Free-Trade Agreements: New Trade Opportunities for Horticulture

- by John Wainio and Barry Krissoff

- 4/9/2013

Highlights

- The United States has embarked on ambitious negotiations to create a Trans-Pacific Partnership and a comprehensive trans-Atlantic agreement with the European Union that will liberalize and promote trade.

- The horticulture industry, as well as all of U.S. agriculture, shares a strong interest in the outcome of both negotiations, as fruit and vegetable trade patterns continue to be influenced by a range of trade-distorting policies.

- Reductions in horticultural tariffs and more openness and transparent procedures for sanitary, phytosanitary, and technical standards can generate increased demand and trade for U.S. fruit and vegetables.

The United States has been engaged in negotiating free trade agreements (FTAs) since the 1980s, when it signed pacts with Israel and Canada. In 1994, the Canadian-U.S. accord expanded to include Mexico, creating the North American Free Trade Agreement (NAFTA). Twelve other FTAs with 17 countries followed, each providing additional opportunities for the U.S. economy and the agricultural sector. The United States recently embarked on ambitious negotiations to create a Trans-Pacific Partnership (TPP) with 10 countries that will liberalize and promote trade and investment in the Asia-Pacific region (Australia, Brunei, Canada, Chile, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam). Japan has announced its intentions to join the negotiations as well. The United States has also agreed to launch negotiations with the European Union to establish a Transatlantic Trade and Investment Partnership (TTIP), a free-trade area between the world’s two largest trading partners.

Both TPP and TTIP would have trade implications for all sectors of the economy, including the food and agricultural sector. The 10 U.S. TPP partners, and potential TPP partner Japan, have a population of 475 million people and a combined Gross Domestic Product (GDP) estimated at over $11.5 trillion (2011). The EU encompasses 27 countries with a combined population and GDP of 502.5 million and $17.6 trillion, respectively. Both regions are important markets for U.S. agricultural exports; hence, the interest in how these agreements might affect the United States.

One subsector of U.S. agriculture, the sometimes overlooked horticulture industry, shares a strong interest in the outcome of both negotiations, as fruit and vegetable trade patterns continue to be influenced by a range of trade-distorting policies. The horticultural sector faces a large number of high tariff rates as well as tariff-rate quotas (TRQs), some of which are characterized by cumbersome administrative procedures and over-quota tariff rates at trade-prohibitive levels. Moreover, phytosanitary and technical measures have affected trade by limiting or blocking imports of select horticultural products into world markets.

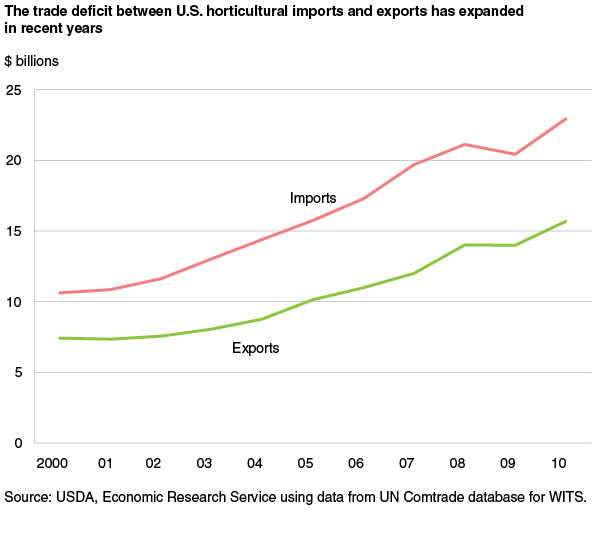

Growth in U.S. and Global Horticultural Trade

Over the past decade, growth in global horticultural trade has been substantial. According to the United Nations’ ComTrade database, fruit and vegetable trade rose from over $90 billion (2000) to nearly $218 billion (2010) (derived from import data) and accounts for almost 21 percent of global food and animal product trade. From a U.S. perspective, fruit and vegetable imports and exports more than doubled in value, reaching $22.9 billion and $15.7 billion, respectively, or about 26 percent of U.S. food and agricultural imports and 13 percent of exports.

