Agricultural Recovery in Russia and the Rise of Its South

- by Nicholas Rada, William M. Liefert and Olga Liefert

- 4/25/2017

Highlights

- During the last two decades, Russian agriculture has moved to greater product specialization by district

- Between 2005 and 2013, input growth (average growth in land, labor, materials, and capital) and productivity growth accounted for 25 percent and 75 percent, respectively, of the rise in Russian agricultural output.

- But that national productivity growth is largely an outcome of activities in the South, which is exploiting relative geographic, infrastructural, and institutional advantages to spearhead the country’s agricultural improvements.

Russia’s transition from a centrally planned economy to a market-based economy began in the early 1990s. In the Soviet planned economy, farms received specific allocations of inputs tied to mandated output targets from central planners. In Russia’s market economy, however, farms have had not only the potential to earn profit but also the decisionmaking freedom over the choice of output and stronger managerial control to improve labor incentives. The decline of state subsidies during the economic transition contributed to a severe drop in the inputs used in production, and, therefore, agricultural output. However, by the late 1990s, the agricultural output decline had bottomed out and growth resumed.

The production rebound has had major consequences for U.S. and world agricultural trade. As grain production rose steadily after the late 1990s, Russia switched from being a small grain importer to a major exporter. The country currently exports about 35 million metric tons (mmt) of grain a year. In 2015-16, Russia supplied 10 percent of total world grain exports and 15 percent of wheat exports. In comparison, the United States supplied 24 percent of total world grain exports and 14 percent of wheat exports.

