Dairy & Livestock

Dairy & Livestock: Title I (Commodities), Title XII (Miscellaneous)

Enhances a risk management program for dairy farmers, revises a minimum price formula for milk processed for fluid beverage use, establishes a program to assist with milk donations, augments disaster assistance programs for livestock producers, and includes other provisions to support dairy and livestock operations.

Highlights

- Replaces the Margin Protection Program for Dairy Producers (MPP-Dairy) with the Dairy Margin Coverage (DMC) program.

- Changes a formula used by the Federal Milk Marketing Order (FMMO) system to set minimum prices for dairy farmers.

- Establishes a program to reimburse fluid milk processors for costs incurred in donating fluid beverage milk to low income groups.

- Removes the payment limit for the Emergency Assistance for Livestock, Honey Bees, and Farm-Raised Fish Program (ELAP), leaving the Livestock Forage Disaster Program (LFP) the only Supplemental Agricultural Disaster Assistance Program still having a per person and legal entity annual program payment limitation of $125,000.

- Covers the costs of inspecting for cattle tick fever through the ELAP.

- Extends coverage in the Livestock Indemnity Program (LIP) for additional causes of death or sales loss.

- Creates two programs for the benefit of improving how the United States protects against, prepares for, and responds to animal and zoonotic disease outbreaks: the National Animal Disease Preparedness and Response Program (NADPRP) and the National Animal Vaccine and Veterinary Countermeasures Bank (NAVVCB).

Programs and Provisions

Dairy Margin Coverage (DMC)

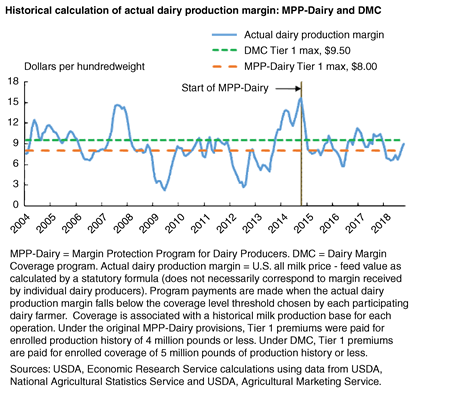

The DMC program was established by the Agriculture Improvement Act of 2018 (2018 Farm Act). It replaces MPP-Dairy, a program established by the Agricultural Act of 2014 (2014 Farm Act) and amended by the Bipartisan Budget Act of 2018 (BBA of 2018). Like MPP-Dairy, DMC offers payments to dairy farmers when the difference between the U.S. all-milk price and the national average feed cost (as calculated by a statutory formula) falls below a certain dollar amount selected by the dairy farmer.

Like MPP-Dairy, DMC requires each participating operation to establish of a historical milk production base (production history) that is equal to the highest annual quantity of milk marketed by the operation during the period from 2011-13. Under MPP-Dairy, this production history was adjusted each year to reflect any increase in national average milk production. Under DMC, no adjustments are made past 2018.

Each participating dairy operation elects the share of production history (coverage percentage) to cover in the program. The covered production history (CPH) is the product of the operation’s production history and the coverage percentage. Under the 2014 Farm Act, a dairy operation was allowed to cover between 25 to 90 percent of its production history. DMC expands the options to allow an operation to cover between 5 and 95 percent of its production history.

The Actual Dairy Production Margin (ADPM), as defined in both the 2014 and 2018 Farm Acts, is the difference between the U.S. all-milk price and the average feed cost, as calculated using a formula provided in the legislation. (Although the calculation is called an "actual" margin in the legislation, it does not necessarily correspond to the margin experienced by individual dairy farmers.) While the ADPM was calculated for each 2-month period throughout the year under the 2014 Farm Act, the BBA of 2018 amended this to a monthly calculation. The 2018 Farm Act retains the monthly calculation.

Each participating operation annually chooses a coverage level threshold (CLT), the dollar value of the ADPM as chosen by the farmer to trigger payments to be made through the program. For example, if an operation chooses a CLT of $6.00 per hundredweight (cwt), it will receive an indemnity payment equal to the CLT minus the ADPM when the margin falls below $6.00 per cwt.

