Rural Manufacturing Survival and Its Role in the Rural Economy

- by Sarah A. Low

- 10/25/2017

Highlights

- Manufacturing is more important to the rural economy than to the urban economy.

- Rural manufacturing plants survive longer than urban plants, making rural areas better poised to retain manufacturing jobs.

- Access to financial capital is strongly associated with rural plant survival, while State and local tax rates may not be.

Manufacturing provides more jobs and higher earnings in rural areas than many other sectors, including agriculture and mining. Manufacturing is also relatively more important to the rural economy than to the urban economy.

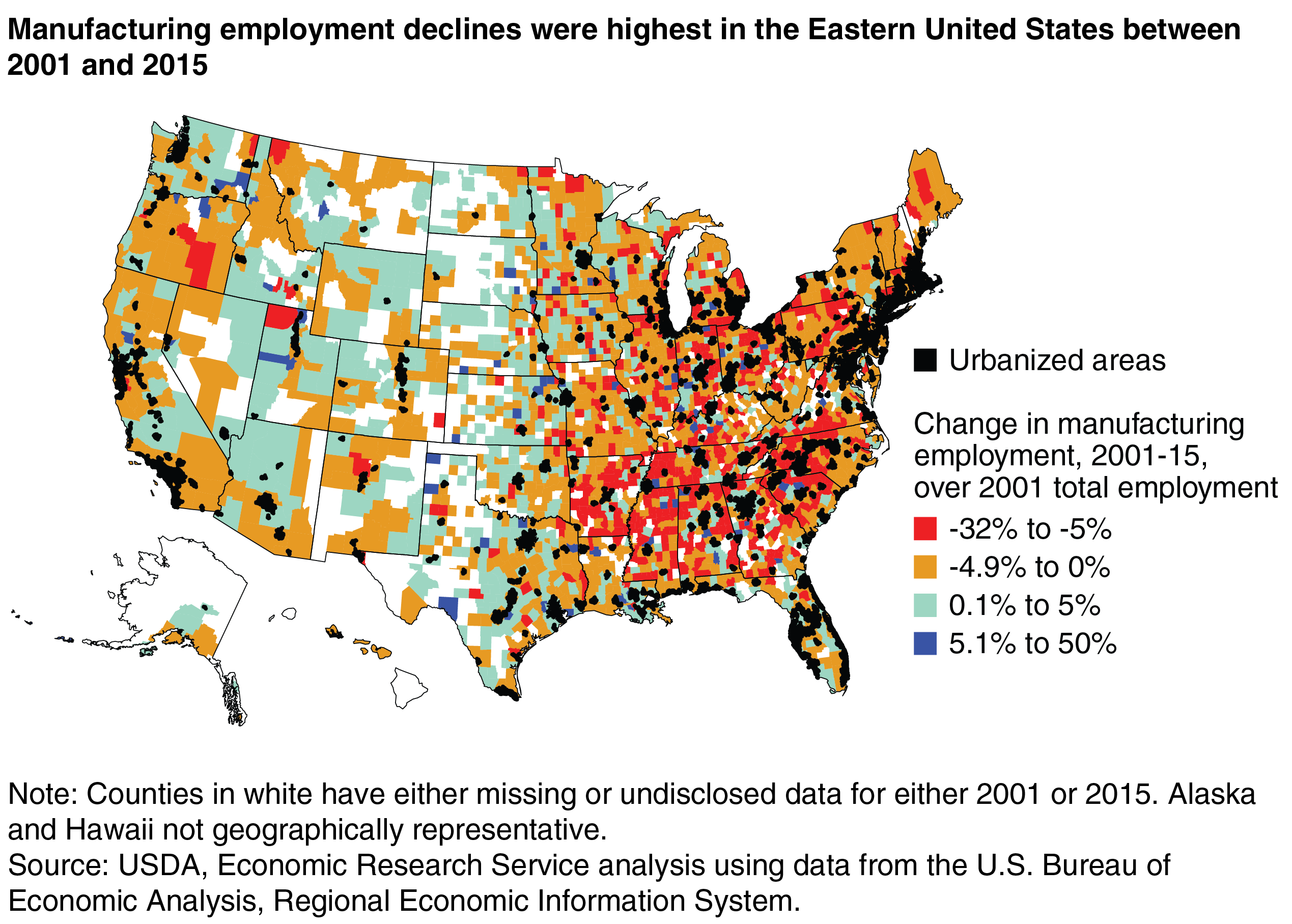

Between 2001 and 2015, a period that included the 2001 and 2007-09 recessions, manufacturing employment fell by close to 30 percent, however. Because of manufacturing’s prevalence in rural America, this decline hit rural areas disproportionately hard. A better understanding of the factors affecting the survival of rural manufacturing plants may help develop strategies to retain these jobs.