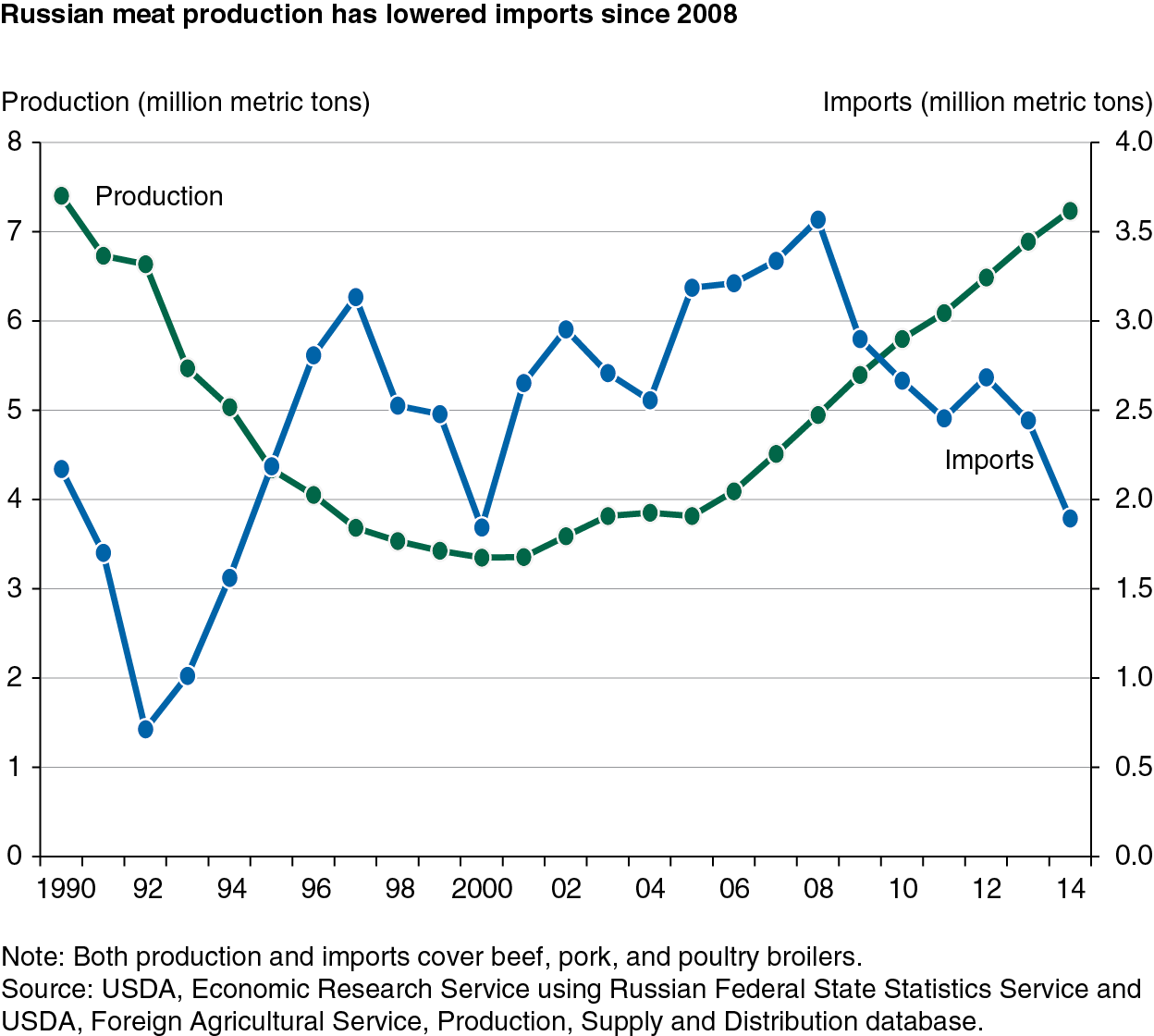

During the 1990s and into the 2000s, Russia was a major importer of other products, such as meat. The country became the biggest foreign market for U.S. poultry, with exports during 1995-2008 averaging 0.77 mmt a year (more than a quarter of total U.S. poultry exports). However, growth in Russian meat output, including a boom in poultry production, began in 2000. Total meat imports peaked in 2008 at 3.6 mmt and have steadily declined since. By 2013, Russia’s share of U.S. poultry exports had fallen to 10 percent (0.28 mmt). U.S. exports subsequently declined further following a 2014 import ban by Russia on many agricultural and food products from this country as well as from the European Union and various other Western nations.

The Russian Government and agricultural establishment regarded the output decline during the 1990s as a calamity, and in 2005, the Government identified agriculture as a national priority area that would receive more funding. Whether Russia’s recent agricultural growth is the result of a rise in production resources or an increase of agricultural total factor productivity (TFP) has substantial implications, not just for Russian agriculture but also for world agricultural trade and food security. TFP is the output per unit of aggregate input and is a comprehensive measure of agricultural performance because it accounts for the contribution of all factors (factor = input) of farm production (land, labor, capital, and material resources). If the output expansion is because of area growth and/or more resources applied per acre, then its long-term viability comes into question and may be transitory. However, if the increase is due to TFP growth (application of new technologies or improvements in the efficiency of the production process that results in an increase in output), then the long-term prospects point to a continuation of climbing grain exports and declining meat exports.

To investigate this issue, ERS economists estimated TFP growth in Russian agriculture since the mid-1990s. They applied growth-accounting estimation to Russian agricultural output and input data to construct growth indexes for these categories as well as for TFP at the national and district levels.

Agricultural Output Specialization Emerges Across Russia

In the Soviet planned economy, most agricultural output came from large state and collective farms. These farms did not have decisionmaking power over their input use or output choice. Producers faced no competitive market pressure to be efficient, reduce waste, or economize on inputs. The Soviet planners generally followed an agricultural policy of product nonspecialization, both within individual farms and districts, whereby the latter produced a range of products that largely satisfied local consumption needs. Compared with a market economy, taking advantage of local comparative advantages to specialize in certain commodities was a much weaker determinant of regional agricultural production.