At least four key long-term factors underlie the increase in fruit and vegetable trade. A growing middle class in emerging market countries has demonstrated a strong demand for product quality, variety, convenience, and the benefits of healthy and nutritious fruits and vegetables, further boosting trade in these products. Second, technological innovations, most notably in communication and transportation, have lowered the transaction costs of international trade, thus making imports more affordable. For example, retailer Ahold adopted Google Apps Premier Edition to provide a single Web-based communication system among its global employees that includes a messaging platform, calendar sharing, video capability, and automatic language translation. Third, the global consolidation of the grocery industry has encouraged increased coordination and integration of grower/shipper operations and improved supply chain efficiency, an enormous benefit for highly perishable products such as fruits and vegetables. Retail chains like Walmart and Carrefour have opened hundreds of stores in developing country markets and source globally year round.

Finally, barriers to horticultural trade have been reduced through the 1995 World Trade Organization (WTO) Agreement on Agriculture and a number of regional preferential trading arrangements. Within North America, NAFTA has helped create a liberalized trading environment and is a contributing factor in the large increase in fruit and vegetable trade among the United States, Canada, and Mexico. Since NAFTA was signed, the U.S. has concluded 12 additional preferential trade agreements with 17 countries, including the 3 recently implemented agreements with Korea, Colombia, and Panama.

The map provides a snapshot of recent changes in U.S. trade with FTA and selected non-FTA countries. The countries in blue represent those with which the U.S. formed an FTA after 2001. In the 1999-2001 period, before any of these countries became FTA partners with the U.S., they accounted for 3.9 percent of U.S. horticultural exports per year and provided 21.2 percent of U.S. horticultural imports. By 2009-11, when all had become U.S. FTA partners, annual U.S. horticultural imports had increased by $2.5 billion, or 127 percent, while exports were up $472 million, or 176 percent. As a group, the partner countries also saw modest increases in their share of total U.S. horticultural trade during this time. It should be noted that while all of the trade agreements with these countries were in place by 2009, many of the tariff cuts on horticultural products that have been agreed to have yet to be fully implemented.

While U.S. imports of horticultural products from current FTA partners were twice the level of U.S. exports to these same countries during 2009/11, the same is not true of the countries with which the U.S. is currently negotiating trade agreements. During the same period, the United States had a positive balance of trade with both the EU and the five TPP partners (countries in purple) with which it does not currently have an FTA. But trade with these countries has grown at a slower rate than trade with other FTA partner countries. As a result, the share of total U.S. horticultural trade (imports plus exports) with the EU and the five non-FTA TPP countries dropped from 22.4 percent in 1999-2001 to 15.2 percent in 2009-11. A successful TPP and TTIP have the potential to increase both trade and market shares as trade barriers are reduced or eliminated.

Exports Are Key for Many U.S. Fruit, Nut, and Vegetable Producers

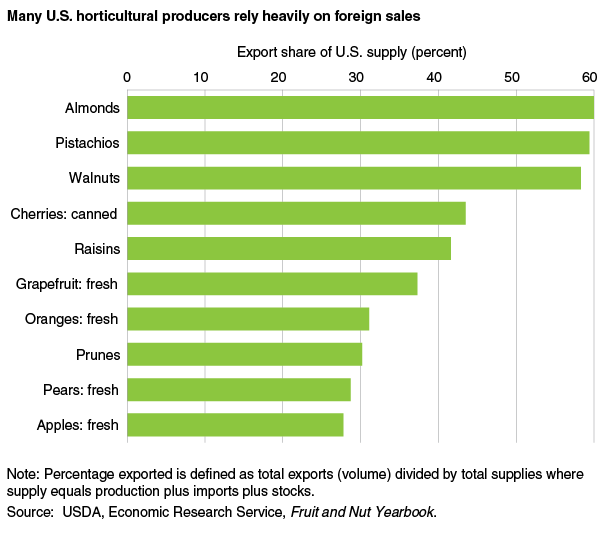

Exports play an important and sometimes critical role for U.S. growers of select fruit and nuts. Several individual U.S. fruit and nut exports account for a large share of the total volume of U.S. supply. For example, exports of almonds, pistachios, and walnuts each make up over 50 percent of the volume of U.S. supply for each product. Select fresh, canned, and dried fruit are also highly dependent on exports--grapefruit, canned cherry, and raisin exports, for example, comprise between 35 and 50 percent of the U.S. supply for each product.