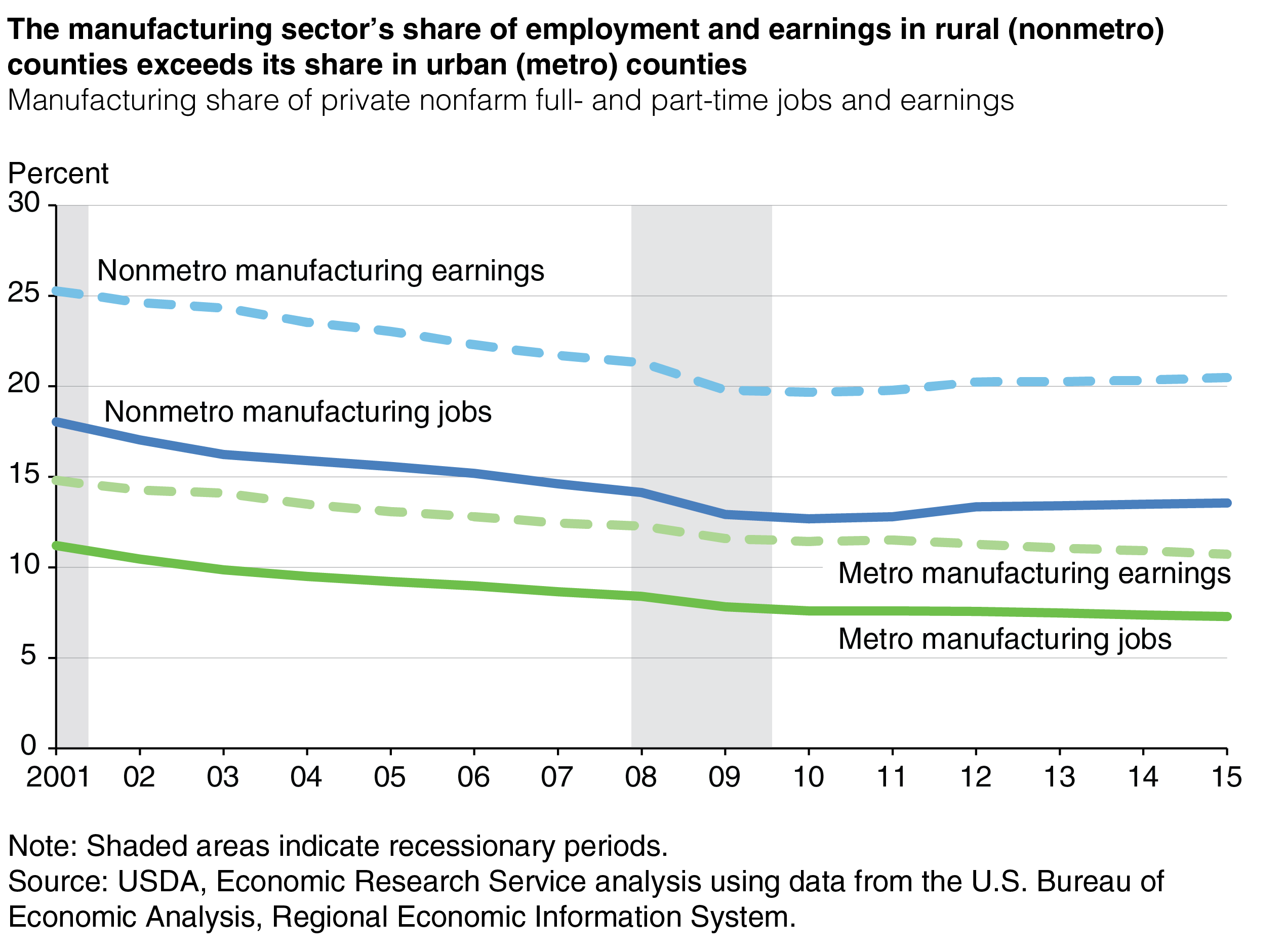

Manufacturing Remains an Important Source of Employment in Rural America

The manufacturing sector’s share of employment and earnings in rural (nonmetro) areas began to exceed its share in urban (metro) areas in the 1980s, when import competition forced domestic manufacturers to lower costs. Wages, property taxes, and land prices are generally lower in rural areas. And despite the sector’s declining employment share since the 1940s, manufacturing jobs still represented 14 percent of rural private nonfarm jobs in 2015 (compared to 7 percent for urban). As a share, manufacturing earnings are even more important to rural America. Manufacturing earnings represented 21 percent of rural private nonfarm earnings in 2015 (compared to 11 percent for urban).

