Thin Markets Raise Concerns, But Many Are Capable of Paying Producers Fair Prices

Highlights:

-

Markets for many farm products are increasingly concentrated at the processing level, meaning less competition for the products that farmers sell.

-

Increased coordination between farmers and processors can resolve information problems encountered by traditional spot markets and enhance the efficiency of agricultural production.

-

Farm product processors must offer a price that is at least sufficient to cover farmers’ longrun costs to ensure a stable input supply, but the transaction costs of contracting leave small producers at a disadvantage.

The Thin Markets Problem

U.S. agricultural production is becoming more concentrated at both the farm and farm product procurement levels, reviving longstanding tensions between producers and processors (we use the generic term “processors” to refer to downstream buyers). Increasingly, thin markets—meaning those with few purchasers and limited trading volume and liquidity—have received attention from policymakers because of concerns that processing firms could depress farm-level prices below those that would prevail in a competitive market. In addition, the low volume of spot market trading in thin markets provides fewer data for market observers and regulators to use, analyze, and publish, leaving producers to wonder whether they are being paid a fair price in a shrinking cash market or in contracts where few price benchmarks may be available. Regulatory efforts in response to these concerns include mandatory price reporting for large livestock packers and an attempt to restructure the way certain livestock commodities are marketed.

The same alternative exchange methods that draw volume away from spot markets—contracts and vertical integration—may offer enhanced opportunities for coordination between farmers and processors. Researchers have documented substantial efficiency gains, in the form of lower per-unit production costs and higher outputs, tied to the improved coordination available from contractual relationships. Furthermore, forward-looking processors in many thin markets have strong incentives to pay a farmgate price high enough to ensure a stable input supply. Thin market producers who can successfully maintain contracts with such processors can achieve returns that meet or exceed their longrun costs and ensure an adequate return on their investments. However, thin markets pose several new risks to unfamiliar producers.

U.S. Commodity Markets Are Thinning

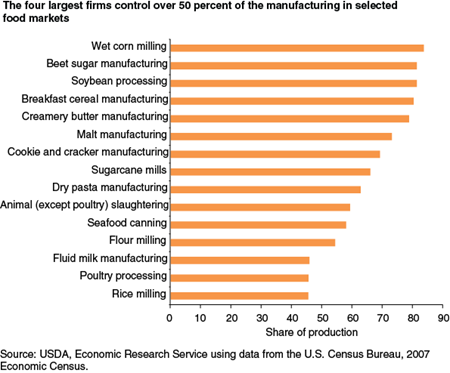

Concentration in U.S. food production, processing, and retailing is high, and in many cases, is increasing. The number of buyers and sellers of agricultural products is falling. The farms that account for half the sales of all farm products decreased by half from 1987 to 2012. For many farm products, just four firms control over 50 percent of food manufacturing. For livestock, the four largest packers now account for nearly 70 percent of the value of all U.S. livestock purchased for slaughter, compared with just 26 percent in 1980. Retail concentration has also intensified rapidly.

| All products | Cattle and calves | Hogs and pigs | Poultry and eggs | Dairy | Grains and other crops* | |

|---|---|---|---|---|---|---|

| 1987 | 75,682 | 39,879 | 15,017 | 12,776 | 11,828 | 40,904 |

| 1992 | 61,673 | 30,178 | 9,844 | 11,109 | 8,551 | 32,137 |

| 1997 | 46,068 | 20,083 | 6,769 | 10,138 | 5,565 | 21,281 |

| 2002 | 34,085 | 14,314 | 4,850 | 7,116 | 4,841 | 13,852 |

| 2007 | 32,886 | 14,414 | 4,701 | 7,311 | 4,786 | 16,291 |

| 2012 | 33,330 | 12,879 | 4,465 | 6,123 | 4,211 | 20,197 |

| *Other crops include oilseeds, dry beans, and dry peas. Source: USDA, Economic Research Service using USDA Census of Agriculture data. |

||||||

A related factor contributing to commodity market thinness is heightened product heterogeneity; consumer food demand is becoming increasingly differentiated. Beyond traditional preferences of taste, appearance, and convenience, many Americans today desire food attributes related to healthfulness, environmental concerns, treatment of animals, location of production, and the perceived fairness of marketing arrangements with producers. While these features present farmers and processors with opportunities to differentiate their products and develop market niches, they also reduce the volume of trade in each attribute niche.