Dairy operations pay premiums for their annually selected CLTs based on two premium schedules, or tiers. Under the original MPP-Dairy, the Tier 1 schedule was for CPH of 4 million pounds or less, and the Tier 2 schedule was for CPH of greater than 4 million pounds. For a given CLT, Tier 1 premiums were lower than Tier 2 premiums. The BBA of 2018 amended MPP-Dairy to change the demarcation between the two tiers to 5 million pounds, and it remains at 5 million pounds under DMC.

Under MPP-Dairy, each participating dairy operation chose one CLT annually that applied to all of the operation’s CPH. With DMC, a dairy operation may enroll 5 million pounds of CPH at a CLT of $8.00 to $9.50 per cwt (Tier 1) and CPH above 5 million pounds at a CLT of $4.00 to $8.00 (Tier 2). For example, a dairy operation enrolling 10 million pounds of CPH could choose a $9.50 per cwt CLT for its first 5 million pounds (under Tier 1) and a $5.00 CLT for the remaining 5 million pounds (under Tier 2).

Under the 2014 Farm Act, the MPP-Dairy CLT choices ranged from $4.00 per cwt to $8.00 per cwt for both tiers. A dairy operation could pay the $100 administrative fee and be automatically enrolled at the $4.00 CLT for 90 percent of its production history. This CLT was called the catastrophic level. Under the BBA of 2018, the catastrophic CLT for Tier 1 was raised to $5.00 per cwt, and Tier 1 premiums were reduced while Tier 2 premiums remained unchanged. Under the DMC program, the catastrophic level for Tier 1 under the DMC program has been returned to $4.00 per cwt, but the maximum CLT choice has been raised to $9.50. Additionally, Tier 1 premiums are significantly lower than with the original MPP-Dairy. For Tier 2, the range of CLT options remains at $4.00 to $8.00 per cwt, with premiums lowered for some CLTs but raised for others. The catastrophic level protection for both tiers automatically applies to 95 percent of the operation’s production history if the dairy operation enrolls and pays only the $100 administration fee.

Under DMC, an operation that enrolls in the program must remain in the program through the end of the 2018 Farm Act in 2023. An operation can elect a different CPH and CLT each year. If, however, an operation elects to lock in the same CPH and CLT for the duration of the 2018 Farm Act, the operation will receive a 25-percent premium discount.

Under DMC, operations that paid MPP-Dairy premiums in excess of indemnities from 2014-17 are eligible for partial refunds of those premiums. A dairy operation has two options for the refund: (1) receive 75 percent of premiums paid in excess of benefits as credit for DMC premium payments or (2) receive 50 percent of premiums paid in excess of benefits as cash. Option 2 applies even if the operation is no longer in business.

Under the 2014 Farm Act, a participating dairy operation was not allowed to participate in both MPP-Dairy and the Livestock Gross Margin for Dairy Cattle (LGM-Dairy) program. This restriction has been lifted with DMC. LGM-Dairy is an insurance product administered by USDA’s Risk Management Agency (RMA) under the auspices of the Federal Crop Insurance Act (FCIA), as amended. It provides protection when feed costs rise or milk prices drop, and policies can be tailored to any size farm. Margin parameters for the program are determined using futures prices for corn, soybean meal, and milk. For more information, see the RMA publication Livestock Gross Margin Insurance for Dairy Cattle, Fact Sheet.

