Farmland Values on the Rise: 2000-2010

Highlights:

-

Farmland values have been rising but so have farm earnings.

-

Historically low interest rates contribute to sustained high farmland prices and have helped improve the affordability of farmland.

-

Strong farm earnings have dampened the impact of a significant downturn in residential land markets.

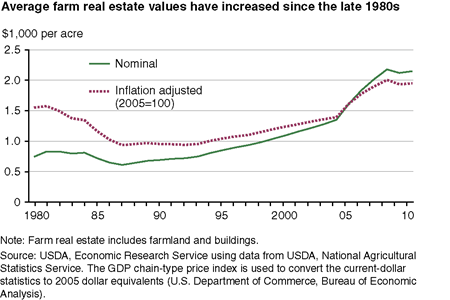

Farmland values have increased considerably in recent years, with double-digit annual growth in some States. Between 1994 and 2004, national average farm real estate values (including land and structures) increased between 2 and 4 percent annually in inflation-adjusted terms. In 2005 and 2006, they increased by 16 and 10 percent, respectively. And while the modest dip in national average values in 2008-09 suggests farm real estate values were not immune to the effects of the recession, average values for the Nation during the period mask wide regional variation. In 31 States, farm real estate values increased over 2007-09; declines were largely concentrated in the more urbanized States along the East Coast, where residential and commercial development opportunities strongly influence farmland values. In 2010 and 2011, States in several regions, including the Corn Belt and Great Plains, experienced significant growth in cropland values--including a 31-percent spike in Iowa from the third quarter of 2010 to the third quarter of 2011--while many States in the Southeast and Northeast experienced declines.

With a value of $1.85 trillion, farm real estate accounted for 85 percent of the total value of U.S. farm assets in 2010. Because farmland represents the major asset for most U.S. farm businesses and is the largest single investment in a typical farmer's portfolio, changes in farm real estate values affect the financial well-being of agricultural producers. In addition, farm real estate serves as the principal source of collateral for farm loans--enabling farm operators to purchase additional farmland and equipment, finance current operating expenses, and meet household needs

ERS researchers recently examined several factors that affect farmland values, including the role of farm business earnings; macroeconomic factors, such as interest rates; and changes in competing land markets. Although the recent rates of increase in farmland values are reminiscent of the boom experienced in the late 1970s, when high returns and Federal policies that increased incentives for investing in agriculture fueled a bubble, recent high farmland price increases are not occurring under the same conditions that contributed to the earlier boom. Current farmland values, at least for the farm sector as a whole, appear to be supportable given recent trends in farm earnings and interest rates.

Farmland Values Are Influenced by Many Factors

Economic theory posits that land values are derived mainly from expectations about the future stream of income generated by its most profitable use, with consistently higher incomes leading to higher land values. However, farm income trends do not always move in the same direction as farmland values. Although farm incomes and farmland values were once closely linked, in recent decades, the relationship has become less clear at the national level. Many factors not directly related to agricultural production help account for the weakening link between farm income and farmland values. For example, in areas close to urban centers, the value of farmland reflects the returns it could earn from being developed for housing or commercial use when those returns exceed those for agricultural use alone. Even in relatively remote areas heavily dominated by agriculture, nonagricultural factors, such as income from hunting leases, may push farmland values higher than could be justified from farming alone. In addition, a substantial number of farm operators--about 1.2 million of the Nation's 2 million principal farm operators--do not engage in farming as their primary occupation (for example, operators can meet the minimum criteria for being considered a farm--generating $1,000 in sales of agricultural products in a typical year--by grazing cattle and selling some each year. Low levels of farming activity can leave time for working off-farm jobs). While this group of operators controls a significant amount of farmland, it does not generate much income from farming, on average. For these farm operators, owning and living on a farm may have less to do with the economic returns to the farm business than with the lifestyle and recreational benefits farmland provides.

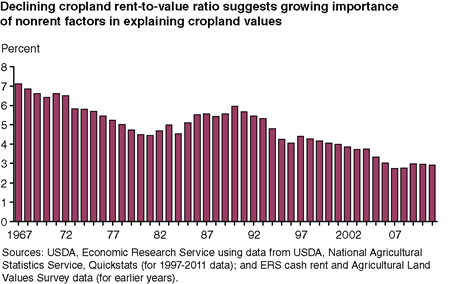

Comparisons of rent-to-value (RTV) ratios demonstrate changes in the value of land relative to farm income. At a national level, average rent-to-value ratios--calculated as the average cash rent per acre divided by the average per acre value of land--have been decreasing over the past 45 years. Decreasing RTV ratios are consistent with the growing importance of nonagricultural factors in determining land values that may not be reflected in rents. Over the last decade, declining RTV ratios have occurred in every region of the country, though in some regions the changes are larger or more variable than in others.