Meeting these evolving demands requires a level of coordination that is typically not possible in a traditional, competitive spot market in which goods are homogeneous. Instead, food processors identify and establish contractual relationships with reliable producers who can consistently deliver products with the required attributes on schedule. Today, large agricultural firms market differentiated farm products aimed at diverse consumer preferences. They do so by forming relationships with producers they can depend on to supply products according to buyer specifications. In these settings, farmers often have only a small number of potential buyers.

Concerns Over Thin Markets

Most concerns about thin markets are related to transparency and pricing fairness at the product procurement stage. Low trading volume and liquidity in thin markets reduces the visibility of price and volume data. This can impair price discovery, the process by which new information about a commodity is incorporated into its price, potentially leading to heightened price volatility. When prices do not adjust efficiently to new supply and demand information, they can lead to suboptimal decisions on the part of producers and processors alike. Sparse data also complicate USDA’s efforts to collect and disseminate commodity market information, administer price support programs, and issue and manage crop insurance.

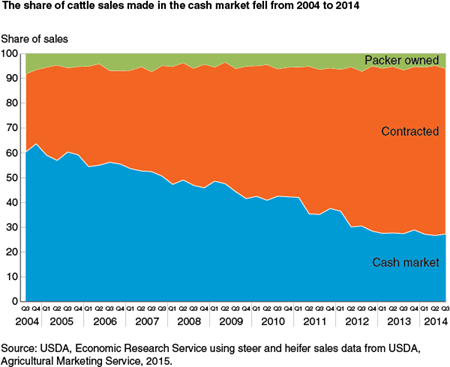

Because prices and transaction volumes are difficult to come by, the information available to market participants is asymmetric. In thin markets, where private, two-party contracts are common, farm prices are usually determined by negotiations between buyer and seller. The decline in observable spot market trades, which can serve as benchmarks for price-setting in these contracts, means that producers have less information than processors when it comes to negotiating a fair price. An example of the transition from cash market to contract marketing is provided by the U.S. cattle market, which saw its share of cash market sales (negotiated cash and negotiated grid) fall from 60 percent in 2004 to less than 27 percent in 2014. Farmers may have only one potential buyer, while processors deal with many farmers. Lack of transaction transparency in thin markets can, therefore, lead producers to wonder whether they are being paid a fair price.

According to traditional economic models that consider only a near horizon, processors who have market power—the ability to affect farm product prices through their actions—could increase their profits by restricting the prices they pay to farmers. However, despite higher concentration in many domestic procurement markets, most recent research has found that increased concentration has had negligible effects on prices. Even in these traditional models, the price impacts of buyer power depend on the degree of competition, the extent of barriers to entry of new competitors, and the responsiveness of supply to a lower price.

When Do Thin Markets Work, and Who Could Be Left Out?

Another reason why buyer power in a procurement market does not necessarily lead to lower farm prices is that most processors are forward looking, concerned with maximizing profits over the life of the operation instead of just for a single period. A processor who forces producers out of the market by keeping prices too low jeopardizes his or her ability to acquire farm products. To promote a stable supply of such products, processors must pay a farmgate price that covers producers’ total production costs plus a fair return on investment. Such a price ensures that enough local producers are available to provide the processor with the farm products needed to meet its own production plans, deterring producers from planting or growing potential substitute farm products. Therefore, many thin market processors forego shortrun buyer-power profits and instead seek mutually beneficial, coordinated production relationships with nearby farmers as a way of maximizing returns over the long run.

However, certain conditions can threaten that strategy. If the industry or processor is facing financial insolvency, shortrun market-power profits become more attractive because, in essence, there is no long run. More generally, the relative value placed on profits today versus tomorrow can affect a processor’s negotiation strategy—one who discounts future payoffs at a greater rate is more likely to drive a harder bargain today.