Manufacturing provides a higher share of total jobs and total earnings in rural America than other sectors commonly associated with rural places: production agriculture and mining. In rural America in 2015, manufacturing jobs totaled 2.5 million, while farm jobs stood at 1.4 million and mining jobs (including oil and gas extraction) stood at 0.5 million. Rural earnings in 2015 included $158.1 million from manufacturing, $45.4 million from farming, and $37.3 million from mining.

Still, employment in “service” industries dwarfs manufacturing employment in rural America, at least at a national level. Indeed, manufacturing’s relative rural importance is due, in part, to the rural service sector not growing as quickly as the urban service sector. As demand for services grows, economic restructuring is altering job opportunities in rural areas. Producer services jobs (e.g., information, finance, insurance, real estate) numbered 3.7 million in rural America in 2015, while jobs in consumer services (e.g., healthcare, entertainment, food service) numbered 6.2 million, over a quarter of all rural jobs. By comparison, rural manufacturing employment was only a little larger than that of healthcare and social assistance, a component of consumer services. These rural totals mask variation across different areas; in some rural areas, manufacturing employment is dwarfed by farm employment or has become relatively less important as mining employment has grown.

Rural manufacturing is no longer the driver of job growth that it once was: 71 percent of U.S. counties experienced a decline in manufacturing employment between 2001 and 2015. Counties with the largest relative declines were concentrated in the Eastern United States, the traditional hub of U.S. manufacturing.

Globalization and rapid changes in technology have also changed the manufacturing sector. The Asian financial crisis in 1997 and the United States’ granting of Permanent Normal Trade Relations to China in 2001 facilitated investment in Chinese manufacturing plants. The implementation of the North American Free Trade Agreement in 1994 may have led to job losses in some labor-intensive industries. Additionally, labor-saving technological changes have affected manufacturing employment and will likely continue to do so. While assembly line production is still widely used in manufacturing, automation has reduced its importance, reducing total manufacturing employment and shifting employment composition in the sector toward skilled professionals.

