Credit

Credit: Title V; See also Beginning, Socially Disadvantaged, and Veteran Farmers and Ranchers

The Agriculture Improvement Act of 2018 (“2018 Farm Act”) provides support to farmers with limited access to traditional lending markets by increasing direct loan and loan guarantee limits made by the Farm Service Agency. It places special emphasis on making loans to the next generation of farmers, including beginning farmers, farmers with limited means, and military veterans. It also relaxes limits to loans that can be sold to Farmer Mac by other institutional lenders, pending the result of a study by the Farm Credit Administration.

Highlights

- Raises the maximum loan size for Farm Ownership Loans from $300,000 to $600,000 for direct loans and the maximum loan size for guaranteed loans from $700,000 (inflation adjusted to $1,429,000 in 2018) to $1.75 million.

- Raises the maximum loan size for Operating Loans from $300,000 to $400,000 for direct loans and from $700,000 (inflation adjusted to $1,429,000 in 2018) to $1.75 million for guaranteed loans.

- Increases the Loan Authorization Levels (the overall authorization of what may be loaned in a given year) for all direct and guaranteed farm loan programs from $4.226 billion per fiscal year to $10 billion per fiscal year from 2019 to 2023, with the shares for direct and guaranteed loans remaining the same at 30 and 70 percent.

- Reauthorizes Loan Fund Set-Asides that require 50 percent of direct operating loans to be reserved for qualifying beginning farmers and ranchers for FY2019-FY2023.

- Reauthorizes appropriations of $150 million annually for FY2019-FY2023 for the Conservation Loan and Loan Guarantee Program for qualifying conservation projects.

- Reauthorizes Cooperative Lending Pilot Projects, which allow the Secretary to make up to $10 million annually in loans to community development financial institutions for FY2019-FY2023.

- Amends the Acreage Exception to Loan Amount Limitation to increase the acreage exception from 1,000 acres to 2,000 acres to remain a qualified Farmer Mac secondary market loan. This will enable larger loans to be sold to Farmer Mac by commercial banks and members of the Farm Credit System. This will be implemented pending a feasibility study by the Farm Credit Administration.

- Allows the Secretary to reduce or waive the eligibility requirement that an applicant have participated in the business operations of a farm or ranch for 3 years for farm ownership loans based on certain experience, training, or education (see Beginning, Socially Disadvantaged, and Veteran Farmers and Ranchers).

- Increases the loan guarantees from 90 to 95 percent for socially disadvantaged and beginning farmers.

New Programs and Provisions

Equitable Relief (Title V) – Authorizes the Secretary of Agriculture to provide equitable relief to farm loan program borrowers who were mistakenly qualified for farm loan program loans and who acted in good faith. Relief measures can include the borrower’s right to retain the loan or other benefits associated with the loan, or other means as the Secretary deems to be appropriate.

Use of Additional Funds for Direct Operating Microloans (Title V) – Authorizes appropriations of up to an additional $5 million annually for FY2019-FY2023 to allow the Secretary of Agriculture to make additional direct operating microloans in any fiscal year in which it is determined that the need for direct operating loans is greater than the aggregate authorized amount. Microloans are loans of up to $50,000 to individual borrowers that have more flexible application requirements than larger loans.

State Agricultural Loan Mediation Programs (Title V) – Reauthorizes the program for FY2019-FY2023 and extends the scope of State mediation programs to cover: organic compliance, lease issues, family farm transitions, farmer-neighbor disputes, credit counseling, or other issues as determined appropriate by the Secretary of Agriculture. The Provision also requires the Secretary to submit a report to Congress describing the efficacy of these mediation programs within 2 years of the 2018 Farm Act.

Economic Implications

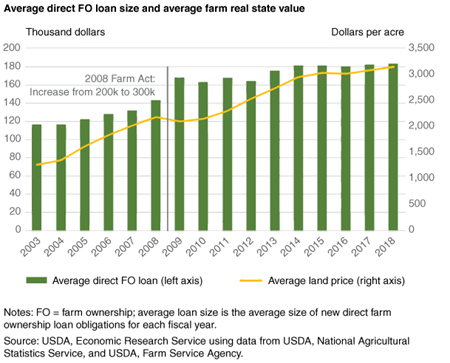

- The 2018 Farm Act’s increases in maximum loan sizes for direct farm ownership have followed the rising value of farmland. In 2008, the farm bill increased the direct farm ownership loan limit from $200,000 to $300,000. The following year, the average direct farm ownership loan size increased by $25,000. If direct borrowers are facing constraints due to the current loan limit, a similar increase may occur in FY2019. By increasing the direct farm ownership loan size, the 2018 Farm Act seeks to ensure that beginning farmers and those from socially disadvantaged populations can use direct farm loan programs for real estate purchases. This increase will allow direct farm loan applicants to seek sufficient credit despite rising land prices.

- The increase in loan guarantee limits for Farm Service Agency loans coincides with the growth in average size of those loans over time. Between 2008 and 2018, the average guaranteed farm ownership loan increased from $352,038 to $481,551 in nominal terms. While the prior guaranteed limit was inflation adjusted, increases in farmland value and consolidation have contributed to growth in farm debt that outpaces inflation. By increasing the maximum loan limits for USDA farm loan programs, the 2018 Act will enable the Farm Service Agency to guarantee larger loans without having to make fewer loans to stay within their current level of appropriations.

- Increased funding and increased maximum loan size coincide with increases in the use of those USDA, Farm Service Agency (FSA) programs: in FY2018, the total volume of direct farm ownership loans were the highest in FSA history, while guaranteed farm ownership loans were the third highest in FSA history. FSA made 10,637 loans through these programs in FY2018.

- Financial institutions market a portion of their loans on secondary markets managed by Farmer Mac, up to a maximum limit of $2.5 million per loan, subject to an exception based on the size of the farm covered by the loan, in acres. A doubling—from 1,000 acres to 2,000 acres—of the exception could result in more loan volumes reaching the secondary market.