Dairy operations also have the option of participating in the Dairy Revenue Protection (Dairy-RP) program, a new insurance product administered by RMA, and they can participate in DMC and Dairy-RP simultaneously. Dairy-RP insures against unexpected declines in the quarterly revenue from milk sales relative to a guaranteed coverage level chosen by the dairy farmer. Sign-up for Dairy-RP began in October 2018, with the first available coverage starting in the first quarter of 2019. For more information, see the RMA publication Dairy Revenue Protection, Fact Sheet.

| Feature | MPP-Dairy under 2014 Farm Act | MPP-Dairy under BBA of 2018 | DMC under 2018 Farm Act |

|---|---|---|---|

| Legislation | Agricultural Act of 2014 (2014 Farm Act). | 2014 Farm Act as amended by the Bipartisan Budget Act of 2018 (BBA of 2018). | Agriculture Improvement Act of 2018 (2018 Farm Act). |

| Production history (base production for participating producer) | Highest milk production for the years 2011 through 2013, with adjustments reflecting changes in national milk production each year. | No change from 2014 Farm Act. | Highest milk production for the years 2011 through 2013, with adjustments reflecting changes in national milk production through 2018. |

| Election of covered production history (CPH) | 25 to 90 percent of production history. | No change from 2014 Farm Act. | 5 to 95 percent of production history. |

| CPH covered under Tier 1 | 4 million pounds or less | 5 million pounds or less | 5 million pounds or less |

| Coverage level threshold (CLT) | Tier 1 and Tier 2 coverage both from $4.00 to $8.00 per hundredweight (cwt). | Tier 1 coverage from $5.00 to $8.00 per cwt. Tier 2 coverage from $4.00 to $8.00 per cwt. | Tier 1 coverage from $4.00 to $9.50 per cwt. Tier 2 coverage from $4.00 to $8.00 per cwt. Operation may enroll 5 million pounds of CPH at a CLT of $8.00 to $9.50 per cwt (Tier 1) and CPH above 5 million pounds at a CLT of $4.00 to $8.00 (Tier 2). |

| Catastrophic CLT coverage requiring only payment of $100 administrative fee | $4.00 per cwt on 90 percent of production history. | $5.00 per cwt on 90 percent of production history for Tier 1. $4.00 per cwt on 90% of production history for Tier 2. | $4.00 per cwt on 95 percent of production history. |

| Premium rates | Tier 1 premiums lowered from original level. | Tier 1 premiums lowered from original level. For Tier 2, some premiums lowered and other premiums raised. | |

| Refunds | Partial refunds eligible for dairy operations that paid premiums in excess of indemnities from 2014 to 2017. | ||

| Participation in other risk management programs | Participants not allowed to participate in the Livestock Gross Margin for Dairy Cattle (LGM-Dairy) program. | Participants not allowed to participate in LGM-Dairy. | Participants allowed to participate in LGM-Dairy or other available risk management programs, including the Dairy Revenue Protection (Dairy-RP) program. |

| Table produced by USDA, Economic Research Service. Sources: Agricultural Act of 2014, Bipartisan Budget Act of 2018, and Agriculture Improvement Act of 2018. |

|||

| MPP-Dairy 2 | DMC 3 | ||||

|---|---|---|---|---|---|

| Coverage Level Threshold | Tier 1 for 2016-2017 (<=4 mil. lbs.) 4 | Tier 1 for 2018 (<=5 mil. lbs.) 5 | Tier 2 (>4 mil. lbs. before 2018, >5 mil. lbs. | Tier 1 (<=5 mil. lbs.) | Tier 2 (>5 mil. lbs.) |

| 4.00 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| 4.50 | 0.0100 | 0.0000 | 0.0200 | 0.0025 | 0.0025 |