In the early 1990s, the former state and collective farms inherited from the Soviet period were forced to reorganize. Most became corporate farms owned by their management and workers. During that time, there was little change concerning internal organization, administration, and work incentives for many farms. However, one major modification was that farms not only had the potential to earn profit but were required to be largely self-financing. They also had to determine the goods to produce and inputs to use.

Russian producers responded by moving toward greater product specialization, within individual farms and districts. Since 2000, the South has decreased potato and egg output and expanded wheat, corn, and sunflower seed production. The Central district has traditionally been the country’s biggest producer of sugar beets and potatoes, but it increased production of the former while decreasing output of the latter. This district also expanded its corn production (for feed) and became the top Russian meat producer. With less favorable soil and climate, the Northwest and Far East districts deepened their specialization in livestock products (meat and eggs).

Some agricultural producers responded to the new market opportunities and decisionmaking freedom in ways that improved the efficiency of their operations. Indeed, around the year 2000, a new type of agricultural enterprise emerged, which some Russian agricultural specialists have called “new operators.” A particular class of these new operators is the very large agroholdings. Agroholdings acquire existing corporate farms and vertically integrate them; that is, they combine primary production, processing, distribution, and sometimes retail sale.

Advantages that agroholdings wield include an emphasis on managerial and staff training and fewer credit and liquidity constraints. By pooling collateral, they reduce banks’ lending risk and are able to get lower applied interest rates. Despite the progress made by Russian agriculture since 2000, the sector still suffers from deficient infrastructure (physical, commercial, and institutional) that increases the production and transaction costs of doing business. However, the agroholdings’ large size and vertical integration give them advantages over smaller Russian producers in reducing these costs.

Previous research suggests that the new operators and agroholdings brought much-needed capital investment to modernize the agricultural sector. They took advantage of market opportunities to increase productivity from product specialization and by tapping into Western technology. Agroholdings have been the driving force behind Russia’s booming poultry industry, which over the period 2000 to 2013 raised broiler output from 0.41 to 3.01 million tons. By 2008, five agroholdings accounted for 35 percent of Russia’s broiler production, using modern mass production techniques adopted from the West.

