Consumer Demand for Fresh Fruit Drives Increases Across Sector

- by Travis Minor and Agnes Perez

- 4/2/2018

Fresh fruit availability, production, and imports are increasing. However, rather than seeing increased supply lead to depressed prices, strong consumer demand appears to be supporting healthy growth in the prices of fruit commodities as availability grows, according to ERS’s annual update of the Fruit and Tree Nut Yearbook.

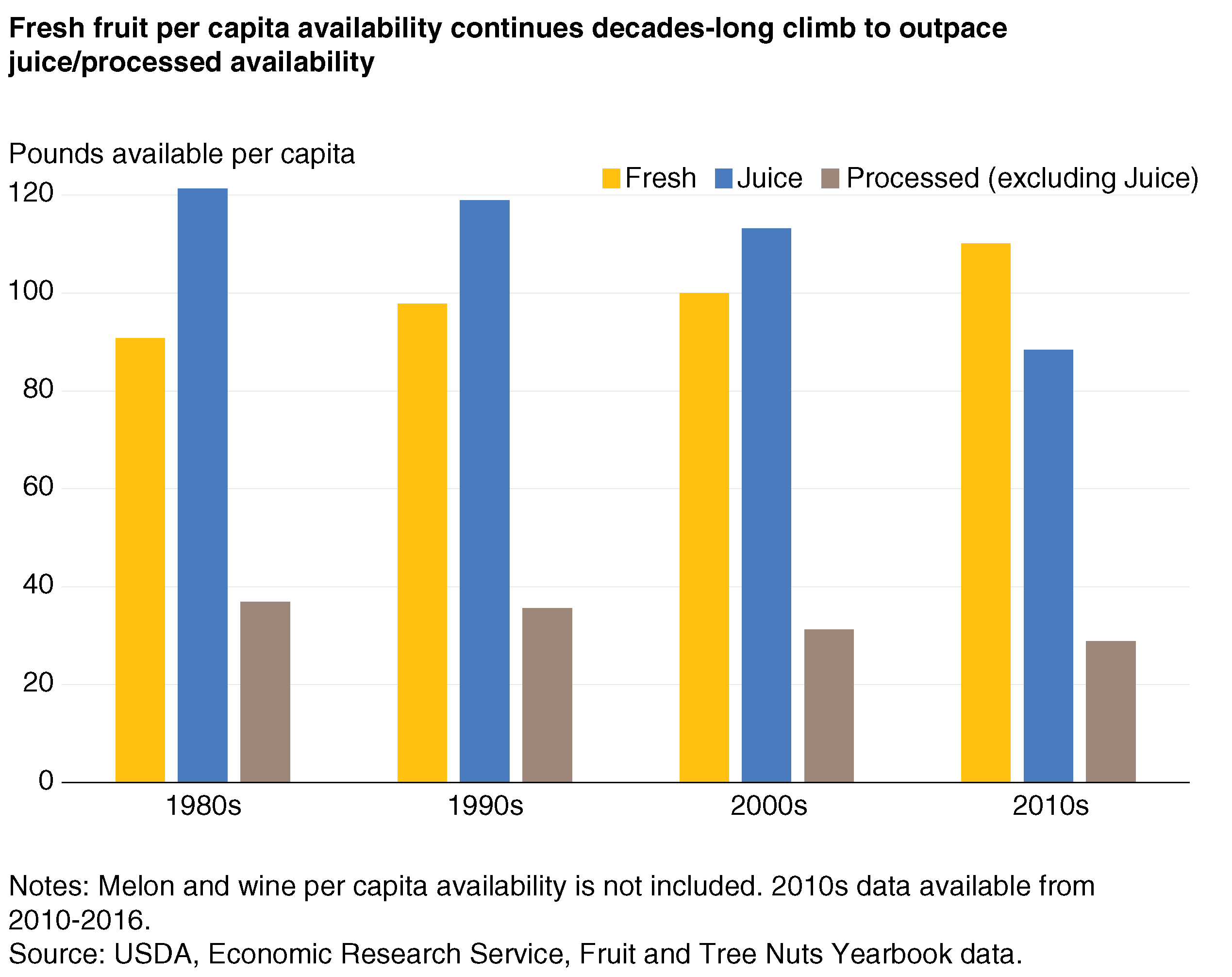

Decade averages show fresh fruit per capita availability increased by 21 percent over the past 40 years, from around 90 pounds in the 1980s to 110 pounds between 2000 and 2016. The opposite trend is seen in processed fruit and fruit-for-juice per capita availability, which has slowly declined over the decades. Since their relative peaks in the 1980s, availabilities for both processed fruit and fruit for juice have declined approximately 26 percent, to 29 and 88 pounds per person, respectively.

