Glossary

Note: This database is no longer being updated.

The following terms are arranged by subject group and provide a basic understanding of elasticities and related economic concepts.

Demand Elasticities

- Price Elasticity of Demand

- Own-Price Elasticity

- Cross-Price Elasticity

- Income Elasticity of Demand

- Expenditure Elasticity of Demand

Demand Functions

- Hicksian or Compensated Demand

- Marshallian, Ordinary, or

- Uncompensated Demand

- Conditional Demand

- Unconditional Demand

Demand Properties (relationships among elasticities)

Commodity Elasticity Models

Type of Data Used

Resources

Demand Elasticities

A measure of how demand changes in response to changes in prices or income. Since elasticity is a relative measure, it is independent of scale and, thus, provides a useful measure of comparison across all ranges and quantities.

Price Elasticity of Demand

A measure of the responsiveness of demand to a change in price.

Own-Price Elasticity

A measure of the responsiveness of demand for a good to a change in price of that good. Represented by the ratio between percentage change in quantity demanded and percentage change in price:

If the percent change in the quantity demanded is greater than the percent change in the price of a good, demand is said to be price elastic or more responsive to price changes. (Example: A 1-percent change in price induces a change in quantity demanded by more than 1 percent.) If the percent change in the quantity demanded is less than the percent change in the price of a good, demand is said to be price inelastic, or less responsive to price changes. (Example: A 1-percent change in price induces a change in quantity demanded by less than 1 percent.) If the response is exactly equal to 1 percent, the demand is said to be unitary, where a 1-percent decrease in price results in a 1-percent increase in demand. The higher the price elasticity, the more sensitive consumer demand is to price changes.

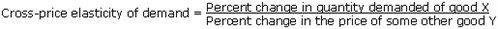

Cross-Price Elasticity

A measure of responsiveness of demand for one good to a change in the price of another good. Represented by the ratio of the percent change in the quantity demanded of good X to a percent change in the price of some other good Y:

If the percent change in the quantity demanded of good X is greater than the percent change in the price of good Y, the demand for good X is said to be cross-price elastic with respect to good Y, or responsive to changes in the price of good Y. (Example: A 1-percent change in cross price induces a change in quantity demanded by more than 1 percent.) If the percent change in the quantity demanded of good X is less than the percent change in the price of good Y, the demand for good X is said to be cross-price inelastic with respect to good Y, or not responsive to changes in the price of good Y. (Example: A 1-percent change in cross price induces a change in the quantity demanded by less than 1 percent.) Cross-price elasticities can be complements or substitutes. If the cross-price elasticity of demand is positive, the goods X and Y are substitutes. If the cross-price elasticity of demand is negative, the goods X and Y are complements.

Income Elasticity of Demand

A measure of the responsiveness of demand to changes in income. Shows how the quantity purchased changes (how sensitive it is) in response to a change in the consumer's income. Represented by the ratio between percentage change in quantity demanded and percentage change in income:

If the percent change in the quantity demanded is greater than the percent change in consumer income, the demand is said to be income elastic, or responsive to changes in consumer income. (Example: A 1-percent change in income induces a change in quantity demanded by more than 1 percent.) If the percent change in the quantity demanded is less than the percent change in consumer income, the demand is said to be income inelastic, or not responsive to changes in consumer income. (Example: A 1-percent change in income induces a change in quantity demanded by less than 1 percent.) The higher the income elasticity, the more sensitive consumer demand is to income changes.

Assumption: If the income elasticity of demand is positive, the good is a normal good, and if the income elasticity of demand is negative, the good must be an inferior good. Negative income elasticity is common with staple foods in developing countries, generally considered inferior goods. As income increases, consumers substitute traditional staple foods (such as rice, cassava, corn, wheat, and potatoes) for higher value foods such as meats, fruits, and processed products.