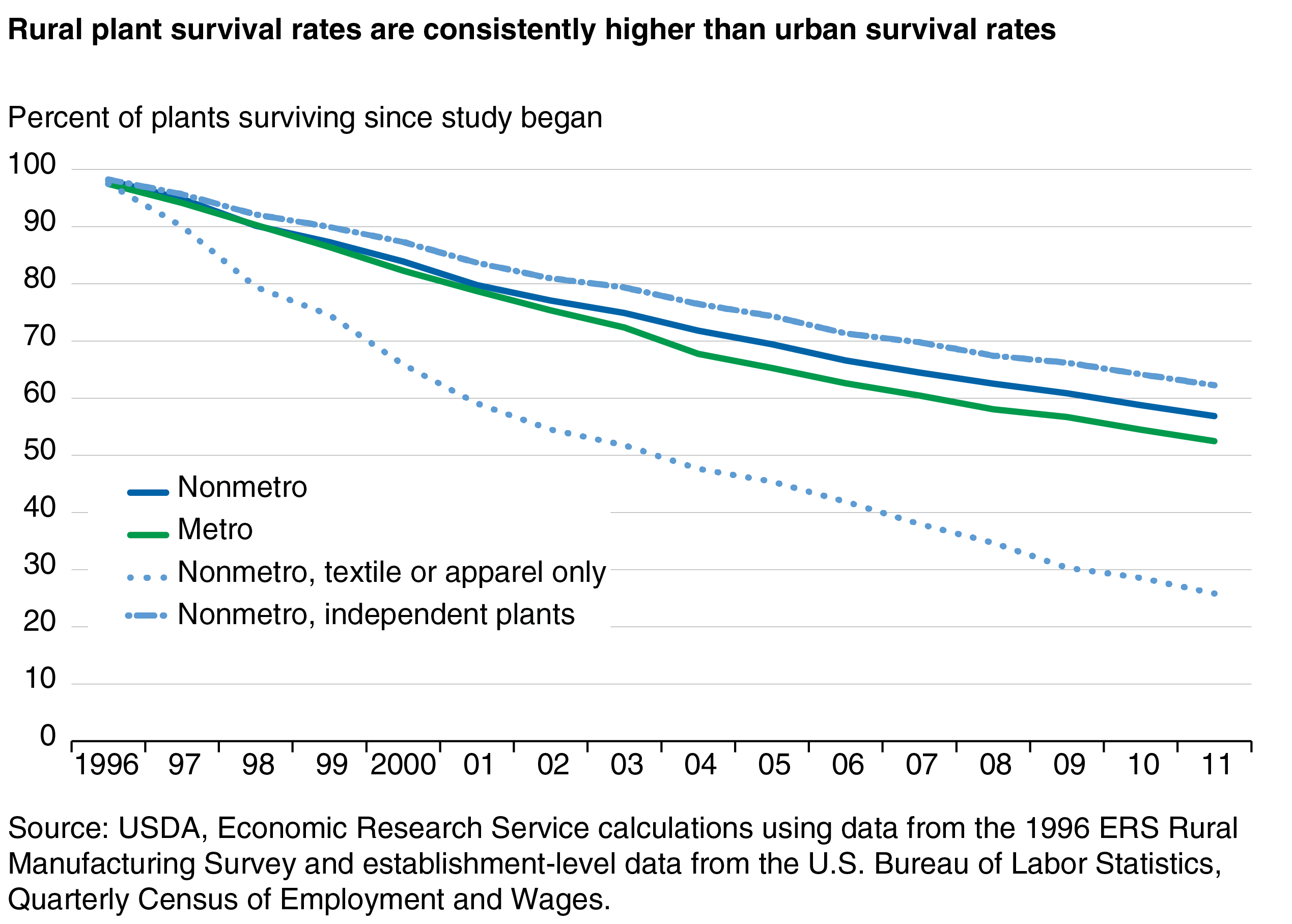

Rural Plants Survived Longer Than Urban Plants, 1996-2011

In many communities, the closing of a manufacturing plant can reduce local employment, earnings, and government tax revenue. To improve understanding of the factors affecting the survival of manufacturing plants, ERS studied manufacturing plant survival for a nationally representative sample of plants that responded to the 1996 ERS Rural Manufacturing Survey. ERS followed the plants quarterly until the end of 2011, if they survived that long. The study found that rural plants have a higher survival rate than urban plants. All else being equal, plants in urban counties were 23 percent less likely to survive than plants in rural counties.

Survival rates also varied by ownership structure: Overall, independent plants (single-unit plants with only one physical location) had a 59-percent survival rate over the 15-year period, while multiunit plants had a 50-percent survival rate. Independent plants located in rural counties had the highest average survival rate (62 percent). By comparison, urban and rural multiunit plants (plants part of a firm with multiple locations, such as branch plants or firm headquarters) had similar survival rates. This suggests that independent plants drove the rural survival advantage during the period of manufacturing decline and two recessions. That independent manufacturing plants were more likely to survive the broader economic shocks occurring over the study period could be due to their being more likely to have close ties to the community. Multiunit plant survival was more unpredictable, likely because multiunit plants are affected by decisions made at a distant headquarters that apply to all its plant locations.

While survival rates did vary some by industry, they were significantly lower only for textile and apparel manufacturing industries. In rural America, textile and apparel manufacturing plants had a 26-percent survival rate between 1996 and 2011—while rural plants, overall, had a 57-percent survival rate. Textiles and apparel were hard-hit during the study period, in part due to trade-related policy changes and automation.

Among rural independent plants, smaller plants and plants outside the South were more likely to survive, all else being equal. For example, a rural independent plant with 100 employees was 9 percent more likely to survive than a similar plant with 200 employees. Compared to plants in the South, those in the West were 34 percent more likely to survive; those in the Midwest, 36 percent more likely to survive; and those in the Northeast, 41 percent more likely to survive. Other studies have also documented this Southern “disadvantage.” One possible positive interpretation of this result is that during the study period, less-efficient independent plants in the South were shutting down as the sector became more flexible and modern (an economic concept known as creative destruction).

