Mergers and Competition in Seed and Agricultural Chemical Markets

- by James M. MacDonald

- 4/3/2017

Highlights

- Under recent merger proposals, the six global firms that dominate private agricultural chemical and seed research and production would be reduced to four.

- The mergers are subject to antitrust review in both the United States and the European Union.

- The antitrust reviews will evaluate the likely effects of the mergers on specific seed and agricultural chemical markets, prices, and innovation.

Agriculture in the United States uses less land, and far less labor, today than it did in the 1940s. Yet agricultural production grew by 169 percent between 1948 and 2013, with nearly all of it due to improvements in productivity. Biological, mechanical, chemical, and organizational innovations from both public and private sector investments in research and development (R&D) have largely driven this productivity growth.

Private-sector research has focused primarily on seeds, crop-protection chemicals, and farm machinery. A handful of global firms (known as the “Big Six”) dominate private-sector research on both seeds and crop-protection chemicals: BASF and Bayer, from Germany; the U.S. firms Dow Chemical, DuPont, and Monsanto; and the Swiss firm Syngenta. Each firm combines pest control and seed businesses. Their pest control products consist primarily of chemical pesticides, but also include biological products and seed treatments. The seed businesses include sales of crop seeds, as well as genetically modified seed traits placed in their own seeds or licensed to other seed firms, and tools for genetic modification, which can also yield fees when licensed to other firms.

| Company | Country | 2015 sales: Seeds and biotech ($ millions) |

2015 sales: Agricultural chemicals ($ millions) |

Proposed merger partner |

|---|---|---|---|---|

| BASF | Germany | Small | 6,211 | None |

| Bayer | Germany | 819 | 9,548 | Monsanto |

| Dow Chemical | U.S. | 1,409 | 4,977 | DuPont |

| DuPont | U.S. | 6,785 | 3,013 | Dow Chemical |

| Monsanto | U.S. | 10,243 | 4,758 | Bayer |

| Syngenta | Switzerland | 2,838 | 10,005 | ChemChina |

| Note: BASF does not separately report seed sales, placing them under an “other” category. Source: USDA, Economic Research Service using data from Company Annual Reports. |

||||

Recently proposed mergers promise to change the industry. In December 2015, Dow Chemical and DuPont proposed to merge with the intention of later separating their combined agriculture, materials science, and specialty products businesses into three independent and specialized corporations. In February 2016, the State-owned Chinese company ChemChina offered $43 billion to acquire Syngenta. Several months later, in September 2016, Bayer proposed to purchase Monsanto for $66 billion. These mergers would transform the “Big Six” into the “Big Four.”

Each merger is subject to review by antitrust authorities in the United States and the European Union; those reviews, and the financing requirements of the transactions, can slow their completion. Dow and Dupont executives met with the EU competition authority again in March 2017, and stated that their merger would be completed by August 2017. A Syngenta spokesperson gave a similar target date. Bayer expects to complete its acquisition of Monsanto late in 2017.

The antitrust investigations focus on two major concerns about the potential impact of the mergers on competition in chemical and seed markets. First, would the mergers reduce competition in sales of seed and chemical products so that surviving firms could raise prices for these products? Second, would the mergers reduce competition in research, leading surviving firms to reduce investments in R&D and therefore generate fewer innovations in the future? These issues are of interest not only to antitrust agencies, but to farmers, rival producers, and investors.

Background

The “Big Six” emerged in the 1990s and early 2000s, arising from mergers among large chemical, pharmaceutical, and seed companies as well as from their acquisitions of many smaller seed and biotechnology companies. At the time, the future of integrated life sciences companies promised to use new developments in biotechnology to support work in human pharmaceuticals, seed genetics, and agricultural chemicals. That vision did not reach fruition, as the pharmaceutical businesses later separated from the seed and agricultural chemical businesses.

The present Big Six firms combine seeds with agricultural chemicals, and may benefit from linking research and marketing efforts for their seeds and chemicals. Genetically modified seeds, for example, affect chemical use—either by substituting seeds for chemicals (as in the case of insecticides) or by encouraging the use of specific herbicides (as in the case of genetically modified herbicide-tolerant seeds). This close relationship may encourage combination and linked pricing of seeds and chemicals.