The rapid rise in farmland values over the last decade and the influence of nonagricultural factors on land values raise two critical questions for farmers. For the 800,000 farm operators that continue to depend on farming for their livelihood, is farmland still affordable? And how vulnerable are farmland values to unexpected changes in interest rates and the residential housing market, both of which have experienced significant changes in the last 10 years?

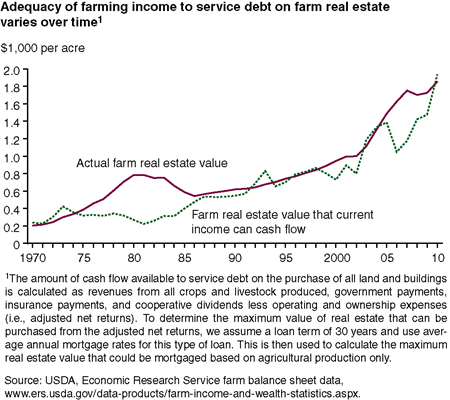

On Average, Farm Earnings Are Currently Sufficient To Service Farm Real Estate Debt

For those concerned about keeping farmland in agricultural production, a key measure of farmland affordability is whether farm income is sufficient to service debt on farm mortgages. In recent years, farm incomes have increased and interest rates have declined, and these two trends have combined to increase the maximum value of farmland that can be supported by current farm incomes. In 2009 and 2010 and between 1986 and 2004, farm real estate values were closely aligned with farm income. However, during two periods in particular--1978-85 and 2005-08--income from farming alone was insufficient to service the debt on farm real estate purchases. Nonagricultural factors likely had a large role in buoying farmland values during these two periods.

In addition to nonagricultural factors, thin farmland markets may be a reason for sustained high farmland values during periods when farmland is less affordable. Historically, relatively little farmland has been available for purchase, with some estimates indicating about 0.5 percent of U.S. farmland is sold annually. Evidence suggests that most farmland owners are slow to react to changes in the market value of their land and will not necessarily sell land when farmland values are high and affordability is low. Indeed, studies of farmland market activity reveal that sales of farmland are more often due to the death or retirement of the owner rather than a result of changing affordability levels.

Changes in farm earnings will determine whether farmland values will continue recent patterns and remain affordable. At present, the demand for crops for food and as an energy source is keeping commodity stocks tight and export demand strong. However, many farm operators also receive government agricultural payments which support farm income. Many proposals for the next farm bill call for an elimination or substantial reduction in some of these payment programs. Research has shown that these payments have increased farmland values, so if these programs are abruptly terminated and not replaced with programs that provide similar levels of payments, farmland values could decline.

Farmland Values Are Sensitive to Prevailing Interest Rates

In addition to farm earnings, historically low interest rates in recent years have been a key contributor to increasing farmland values. Indeed, the low cost of borrowing has helped improve the affordability of farmland. Record-low farm mortgage interest rates benefit farm operators who use debt to finance farmland purchases. Data from USDA's Agricultural Resource Management Survey (ARMS) reveal that land purchases by farm operators in 2008 and 2009 were financed predominantly by credit.

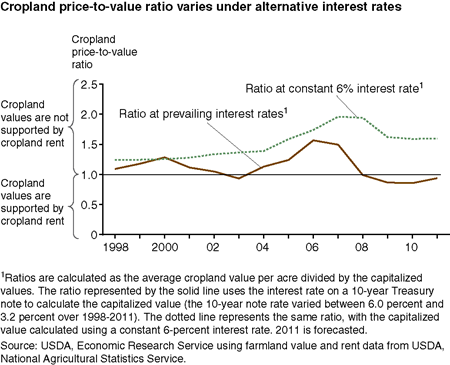

In 2000, average interest rates were equal to the long-term average Treasury note rate of 6 percent. Had interest rates remained at this 6-percent level over the decade, the stream of cash flows from farmland would not have been sufficient to support the increasing farmland values experienced over the past decade. But because interest rates have generally declined over the past decade, farmland has been more affordable than it would have been had interest rates remained steady. Improved affordability can increase demand for farmland and put upward pressure on farmland values.