There is not much evidence that thin market prices are restricted below the competitive level. Furthermore, research demonstrates that the increased coordination between producers and processors afforded by the contract system in thin markets provides substantial efficiency gains, including a reduction in the costs of production. In turn, reduced per-unit resource costs free up labor, capital, material, and land inputs for other uses.

Even in thin markets that pay a fair price to producers while meeting retail demands, however, smaller farmers can be overlooked due to transaction costs associated with contracting and production cost advantages in production that increase with the size of the farming operation. To minimize their own costs, processors seek out the most efficient producers who can meet desired quality levels. Because searching for producers, negotiating, and writing contracts have costs, processors will engage the lowest number of producers whose combined production will meet their input demand.

The transition to thin markets is unlikely to affect all producers equally. In a thin market environment, small producers face a natural disadvantage. Larger producers can spread their fixed costs over a bigger crop, meaning lower production costs and lower sustainable farmgate prices. In the short run, small growers might be able to differentiate themselves sufficiently to fill a customization niche. However, as the market matures, it will attract more efficient producers, and processors (who seek to minimize transaction costs) will move away from small farms unless small producers are able to adjust to the new environment.

If producers make investments to suit their production to a particular processor’s taste, they may have difficulty attracting another buyer or arguing for better contract terms if the original relationship becomes less stable or ends. For example, to contract with a new processor, a farmer growing a proprietary variety of malting barley for one brewer would need to exit production and plant an alternative crop on the acreage to prevent contamination between differing brewery-preferred seed mixes. Because a contract with another brewer cannot be secured until the land is ready for planting, switching buyers increases costs and risks to the farmer.

Thin Markets Complicate Regulatory Efforts

USDA’s mission includes collecting and disseminating commodity market information, administering price supports for selected commodities, and managing crop insurance programs. As a market grows thinner, each of these tasks becomes more complicated. Markets work more efficiently and more equitably when their participants are well informed, but private entities have little incentive to provide that service at an optimal level. As a result, public entities like USDA Market News serve an important role by publishing transaction data.

While there are few barriers to collecting and publishing price and quantity data in thick markets (those with many buyers and high liquidity and trading volume), in thin markets, which are dominated by bilateral contracts, these data are privately held. USDA requests that large participants provide data on a voluntary basis. Even when there are sufficient data to generate and publish market statistics, they are not always representative of highly differentiated products, because the published price represents an average and farm goods in thin markets are often far from homogeneous. Consequently, more specialized (and often smaller) producers are left to justify charging a higher price to their buyers, even if their product has attractive and distinctive attributes.

Insuring a thin market crop is also challenging. USDA offers farmers a range of insurance options to protect their yields or revenues from loss due to problems like poor weather or pests. An accurate forecast of the price a farmer would otherwise receive is crucial to establishing the liability level, a fair insurance premium, and a payout methodology. For a thick market commodity like corn, timely forecasts are easily found in an active futures market. However, for thin market commodities like organic corn or peanuts, the forecast procedure is more complicated. Historical data for prices are combined with prices and volatilities for related commodities or production substitutes that have active futures markets. Data reliability issues, harvest timing, and individual market supply and demand shocks affect the accuracy of the underlying historical correlations that USDA uses to design insurance products.

USDA farm-support initiatives are likewise complicated by a lack of market transparency. To help producers of certain commodities avoid having to market their crop at harvest time—when prices are lowest and supplies are highest—USDA offers them cash flow help via marketing assistance loans and loan deficiency payments through the Commodity Credit Corporation. These systems operate to guarantee a price floor to producers, but the market data used to arrive at repayment methodologies have been questioned, and the repayment scheme can lead to unintended consequences, like excess planting and surplus supplies (see box “Peanuts: A Thin Market With a Government-Set Price Floor”).

Addressing Thin Market Issues

Options to address perceived thin market problems, keeping in mind the efficiency gains afforded by producer/processor coordination, include the following:

Limiting vertical integration – One way to increase spot market liquidity would be to ban or limit the growing practice of packer-owned livestock. However, affected packers would likely choose to vertically coordinate via contract with producers instead of bidding on the spot market because contracting offers at least partial control over the production process. Recent research suggests that producers would be unlikely to benefit from legislation that forces packers to purchase a certain percentage of their livestock on the spot market. Underlying evidence from the research demonstrates that forcing integrated hog packers to shift their operations to the spot market actually reduces spot prices.