Mergers and Industry Competition

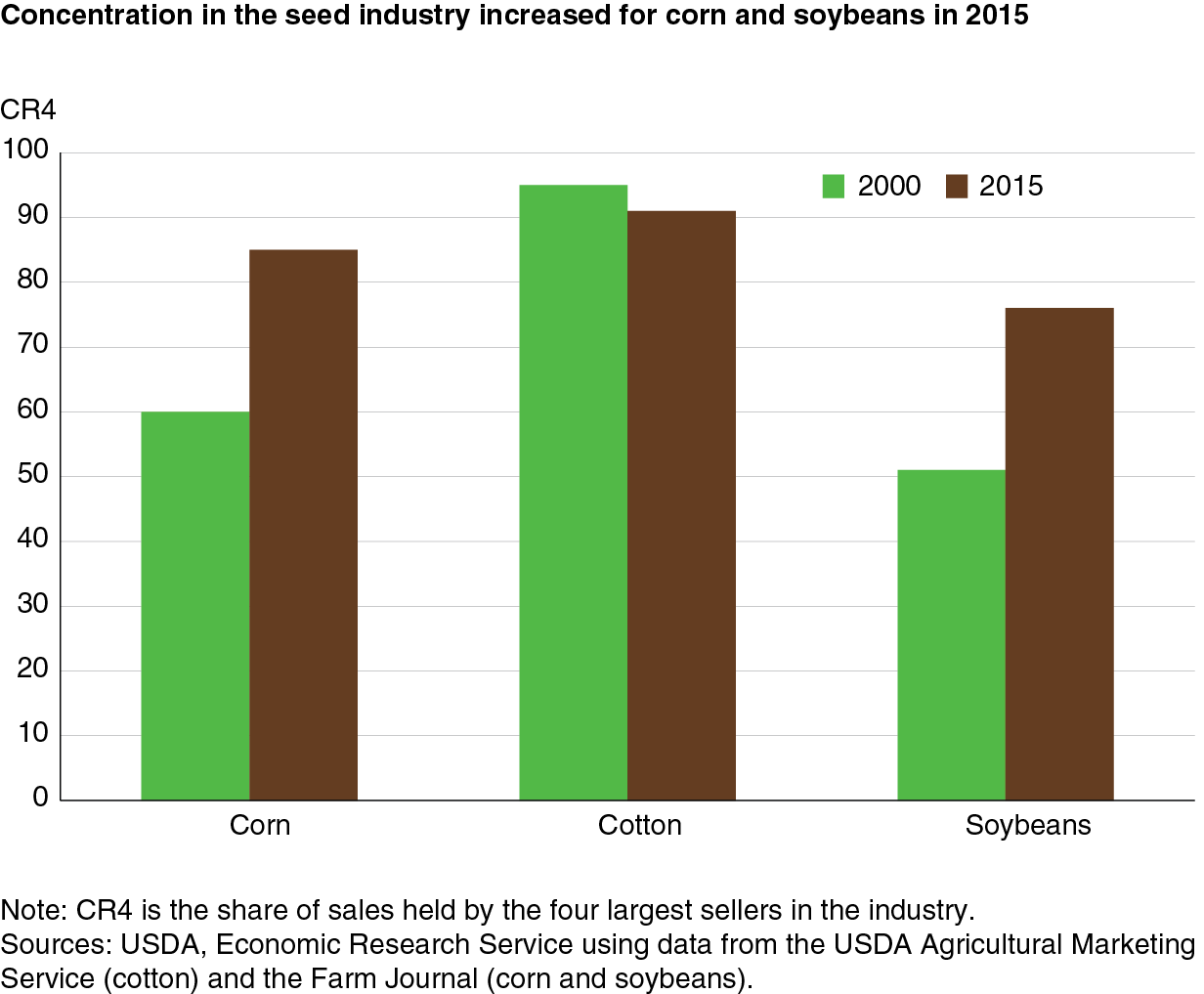

Many specific chemical and seed markets are already highly concentrated and grew more concentrated during the formation of the Big Six. For example, the largest four sellers of corn seed accounted for 85 percent of U.S. corn seed sales in 2015, up from 60 percent in 2000, while soybean sales from the largest four sellers rose from 51 to 76 percent, according to data from the trade publication Farm Journal. In cotton, the share fell from 95 percent in 2000 to a still quite high 91 percent, according to USDA data. Monsanto and Bayer are the two largest sellers of cottonseed, so the merger would make that industry noticeably more concentrated. The effects of the merger on corn and soybean markets would be much smaller, since Bayer does not have a major presence in them. The Dow-Dupont combination would likely raise concentration in some specific chemical markets.

