The Size and Scope of Locally Marketed Food Production

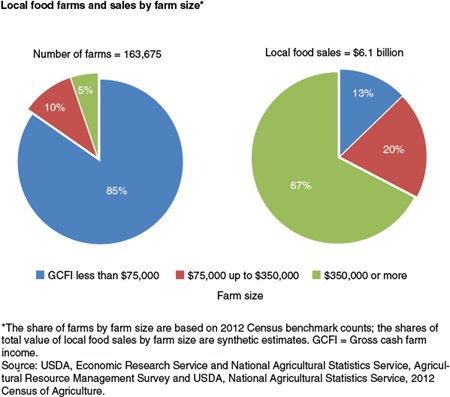

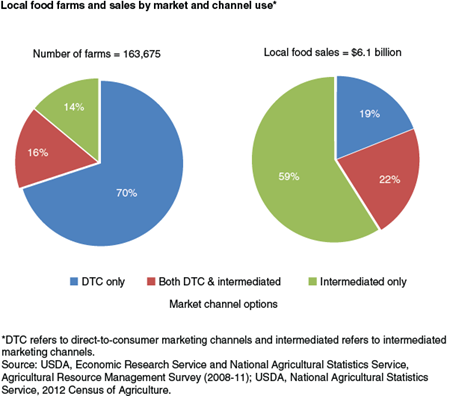

In 2012, 163,675 farmers sold an estimated $6.1 billion in local foods, according to recently published ERS estimates. Our definition of local foods includes food for human consumption sold via direct-to-consumer (e.g., farmers’ markets, on-farm stores, farm stands, pick-your-own activities, and other farmer-to-consumer venues) and intermediated marketing channels (sales directly to restaurants, grocers, schools, universities and other institutions, as well as sales to distributors, brokers, and other aggregators dedicated to local foods sourcing). Farms with local food sales represent 7.8 percent of U.S. farms, and local food sales account for an estimated 1.5 percent of the value of U.S. agricultural production.

A total of 144,530 farmers sold $1.31 billion in food through direct-to-consumer (DTC) channels, accounting for approximately 20 percent of local food sales. Although the number of farmers marketing through DTC channels increased between the 2007 and 2012 Censuses of Agriculture, the total value of DTC sales declined by 1 percent when adjusted for inflation. Between the 2002 and 2007 Censuses, the inflation-adjusted value of DTC sales had increased by 32 percent.

Two factors may have contributed to the lack of growth in DTC sales since 2007. First, consumer demand for local food purchased through DTC outlets may have plateaued. Second, where local food systems have been thriving, farmers may have been able to direct more of their sales to intermediated marketing channels—that is, growing consumer demand for local food may have been met by retailers rather than through DTC outlets.

In 2012, 48,371 farmers sold an estimated $4.8 billion of locally sourced food through intermediated marketing channels. Thus, while fewer than 30 percent of local food farms reported intermediated sales of local food, they account for almost 80 percent of all local food sales. Data are not available on the growth of local foods marketing through intermediated channels, since 2012 was the first time the Census collected this information.

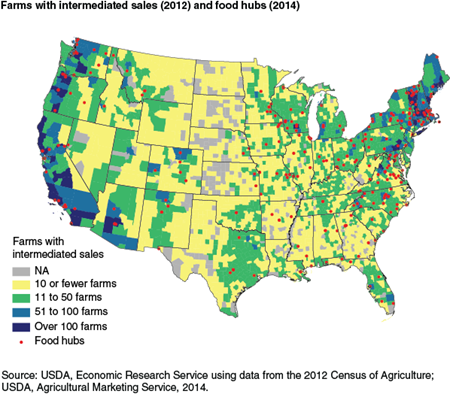

The number of local food aggregators, known as regional food hubs, increased by 288 percent between 2007 and 2014, to a total of 302. This increase may indicate growing economies of scale and scope in local food systems. By engaging in market outreach activities and offering technical services to producers, food hubs provide scale-appropriate markets for midsized farmers and opportunities for small and beginning farmers to scale-up local food sales without increasing the time farm operators and their households spend on marketing activities. Geographically, most food hubs are located in metropolitan areas. Fifty-six percent of the food hubs are found in a broad Northeastern quadrant stretching from Wisconsin to North Carolina, and 23 percent are on the West Coast.

Although small local-food farms are the most numerous, larger farms account for the greatest share of local food sales. As measured by gross cash farm income (GCFI), farms with less than $75,000 in annual GCFI account for 85 percent of all local food farms but generate only 13 percent of all local food sales. In contrast, farms with $350,000 or more in GCFI represent only 5 percent of local food farms while generating 67 percent of total local food sales.

Although most local food farms use DTC marketing outlets, the majority of the value of local food sales comes from intermediated marketing channels, such as sales to restaurants and grocers. Seventy percent of local food farmers use DTC marketing channels exclusively but these farmers earn only 19 percent of all local food sales, whereas the 14 percent of farmers who rely exclusively on intermediated marketing channels for local food sales earn 59 percent of all local food sales. Farmers’ use of particular local food marketing channels is correlated with the size of farm operations. As the size of local-food-sales farms increases, the frequency of selling through DTC marketing channels declines and the frequency of sales through intermediated marketing channels increases. Small local-food farms are three times as likely as larger local-food farms to rely exclusively on DTC channels, while over half of all large local-food farms marketed only through intermediated channels.

Trends in U.S. Local and Regional Food Systems: A Report to Congress, by Sarah A. Low, Aaron Adalja, Elizabeth Beaulieu, Nigel Key, Stephen Martinez, Alex Melton, Agnes Perez, Katherine Ralston, Hayden Stewart, Shellye Suttles, Stephen Vogel, and Becca B.R. Jablonski, USDA, Economic Research Service, January 2015

Local Food Systems: Concepts, Impacts, and Issues, by Stephen Martinez, Michael S. Hand, Michelle Da Pra, Susan Pollack, Katherine Ralston, Travis Smith, Stephen Vogel, Shellye Clark, Luanne Lohr, Sarah A. Low, and Constance Newman, USDA, Economic Research Service, May 2010

Direct and Intermediated Marketing of Local Foods in the United States, by Sarah A. Low and Stephen Vogel, USDA, Economic Research Service, November 2011