Standardizing contracts – Regulators could impose uniformity of contract terms to prevent processors from using contracts to exert market power. However, eliminating the ability to reward producers for meeting key input requests could drive away the most efficient producers. Still, small producers facing a transactions cost disadvantage may be assisted if the contracting process was facilitated. Establishing a common format in each market that uses clear language to communicate terms—while allowing terms to differ between negotiating parties—would reduce transaction costs and improve the ability of small producers to secure thin market contracts, while preserving efficiency gains.

Clarifying the price discovery process – Collection and dissemination of transacted prices, quantities, and the size and number of market participants reduces disparities in information. Researchers have found that mandatory large-processor price reporting has increased public knowledge about certain livestock prices, and this is one potential approach for making thin markets more transparent. Some producers, especially if their product is customized, believe that prices reported for average products can weaken their negotiating position. Publishing a price range rather than a single average price may better represent thin-market commodities that differ in attributes.

Recognizing new challenges – In thin markets, small producers are at a disadvantage because processors minimize transaction costs by contracting with the fewest producers needed for achieving their desired output. Processors target the most efficient producers, who tend to be the largest ones. Small farmers who are left out exit the industry. Policies that could improve outcomes for small producers by enhancing their economic efficiency include providing public information about expected market conditions and production and providing marketing advice through public extension services.

<a name='sidebar'>Peanuts: A Thin Market With a Government-Set Price Floor</a>

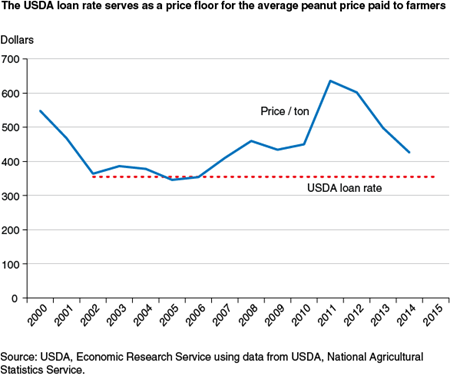

Peanuts have never had an active cash or derivative market. Farm bill changes in the early 2000s eliminated traditional price supports and altered the way growers are paid; farmers now contract with one of a handful of major domestic shellers to market their product. Two shellers account for about 70 percent of all peanut handling. Shellers contract with peanut growers, typically for a 1-year term, and pay the USDA repayment loan rate of $355 per ton plus a premium. The premium, however, varies substantially from year to year, based on inventory carryover, expected production, and expected harvest-time price of competing crops that growers may also choose to plant, such as corn, soybeans, and cotton. Given these options, shellers must tailor the premium to attract enough quality growers, ensuring a stable supply of peanuts to downstream buyers.

Thus, even though peanut shelling is a highly concentrated industry, farmers have the advantage of a price floor established by the loan rate, and their ability to plant other crops gives them a degree of bargaining power in the price-setting process. From an efficiency standpoint, however, the existence of a known price floor (and supplemental Government “price loss” payments if national prices drop below a statutorily-set reference price), even for noncontracted peanuts, can encourage periodic excess plantings and surplus supplies, delayed contracting, and, ultimately, a breakdown in the longrun relationship between growers and processors. Since the marketing assistance loan rate was introduced to peanuts beginning with the 2002 Farm Act, the average peanut price received by farmers has approached the Government-set price floor several times but never meaningfully dropped below it.

Thinning Markets in U.S. Agriculture, by Michael K. Adjemian, B. Wade Brorsen, William Hahn, Tina L. Saitone, and Richard J. Sexton, USDA, Economic Research Service, March 2016

“A Framework to Analyze the Performance of Thinly Traded Agricultural Commodity Markets.” by Michael Adjemian, Tina Saitone, and Richard Sexton, American Journal of Agricultural Economics, February 2016