| 5.00 | 0.0250 | 0.0000 | 0.0400 | 0.0050 | 0.0050 |

| 5.50 | 0.0400 | 0.0090 | 0.1000 | 0.0300 | 0.1000 |

| 6.00 | 0.0550 | 0.0160 | 0.1550 | 0.0500 | 0.3100 |

| 6.50 | 0.0900 | 0.0400 | 0.2900 | 0.0700 | 0.6500 |

| 7.00 | 0.2170 | 0.0630 | 0.8300 | 0.0800 | 1.1070 |

| 7.50 | 0.3000 | 0.0870 | 1.0600 | 0.0900 | 1.4130 |

| 8.00 | 0.4750 | 0.1420 | 1.3600 | 0.1000 | 1.8130 |

| 8.50 | NA | NA | NA | 0.1050 | NA |

| 9.00 | NA | NA | NA | 0.1100 | NA |

| 9.50 | NA | NA | NA | 0.1500 | NA |

| 1 Premiums displayed in this table do not include the $100 annual administrative fee. 2 MPP-Dairy was established by the Agricultural Act of 2014 (2014 Farm Act). MPP-Dairy had discounted premiums in 2015 that are not displayed in this table. 3 Under the Agriculture Improvement Act of 2018 (2018 Farm Act), the DMC program replaced MPP-Dairy. Discounts of 25 percent apply for dairy operations that choose a constant covered production history and coverage level threshold until the program ends in December 2023. 4 The column labels for Tier 1 and Tier 2 coverage levels refer to millions of pounds of covered milk production history. 5 Under the Bipartisan Budget Act of 2018 (BBA of 2018), Tier 1 premiums were lowered and the demarcation between Tier 1 and Tier 2 was changed from 4 million pounds to 5 million pounds. Table produced by USDA, Economic Research Service. Sources: Agricultural Act of 2014, Bipartisan Budget Act of 2018, and Agriculture Improvement Act of 2018. |

|||||

Change to Federal Milk Marketing Order (FMMO) Class I Mover Formula

A formula used by the Federal Milk Marketing Order (FMMO) system to set minimum milk prices for dairy farmers will be changed to facilitate hedging of milk purchased by fluid milk processors. To gain a basic understanding of this change, some background information may be helpful. (More detailed background information about the FMMO system is available at https://www.ams.usda.gov/rules-regulations/moa/dairy.)

FMMOs establish rules under which first buyers of milk (called handlers in FMMO provisions) purchase milk from dairy farmers. There are currently 11 regional FMMOs that regulate over 80 percent of all milk produced in the United States. FMMOs set minimum prices that handlers pay dairy farmers or their cooperatives. Minimum prices are set monthly and are based on formulas that include market-determined dairy product prices combined with other fixed factors reflecting estimated processing costs, yield, and location. FMMO minimum milk prices rise if dairy product prices rise, and they fall if product prices fall.

Handlers are required to pay at least minimum prices based on the end use, or class, of the milk. There are four classes of milk:

- Class I: milk products intended to be used as fluid or beverage milk.

- Class II: cream products, cottage cheese, yogurt, and frozen desserts.

- Class III: hard cheeses and cream cheese.

- Class IV: butter and milk products in dried form.

The Class I price is usually the highest price. The higher price for Class I milk is achieved by adding a differential to the Class I mover, which is currently the higher of the Class III or Class IV advanced skim milk pricing factors. This method of calculating the Class I mover was established through a regulatory process, and the formula has been in place since 2000. Class III milk pricing factors, for the most part, move up and down with cheese and dry whey prices while Class IV milk pricing factors move up and down with butter and nonfat dry milk prices.

While the Chicago Mercantile Exchange (CME) has futures price contracts for Class III and IV milk, the CME does not have futures contracts for Class I milk. Buyers of Class I milk, or their customers, sometimes attempt to hedge their risks by using Class III or IV futures. However, since the Class I price sometimes moves with Class III but other times with Class IV, there is considerable basis risk in trying to cross hedge in this manner.

Under the 2018 Farm Act, the Class I mover will be calculated as the average of the Class III and Class IV advanced skim milk pricing factors plus 74 cents per cwt. This change is designed to substantially reduce the basis risk in hedging Class I milk prices using CME Class III and IV futures prices without affecting the long-term average price level for the Class I mover. Historically, adding 74 cents to the average of the Class III and IV skim milk pricing factors would result in about the same long-term average for the Class I mover as the formulation using the higher of Class III or IV advanced skim milk pricing factors.