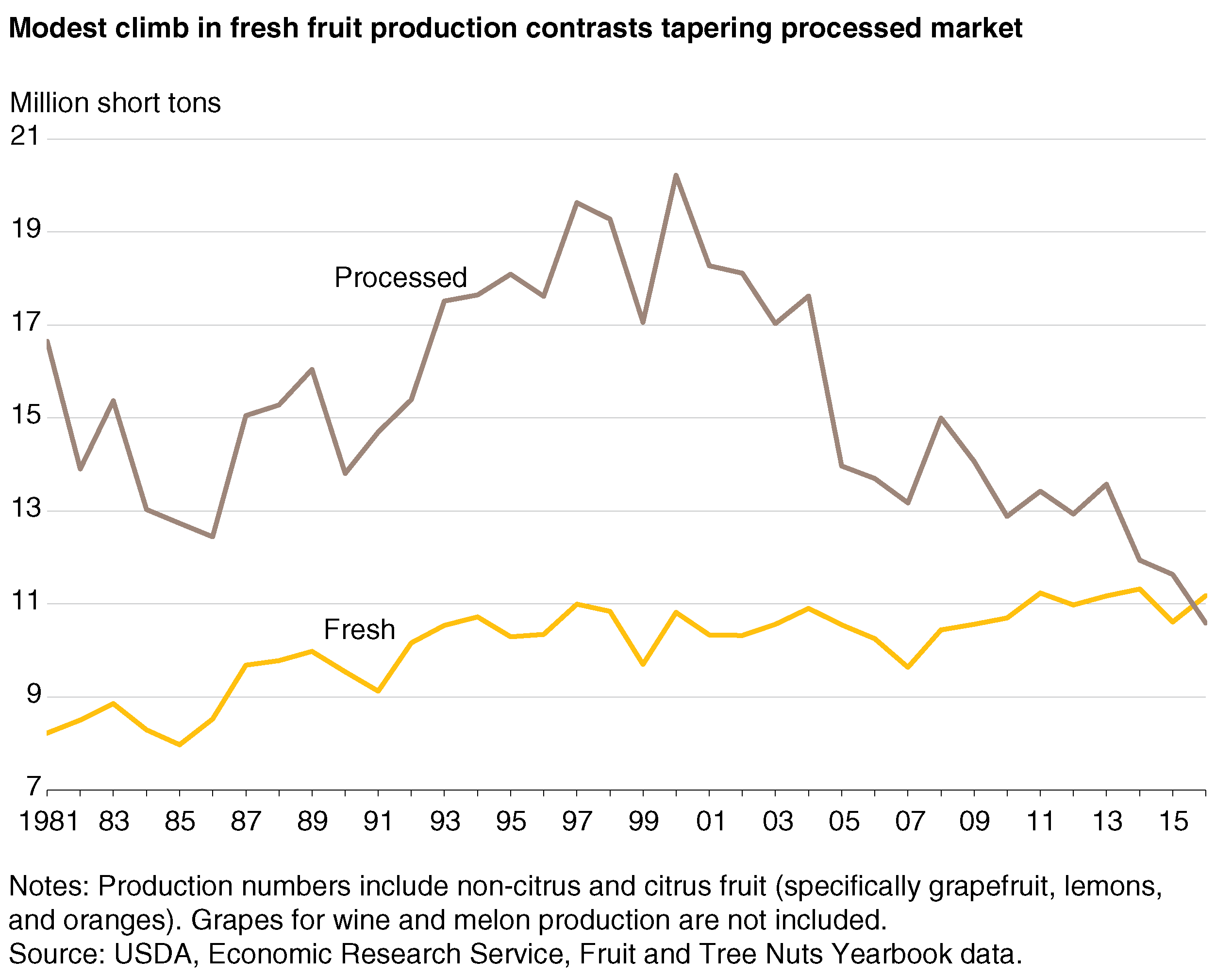

Domestic juice, processed, and even fresh-citrus production has been steady or slightly trending down since the 1980s. The growth through the mid-1990s was mainly driven by oranges for processing, traditionally around 50 percent, but falling to 35-40 percent in the most recent years. Citrus bearing acreage, mainly for processing, has been declining in Florida (focused mostly on the citrus processing sector) due to disease pressure (most notably citrus greening) and hurricane impacts. Over the same period, domestic production of fresh fruits, primarily driven by non-citrus production, has been modestly increasing, suggesting that the market may be shifting from processed to fresh preparations. Citrus bearing acres are also declining in California, which dominates U.S. fresh market citrus production, where some producers are switching to higher value crops, including tree nuts such as almonds.