While the United States is one of the world’s largest producers of fruits, nuts, and vegetables, it imports many of these products as well. For example, the U.S. imports bananas, pineapples, and other tropical fruits that cannot be produced in sufficient quantities domestically but are in high demand. It imports other products, such as grapes, plums, and blueberries, to complement U.S. seasonal patterns of production. Still other U.S. imports compete directly with domestic production. Spanish clementines, for example, are marketed mainly in the U.S. winter months, vying for consumer attention with California oranges and mandarins.

TPP Trade Agreement Will Improve Market Access for U.S. Horticulture

The TPP provides a framework for increasing market access in Brunei, Malaysia, New Zealand, Vietnam, and Japan (if it joins), countries with which the U.S. does not currently have existing bilateral free trade agreements. U.S. exports are levied the most-favored-nation (MFN) duty in these five countries and face a disadvantage against exports from competitors with FTAs already in place. The TPP would help level the playing field for U.S. exporters against countries with existing FTAs while providing them with preferential access over countries that will continue to face MFN rates.

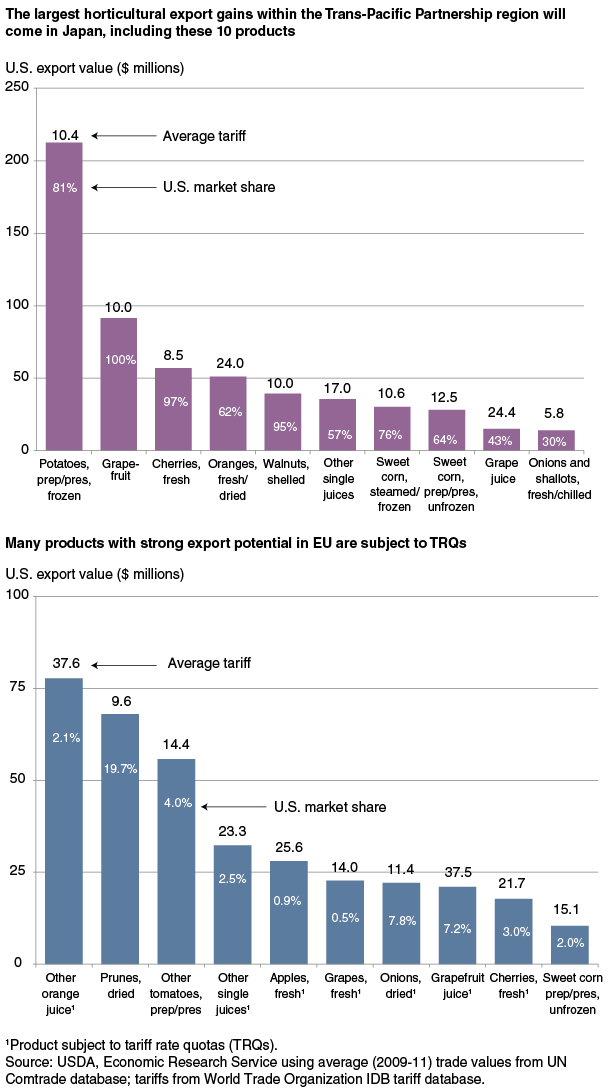

A number of products may hold strong U.S. export potential in these five countries, based on the size of the overall market, the MFN tariff, and the competitive position of the United States, but the Japanese market is the most lucrative, at least in the short term. These products include cherries, oranges, grapefruits, grapefruit juice, other noncitrus juices, sweet corn, frozen potatoes, fresh and chilled onions, and walnuts. Together these 10 products accounted for almost 50 percent of total U.S. horticultural exports to the above five TPP countries during 2009-11. Much of the remaining trade was either duty free, assessed very low tariffs, or was small in value. While greater access to the Japanese horticultural market is the immediate goal, in the longer term the U.S. would be expected to make export gains in some of the other countries as their incomes grow over time. Some of the products with the highest potential include frozen potatoes, apples, grapes, and raisins in Malaysia and grapes, apples, raisins, selected fruit and vegetable juices, sweet corn, and potatoes in Vietnam.

The United States is already the dominant supplier in many of these markets, including those for frozen potatoes, grapefruit, fresh cherries, and shelled walnuts in Japan. The U.S. would be expected to maintain this position but probably not increase market share by much. In these cases, gains would most likely result from overall growth in imports, as eliminating tariff protection leads to decreases in domestic production and lower prices and greater variety for consumers.