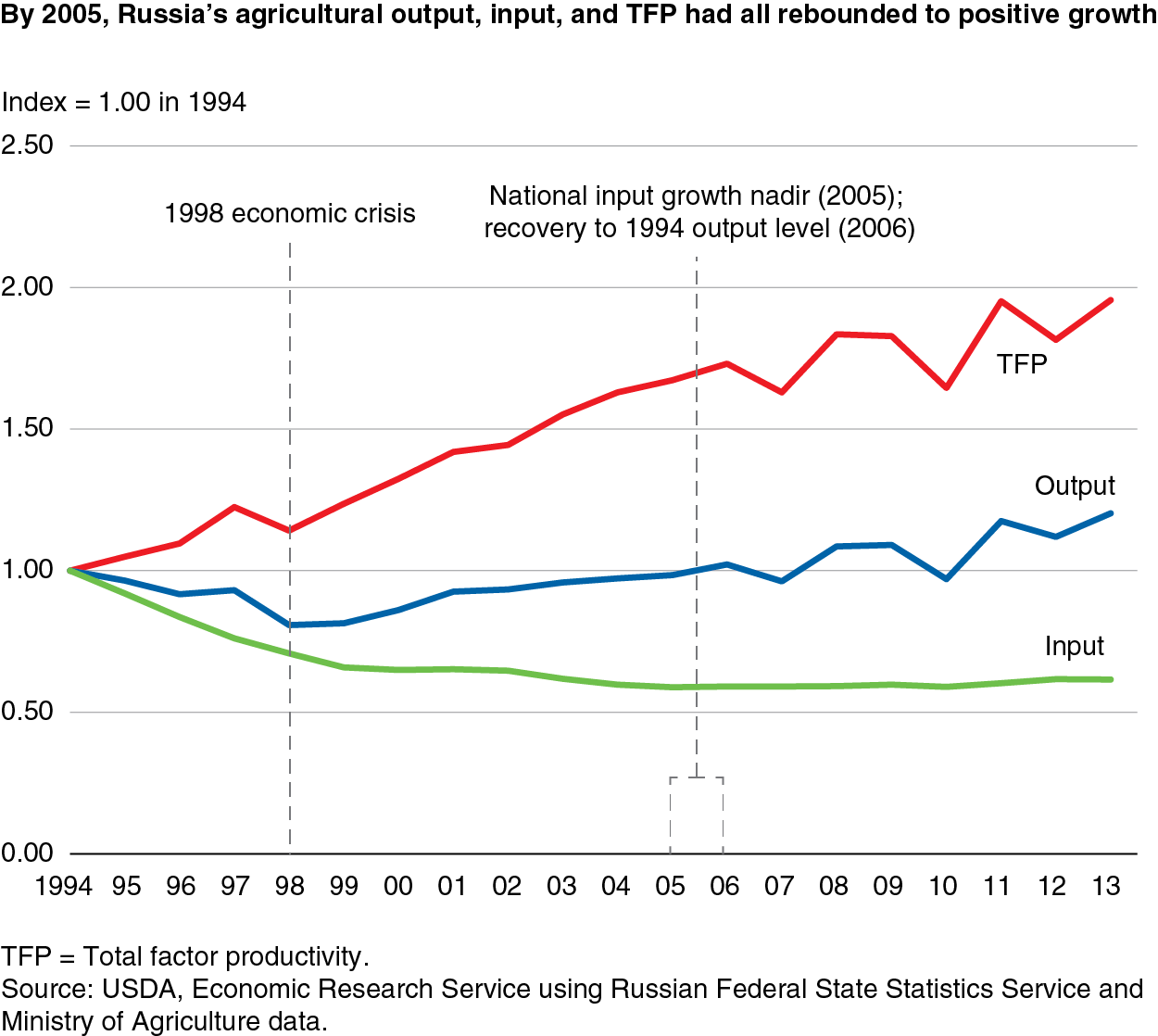

Russia’s Agricultural TFP Since 1994

ERS uses data from Russia’s Federal State Statistics Service and Ministry of Agriculture to evaluate output, input, and TFP growth at the national level and across seven districts. Three distinct periods emerge when evaluating aggregate national agricultural TFP growth: (1) 1994-98; (2) 1998-05; and (3) 2005-13. Between 1994 and 1998, Russia’s aggregate input use declined at nearly twice the rate as output, which led to a 4.2-percent annual TFP increase. Yet, this TFP growth rate simply reflects the process of downsizing agriculture to a level compatible with a market economy, compared with the costly and over-expanded agricultural sector determined by Soviet planners using large subsidies. Therefore, this growth does not indicate a rapid rate of technical progress.