Milk Donation Program

Under the Milk Donation Program, fluid milk processors may be reimbursed for costs incurred in donating fluid beverage milk to low income groups. The reimbursement would be based upon the difference between the Class I milk price and the lower of the Class III price or Class IV milk price. The program would be funded by Commodity Credit Corporation, with $9 million available for fiscal year 2019 and $5 million for each fiscal year thereafter. Unused funds for a particular year could be used in the following fiscal year.

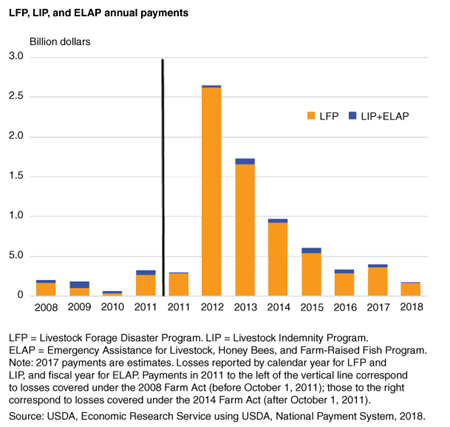

Supplemental Agricultural Disaster Assistance Programs

Subtitle E under Title I of the 2018 Farm Act reauthorizes disaster assistance programs for livestock losses under the LIP, ELAP, and LFP and amends the list of individuals or entities eligible for these programs to include Indian tribes or tribal organizations. The 2014 Farm Act subjected all three programs to a single per person or legal entity annual payment limitation of $125,000. The Bipartisan Budget Act of 2018 lifted the payment limitation for LIP. The 2018 Farm Act removes the payment limit for ELAP, leaving only LFP subject to the limit. The reauthorization of the LFP maintains compensation for qualifying grazing losses for covered livestock.

The Bipartisan Budget Act of 2018 expanded LIP to cover financial losses sustained when livestock are not killed but are injured by an eligible cause of loss and sold for a reduced price. The 2018 Farm Act further expands LIP coverage for livestock deaths to include payment losses as a result of diseases that are caused or transmitted by a vector that is not controlled by vaccination or other acceptable management practices. It also allows the Secretary to provide for LIP assistance for the death of unweaned livestock due to adverse weather without regard to management protocols.

The ELAP program continues to cover production types and losses not covered by LFP or LIP. While the Bipartisan Budget Act of 2018 removed the annual $20 million funding cap effective with the 2017 and subsequent program years, the 2018 Farm Act permits funds to cover the cost of inspections for cattle tick fever.

Animal Disease Prevention and Management

Title XII of the 2014 Farm Act amended the Animal Health Protection Act of 2002 to create the National Animal Health Laboratory Network (NAHLN), authorizing appropriations of $15 million for each fiscal year 2014-18. The 2018 Farm Act amendments further establish, under the Animal Health Protection Act, the National Animal Disease Preparedness and Response Program (NADPRP) and the National Animal Vaccine and Veterinary Countermeasures Bank (NAVVCB). For all three programs, the 2018 Farm Act provides mandatory funding in the amount of $120 million for fiscal years 2019-22, of which $20 million is reserved for NADPRP. For subsequent fiscal years, $30 million will be made available, of which not less than $18 million shall be made available for each of those fiscal years to carry out the NADPRP. Additional annual appropriations of $30 million are authorized to carry out NAHLN for fiscal years 2019-23, while the 2018 Farm Act authorizes “such sums as are necessary” to carry out NADPRP and NAVVCB for each of the years 2019-23.

The reauthorization of mandatory funding for the NAHLN and the creation of the NADPRP and the NAVVCB are long-run investments that could yield benefits in the future to the livestock industries, assuming continued funding support. A vaccine bank is aimed at reducing the risk from infectious diseases, specifically the NAVVCB is directed to prioritize foot-and-mouth disease.

Repealed Programs and Provisions

The Dairy Product Donation Program is repealed.

Economic Implications

To get a sense of the economic implications of the DMC program, it is helpful to examine some statistics from the MPP-Dairy program that it replaces. From 2015 through 2017, the average annual participation rate among dairy operations for MPP-Dairy was 54.8 percent, covering 69.0 percent of milk production. An annual average of 82.4 percent of covered production was signed up at the minimum $4 per cwt CLT (USDA Farm Service Agency, Results of MPP-Dairy Enrollment, 2015 through 2017).