A recently released Congressional Research Service report concluded that policies promoting new manufacturing plants may be less effective at preserving or creating manufacturing jobs than policies aimed at retaining or expanding existing manufacturing plants. The report found that most employment growth in the sector comes from existing plants. In 2014 (the most recent year available), plant startups and shutdowns—called churn, often used as a metric of creative destruction or entrepreneurship—were at their lowest since records began being compiled in 1977. The number of U.S. manufacturing plants also declined by one-quarter between 1996 and 2014. Furthermore, recent research shows that relatively few manufacturing plants move to new States. These factors—few startups, many plant closings, and little plant mobility—may be driven by the high capital costs associated with running modern manufacturing plants.

Access to Financial Capital Is Strongly Associated With Rural Plant Survival

Industrial recruitment policies, such as providing tax incentives to recruit a plant to a locale, have long dominated U.S. economic development practice despite frequent criticism by researchers. Recruitment leads to immediate, tangible results. An alternative economic development strategy, encouraging entrepreneurship and innovation (or otherwise improving existing firms), has slower and/or less visible results. Other popular strategies for retention and growth of existing businesses include increasing access to financial capital and technical assistance.

In rural areas, the 1996 ERS Rural Manufacturing Survey found that 26 percent of independent manufacturing plants and 18 percent of multiunit manufacturing plants reported that access to financial institutions was a major or minor problem. The same survey found that 15 percent of rural, independent plants and 13 percent of rural, multiunit plants indicated that obtaining sufficient capital was a major problem impeding the implementation of plant improvements. Compared to plants indicating that access to capital was only a minor problem or not a problem, independent plants indicating it was a major problem were 91 percent and multiunit plants 31 percent less likely to survive (all else being equal). Because these results are based only on perceptions in 1996, they can only suggest that improving access to capital can help improve plant survival prospects. More research is needed to establish whether that is the case; this would necessitate collecting data on financial capital obtained by individual manufacturing plants.

State and local tax incentives, a common industrial policy incentive, were perceived to be very important over the 3 years prior to the 1996 ERS survey by 18 percent of independent plants and 23 percent of multiunit plants. An additional 23 percent of independent plants and 36 percent of multiunit plants indicated that State and local tax incentives were somewhat important. Moreover, 25 percent of independent plants and 18 percent of multiunit plants indicated that State and local tax rates were a major problem for their ability to compete. However, neither the perception that tax rates were a major problem nor that tax breaks were important correlated with plant survival in the analysis. This result could imply that tax incentives have no effect on survival, but the result could also imply that there is an effect, but it is small and/or masked by statistical or other methodological issues.

The financial investment necessary for operating modern manufacturing plants may be reducing manufacturing plant churn. The amount of financial capital needed to start up a manufacturing plant is higher than the investment necessary to start up many other types of business. Furthermore, once in operation, the investment made is an incentive to stay open—particularly in rural areas where there are fewer opportunities to reuse a plant’s infrastructure. Although technology has increased the possibility of banking at a distance, reduced contact between lenders and rural borrowers puts rural businesses at a disadvantage. It is this commercial credit market-failure that is the justification for policies oriented toward increased access to financial capital for rural businesses.

Conclusion

It may be difficult to reverse the decline in manufacturing employment in communities that have lost a plant. But research suggests that strategies aimed at retaining and/or expanding existing plants may help. More research into the actual (rather than perceived) effectiveness of strategies such as financial capital availability programs could help inform policy decisions.

Errata: On October 25, 2017, this article was reposted to correct issues in the second and third paragraphs. The decade of the manufacturing sector’s employment share decline commencing was corrected from the 1950s to the 1940s.

This article is drawn from:

- Low, S.A. (2017). Rural Manufacturing Resilience: Factors Associated With Plant Survival, 1996-2011. U.S. Department of Agriculture, Economic Research Service. ERR-230.

- Low, S.A. (2017). Rural Manufacturing at a Glance, 2017 Edition. U.S. Department of Agriculture, Economic Research Service. EIB-177.

- “Manufacturing Plant Survival in a Period of Decline”. (2017). by Sarah A. Low and Jason P. Brown, Growth and Change, Vol. 48, Issue 3, 297-312.

You may also like:

- “Regional Business Climate and Interstate Manufacturing Relocation Decisions,” by Tessa Conroy, Steven Deller, and Alexandra Tsvetkova. (2016). Regional Science and Urban Economics, Vol. 60, 155-168.

- “Job Creation in the Manufacturing Revival”. (2017). by Marc Levinson, R41898, Congressional Research Service.

- Business Dynamics Statistics. (2014). U.S. Census Bureau.