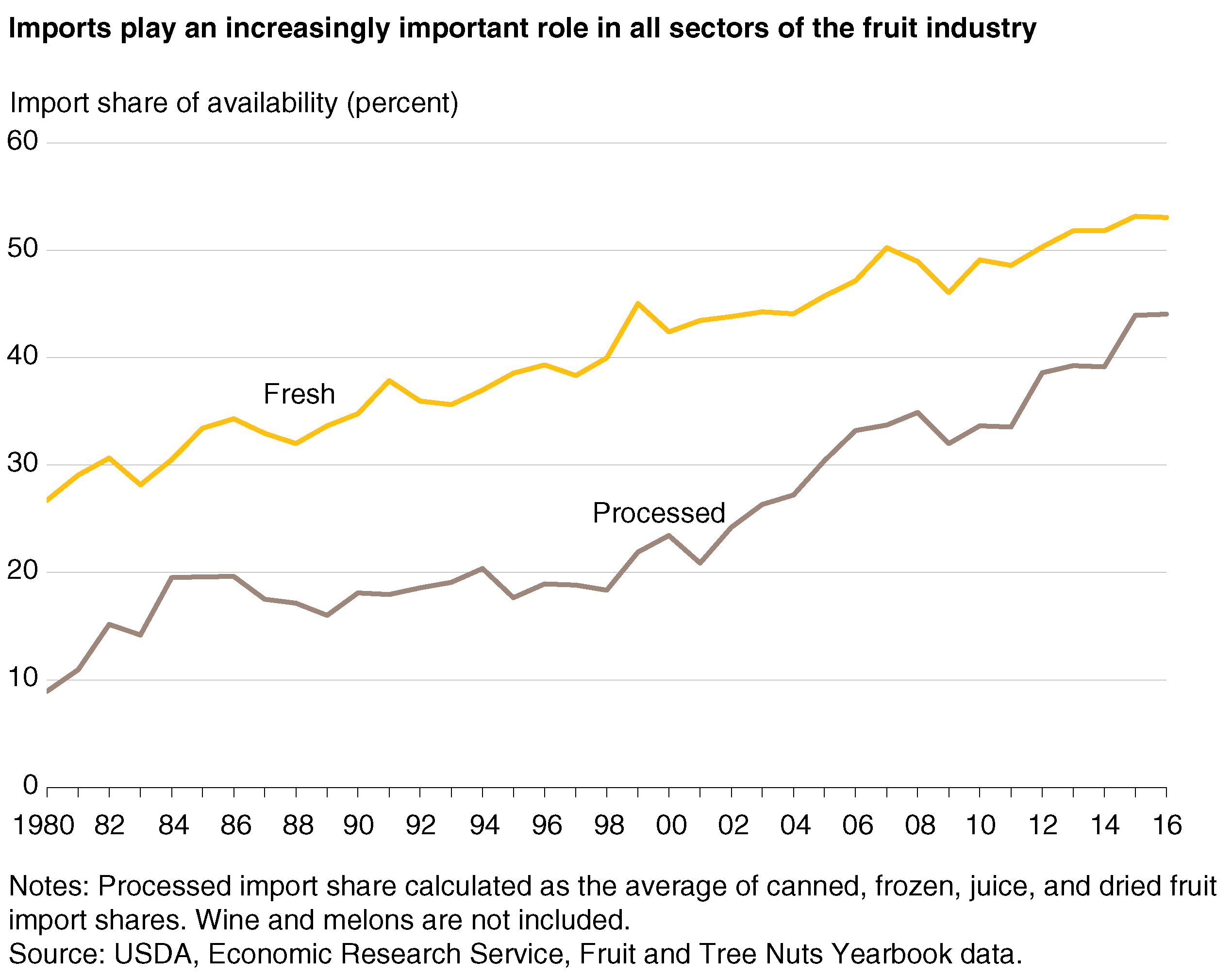

Trade plays an increasingly important part in both fresh and processed fruit markets. The United States imports more fresh and processed fruit than it exports. In 1980, fresh fruit imports were 27 percent of domestic availability, and processed fruit (excluding wine) imports were about 9 percent of domestic availability. By 2016, the import share of domestic availability nearly doubled, to over 53 percent, for fresh fruits and rose nearly fivefold, to 44 percent, for all processed fruits. Growth in both markets is partially explained by two phenomena. First, growth in counter-seasonal imports has expanded as southern hemisphere trade partners like Chile have become more export-oriented to satisfy U.S. consumer demand for year-round availability of popular fruits. Second, the North American Free Trade Agreement (NAFTA) opened up trade with Mexico, a significant U.S. supplier of fresh fruit. However, across all markets, strong, steady growth is observed even before the mid-90s, reflecting the long-term global trend of expanded agricultural trade. The export market for fruits, which may have been similarly impacted by NAFTA, has grown at a slower pace.