The mergers raise questions about competition in pricing and in research. This is different than in many other agricultural markets, such as meatpacking, milk processing, or grain transportation, where merger-related competition concerns focused heavily on pricing. For example, the largest four buyers of fed cattle handled 80 percent of all U.S. purchases in 2008, when the Nation’s third largest meatpacker, JBS Swift, proposed to acquire National, the fourth largest. The issue in that case focused on the likely effects on prices paid for cattle. The U.S. Department of Justice, in successfully opposing the merger, argued that it would reduce the number of buyers in most regional markets from four to three, and from three to two in some. While prior research found a limited impact of concentration on cattle prices, the Department argued that increased concentration in already highly concentrated markets would allow packers to pay lower prices to acquire cattle.

Similarly, the 1998 acquisition of Continental Grain’s U.S. facilities by Cargill attracted antitrust scrutiny because of the possibility that increased concentration in port elevators would lead to reduced prices paid for export grain. Mergers among freight railroads in the 1990s raised concerns that higher concentration would lead to higher rates for the transport of grain, coal, fertilizer, and other commodities. In the meatpacking and transportation mergers, the issues concerned markets with only a few firms (two, three, or four), in which a merger would remove a competitor—and the likelihood that the merger would then allow remaining firms to raise prices for their services or to reduce prices for products that they purchased.

Pricing issues also arise in the recent chemical/seed mergers. The firms compete in many different national and regional markets for specific chemicals and seed varieties. In some, the mergers would reduce the number of sellers in markets that already had few competitors, while in others, the mergers would have little effect on concentration, because the market had many sellers or because the merging firms did not compete in the market.

At low levels of concentration, when they face many competitors, firms have little control over prices. If a single firm attempts to raise the price for its seeds or chemicals, farmers would be able to quickly switch to rival sellers, and the firm would lose so much business that the price increase would result in reduced revenues and profits. However, at higher levels of concentration, with only a few rivals in a market, farmers have fewer alternatives if a seller raised seed or chemical prices. Moreover, those few rivals might likely draw the conclusion that each could benefit if they all raised prices. In that case, the only protection that farmers might have against price increases would be the threat of entry, most likely by another chemical/seed company in a related product line, in response to the profits provided by higher prices.

If new firms were to enter a market, that would provide farmers with alternative sellers and would restrain incumbent firms from raising prices after a merger. Entry by new competitors into a market is easier (less costly) if they can produce for the market from existing facilities instead of building new ones. It is also easier if they can quickly develop distribution networks—by contracting with existing networks—than if they have to develop their own from scratch. It’s easier to enter into rapidly growing markets, and entry is easier if farmers can quickly switch their purchases to entrants, because they are not constrained by existing long-term contracts or by technical ties to existing products.

In the 1960s and 1970s, antitrust agencies focused heavily on concentration as a sufficient indicator of market power. That is, increases in concentration beyond some relatively low threshold could be expected, with a high degree of confidence, to lead to price changes irrespective of other market factors.

Policy has since changed sharply, based in part on economic analyses of competition in markets. While concentration still matters, it alone is no longer considered to be a sufficient indicator of market power. Other factors, such as the ease of rival entry and the ease with which buyers can switch their purchases among sellers, now matter as well. Moreover, the concentration levels that attract scrutiny are considerably higher than they were in the past. Mergers today are likely to attract antitrust concern if they lead to a reduction of four sellers to three, three to two, or two to one. They may attract antitrust action in some less concentrated markets (six sellers to five, or five to four), if other factors, such as high barriers to entry or high costs to buyers switching among sellers, support market power among the sellers.

Competition, Research Investments, and Innovation

The links between competition, investments in research, and innovation are more complex because intense competition may dissuade investments in research. Major innovations usually require substantial investments in R&D, and often take many years before being brought to market. In highly competitive industries, where there are many rivals, an innovator may not be able to earn enough from the innovation to recover R&D investments because rivals can quickly copy the innovation and apply it themselves. Rivals can obtain the knowledge needed to copy an innovation by hiring key employees away from an innovator, by reverse-engineering an innovator’s product, and by accessing the same broad scientific information that supported the original innovation. If they realize that imitation is easy, potential innovators are unlikely to make the investment.

Governments aim to forestall this effect of competition on innovation through patent policy. A patent provides the holder with a temporary monopoly on the use of a new technology expressly to prevent competition during the life of the patent. This gives the innovator an opportunity to appropriate the returns to a successful new innovation, providing greater incentives to invest in R&D while encouraging innovation.