This relationship can be better understood by looking at the cropland price-to-capitalized value ratio (see box, 'What Is Capitalized Value?'). In 2010, this price-to-value ratio was about 0.9 based on the then-current interest rate of 3.2 percent (price-to-value ratios less than 1.0 indicate cropland values are supported by farm earnings). This suggests that farmland was somewhat undervalued given expected returns to cropland and borrowing costs, encouraging the observed appreciation in farmland values. However, it also demonstrates how quickly that could change if interest rates should begin to rise. If interest rates were to jump to the long-term average of 6 percent, the price-to-value ratio would sharply increase to over 1.5, signaling that cropland values are not supported by the stream of rents the land could earn. Abrupt changes in interest rates are not common, however.

While rapid increases in interest rates could make it difficult for some farm operators to service debt, most farm operators are not leveraged to the extent that they were leading up to the farm crisis of the 1980s. As real farm debt has remained stable while real farm asset values have increased, the farm sector debt-to-asset ratio has decreased from 0.22 in 1985 to 0.11 in 2010 (see ERS Topics page on Farm Economy).

Strong Farm Earnings Have Dampened the Impact of Downturn in Residential Land Markets

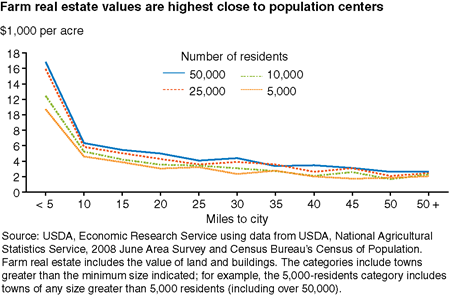

Over the last decade, most regions of the country experienced a boom-and-bust cycle in housing values. Because farmland is often the source of land used for new residential construction in urbanizing areas, changes in housing markets can affect farmland values. The effects are likely to be greatest for farmland closest to urban areas. Examining the relationship between value and distance reveals that the value of farm real estate is typically highest for farmland located less than 10 miles from the borders of a population center, and then tapers off at greater distances. Further, farm real estate values are higher for farmland near larger cities. For example, the average value in 2008 for agricultural parcels within 5 miles of a city of at least 50,000 residents is approximately $16,801 per acre, but when parcels the same distance from a town of at least 5,000 residents are included, the average value is $10,705. While the effects of the housing downturn may have the largest impacts on the 20 percent of farmland that ERS estimates to be subject to some form of urban influence, residential housing exists even in the most rural areas--so changes in rural housing markets have the potential to affect the values of far more farmland.

A comparison of farm real estate values between the boom-and-bust periods in the residential housing market reveals that average farm real estate values increased in all States during 2001-04, and the gains were often as great as or greater than gains in the rural housing market. From 2007 to 2009, average farm real estate values declined in many States as the housing bubble burst, but the reversals were generally more moderate than in the rural housing sector. In 19 States, notably California, Oregon, Washington, and Nevada, farm real estate values actually increased in 2007-09 while rural housing values declined. These trends suggest that strong gains in farm earnings and declining interest rates during 2007-09 helped the farmland market withstand the significant downturn in housing markets.

Many Factors Affect Whether Current Trends Are Likely To Continue

The current demand for crops for food and as an energy source continues to help support farm incomes. While stable farm incomes and interest rates could keep farmland values at or above their current levels, increasing interest rates, increasing volatility in agricultural markets, or sharp reductions in or elimination of government payment programs could lead to reductions in farmland values. Interest rates on farm loans and investments continue to be relatively low and stable, but they are sensitive to many factors outside of the agricultural sector's control, including the impacts of changes in monetary policy, tighter credit markets as the general economy recovers, and rising risk premiums on loans in general. Though as a whole the farm sector is currently not highly leveraged, if interest rates increase rapidly some highly leveraged farms may have difficulty servicing real estate debt. Gradual changes in interest rates are more the norm, however, and are less likely to have as immediate an effect in farmland markets because market participants have more time to adjust as expectations change.

What Is Capitalized Value?

Capitalized values are used to quantify impacts of both cash rent and interest rate changes on land values. A capitalized value represents the expected discounted value of all future cash flows to farmland. The capitalized value is calculated by dividing cash rent (a measure of cash flow generated from agricultural production) by a discount factor, typically an appropriate interest rate. When farmland prices divided by the capitalized value (price-to-value ratio) exceed 1, farmland values are not supported by the stream of cash flows the farmland could earn.

Trends in U.S. Farmland Values and Ownership, by Cynthia Nickerson, Mitch Morehart, Todd Kuethe, Jayson Beckman, Jennifer Ifft, and Ryan Williams, USDA, Economic Research Service, February 2012