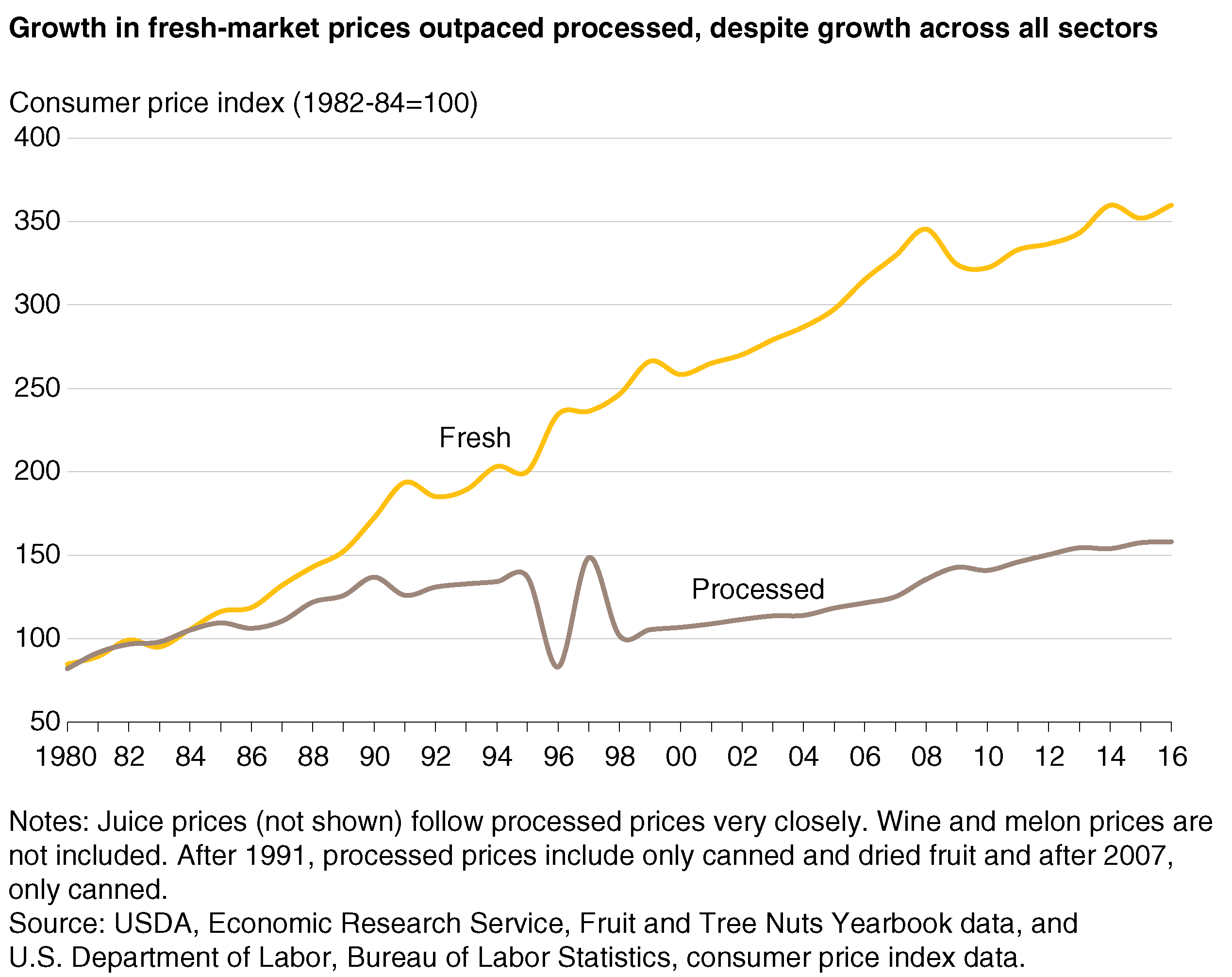

Prices in both fresh and processed fruit markets have been trending higher. Consumer prices of processed products (not adjusted for inflation) have doubled since the 1980s, while fresh market consumer prices more than quadrupled by 2016 from the average levels in the 1982-84 period. This substantial growth in the fresh market price, despite expanding supply, indicates that demand-side issues, driven by expanding consumer preferences, are driving this market forward. Yearbook data do show growth in exports of fruit, both fresh and processed, which are more modest than that of imports or consumer prices.

