases in farm production volumes, a strong U.S. dollar (which made imported foods and ingredients less expensive), and lower energy and oil prices.

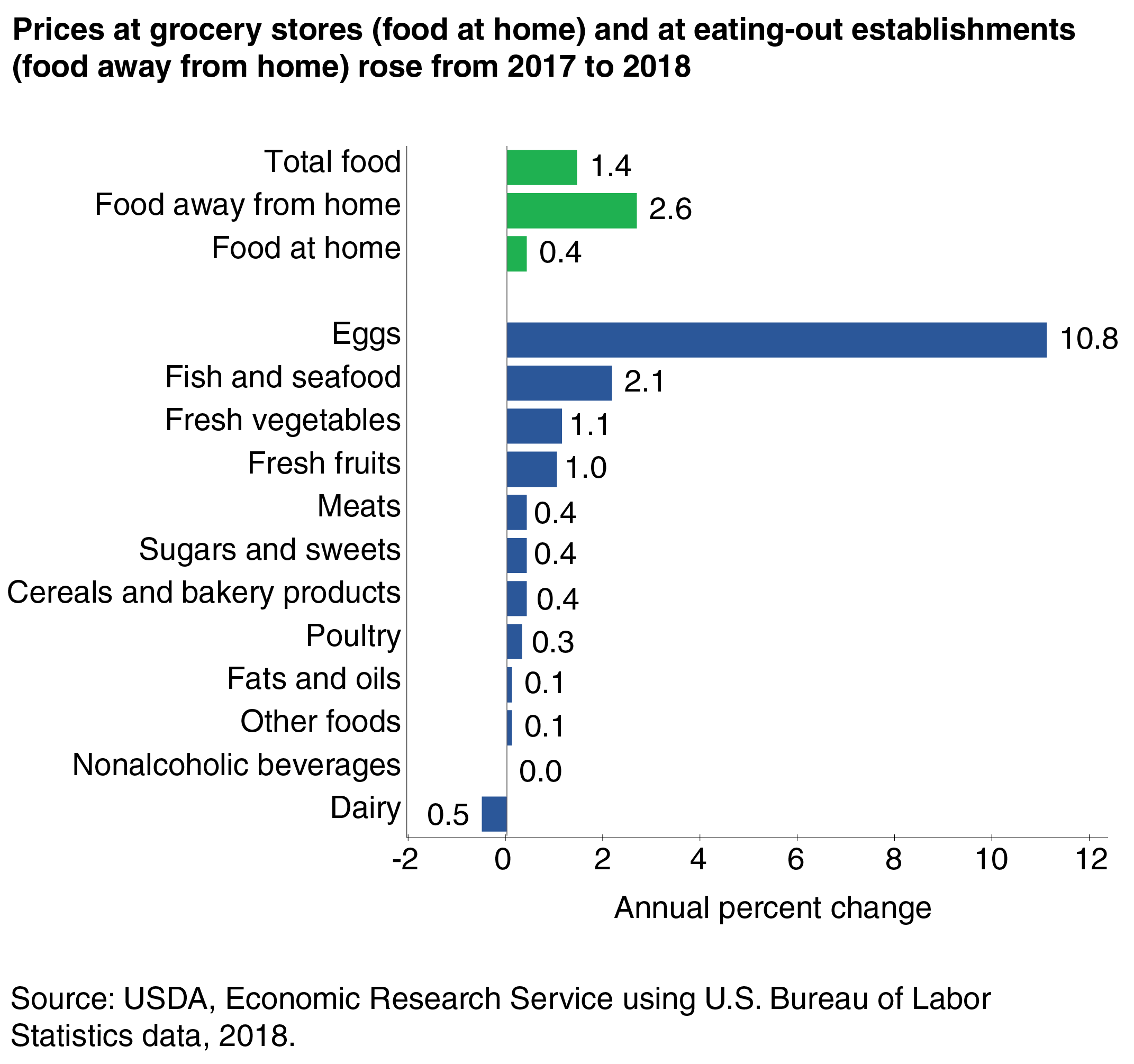

Although the average increase in food-at-home prices from 2017 to 2018 was moderate, increases varied across the grocery aisle. Prices for nonalcoholic beverages were flat in 2018, and prices for dairy products fell by 0.5 percent. The other major food categories all posted price increases. Increases were largest for eggs (10.8 percent from 2017) and fish and seafood (2.1 percent from 2017). These categories represent relatively small shares of the average American’s grocery basket. Prices for foods that consumers tend to spend more on rose at rates of 1.1 percent (as fresh vegetables did) or less. Prices for sugar and sweets, meats, and cereal and bakery products rose only 0.4 percent in 2018.

On the other hand, prices for foods purchased in restaurants and other food-away-from-home eating places rose 2.6 percent in 2018, after increasing in 2016 and 2017, as well. Food costs represent a smaller share of the prices consumers pay at eating places compared with grocery store prices. Labor costs—for cooks, servers, dishwashers, and other employees—make up a larger share of costs for eating places. Rising restaurant prices primarily reflected increases in labor and rental costs from 2016 to 2018.

This article is drawn from:

- Food Price Outlook. (n.d.). U.S. Department of Agriculture, Economic Research Service.

You may also like:

- Food Price Outlook. (n.d.). U.S. Department of Agriculture, Economic Research Service.