Just as patents limit competition, firms in concentrated industries may be more likely to invest in research because they can appropriate more of the returns from an innovation: with few rivals, they face limited possibilities of imitation and a greater likelihood of recovering their investment in research. These industries are sometimes highly concentrated precisely because there are economies of scale in production or in distribution that make it very difficult for new rivals to enter, or for existing rivals to expand quickly. Indeed, much private agricultural R&D is done in concentrated industries with a relatively small number of rivals.

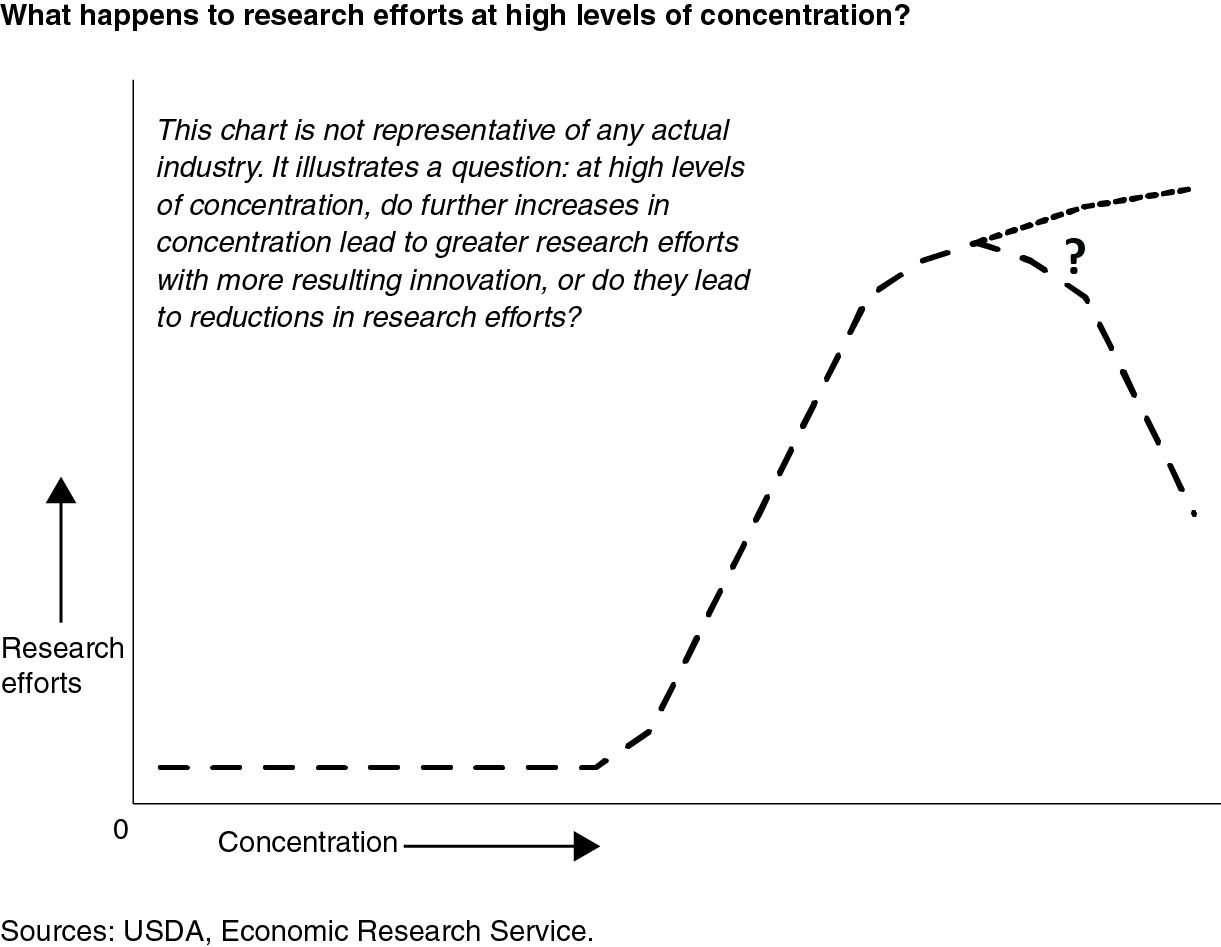

Firms may be more likely to invest in R&D if they are in industries with a few large rivals. But will they do more R&D, and create more innovations, if there are even fewer rivals? Will a merger that reduces the number of rivals from six to four lead to more innovation? If that’s the case, would further consolidation, to two firms or just one, lead to even more innovation? After all, a monopolist—a single seller—could count on realizing all of the returns to an innovation.

