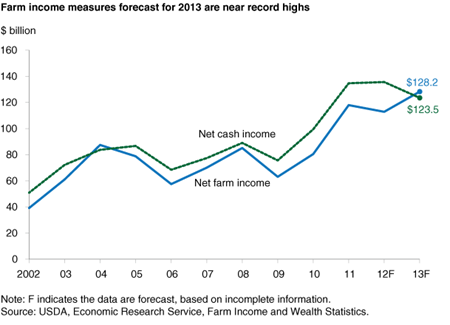

Farm Income Forecast To Remain High in 2013

The two main measures of farm sector income are currently expected to be close to record highs in 2013. Net farm income is forecast to be $128.2 billion, which would be nearly 14 percent higher than its 2012 forecast. Adjusting for inflation, this would be the highest net farm income since 1973. Net cash income, forecast at $123.5 billion, would be down nearly 9 percent from 2012 but still high by historical standards. The different trajectories for net farm income and net cash income are mainly due to expectations of substantial increases in the value of corn inventories during the year. Value of inventory change is included in net farm income but only affects net cash income when inventories are sold. The value of corn inventories is expected to rise based on projections of average corn yields and historic corn-acreage levels.

Expected changes in the value of farm production and expenses underlie these income forecasts. The value of crop production is projected to reach $233 billion in 2013. Like net farm income, this is driven by expectations of a large corn crop. While the total value of crop production is expected to increase 11 percent in 2013, the value of cotton production is forecast down over 28 percent in 2013 because of lower expected planted acreage and declining prices. The value of livestock production is forecast up 3.5 percent, to $176.2 billion, in 2013. Projected increases in the value of broiler and cattle/calf production are driving this increase. Expenses are expected to continue their decade-long rise in 2013, driven by increasing feed costs as well as 10- to 12-percent increases in both labor and rental expenses.

Longer term trends in farm production and expenses are also driving changes in the farm sector’s balance sheet. Farm sector equity is forecast to reach $2.45 trillion in 2013, a new record high, as the value of farm assets is expected to increase faster than farm debt. The growth in the value of farm assets is being driven by a projected 7.5-percent increase in real estate values. Farm sector debt is expected to rise 3 percent in 2013. The net effect of these changes is that the farm sector’s debt-to-asset and debt-to-equity ratios are forecast to reach their lowest levels on record. Low levels of these ratios indicate that the farm sector has a greater ability to handle income shocks.

Farm Sector Income & Finances, by Farm Income Team, USDA, Economic Research Service, February 2024