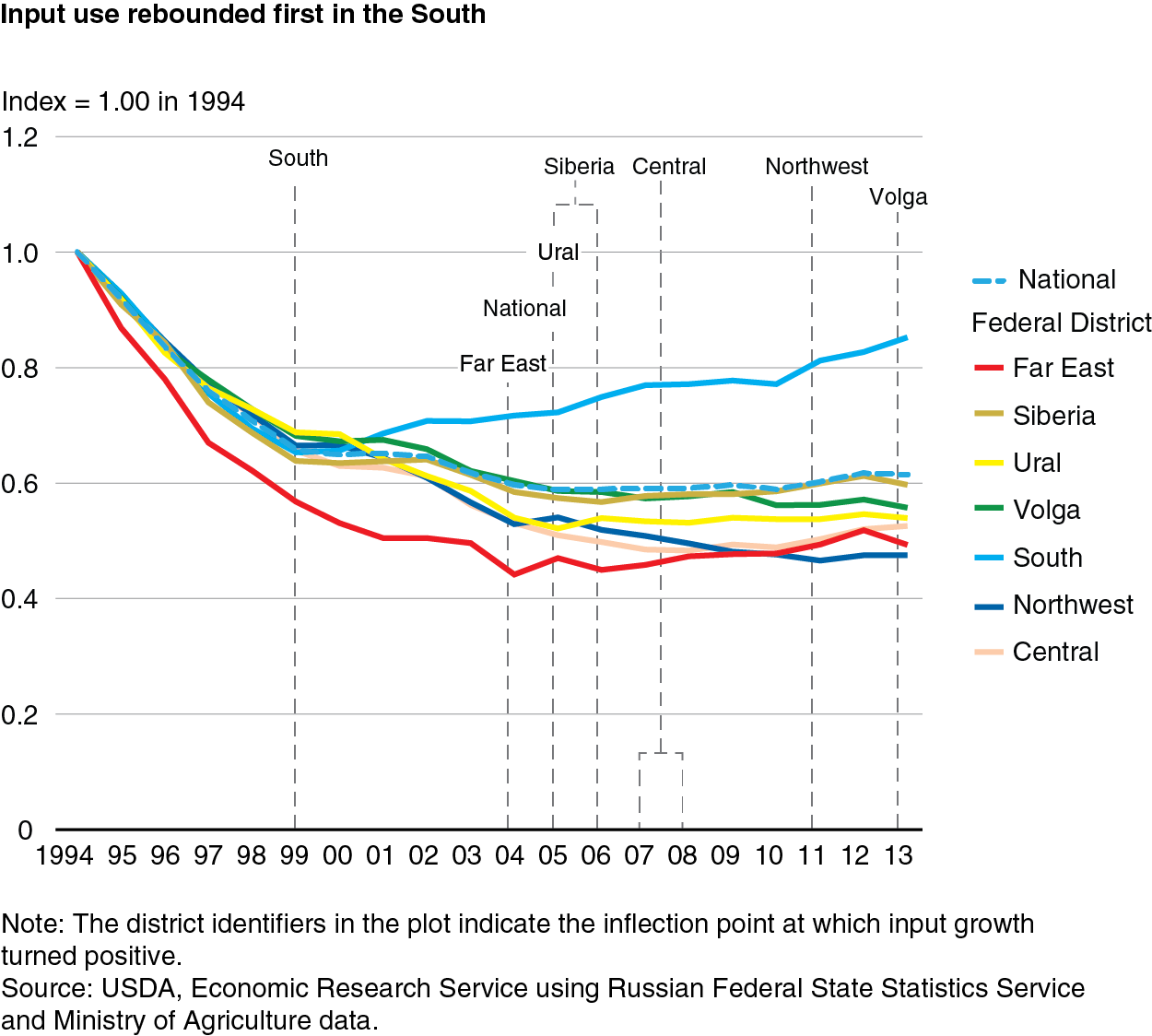

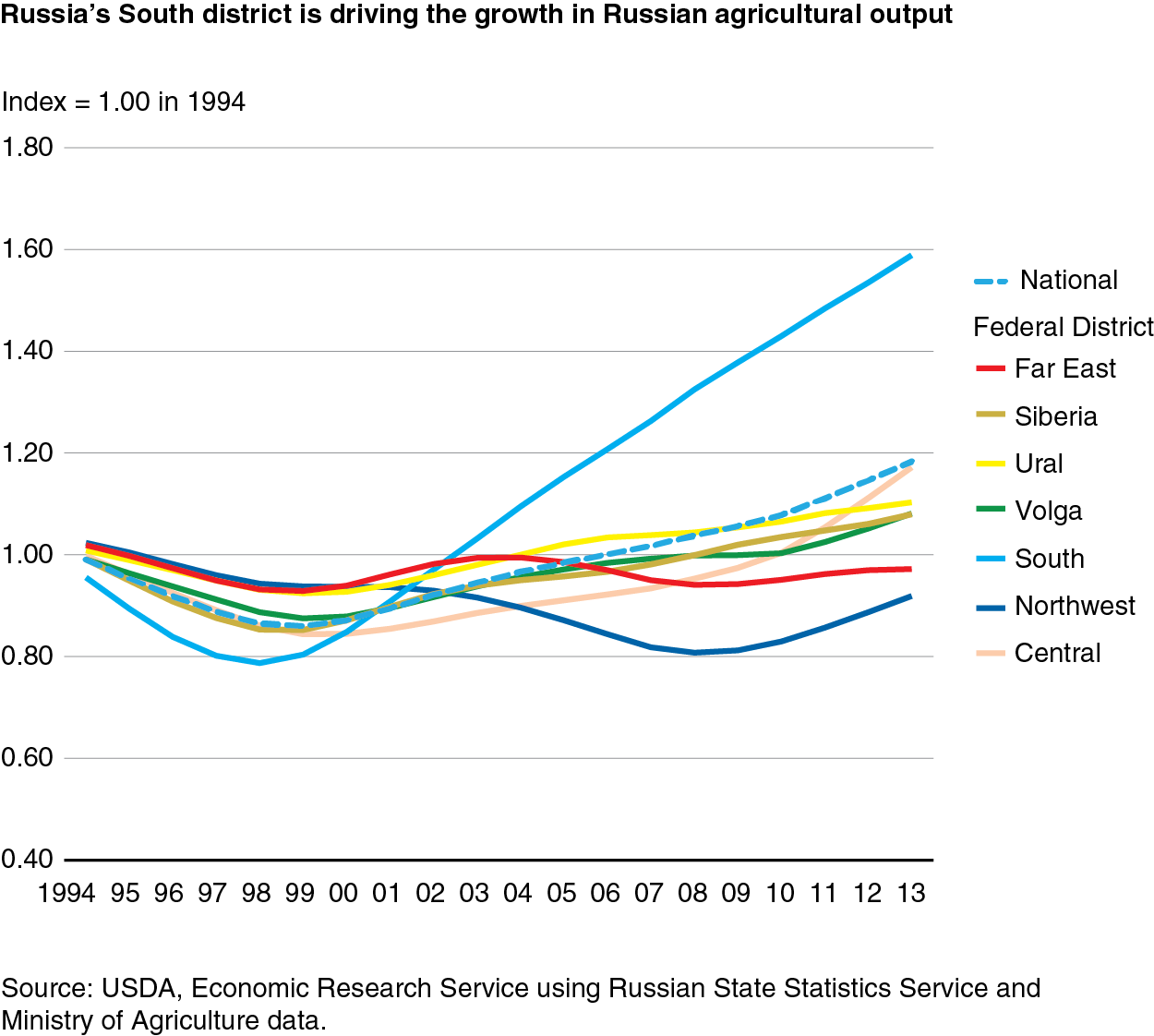

In the second period (1998-2005), output growth rebounded while input use continued to fall, which raised annual average TFP growth to 5.4 percent. Each Russian district experienced the same downward growth trend that led to the 1998 economic crisis, but the depth of those production losses-–and subsequent recovery-–varied widely by district. Because the post-1998 national output recovery was largely a reflection of growth in the South, the period’s 5.4-percent TFP increase is not an accurate measure of national agricultural performance. On average, across regions, input use continued to decline as the sector had not finished shedding its resources. With the key exception of the South, districts that generated any production rise had slight output growth.

In the third period (2005-13), aggregate input use began to expand slightly, output growth slowed, and Russia’s agricultural productivity growth dropped to 1.7 percent per year. The production growth slowdown reflects, in part, weather-driven volatility typical of rain-fed agriculture. But the rise of Russia’s aggregate input use, on average across districts, indicates agricultural recovery from the transition to a market-based economy. In all districts but one, input use stopped falling, such that the districts at least maintained, if not increased, their base level of input use. As such, the modest rate of annual average productivity growth (1.7 percent) estimated for this period reflects the productive application of inputs to increase agricultural output. It also provides a reasonable estimate from which one may set future expectations of Russia’s agricultural performance.