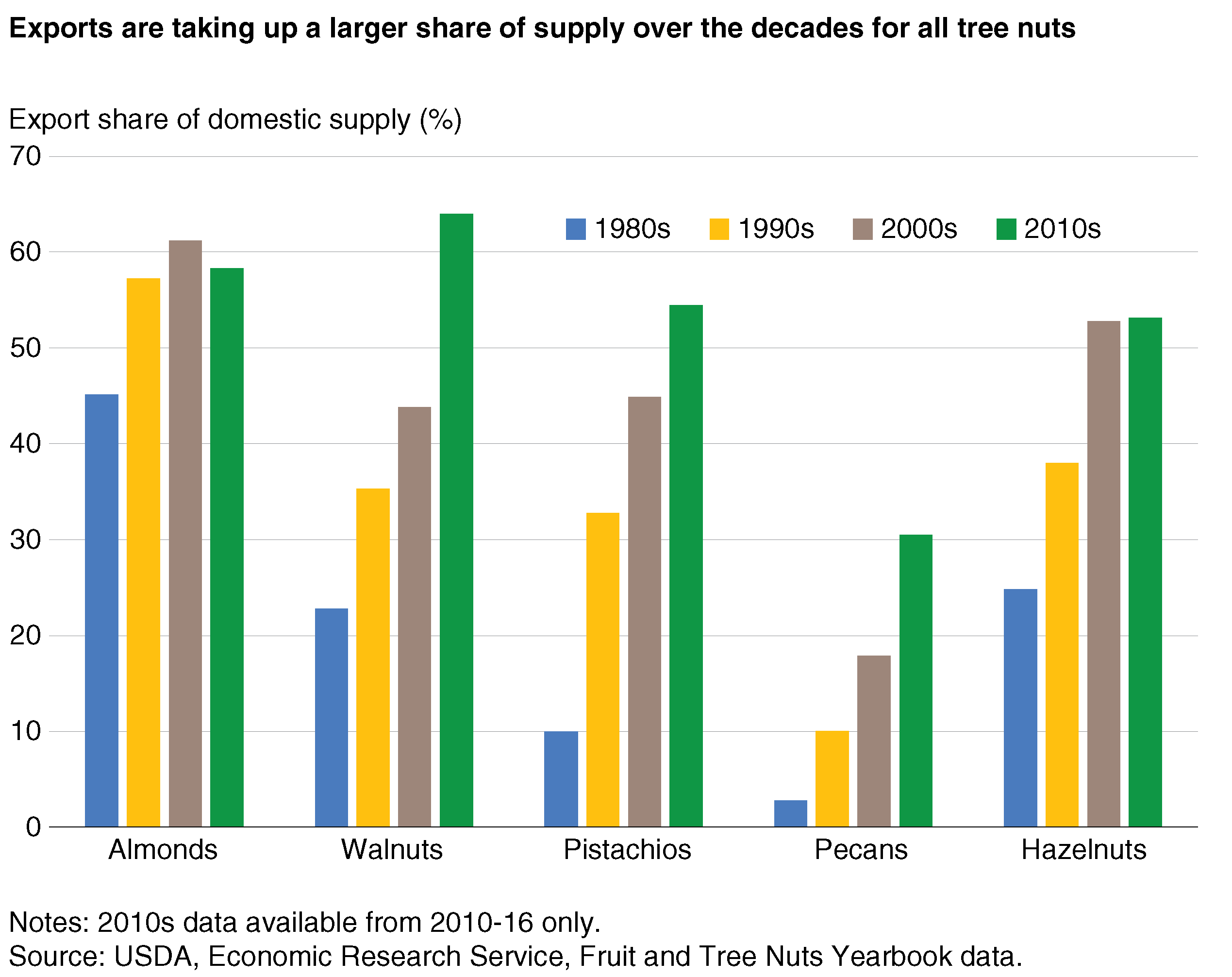

As it is with many other fruits, the United States is a net importer of melons, and imports have accounted for a growing share of domestic availability over several decades. Unlike the fruit sector, the U.S. tree nut industry (as a whole) is a net exporter. While almonds, produced mainly in California, have been exported at high levels for decades, many other tree nuts have expanded the share of domestic supplies sold on the export market. U.S. almond, walnut, pistachio, and hazelnut production is dependent on exports for more than 50 percent of sales, and pecan production has become more export-oriented as well. Expanding export demand has driven domestic grower prices higher, although record tree nut production in recent years has stabilized prices for most varieties.

For additional information about the topics discussed in this article, download the recently updated 2017 Fruit and Tree Nut Yearbook, which contains data specific to fresh fruit, processed fruit, melons, and tree nut markets. The data include estimates for fresh and processed fruits, including apples, bananas, oranges, strawberries, and many others. Data on melons and tree nuts, such as almonds, pecans, and walnuts, are also included in the yearbook. The yearbook data give analysts the ability to track long-term trends in all aspects of the market and observe changes over time.

This article is drawn from:

- Fruit and Tree Nuts Data - Fruit and Tree Nuts Yearbook Tables. (n.d.). U.S. Department of Agriculture, Economic Research Service.

You may also like:

- Bentley, J. & Perez, A. (2015, May 4). Fresh Fruit Makes Up a Growing Share of U.S. Fruit Availability . Amber Waves, U.S. Department of Agriculture, Economic Research Service.

- Perez, A. (2016, July 5). A Bigger Piece of the Pie: Exports Rising in Share of U.S. Apple Production . Amber Waves, U.S. Department of Agriculture, Economic Research Service.