Crop Insurance

Crop Insurance: Title XI and Title XII (Miscellaneous)

Provides new and continuing insurance products to protect producers against losses resulting from price and yield risks. Under the Federal crop insurance program, private-sector insurance companies sell and service the policies, and USDA’s Risk Management Agency develops and/or approves the premium rate, administers premium and expense subsidies, approves and supports products, and reinsures the companies.

Highlights

- The new Supplemental Coverage Option (SCO) creates a new insurance product for crop producers that provides area-based coverage in combination with coverage offered by traditional crop insurance policies, beginning with the 2015 crop year.

- The Stacked Income Protection Plan (STAX) replaces traditional commodity program coverage for producers of upland cotton, beginning with the 2015 crop.

- The Noninsured Crop Assistance Program (NAP) (Title XII), which provides weather-related coverage for commodities for which crop insurance policies are not available, is expanded. Additional “buy-up” coverage above catastrophic loss levels will be allowed for commodities that otherwise would not have additional coverage available to them.

- USDA’s Risk Management Agency is directed to move toward expansion of the Federal crop insurance program by developing a peanut revenue insurance program to be available beginning with the 2015 crop and by studying new insurance products for a range of commodities, including livestock, bioenergy crops, and specialty crops.

- New methods for establishing insurable yields allow producers to drop years in which the county or adjacent county yield is 50 percent or more below the 10-year county average.

New Programs and Provisions

The Supplemental Coverage Option (SCO) offers producers additional area-based insurance coverage in combination with coverage by traditional crop insurance policies. The program provides coverage based on county average yield or revenue and will be made available beginning with the 2015 crop. The program will provide subsidies to producers of 65 percent of their premiums. SCO coverage is not available to producers who elect to participate in either the Agriculture Risk Coverage (ARC) program under Title I or the Stacked Income Protection Plan (STAX). SCO, like traditional crop insurance, is not subject to payment limitations or adjusted gross income (AGI) eligibility limits.

The Stacked Income Protection Plan (STAX) provides revenue insurance policies to producers of upland cotton beginning with the 2015 crop, in place of coverage for cotton under the new Title I Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC) programs. To provide support while the new program is being implemented, upland cotton producers will receive transition payments for crop year 2014 and also for crop year 2015 in any areas where STAX policies are not yet available. STAX policies can supplement insurance coverage available through the Federal crop insurance program, or be purchased as a stand-alone policy. Federal subsidies will cover 80 percent of producers’ premiums. STAX, like traditional crop insurance, is not subject to payment limitations or adjusted gross income (AGI) eligibility limits.

The Noninsured Crop Assistance Program (NAP), which provides weather-related loss coverage for situations where crop insurance coverage is unavailable, is expanded to allow for additional “buy-up” coverage above the catastrophic loss level. Payments under NAP cannot exceed $125,000 per individual for a single crop year.

USDA’s Risk Management Agency will offer peanut revenue insurance coverage starting in crop year 2015, subject to the development of an actuarially sound product. The Federal Crop Insurance Board is authorized to consider and offer privately developed index-based weather coverage for commodities not well served by existing products. Research and development activities are also authorized to study new insurance products for bioenergy crops, catfish, alfalfa, livestock diseases and business interruptions, whole-farm diversified operations, and food safety for specialty crops.

Economic Implications

- The subsidy rate of SCO premiums is fixed at 65 percent, while the subsidy rate of premiums for traditional crop insurance ranges from 38 to 80 percent, depending on the coverage level and other options chosen by the producer. As a result, the introduction of SCO to protect against shallow losses could lead to changes in the level of traditional crop insurance coverage chosen by producers.

- SCO coverage is based on county average yield or revenue, rather than individual farm losses. Thus, the closer a producer’s farm yields and revenues are to county averages, the better the fit of SCO coverage.

- The STAX program, for which only upland cotton producers are eligible, seeks to address U.S. obligations under the WTO ruling that U.S. upland cotton subsidies under previous Title I programs affected world prices and thus distorted trade. Because the benchmark price for cotton coverage under STAX will be the expected price for the current year, the program will reflect market conditions more rapidly than Title I commodity programs, for which benchmark prices are either fixed reference prices or multi-year averages.

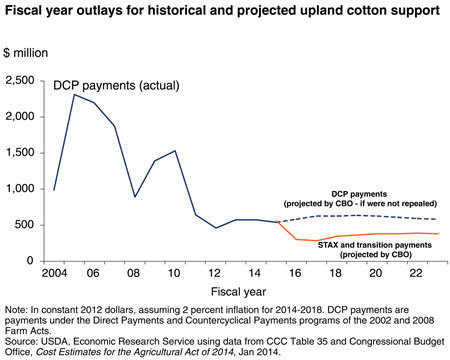

- Even with the 80-percent premium subsidies offered by the program, government outlays for upland cotton support as estimated by the Congressional Budget Office will be lower than levels under the repealed direct and countercyclical payment (DCP) programs.

- Allowing producers to drop very bad years in calculating insurable average yields addresses the problems of isolated severe losses and of systemic disasters that make county-based yield alternatives ineffective. Since this solution increases producers’ insurable yields, it will increase indemnities in years when losses are incurred, although to the extent indemnities increase, premium rates will increase as well.

- Movement under the 2014 Farm Act toward expansion of crop insurance and NAP coverage for underserved commodities reflects efforts to broaden the range of commodities eligible for Federal support. That expansion, however, comes not in the form of direct price or income support as Title I commodity programs had provided, but rather through additional coverage or access to programs more oriented to managing risk. This approach underlines the growing emphasis on risk management, and especially Federal crop insurance, in Federal programs for agriculture.