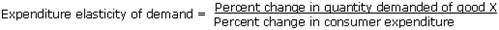

Expenditure Elasticity of Demand

A measure of the responsiveness of demand to changes in expenditure on a bundle of similar goods. Shows how the quantity purchased changes (how sensitive it is) in response to a change in the consumer's expenditure, which is a proxy for income. The expenditure is from a bundle of similar goods that can be separated from other goods. Some demand models, such as the Almost Ideal Demand System (AIDS), use budget shares or expenditure on goods and not household income in estimating the demand system. Represented by the ratio between percentage change in quantity demanded and percentage change in expenditure:

If the percent change in the quantity demanded is greater than the percent change in consumer expenditure, the demand is said to be expenditure elastic, or responsive to changes in consumer expenditure. (Example: A 1-percent change in expenditure induces a change in quantity demanded by more than 1 percent.) If the percent change in the quantity demanded is less than the percent change in consumer expenditure, the demand is said to be expenditure inelastic, or not responsive to changes in consumer expenditure. (Example: A 1-percent change in expenditure induces a change in quantity demanded by less than 1 percent.) The higher the expenditure elasticity, the more sensitive consumer demand is to expenditure changes.

The AIDS demand system provides expenditure elasticities of demand. Modeling demand as commodity groups with budget shares and expenditures uses the composite commodity theorem, separability of commodities, and two-stage budgeting. For reference on these topics, see Deaton and Muellbauer, Economics and Consumer Behavior, Cambridge University Press, Cambridge, MA, 1980, chapter 5, pp. 117-142.

Demand Functions

Economists use mathematical equations (functions) to model consumer demand. The causal relationship is between quantity demanded by the consumer, which is the dependent variable, and the price of a good and consumer income, which are the independent variables.

Hicksian or Compensated Demand

The Hicksian demand function (after British economist Sir John R. Hicks) shows the relationship between the price of a good, P1, and the quantity purchased on the assumption that other prices, P2, and utility, U0, are held constant. This consumer demand function is obtained by minimizing the consumer's expenditures subject to the constraint that his/her utility (the satisfaction a consumer derives from a particular market basket) is fixed at level U0. Hicksian and Compensated Demand functions are the same and are represented by the following equation: h1(P1, P2, U0).

Marshallian, Ordinary, or Uncompensated Demand

The Marshallian demand function (after British economist Alfred Marshall) shows the relationship between the price of a good, P1, and the quantity purchased, Q1, on the assumption that other prices, P2, and the consumer's budget (or income), Y0, is held constant. The demand function is obtained by maximizing the consumer's utility subject to the constraint that the customer's budget is fixed at the level Y0 and so are other prices. Marshallian, Ordinary, and Uncompensated Demand functions are the same and are represented by the following equation: Q1= f (P1, P2, Y0).

Conditional Demand

Conditional demand is derived from using a subset of the consumer's total budget. An example would be estimating food demand using the budget only for food. The demand is conditional upon the food budget and not the entire budget.

Unconditional Demand

Unconditional demand is a demand system that uses the consumer's entire budget.

Demand Properties (relationships among elasticities)

Marshallian and Hicksian demand functions exhibit specific theoretical properties based on the assumptions used to derive the functions. Marshallian demand properties include additivity and homogeneity. Hicksian demand properties include additivity, homogeneity, negativity, and symmetry.

Additivity

For both Marshallian and Hicksian demand functions, the budget constraint is satisfied for the given prices and income. The total expenditure is equal to the sum of individual expenditures on different commodities and goods. Additivity (or adding up) ensures that the income effects add up.

Homogeneity

Marshallian demand functions are homogeneous of degree zero in both prices and income. Hicksian demand functions are homogenous of degree zero in prices only. If both prices and income double, then Marshallian demand does not change. In Hicksian demand functions, if all prices double with a given level of utility, then demand does not change. If price and income increase by the same percentage, there is no change in demand.

Negativity

The negativity-of-own-substitution effect is the law of the downward-sloping Hicksian demand curve. If the own-price increases and expenditure is adjusted to keep utility constant, then demand for the good will decrease. This is a property of the Hicksian demand function only, not of the Marshallian demand function.