Although complete MPP-Dairy data are not yet available for 2018, participation rates and payments to dairy farmers have been substantially higher than for 2015 through 2017. Based on provisions in the BBA of 2018, Secretary Perdue extended the deadline for 2018 enrollment to June 22, 2018, retroactive to January 1, 2018. Since the ADPM in the first half of 2018 had been lower than $7.00 per cwt for most months, many dairy farmers realized that they could buy coverage to receive indemnity payments in excess of premiums.

There are several reasons to expect participation rates and indemnity payments to be higher for DMC than for MPP-Dairy from 2015 to 2017:

- DMC will trigger indemnity payments at a greater frequency than MPP-Dairy. In the 46 months from January 2014 through October 2018, there have been 18 months when the ADPM has fallen below $8.00 per cwt, the highest CLT available. If DMC had been in place over the same months, there would have been 36 months when the DMC margin would have fallen below the maximum coverage rate of $9.50 per cwt.

- Premiums for Tier 1 are lower under DMC than they were under MPP-Dairy. They are also lower for Tier 2 at CLTs less than $5.50 per cwt.

- The option to choose one rate for Tier 1 and another rate for Tier 2 will be attractive to some farmers.

- Since the minimum production history coverage election has been lowered from 25 percent to 5 percent, some dairy operations that previously had production history too large to participate at the Tier 1 level (i.e., (production history X 25 percent) > 5 million pounds) will now be able to pay the lower Tier 1 premiums for the first 5 million pounds of production history.

- Participants in the LGM-Dairy program may also choose to participate in DMC.

However, with additional risk management options now available for dairy farmers, participation in DMC may be limited:

- The BBA of 2018 eliminated a funding limit of $20 million for LGM-Dairy, making the program more widely available. While the 2018 Farm Act allows dairy farmers to participate in both DMC and LGM-Dairy, some farmers will opt to participate in only LGM-Dairy.

- The first available coverage for Dairy-RP starts in the first quarter of 2019. While dairy operations may participate in both DMC and Dairy-RP, some will opt to participate in only Dairy-RP.

Greater risk reduction from DMC compared to MPP-Dairy could provide an incentive for dairy farmers to increase milk production, thereby lowering prices. While this could occur if participation rates and indemnity payments increase as expected, both MPP-Dairy and DMC are partially decoupled programs. Payments depend upon market conditions but not current production, mitigating supply response to some extent for at least two reasons:

- DMC payments do not increase if the dairy farmer’s milk production increases.

- With the consolidation of dairy farms and technological gains contributing to higher milk per cow, production history established is less than current production for most participating dairy farmers.

The Supplemental Agricultural Disaster Assistance Programs—LFP, LIP, and ELAP—provide a safety net for livestock producers when natural disasters occur, including diseases. The eligibility requirements have changed, and now only LFP has an annual payment limitation. LFP has consistently represented the largest share of federal expenditures for livestock disaster assistance programs. The annual expenditures of LFP have been driven primarily by multiple severe drought years and monthly feed prices (since producers need to feed livestock when grazing land or pastureland losses occur). LIP is the second-largest program, followed by ELAP. ELAP expenditures are difficult to predict given the addition of funding for inspections of cattle tick fever and the removal of the annual payment limitation.

The expanded coverage under LIP for losses caused or transmitted by a vector that is not controlled by vaccination or other acceptable management practices will address risks that are not covered under the ELAP cattle tick fever clause or the indemnity programs operated by USDA’s Animal and Plant Health Inspection Service. This would likely cover new non-native insect species such as longhorned ticks, New World screwworm flies, etc. Additionally, assistance for coverage for the death of unweaned livestock and financial losses sustained when livestock are not killed but are injured by an eligible cause of loss and sold for a reduced price may combine to increase program costs.