ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Tuesday, March 5, 2013

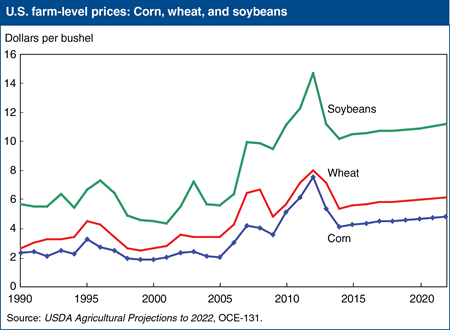

Weather has been an important factor affecting global wheat, corn, and soybean production over the past several years, leading to increases in grain and oilseed prices since 2009/10. Prices for grains and oilseeds are projected to decline in the near term as global production responds to recent high prices. Nonetheless, after these initial price declines, long-term growth in global demand for agricultural products, a depreciating dollar, and continued biofuel demand, particularly in the United States, the EU, Brazil, and Argentina, hold prices for corn, oilseeds, and many other crops above pre-2007 levels. These projections are based on a conditional, longrun scenario that assumes normal weather, a continuation of current U.S. farm legislation, specific U.S. and international macroeconomic conditions, and U.S. and foreign agricultural and trade policies. This chart is from USDA Agricultural Projections to 2022, OCE-131, February 2013.

Monday, February 11, 2013

USDA projects that grain exports by Russia, Ukraine, and Kazakhstan—the major grain exporting regions of the Former Soviet Union—will expand substantially during the coming decade. Gains in grain area are expected to be modest, but higher grain yields are projected to boost Russian grain output by 22 percent and Ukrainian output by 50 percent by 2021. While growth in meat production is expected to continue to increase the demand for feed grain within the region, exportable surpluses of both wheat and corn are projected to rise. By 2021, the combined exports of Russia, Ukraine, and Kazakhstan are projected at 71 million tons, more than 90 percent above the 2006-10 average, with the region’s share of global grain exports rising from 22 percent to 29 percent during the same period. The key reason for the anticipated growth in grain production and exports is further farm-level improvements in the productivity of inputs, led by large new farm operators that have upgraded agricultural technology and management in the region. This chart appears in the ERS report Rising Grain Exports by the Former Soviet Union Region: Causes and Outlook, WHS-13A-01, February 2013.

Monday, January 14, 2013

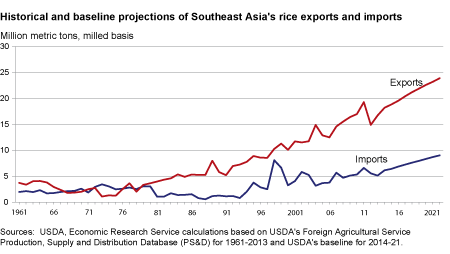

The Southeast Asia region is a major supplier of rice to global markets, accounting for about half of the import needs of the rest of the world in 2011. In USDA's most recent projections, Southeast Asia's rice surplus is expected to continue to expand over the next 10 years. Although rice production in the region is projected to grow at a slower rate over the next decade, growth in production is still expected to outpace growth in the region's rice demand. Land constraints are expected to lead to slower growth in both rice area and production, while the diversification of diets away from rice as incomes rise is projected to slow growth in rice consumption in most of the region. Overall, Southeast Asia's net exports of rice are projected to rise from an average of 11.2 million tons during 2009-11 to an average of 14.5 million tons in 2019-21. For this analysis, the Southeast Asia region refers to Brunei, Burma, Cambodia, Indonesia, Laos, Malaysia, the Philippines, Singapore, Thailand, and Vietnam. This chart appears in the ERS report, Southeast Asia's Rice Surplus, RCS-12l-01, December 2012.

Friday, June 17, 2011

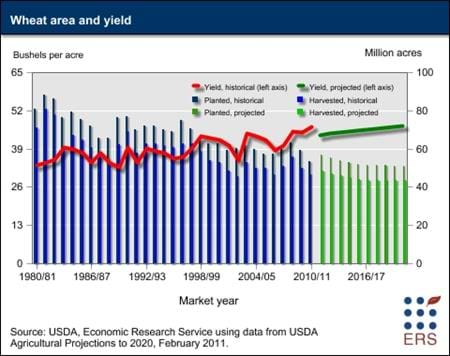

The United States is a major wheat-producing country, with output exceeded only by China, the European Union (EU-27), and India. Nationally, wheat ranks third among field crops in both planted acreage and value of production, behind corn and soybeans. Nonetheless, while varying widely during the past half-century, U.S. wheat area has been trending downward after peaking in the early 1980s, and is expected to do so for the foreseeable future. Past annual fluctuations in wheat area can be explained by changes in the Government's farm program, declining consumer demand for wheat products, and more recently, the relative profitability of growing competing crops. Several long-term factors play important roles in the projected downward trend of the U.S. wheat crop area for the remainder of this decade. The profitability of growing wheat relative to other crops, particularly corn and soybeans, is expected to continue declining. Two factors facilitating the planting of alternative crops, such as corn and sorghum, are the increased use of reduced-tillage and continuing genetic improvements, both of which improve yields of these alternative crops. Furthermore, wheat production in the Ukraine, Russia, and Kazakhstan is expected to continue increasing, competing with the U.S. in global markets. This graphic is from the Wheat briefing room, April 2011.