Symmetry

The cross price elasticities of a Hicksian demand function are symmetric because of Slutsky symmetry conditions. Assuming there is no income effect of a price change, the cross-substitution effect between good X and Y must be the same as the cross-substitution effect between Y and X. This relationship can be used to predict the change in demand for good X if the price of good Y increases.

Commodity Elasticity Models

An equation or set of equations with defined parameters used to measure the elasticity of demand.

Double-Log

The double-log demand equation is obtained by taking logs of both sides of a multiplicative demand equation. The convenient property of double-log demand is that the parameters directly measure the price elasticity of demand.

Translog

This modeling system is known as a flexible functional form. The indirect translog model approximates the indirect utility function by quadratic form in the logarithms of the price-to-expenditure ratios. These demand equations are homogenous of degree zero. A limitation in this model is the large number of parameters to be estimated. For reference, see Christensen, Jorgenson, and Lau, "Transcendental Logarithmic Utility Function," American Economic Review, Vol. 70, 1975, pp. 422-432.

Rotterdam Model

This demand system/model was developed by Theil and Barten and has been used frequently to test economic theory. The model is not in logarithms but works in differentials. Theoretical restrictions are applied directly to the parameters. For references, see A.P. Barten, Theorie en empirie van een volledig stelsel van Vraagvergelijkingen, doctoral dissertation, 1966, University of Rotterdam, Rotterdam, the Netherlands; and Theil, "The Information Approach to Demand Analysis," Econometrica, Vol. 33, 1965, pp. 67-87.

Linear Expenditure System (LES)

The LES demand system is derived from the Stone-Geary utility function and is a general linear formulation of demand and algebraically imposed theoretical restrictions of additivity, homogeneity, and symmetry. The LES is best used to estimate demand for goods with independent marginal utilities such as large baskets of goods or large categories of expenditures such as clothing, housing, food, and durables. For reference, see J.R.N. Stone, "Linear Expenditure System and Demand Analysis: An Application to the Pattern of British Demand," Economic Journal, Vol. 64, 1954, pp. 511-527.

Almost Ideal Demand System (AIDS)

The AIDS demand system is derived from a utility function specified as a second-order approximation to any utility function. Demand is expressed in budget shares and uses the Stone geometric price index. Theoretical restrictions are applied directly to the parameters. This model allows testing of homogeneity and symmetry in estimating demand. For reference, see Deaton and Muellbauer, "An Almost Ideal Demand System," Econometrica, Vol. 70, 1980, pp. 312-336.

Type of Data Used

The timeframe or specific range and coverage of data to be used in estimating the model/demand system.

Time Series Data

A series of observations made over time for the same variable, such as prices or income. The frequency—such as days, weeks, months, or years—is usually evenly spaced over the timeframe. (Example: A data series of weekly retail prices for the same type of head lettuce in the same city for the past 10 years.)

Cross Sectional Data

Observations made at the same time for the same variable but over a number of units. (Example: A data series of retail prices for the same type of head lettuce in different cities across the country for the same week.)

Panel Data

The combination of time series and cross sectional data. (Example: A data series of weekly retail prices for the same type of head lettuce in different cities across the country for the past 10 years.)

Resources

For more information on these definitions and demand estimation, see:

- Deaton, A., and J. Muellbauer. 1980. Economics and Consumer Behavior. New York, NY: Cambridge University Press.

- Johnson, S., Z. Hassan, and R. Green. 1984. Demand Systems Estimation: Methods and Applications. Ames, Iowa: Iowa State University Press.

- Phlips, Louis. 1982. Applied Consumption Analysis. Amsterdam, The Netherlands: Elsevier Science Publisher.

- Pollak, A. R., and T. Wailes. 1995. Demand System Specification and Estimation. Oxford, United Kingdom: Oxford University Press.

- Raunikar, R., and C. Huang. 1987. Food Demand Analysis: Problems, Issues, and Empirical Evidence. Ames, Iowa: Iowa State University Press.

- Waugh, F. 1964. Demand and Price Analysis: Some Examples from Agriculture, U.S. Department of Agriculture, Economic Research Service.