Why Has Agriculture in the South Recovered More Quickly Than in Other Districts?

Although aggregate agricultural output and TFP have grown since 2000, the country’s agricultural performance has been uneven across districts. In particular, the South district has led the rebound in Russian agriculture. Since the late 1990s, agricultural input use and output started to grow, much earlier than in other districts. Input use in the South has risen by 27 percent, and output has grown by 83 percent. These increases stand apart from other districts.

The South has unique comparative advantages within Russia, involving soil and climate, geography, infrastructure, and institutions. First, the district contains the highest proportion of high-quality cropland among Russian districts. It has a mild climate and long summers that enable it to grow winter wheat, corn, and soybeans; these crops can be produced in only a few locations in the country. Another important advantage is that the South contains the Black Sea and Sea of Azov ports through which Russia ships almost all its grain exports. It also has well-developed rail and road systems to transport output to the ports. In addition to helping existing farms, these advantages attracted the new operators and agroholdings, which have strongly contributed to the district’s growth in both the grain and livestock (especially poultry) subsectors.

International technology transfer contributed to raising TFP, but the role of Russia’s agricultural research system is unclear. Starting around 2000, Russia became more integrated into the world agricultural economy, which led to the expansion of international trade, foreign agricultural investment, and technology transfer. Much of its new, imported agricultural technology came in the form of superior Western (including U.S.) machinery, seeds, and animal stock. Since that time, Russia has become a major importer of hybrid corn seed from the West, which helped drive its expansion of corn yields and production (with roughly three-quarters of Russia’s corn produced in the South).

Russia’s Academy of Agricultural Sciences operated 51 research centers and 196 research institutes in 2011. The system employs a structure that allows for commodity research over a national scope, with regional institutes that focus on local adaptation. Yet, Russia’s agricultural research system has been described as disconnected from the majority of farmers. Inadequate smallholder access to technological and managerial innovations and advisory services–-factors that specialists attribute to lifting grain yields for large agricultural enterprises such as agroholdings-–are weaknesses of Russia’s agricultural system.

Despite the progress Russian agriculture has made in recent years, there is room for improvement. For example, Russian wheat yields in 2001-15 were low (2.2 metric tons per hectare—mt/ha) relative to the world average (3.2 mt/ha). Moreover, gaps between actual farm and potential yields of Russian spring wheat range from 100 to 175 percent, depending on location and period evaluated. Biotic stresses (e.g., wheat rust), choice of varietal technology, and low levels of nonland inputs, including irrigation, are factors dampening potential yields.

In sum, the pace of Russia’s agricultural recovery from transition to a market-based economy has varied across the country. By leveraging regional comparative advantages, product specialization, and new technologies and processes, producers in the South raised TFP faster, and therefore grew output quicker, than other Russian districts. The Central district recovered later than the South and may be following a similar growth path.

This article is drawn from:

- Rada, N., Liefert, W.M. & Liefert, O. (2017). Productivity Growth and the Revival of Russian Agriculture. U.S. Department of Agriculture, Economic Research Service. ERR-228.

You may also like:

- Liefert, W.M. & Liefert, O. (2017). Changing Crop Area in the Former Soviet Union Region. U.S. Department of Agriculture, Economic Research Service. FDS-17B-01.

- Liefert, O., Liefert, W.M. & Luebehusen, E. (2013). Rising Grain Exports by the Former Soviet Union Region. U.S. Department of Agriculture, Economic Research Service. WHS-13A-01.

- “Russian Agriculture During Transition: Performance, Global Impact, and Outlook.” William Liefert and Olga Liefert. (2012). Applied Economic Perspectives and Policy 34(1): 37-75.