There is good reason to think that increases in concentration do not persistently lead to greater incentives to innovate; rather, beyond some high level of concentration, further increases could actually reduce the incentive to innovate. That is, the relation between competition and innovation might be “hump-shaped.”

While firms without close rivals can capture the returns on their innovations, they might have limited incentive to invest in R&D and innovation. New products could attract sales away from their own existing products, rather than from rivals, so the net returns to an innovation may be lower. Moreover, at high enough levels of concentration, firms have little fear of a rival scooping them with a new product or process, and therefore feel less need to invest in research to protect their market position and stay ahead of their competition.

In concentrated and innovative industries, firms have existing products and economic profits associated with them. They invest in research partly to protect their existing positions, and also to give themselves a chance to leap ahead of rivals with a major new innovation. Actions that reduce the number of rivals, thereby reducing research competition among rivals, can reduce firms’ incentives to invest in research and innovation.

The reasoning cited above relates to the benefits that firms expect to realize from investing in innovation. But issues of cost also arise. Two scientists working for the same firm and sharing ideas may be more effective than two scientists working at competing firms, especially if coordination can help them avoid duplicating each other’s work. However, having many scientists working for the same firm may be less effective than splitting them into several smaller firms, if different firms encourage dissimilar approaches among their R&D staff. In short, there may be economies of scale in research up to a certain size, so that larger R&D teams may be more effective, but diseconomies of scale at very large sizes.

U.S. antitrust enforcement agencies rarely cited innovation concerns in merger challenges through the early 1990s, but they have been increasingly likely to do so since then and have introduced innovation concerns into merger challenges in agriculture. In 2016, the U.S. Department of Justice challenged the purchase of Precision Planting, LLC, by John Deere on the grounds that the acquisition would reduce innovation in high-speed planters. John Deere and Precision Planting, a unit of Monsanto, are the two major producers in this nascent industry. After many years of research, during 2014 each firm introduced high-speed planting systems that allow row crop farmers to substantially increase planting speeds at no cost in accuracy. While the Deere system was bundled into new planters, the Precision Planting product could be sold as a set of components and retrofitted onto existing planting equipment, including Deere’s. The Department argued that intense rivalry between the two led to improved prices for farmers and to the rapid introduction of innovative new features, and that the merger would eliminate that competition.

This approach to competition and innovation aligns with contemporary antitrust policy regarding competition and pricing. Each focuses on mergers between rivals in highly concentrated markets, and in particular, in markets where a merger would reduce the number of active rivals from four, three, or two. Each also focuses on the ease with which new rivals might enter a market (entry barriers) and on the options open to buyers in affected markets (the ease with which they could shift purchases to alternative products).

A key issue in assessing the likely effects of mergers on innovation is that there is still a very limited base of evidence on the major questions. Some published evidence suggests that further reductions in competition, beyond some point of limited competition among rivals, shrink R&D expenditures and innovation. But there isn’t nearly as much evidence as has been adduced for concentration and pricing, and there isn’t enough to support a high level of confidence in any particular threshold level of competition. A challenge to the “Big Six” mergers would have to identify specific chemical and seed markets where the mergers would remove significant competition, and would further have to generate evidence of a likely reduction in competition, via increased prices or reduced innovation efforts, to be successful.

Finally, antitrust reviews may not necessarily result in either approval or abandonment of a merger. Often, a review agency may have concerns with certain specific markets. Merging firms may be able to meet those concerns by selling plants to other firms, by agreeing to license a technology to other firms, or through other steps to assuage competition concerns. For example, as this article went to press Dupont announced the sale of its chemical pesticide business to FMC Corporation, who had not previously been active in pesticides, in order to meet the EU competition authority’s conditions for approving the merger.

This article is drawn from:

- Fuglie, K., Heisey, P., King, J., Pray, C.E., Day Rubenstein, K., Schimmelpfennig, D., Wang, S.L. & Karmarkar-Deshmukh, R. (2011). Research Investments and Market Structure in the Food Processing, Agricultural Input, and Biofuel Industries Worldwide. U.S. Department of Agriculture, Economic Research Service. ERR-130.

- “Concentration, Contracting, and Competition Policy in U.S. Agribusiness.” James M. MacDonald . (2016). Concurrences: Competition Law Review, No. 1 .