At the other end of the spectrum are markets like grape juice and fresh grapes in Japan and sweet corn, fresh grapes, and selected fruit and vegetable juices in Vietnam. U.S. exports of these products currently compete with those of FTA partners or other MFN countries, and average tariffs are in the double digits. A reduction or elimination of the margin of preference that FTA partners currently receive in these markets while exporting at preferential rates may enable U.S. exporters to capture market share. Other fairly large markets with high MFN tariffs where the United States could also see export gains include those for grapefruit juice, strawberries, other berries, and prepared/preserved tomatoes in Japan.

TTIP Offers Challenges, But Also Opportunities

Despite high average tariffs imposed by the EU on horticultural goods, the U.S. exported a wide range of these products to the EU during 2009-11, with an average annual value of $2.3 billion across 143 different products. Horticultural trade comprises 153 HS6-digit products, 148 of which have been imported by the EU in recent years (2009-11). Unlike the TPP countries, the EU has numerous TRQs for horticultural products. For many fresh products, it also applies different tariffs depending on the time of the year. Processed products are often assessed tariffs based on container size, sugar content, or import price. As a result, tariffs can vary widely within an HS6-digit category, with most trade taking place at tariffs that are significantly below the average.

Five products (shelled almonds, unshelled pistachios, raisins, and shelled and unshelled walnuts) accounted for about two-thirds of total EU horticultural imports from the United States in 2009-11. Among these five, only almonds are subject to a TRQ, although the over-quota tariff is small at 3.5 percent. Shelled walnuts face the highest tariff at 5.1 percent. Although the tariffs are low, the U.S. would be expected to increase exports of all five to the EU should these tariffs be lowered or eliminated.

Other horticultural products with high export potential include prepared/preserved tomatoes, certain fruit juices, dried onions, grapefruit juice, and sweet corn, all with minimum tariffs of 10 percent or greater. Fresh grapes, cherries, and apples and fresh orange juice were all subject to TRQs with over-quota rates in excess of 20 percent and quota fill rates equal or near 100 percent. Strong export gains might also be expected for U.S. prunes, berries, and strawberries.

Addressing Nontariff Measures Would Bring Further Increases in Trade

Countries impose various measures to provide safeguards against threats to food safety and plant and animal health. Countries also enact product standards and testing and other technical requirements. Many of these address legitimate concerns, since imports can carry invasive species such as pathogens, pests, or weeds or contain high levels of chemicals such as pesticides or harmful additives. To minimize trade distortions, WTO members must adhere to the WTO Agreements on the Application of Sanitary and Phytosanitary (SPS) Measures and Technical Barriers to Trade (TBT). These agreements established rules and procedures for regulating trade flows across borders to protect human, plant, or animal life or health and the environment, and to regulate markets and safeguard consumers, among other objectives, while at the same time facilitating international trade.

Bilateral and regional free trade agreements often establish SPS and TBT committees to facilitate consultation and resolve contentious issues. The TPP agreement contains chapters on both SPS and TBT. According to the Office of the U.S. Trade Representative’s 2012 SPS and TBT Reports, the United States has emphasized several key themes: under the SPS committee, commitments on science, transparency, regionalization, cooperation, and equivalence; under the TBT committee, regulatory transparency; the use of Good Regulatory Practices; and the acceptance of conformity assessment procedures and results carried out in TPP countries. This would include the principle that suppliers do not need to have their facilities inspected more than once or have their products tested more than once. Furthermore, countries would permit suppliers in other TPP countries to allow testing to be carried out by a conformity assessment body of their choice, regardless of location, as long as the body meets the importing country’s criteria for approved assessment bodies. These practices would facilitate new product trade for fruit and vegetables and expedite transactions, which is particularly important for highly perishable foods susceptible to quality deterioration and spoilage. Regarding the launch of negotiations on the TTIP, SPS issues appear to be one of the major sticking points between the United States and the European Union.

Economywide Gains Contribute to Agriculture Trade

The goals of TPP and TTIP extend well beyond the agricultural sector. Reductions in economic distortions caused by tariff and nontariff barriers in many sectors can help economies focus on those products that they produce most efficiently. As a result, TPP and TTIP can generate substantial global income gains. The increases in income combined with reductions in TPP and TTIP horticultural tariffs and more openness and transparent procedures for phytosanitary and other technical standards can generate increased demand and trade for U.S. fruit and vegetables.

This article is drawn from:

- Plattner, K. & Perez, A. (2012). Fruit and Tree Nuts Outlook: December 2012. U.S. Department of Agriculture, Economic Research Service. FTS-354.