Middle-Income Countries Drive U.S. Agricultural Trade

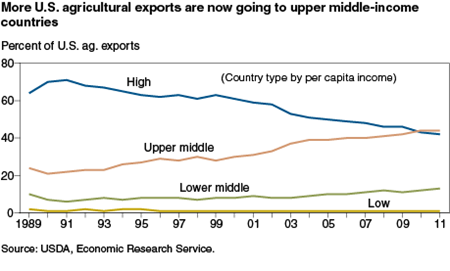

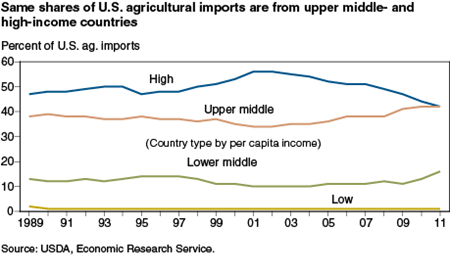

Middle-income countries, including Mexico and China, continue to grow as key partners in U.S. agricultural trade. In 2011, the United States shipped nearly half of its total agricultural exports to upper middle-income countries. Steadily rising income levels, expanding populations, and increased urbanization in developing countries have helped position them as important and fast growing export destinations for U.S. agricultural products, while high-income countries, such as Japan and member states of the European Union, account for declining shares U.S. exports (see 'Income Growth in Developing Countries Can Increase U.S. Agricultural Exports' in the March 2011 issue of Amber Waves). Middle-income countries are also becoming a major source of U.S. agricultural imports--their overall share is now equal to that of high-income countries.

For this analysis, U.S. agricultural export data are broken out by their destination--high-income countries (per capita gross national income of $12,276 or more per year), middle-income (lower middle, $1,006-$3,975 per year; upper middle, $3,976-$12,275 per year), or low-income ($1,005 or less per year)--and their level of processing. U.S. agricultural imports are also broken out by their source and level of processing. ERS used trade data from the Census Bureau and grouped trade partners with respect to income according to the World Bank's classification based on per capital Gross National Income (GNI).

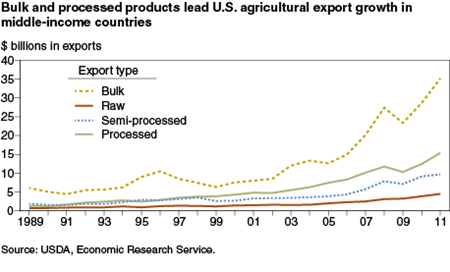

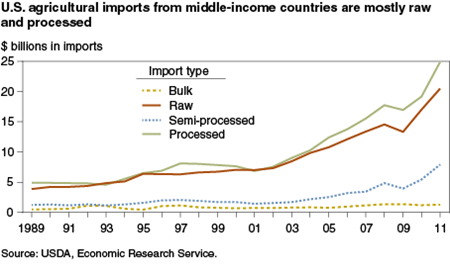

Agricultural trade was analyzed with a special focus on the products' level of processing--bulk, raw (fresh fruit and vegetables), semi-processed, and processed. ERS found that trade patterns differed depending on source or destination countries' income group.

In 2011, middle-income countries accounted for about half of U.S. bulk product exports, such as wheat, soybeans, corn, and cotton. Lower middle-income countries have been shifting toward more imports of processed products, including meat and nonfat dry milk. Upper middle-income countries have also increased their share of processed products, such as beef and sugar. Roughly 60 percent of U.S. exports to low-income countries in 2011 were bulk products (mostly wheat, soybeans, and cotton) and 22 percent were processed products. In contrast, 44 percent of U.S. agricultural exports to high-income countries were processed products, such as meat, wine, and coffee, and only 23 percent were bulk products.

On the import side, the data show that middle-income countries have become an increasingly important source of both raw high-value products (fresh fruit and vegetables) and processed agricultural products shipped to the United States. High- and upper middle-income countries now account for about 84 percent of U.S. agricultural imports. The top agricultural products imported by the United States from high-income countries in 2011 were vegetable oils, wine, and grain products. From upper middle-income countries, the United States imports coffee, beer, fresh tomatoes, sugar, and palm oil. Lower income countries supplied rubber, coffee, cocoa, bananas, macadamia nuts, and other horticultural products.

As per capita incomes grow, consumers tend to substitute higher valued foods for the staples they would normally consume. A better understanding of the kinds of products that emerging markets will demand should help inform policies designed to meet the needs of both U.S. agricultural exporters and importers.

U.S. Agricultural Trade, by Bart Kenner and James Kaufman, USDA, Economic Research Service, February 2024